Re <<Money flowed>>

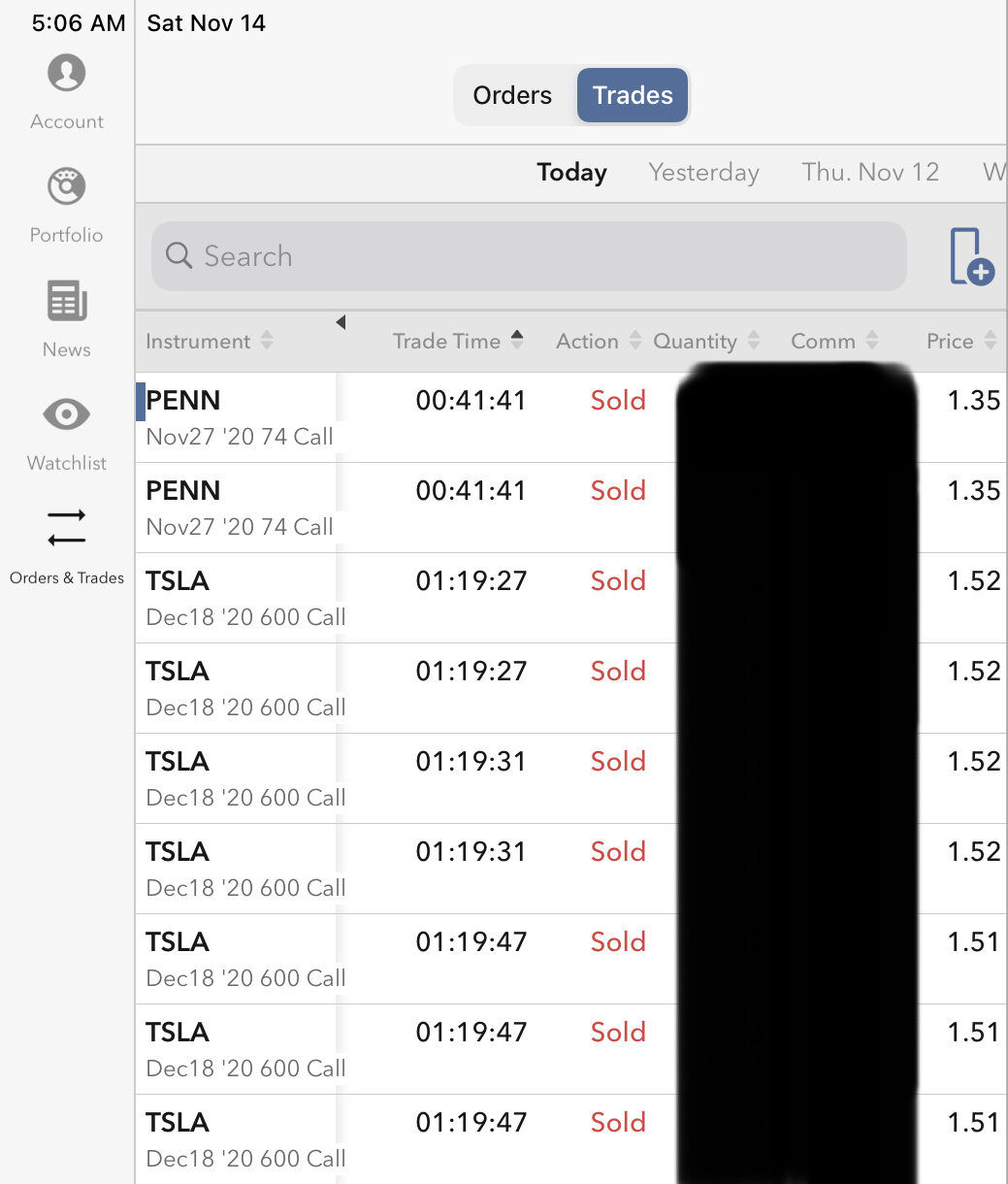

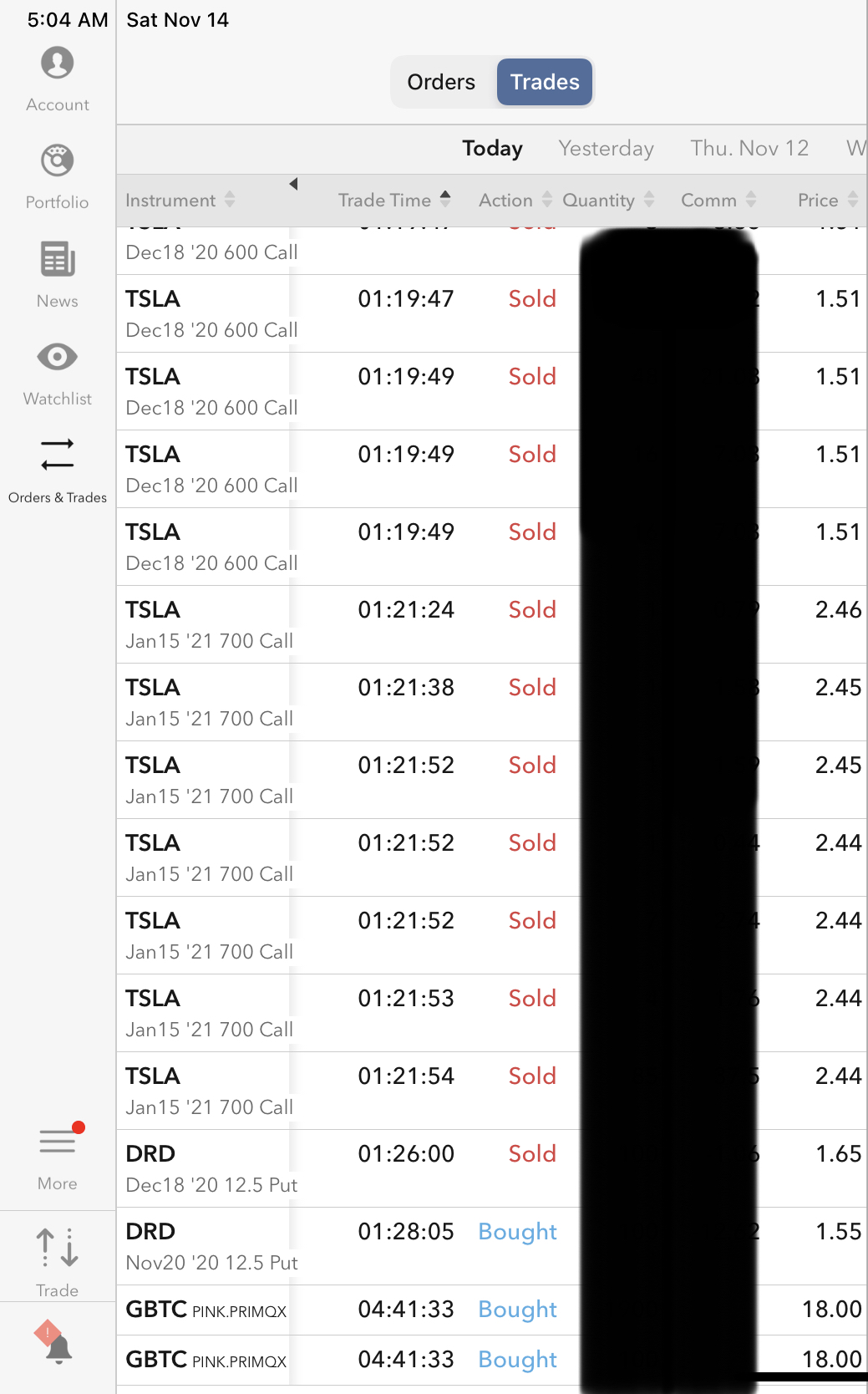

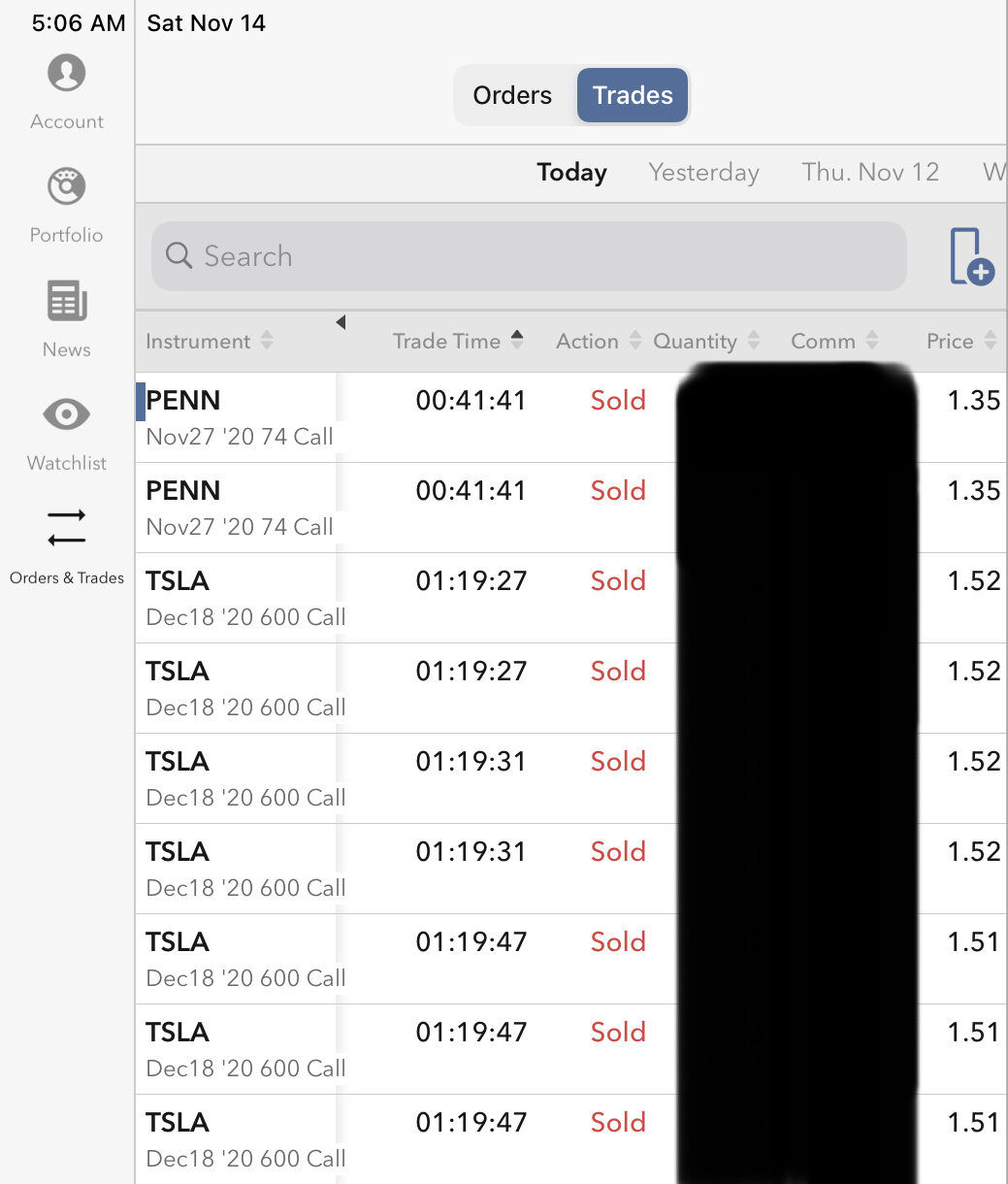

(1) Woke up per usual, soon after midnight (I go to nap at 9:30 on Fridays, and 7:30 / 8:00 on Monday-Thursday), and took some off of Davy Portnoy, and getting away with it so far w/ PENN. This one is tricky because should CoVid lockdown happen, folks would go on-line to wager, but unclear on what, as sports would not happen as much as usual. Maybe virtual poker games? Who can know until we get there, if we do. In any case 27th November is not that far away, whereas strike-74 is. Shorted the PENN call finance.yahoo.com

