Interesting, educational, exciting, and rewarding night.

Was expecting gyration of TSLA on triple-witch / December / pre-S&P500 / whatever, and was not disappointed.

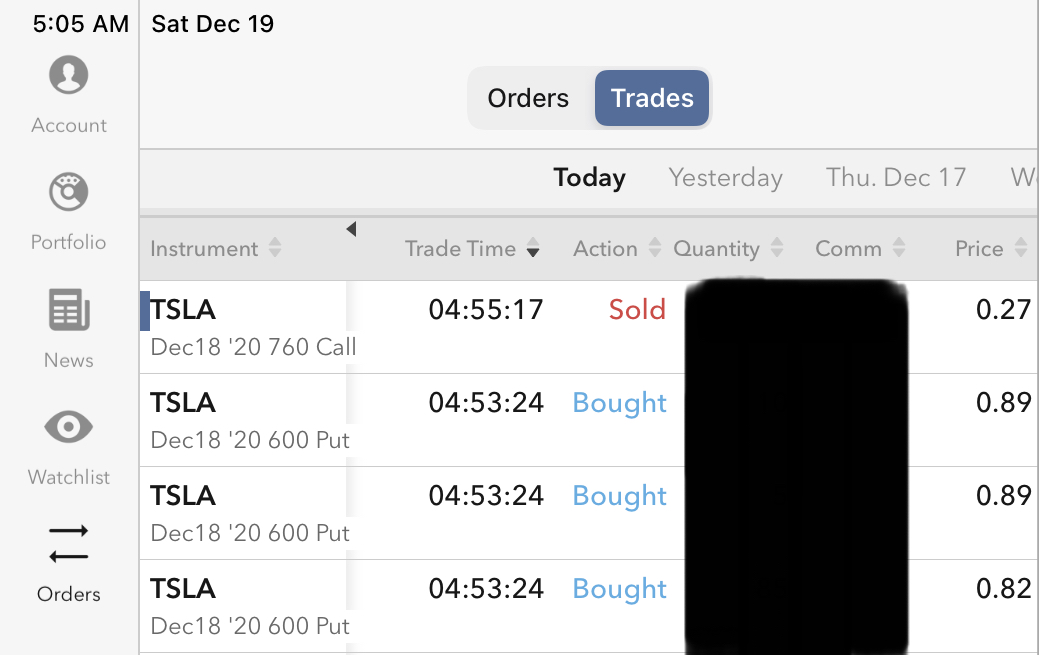

(1) Started the night receiving e-mail alerting to imminent expiration of shorted option positions.

