in the meantime 'they' tell me that the ramp in EV has halted, as opposed to paused to taking respite

the skew in TSLA Call / Put tells a different story - I shall for the moment count on pause, given that calls are way more expensive than puts, and my fire-trench strategy executed w/ poor man's covered call setup of long longer-term nearer-the-money calls (December 31st through March 21st strike-700), and short shorter-term farther out-of-the-money call (December 11 through March 21st, strikes-780/800), aiming for win-win-twice, and given that am also short TSLA Puts (strikes-350), so aiming for win-win-win. Should be okay.

The overall bullish positioning w/ great trepidation is premised on the passive / obedient / patient / presumably dumb- money to be bum-rushed into TSLA shares starting 18th December taking TSLA to greater heights from which to fall.

Closing the various tranches (by expiration date) of the trades is tricky, in that I cannot let the contracts simply expire as there are longs. I must close the longs before time-decay or market events nail them, but not too soon that am exposed to unnecessary short risk.

We should get a clear read 18-19 December to know where the red lines are.

bloomberg.com

Nikola, Tesla Shares Fall as EV Rally Frenzy Comes to a Halt

Esha Dey

25 November 2020, 23:06 GMT+8

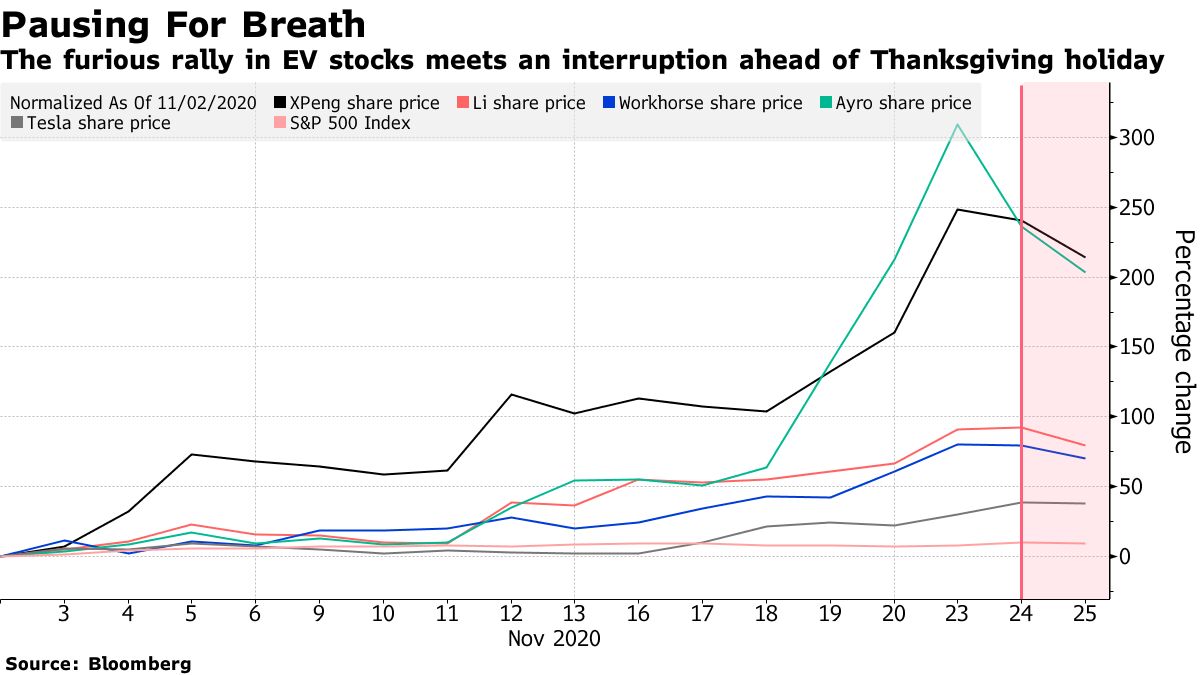

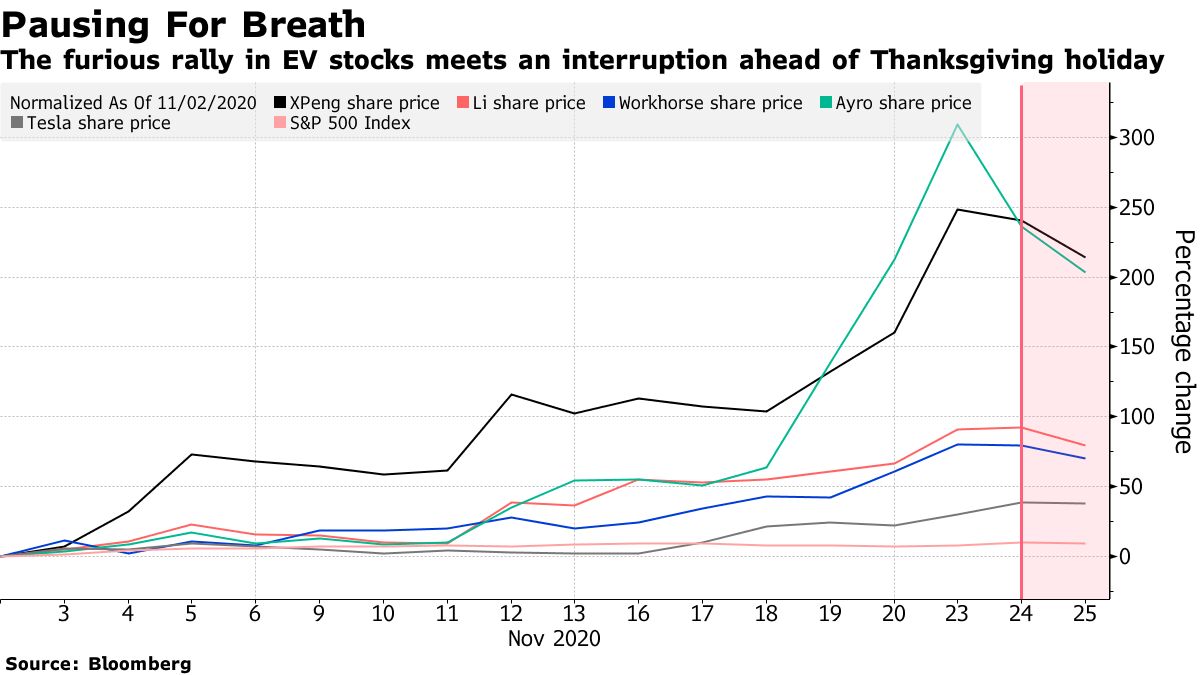

The rapid rally in electric vehicle stocks that helped double the market value of some companies within a week, came to a halt on Wednesday.

The buying frenzy in these companies -- many of which began attracting investor interest earlier this year -- accelerated after S&P Dow Jones Indices said on Nov. 16 industry front-runner Tesla Inc. will be added to the benchmark S&P 500 Index in December. Tesla’s stock rose 36% between the announcement and Tuesday’s close, pushing its market valuation over $500 billion. Shares fell 1.8% Wednesday.