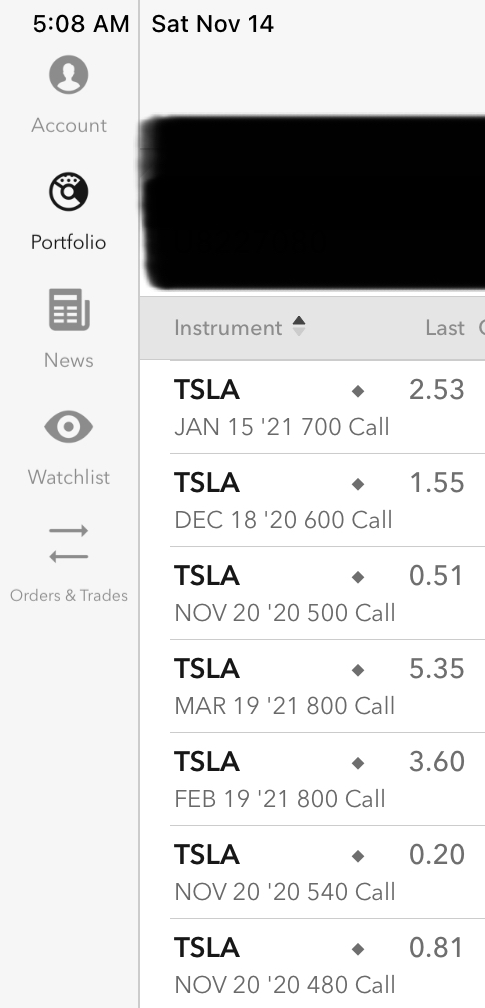

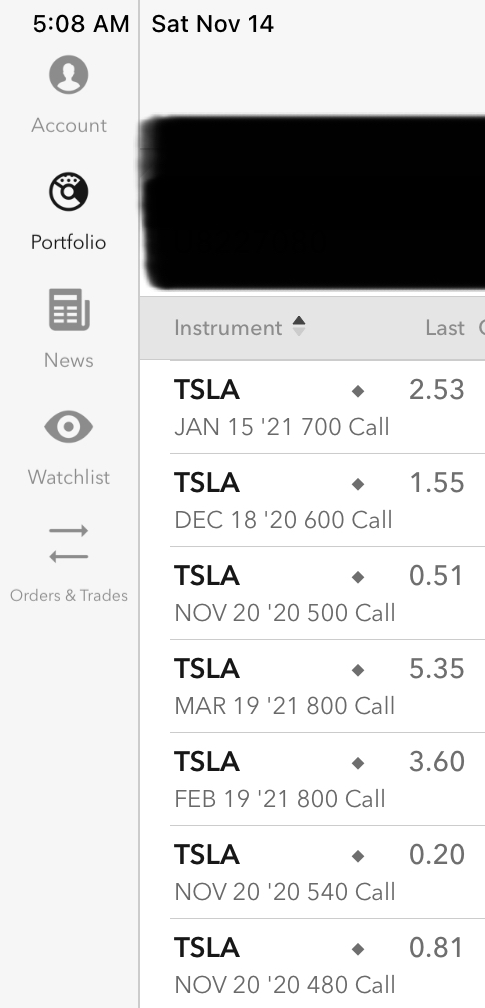

(2) Shorted more naked Dec / Jan TSLA calls finance.yahoo.com because I need the flow more than somebody else did, and so provided the promise w/o any intent to execute on same. I just wanted the cash, and TSLA is a nice, so-far negative-carry, funding currency.

