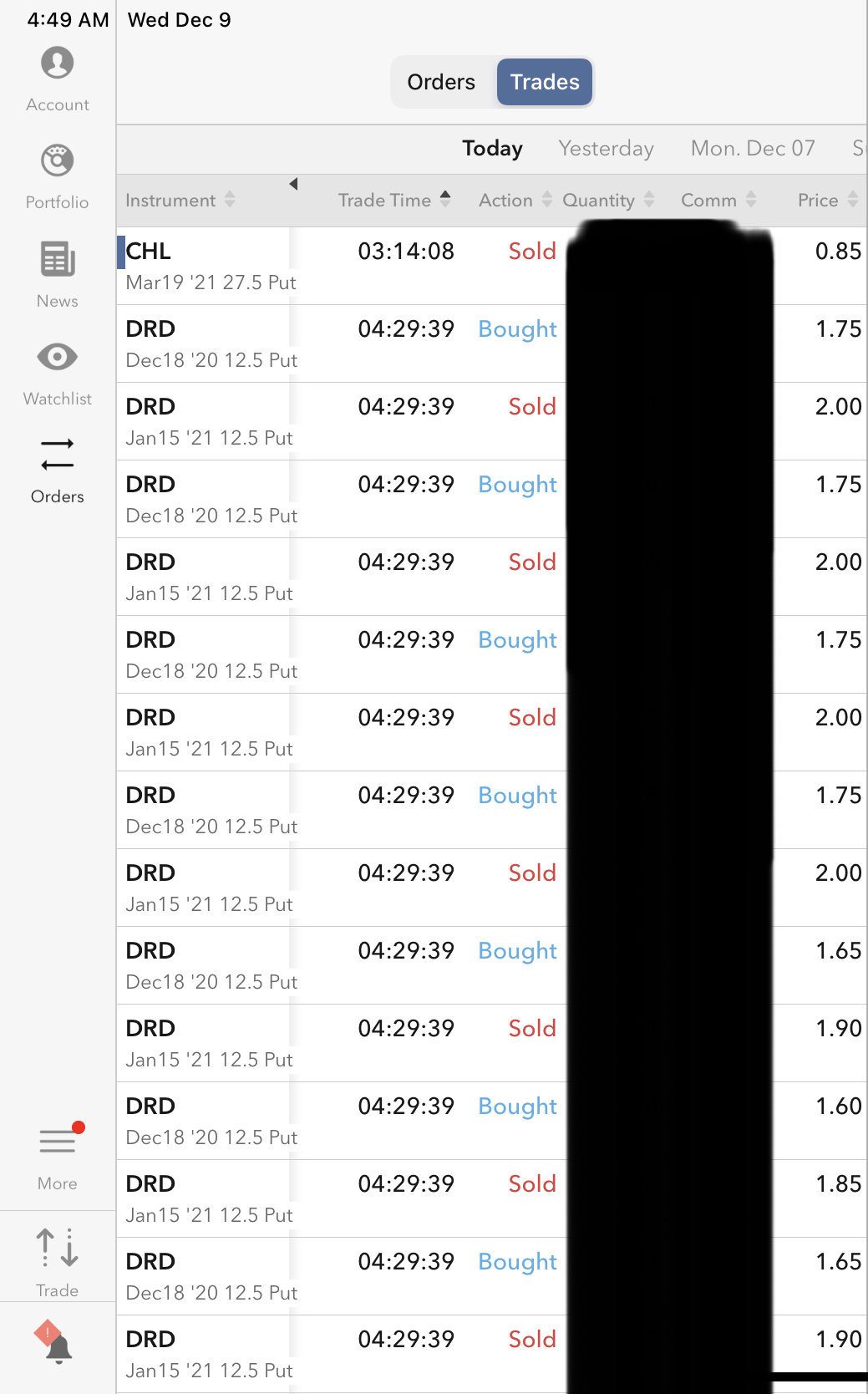

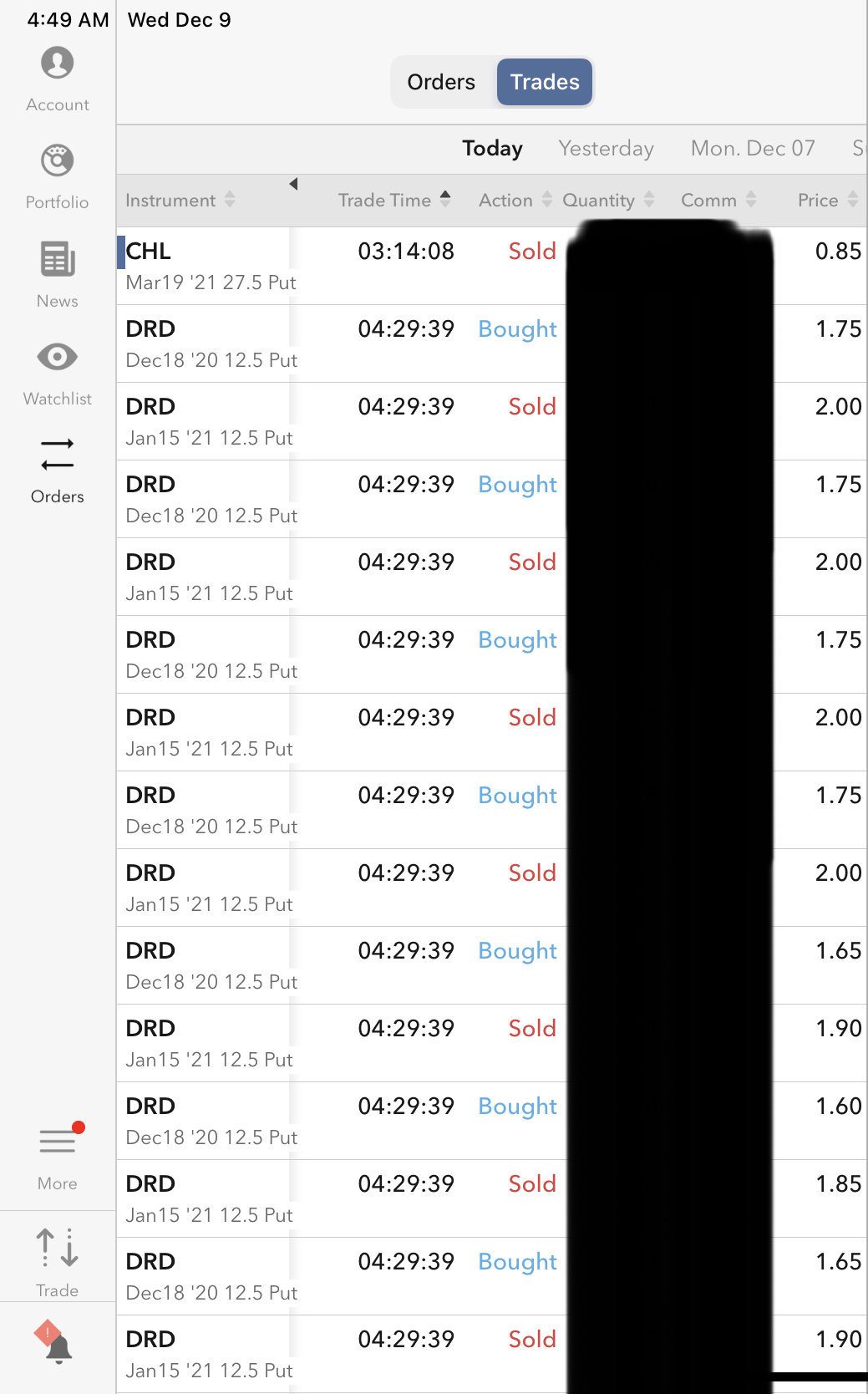

Follow-up to DRD battle front, successfully rolled the DRD Put December 18th Strike-12.5 position forward to January and February, same strikes, and net net got more cash out of the counterparties, and cash is always good, from the first raid, and rolling forward, just selling time for cash, to continue to get DRD average cost down and down and down again.

There remains some minor DRD positions expiring 18th December, and may just let them fend for themselves, given that most of the troops rolled forward, and winning.

Shall be able to do same w/ TSLA is necessary, as I have short Call December 11th strike-700s position, even as matched by long Call March strike-650 and 700. Shall leave the situation until last day (coming Friday), and then do watch & brief on December 18th expiration (coming Friday a week later). And on and on.

The campaigns are usually multi-domain (put / call), multi-time (now, later, later-still), multi-direction (long / short) and multi-strikes

I do not understand why my counterparties buy what I dish out, and sell me what I wish to buy, and can only imagine they are buying portfolio insurance given they have month-to-month mark-to-market duties and I do not. Too much fun does begin to describe the situation.

Am now in effect hedged-short TSLA options to fund zero-cost basis GBTC, and short DRD options to lower DRD cost to asymptotic zero.

The Jack (10) over dinner responded to my question, “what is the most important skill to get right?”

“Logic”

I never ever said such to him. I was figuring him to say math, science, reading, or some such.

He is happy he is able to beat the Beth Harmon chess bot (chess.com) of age 9, though notes, “she is improving fast, and can no longer be bum rushed into bungling”. The Beth Harmon bots are offered at different ages (ranks) and the Jack wants to beat her. Try.

In current events readings, he noted that MSM reports that Team Britain sending aircraft carrier Elizabeth to Japan to show China China China the flag, but ZeroHedge reports that the sister ship Prince of Wales is knocked out for at least 6-months due to engine compartment flooding, and wondering if Team Britain can afford to lose a carrier to rocketry.

All options are short positions, and shorted calls are covered calls. The DRD equity holding is what am willing to hold until gold at 30,000, and BTC at 1,000,000

|