Besides Bitcoin being the new gold, that which allows wealth to pass from wallet to wallet across borders unhindered, and across time less taxed, there is still the matter of anti-fragile, that which be the imperative as we coincidentally veer inexorably through TeoTwawKi and towards inevitable Darkest Interregnum, a/k/a 2026 / 2032

Also coincidentally, a bummer for Brazilians not in Brazil, etc etc and something hinting at 35% of global GDP per just-math and only-history, a/k/a returning to natural size :0)

bloomberg.com

China to Leapfrog 56 Nations During Quarter-Century Income Surge

Alexandre Tanzi

China’s surging economy is set to overtake 56 countries in the world’s per-capita income rankings during the quarter-century through 2025, the International Monetary Fund projects.

By that date, China will rank 70th in the world on the metric, putting it close to joining the richest one-third of nations, according to data analyzed by Bloomberg from last month’s IMF World Economic Outlook.

Single-Generation Progress Living standards will have at least doubled in many nations by 2025 Single-Generation Progress Living standards will have at least doubled in many nations by 2025

Source: Bloomberg analysis of IMF WEO October 2020 data

Notes: Generational living standards approximated by purchasing power parity-based GDP per capita from 2020 to 2025; details for BRIC nations and the U.S. are labeled

The Asian powerhouse is forecast to have per-capita GDP, adjusted for purchasing power, equal to $25,307 in 2025. That will take it past Argentina, one of the richest countries in the world a century ago and now mired in debt and currency crises.

Jim O’Neill, the former head of Global Economic Research at Goldman Sachs Inc. who famously created the BRICs acronym for Brazil, Russia, India and China in 2001, says that bloc “could become collectively bigger than the G-7 countries” in the 2030s, referring to the Group of Seven richest nations. “This is almost exclusively because of China, and to a smaller degree India,” he says.

There are plenty more remarkable findings in the data, which show large leaps especially among east European and Asian countries.

East's FastestAsian-Pacific economies see huge improvements in per-capita incomes East's FastestAsian-Pacific economies see huge improvements in per-capita incomes

Source: IMF WEO October 2020

Notes: Shown are the 10 fastest-growing Asia-Pacific economies, expressed in GDP per capita in purchasing-power-parity terms, from 2000 to 2025; Macau and Singapore are projected to have the highest per-capita GDP by 2025, reaching $144,447 and $115,445, respectively

Turkmenistan is projected to be the only country climbing further up the rankings than China, advancing 58 spots. There are also big gains for Armenia, Georgia, Vietnam and Bangladesh.

Overall, developing Asian countries will see per-capita GDP rise sixfold in the period. By contrast, Latin America and the Caribbean, the Middle East and Central Asia aren’t expected to even double their incomes.

Among the G-7 economies, average per-capita GDP rose from $31,471 to an expected $64,582 in 2025. Italy is the only member forecast to fall sharply down the rankings, to 35th place from 21st.

Read More: An Economist’s Guide to the World in 2050

Regional ProgressEmerging Europe and Asia are set to see large per-capita GDP gains Regional ProgressEmerging Europe and Asia are set to see large per-capita GDP gains

Source: IMF WEO October 2020

Note: Comparison based on GDP per capita in purchasing-power-parity terms

The U.S. has broadly held onto its standing in the world. It ranked 11th in 2000, with a per-capita GDP of $36,318, and is set to move up to 9th place. But its neighbors have fared less well. Canada is expected to drop six spots to 24th and Mexico is one of the period’s biggest losers, plunging 26 places to 77th by 2025.

In general, Latin American and Caribbean economies have been laggards over the quarter-century. They’re also among the hardest-hit by Covid-19 this year, with per-capita GDP forecast to decline in all the region’s economies bar Guyana. In Venezuela, things have gotten so bad that the IMF didn’t even attempt forecasts -- but by 2019, the country’s residents had already seen per-capita GDP slump 36% from 2000.

Haiti hasn’t recovered from the devastating earthquake of 10 years ago, despite billions of dollars in aid. It’s expected to rank 183rd out of 191 measured countries in 2025 –- down from 159th in 2000, and the lowest-ranked nation in the Western Hemisphere.

Mixed OutcomesPer-capita GDP in Argentina, Peru and Ecuador are set to drop this year Mixed OutcomesPer-capita GDP in Argentina, Peru and Ecuador are set to drop this year

Source: IMF WEO October 2020

Notes: Shown are Latin America and the Caribbean's largest economies as of 2020; per-capita GDP growth based on purchasing power-parity-terms

Persian Gulf nations, among the world’s richest at the turn of the century, have lost ground as the oil price receded. Bahrain, Kuwait, Oman and Saudi Arabia are all dropping out of the global top 20 as living standards stagnate or decline.

Others in the region have been devastated by war and political turmoil. Libya, Syria and Yemen have seen large declines. In Lebanon, the situation is so dire that the IMF expects a 25% contraction in GDP this year alone. The Middle East’s woes are reflected in the fact that all five of the countries projected by the IMF to have lower per-capita incomes in 2025 compared with earlier in the century are in the region.