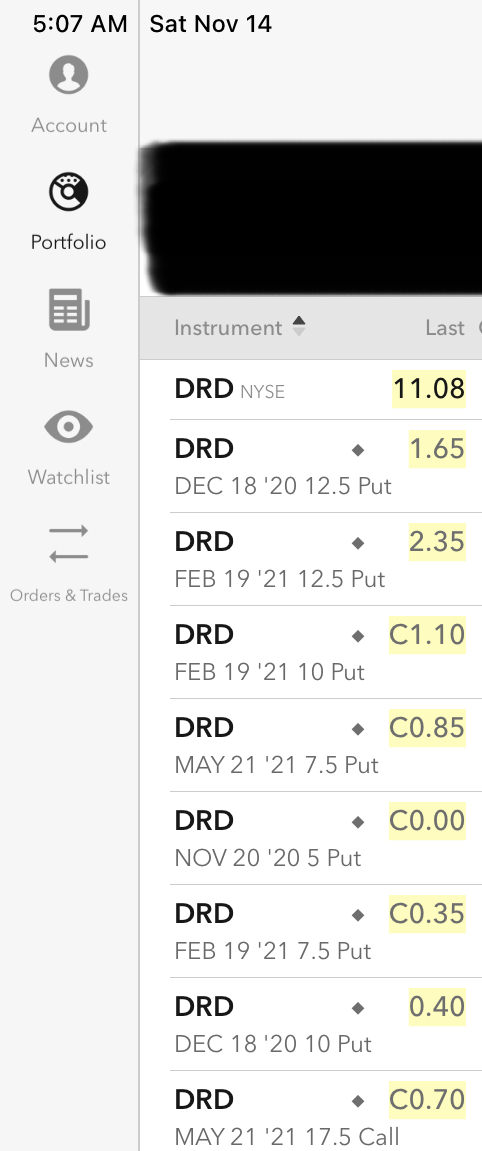

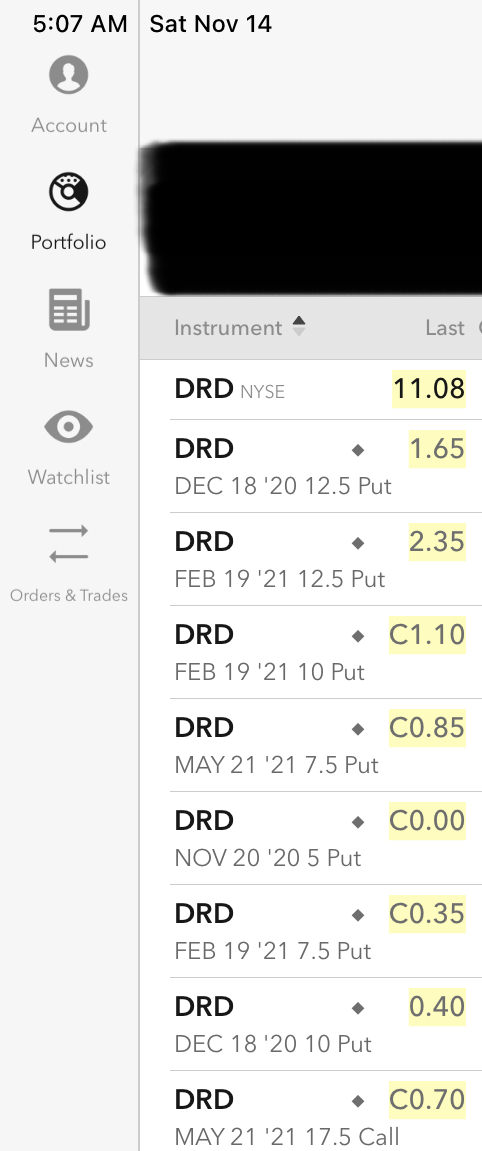

(3) Closed my promise w/r DRD November Put strike-12.5 @ 1.55, and opened new promise w/r to DRD December Put strike-12.5 @ 1.65. Keeping the 0.10 for a job well-done. So, as from now going forward, by actions over the last three days, I am done w/r to November promises that might matter, and onward to December etc etc