Read more: Tesla Hits $500 Billion Mark After Soaring 547% This Year

Gravity finally seems to be catching up, with most of the stocks trading lower on Wednesday morning. Shares of Nikola Corp. dropped as much as 17%, the most intraday since September, after its Chief Executive Officer Mark Russell appeared on Jim Cramer’s “Mad Money” show on CNBC Tuesday night. Russell didn’t offer any new details on the company’s ongoing partnership talks with General Motors Co.

JPMorgan analyst Paul Coster said he was skeptical about the company’s Badger pickup truck, given the CEO has been consistently non-committal about the initiative and also since it is not a strategic interest for Nikola. Both GM and Nikola have said the talks are ongoing without offering much detail on the pact, which is a major catalyst for the EV startup’s shares.

Other big declines in the sector came from Workhorse Group Inc., ElectraMeccanica Vehicles Corp., XPeng Inc., Li Auto Inc. and Ayro Inc., all of which fell more than 8%.

The big outlier of the day is Fisker Inc., which largely sat out the broader rally before, but gained as much as 25% on Wednesday, after Citi analyst Itay Michaeli initiated coverage on the stock with a buy. The analyst noted that as a prerevenue company, Fisker is a higher-risk investment proposition, but praisedits long-term potential. Shares of the company had declined 6.6% since Nov. 16 through Tuesday, while the stocks of the rest of the industry were on fire.

Read more: Tesla-Led EV Mania Embraces Carmakers With No Profit -- or Autos

(Updates to add JPMorgan comment, Fisker initiation.)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |