Summa Silver (SSVR-Cse) Plans Minimum of 15,000 Metre of Drilling in 2021 around the Consolidated Mine at the High-Grade Silver and Gold Mogollon Property, New Mexico

Nov 11th 2020 - NR

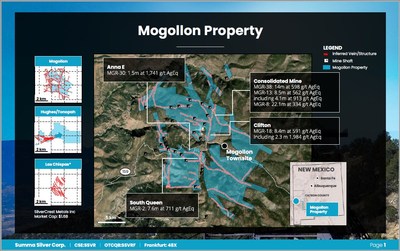

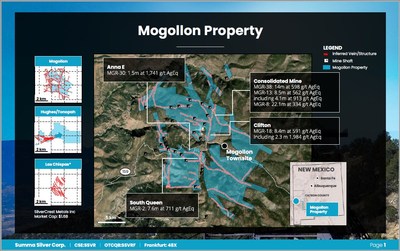

Summa Silver is pleased to announce that is has initiated exploration drill planning and permitting at the Mogollon Property in southwestern New Mexico. The drill program is anticipated to commence in mid-2021 with the primary focus of targeting un-mined extensions of the Consolidated Mine, where past drilling intersected significant high-grade silver and gold mineralization.

Targeting Highlights

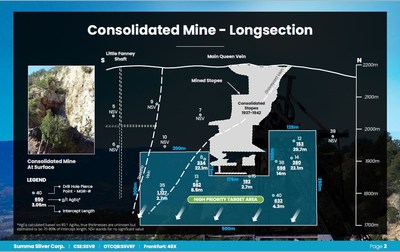

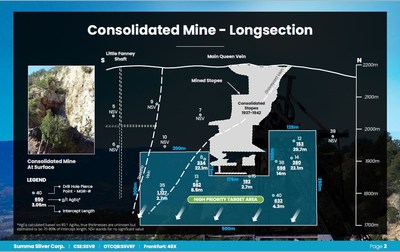

Significant past production: Between 1937 and 1942 the Consolidated Mine is reported to have produced 266,000 tonnes of material grading 660 g/t Ag equivalent*1 (264 g/t Ag and 4.66 g/t Au).

Unfinished business at the Consolidated Mine: Based on three-dimensional modelling of historic drilling results, an initial un-mined target area spanning approximately 500 x 200m has been defined. The target area contains 8 historic drilling intercepts which averaged 497 g/t Ag equivalent (210 g/t Ag and 3.4 g/t Au) over drilled lengths of 13.3 m+* ( see attached figures).

Significant drill program warranted: Preliminary analysis shows that this initial target will require 15,000 to 20,000 m of drilling to systematically test the vein horizon with 50m spaced holes.

More targets anticipated: Targeting studies are currently focused on investigating silver and gold bearing structures on the property where only 1.7 km of the nearly 34 km of cumulative strike length on the property has been drilled.

Mining critical to local economy: The economy of southwestern New Mexico is heavily reliant on mining, and two large open-pit copper mines owned by Freeport-McMoRan are in operation within 90 km of the Mogollon Property.+Note: The potential quantity and grade of this exploration target is conceptual in nature, there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the exploration target being delineated as a mineral resource. In addition, true thicknesses are currently unknown but estimated to be approximately 70-80% of drilled lengths.

Consolidated Mine Historic Drilling Highlights

598 g/t silver equivalent (219 g/t Ag and 4.46 g/t Au) over 14.0 m from 299.0 m in MGR-38

805 g/t silver equivalent (322 g/t Ag and 5.69 g/t Au) over 4.0 m from 306.6 m within 380 g/t silver equivalent (135 g/t Ag and 2.88 g/t Au) over 22.1 m from 290.6 in MGR-14

1,127 g/t silver equivalent (523 g/t Ag and 7.1 g/t Au) over 2.7 m from 343.7 m in MGR-3Galen McNamara, CEO of Summa Silver, stated: "Since optioning the Mogollon property in August and acquiring a large data package, our team has been focused on targeting. Initial results show that the area around the Consolidated Mine is ripe for testing where historic results require both verification by modern drilling and significant confirmatory drilling at a much tighter drill spacing in support of a potential 43-101 compliant resource."

Significant Intersections from Historic Drill Programs at the Consolidated Mine2:

Hole

| Hole

Type

| Area

|

| From

(m)

| To (m)

| Interval

(m)

| Au (g/t)

| Ag (g/t)

| AgEq*

(g/t)

| MGR-8

| RC

| Consolidated

|

| 257.6

| 279.7

| 22.1

| 2.2

| 147

| 334

|

|

|

| incl.

| 275.1

| 279.7

| 4.6

| 4.8

| 372

| 777

| MGR-12

| RC

| Consolidated

|

| 211.1

| 240.8

| 29.7

| 1.3

| 43

| 153

| MGR-13

| Core

| Consolidated

|

| 320.7

| 329.3

| 8.5

| 3.7

| 250

| 562

|

|

|

| incl.

| 323.2

| 323.9

| 0.6

| 23.6

| 1,619

| 3,627

|

|

|

| incl.

| 325.2

| 325.9

| 0.7

| 11.9

| 626

| 1,638

| MGR-14

| Core

| Consolidated

|

| 290.6

| 312.7

| 22.1

| 2.9

| 135

| 380

|

|

|

| incl.

| 306.6

| 310.6

| 4.0

| 5.7

| 322

| 805

| MGR-15

| Core

| Consolidated

|

| 349.6

| 352.3

| 2.7

| 1.1

| 99

| 192

|

|

|

| incl.

| 350.8

| 351.1

| 0.3

| 4.8

| 422

| 833

| MGR-35

| Core

| Consolidated

|

| 343.7

| 346.4

| 2.7

| 7.1

| 523

| 1,127

| MGR-38

| Core

| Consolidated

|

| 299.0

| 313.0

| 14.0

| 4.5

| 219

| 598

| MGR-40

| Core

| Consolidated

|

| 430.7

| 434.9

| 4.3

| 4.3

| 267

| 632

|

|

|

|

|

| Average:

| 13.3

| 3.4

| 210

| 497

|

Hole

| Easting

| Northing

| Orientation

(Azimuth/Dip)

| MGR-8

| 705011

| 3698228

| 280/-60

| MGR-12

| 705100

| 3698526

| 280/-62

| MGR-13

| 705059

| 3698204

| 280/-64

| MGR-14

| 705150

| 3698507

| 280/-60

| MGR-15

| 705104

| 3698376

| 280/-63.5

| MGR-35

| 705082

| 3698090

| 280/-60

| MGR-38

| 705120

| 3698436

| 287/-65

| MGR-40

| 705199

| 3698423

| 282/-67

|

* Silver equivalent ("AgEq") based on 85:1 Au/Ag. Historic drill holes were drilled via reverse circulation and core methods between 1984 and 1989 by Cordex Exploration Company, and John Livermore. Intersections are reported in downhole lengths. True thicknesses are currently unknown but estimated to be approximately 70-80% of downhole lengths. Hole locations are UTM coordinates (NAD 27, Zone 12N).

Mogollon Property Summary

The 2,467-acre Mogollon Property is located in the historically prolific Mogollon mining district of southwest New Mexico, approximately 120 km north of Silver City. Numerous underground workings have exploited high-grade gold and silver veins from three primary mines; Fanney, Last Chance and Consolidated. Mining ceased in 1942 and the district has since been largely inactive besides a few exploration drill programs in the 1980s and in 2010; totalling 15,600 m. The property hosts approximately 34 km of near-continuous epithermal-associated veins and faults where only 1.7 km of those veins and faults have been drill tested. The Mogollon Property therefore offers a unique opportunity to build high-grade ounces near historic past-production while systematically exploring for new discoveries using modern techniques.

Data Verification

The data disclosed in this news release relating to production and drilling is historic in nature. Historic production records for the Property are incomplete and are of unknown accuracy. Neither the Company nor the qualified person can verify the historic production data and therefore investors should not place undue reliance on such data. The Company is unable to verify the drilling data as drill hole rock samples are unavailable, precise drill hole collar locations are unknown, and down-hole survey data is incomplete. As such, the Company is treating the drill results as historical in nature and investors should not place undue reliance on such data. The Company's future exploration work will include verification of the data.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company has options to earn 100% interests in the Hughes property located in central Nevada and the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The mine has remained inactive since commercial production ceased in 1929 due to heavily depressed metal prices and little to no modern exploration work has ever been completed.

ON BEHALF OF THE BOARD OF DIRECTORS

"Galen McNamara"

Galen McNamara, Chief Executive Officer

info@summasilver.com

www.summasilver.com

Investor Relations Contact:

Kin Communications

Arlen Hansen

604-684-6730

SSVR@kincommunications.com |