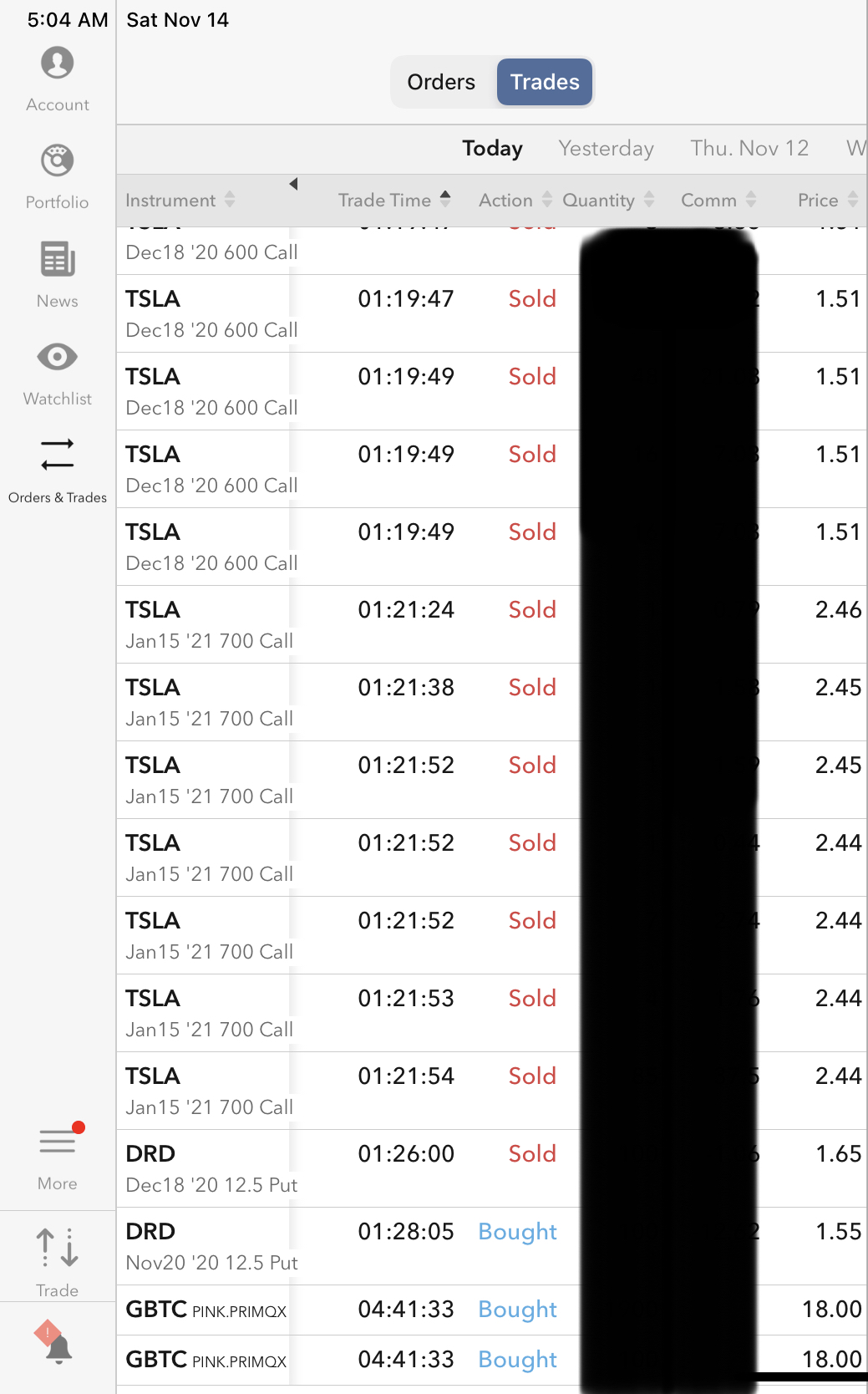

(4) Woke up at 4:30am and pushed all funding aggregated overnight to deposit w/ GBTC, thus in effect shorting PENN, TSLA, and fidgeting w/ DRD to fund addiction of GBTC.

(5) Year to date, not counting gold, the portfolio gains had resulted from 4/5 realized options trades and 1/5 realized shares-holding gains. The options trades have been very important. If I were in most domains except HK, I would have to share my realized winnings w/ whichever undeserving authority at whatever short term rates. As matters stand and shall stand, all mine. According to MSM, folks are hankering to move from HK. I say, “yeah, tell me more”.

MSM says much about HK and bleak future of HK. I reckon I shall listen after I liquidate GBTC at 500 per share. In the meantime I need to increase my holdings of GBTC by 5X. There is actually no upper limit on GBTC as there is none on gold. Just a convenient number to keep score by, and should their price go to zero or 50X, no one except the holder cares. Not true of most other holdings, currencies, commodities, etc etc and anything w/ BoD and CEOs and competition.

Does bitcoin have competition? Does gold? Yes and yes, but not enough to matter.

|