Slowing DownProgress in some Middle Eastern and North African economies to be flat Slowing DownProgress in some Middle Eastern and North African economies to be flat

Source: IMF WEO October 2020

Notes: Shown are 10 economies in the Middle Eastern and North African region with the highest GDP per capita in purchasing-power-parity terms in 2000; no projection made for Lebanon beyond 2020

Sub-Saharan Africa remains a laggard in the world economy, although there are some bright spots. While only Seychelles and Gabon had per-capita GDP exceeding $10,000 in 2000, by 2025 six more economies are forecast to reach or pass that level.

Making GainsBy 2025, Botswana's per-capita GDP may be sub-Sahara's third-highest Making GainsBy 2025, Botswana's per-capita GDP may be sub-Sahara's third-highest

Source: IMF WEO October 2020

Notes: Shown are 10 sub-Saharan economies with the highest projected GDP per capita, in purchasing-power-parity terms, by 2025

It’s in Asia where the increase in living standards is most dramatic.

In China, per-capita GDP roughly doubled from 2000 to 2006, did so again before 2013, and is expected to double once more by 2024 -- an annualized growth rate of 9.1% over the 25-year span.

The Asian city-states of Macau and Singapore are expected to move into the world’s top three for wealth, joining Luxembourg. Singapore’s per-capita GDP, which surpassed the U.S.’s in 2006, is projected by the IMF to reach $115,445 by 2025.

In the coronavirus year of 2020, the IMF expects only four of the world’s 50 biggest economies to achieve an increase in per-capita GDP, with Vietnam, Taiwan and Egypt joining China.

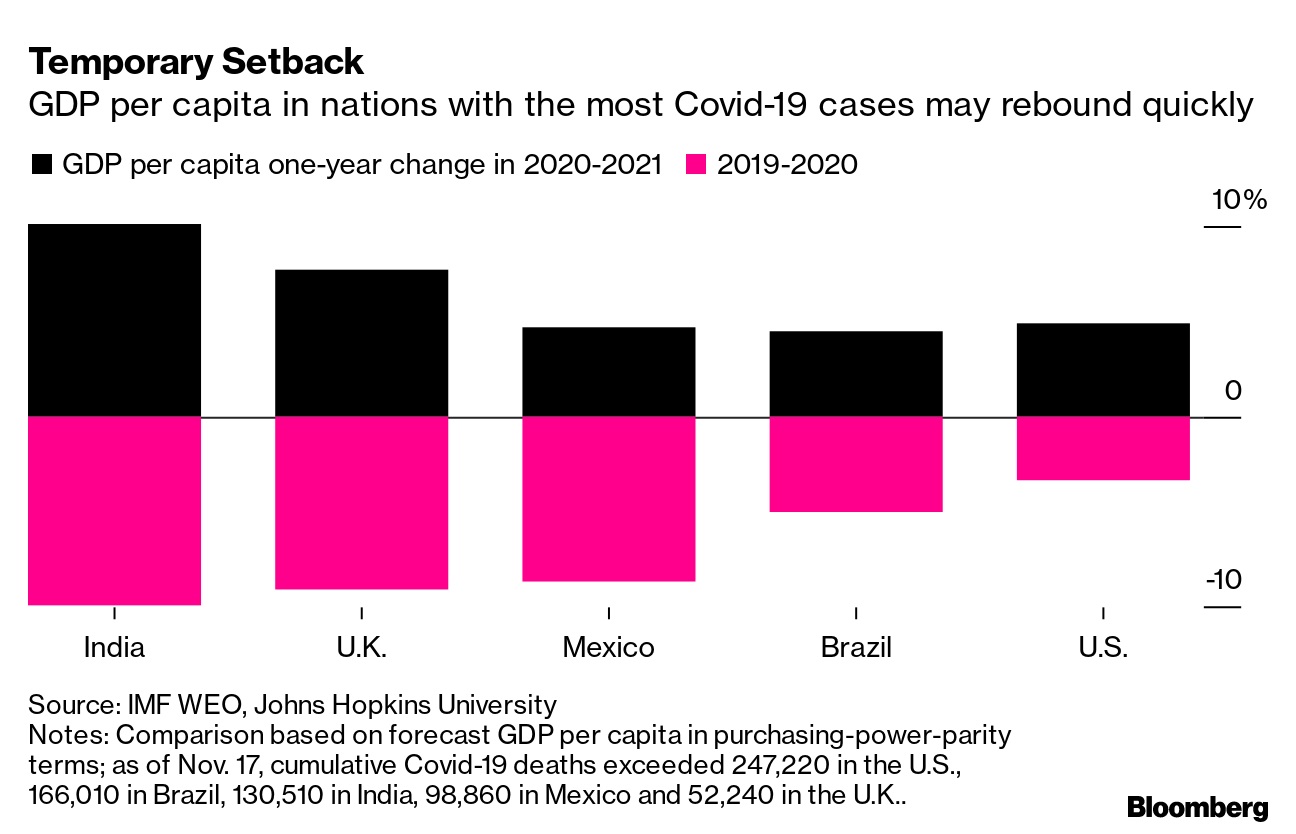

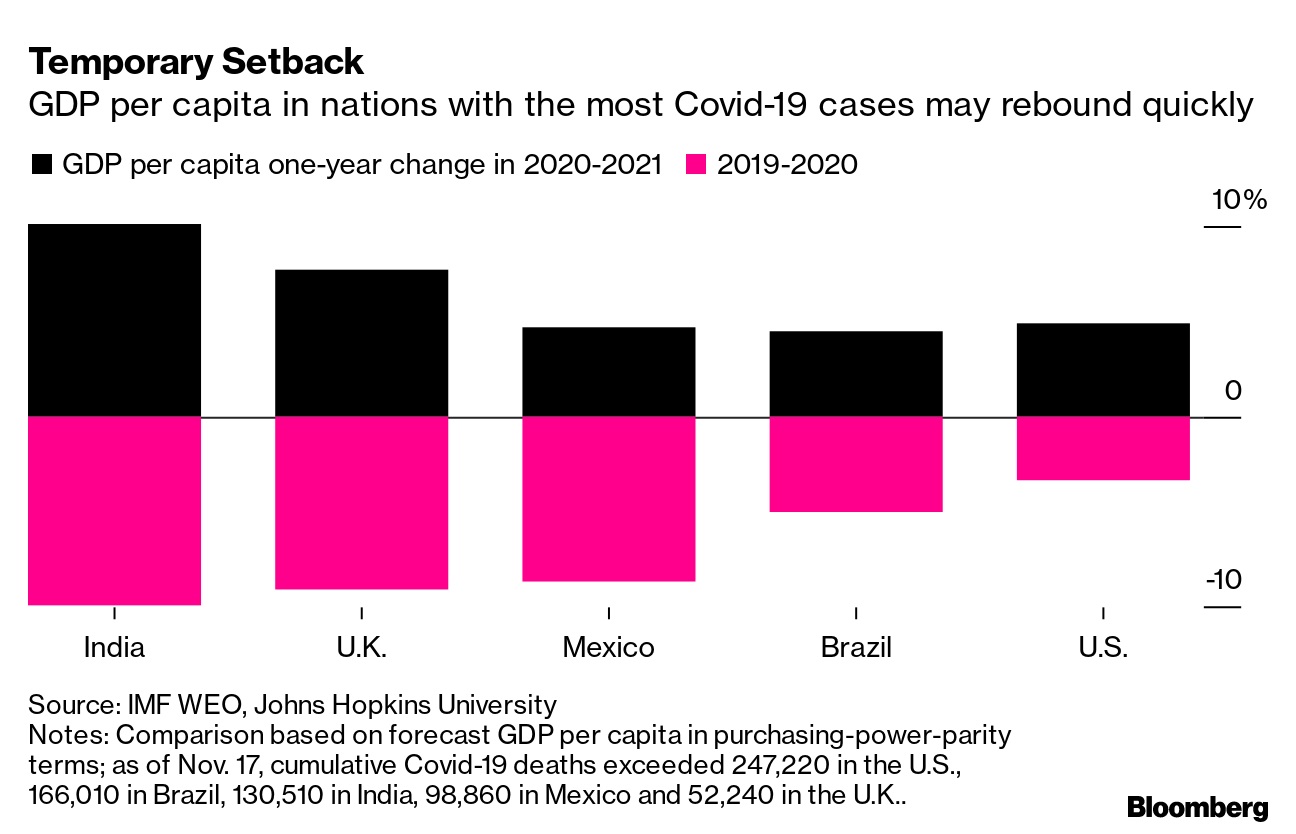

Most of the others are seen rebounding fairly quickly. The five nations with the most Covid-19 deaths -- the U.S., Brazil, India, Mexico and the U.K. -- are all forecast to post strong rebounds. Still, over the course of the pandemic they’ll have lost more ground to China.

“Companies in China have not only reported the greatest success so far in recouping output lost to Covid-19, but also anticipate making the fastest full recovery,” said Chris Williamson, an economist at IHS Markit. “U.S. companies come a close second.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |

Single-Generation Progress Living standards will have at least doubled in many nations by 2025

Single-Generation Progress Living standards will have at least doubled in many nations by 2025 East's FastestAsian-Pacific economies see huge improvements in per-capita incomes

East's FastestAsian-Pacific economies see huge improvements in per-capita incomes Regional ProgressEmerging Europe and Asia are set to see large per-capita GDP gains

Regional ProgressEmerging Europe and Asia are set to see large per-capita GDP gains Mixed OutcomesPer-capita GDP in Argentina, Peru and Ecuador are set to drop this year

Mixed OutcomesPer-capita GDP in Argentina, Peru and Ecuador are set to drop this year Slowing DownProgress in some Middle Eastern and North African economies to be flat

Slowing DownProgress in some Middle Eastern and North African economies to be flat Making GainsBy 2025, Botswana's per-capita GDP may be sub-Sahara's third-highest

Making GainsBy 2025, Botswana's per-capita GDP may be sub-Sahara's third-highest