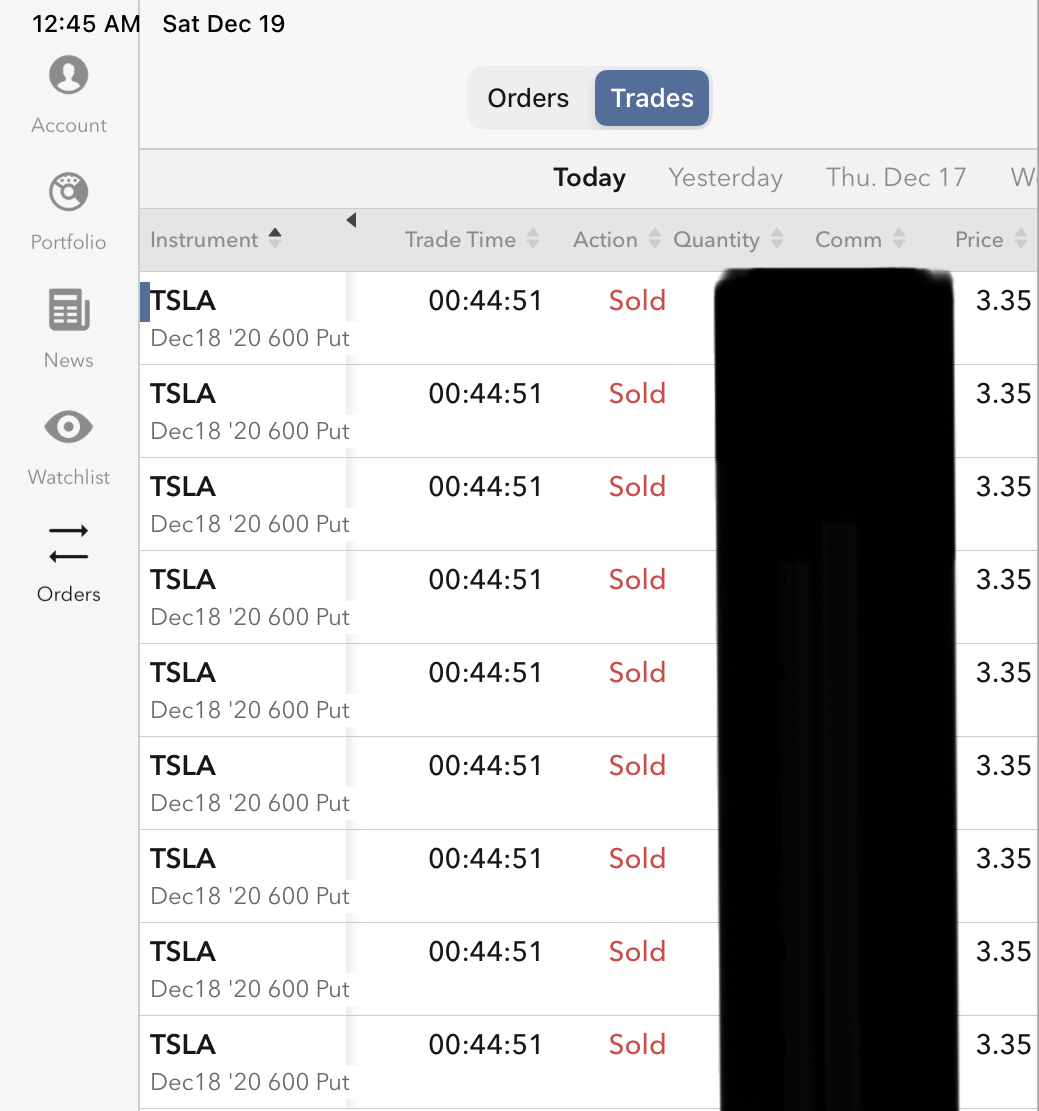

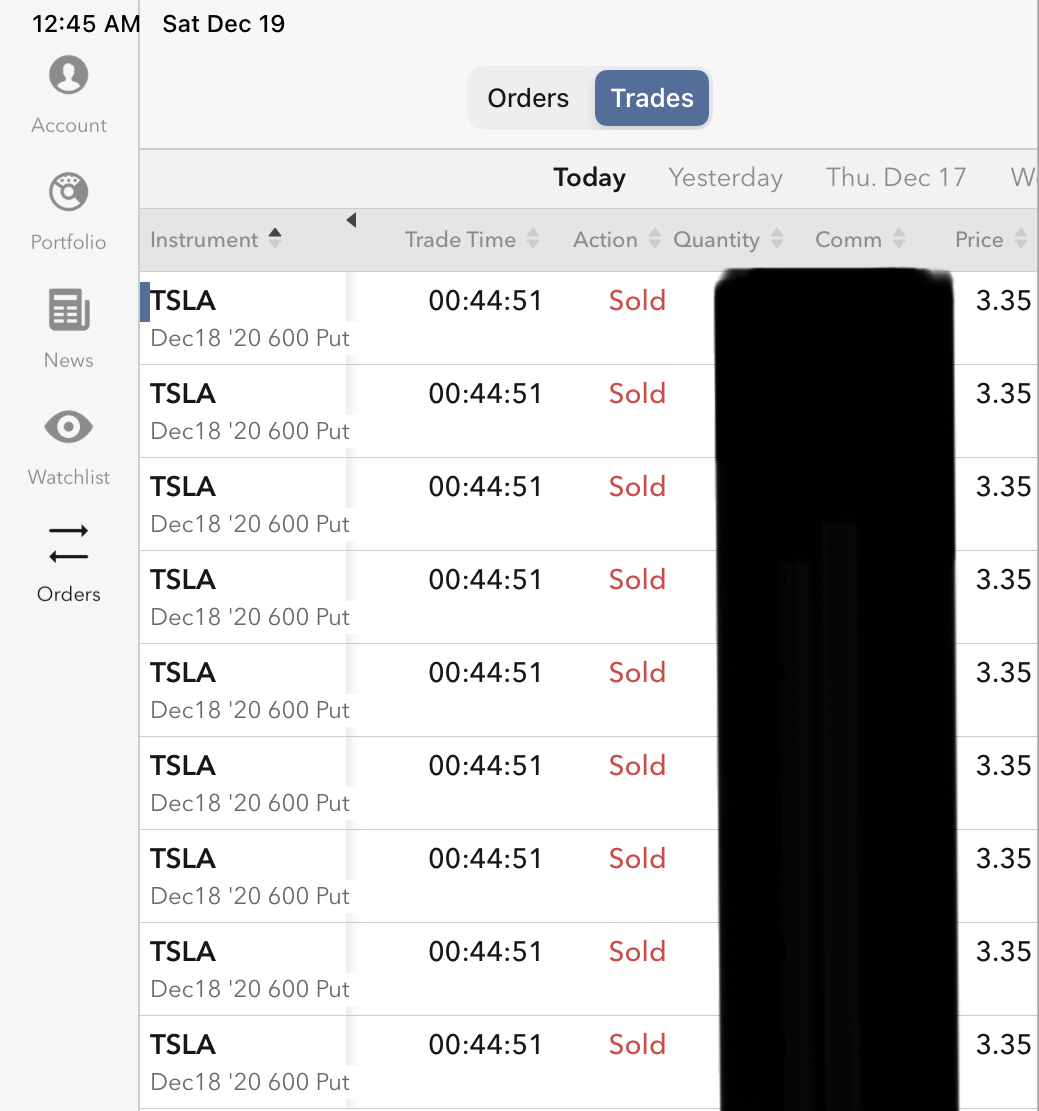

(2) Surveyed the battle space, tenderized by long-range artillery of shorted far-OTM Put (500) & Call (760, 800) options strikes, and decided to commit helicopter-borne infantry for house-to-house melee combat, expressed as shorted 18th December Put strike-600, at 3.35 per share:

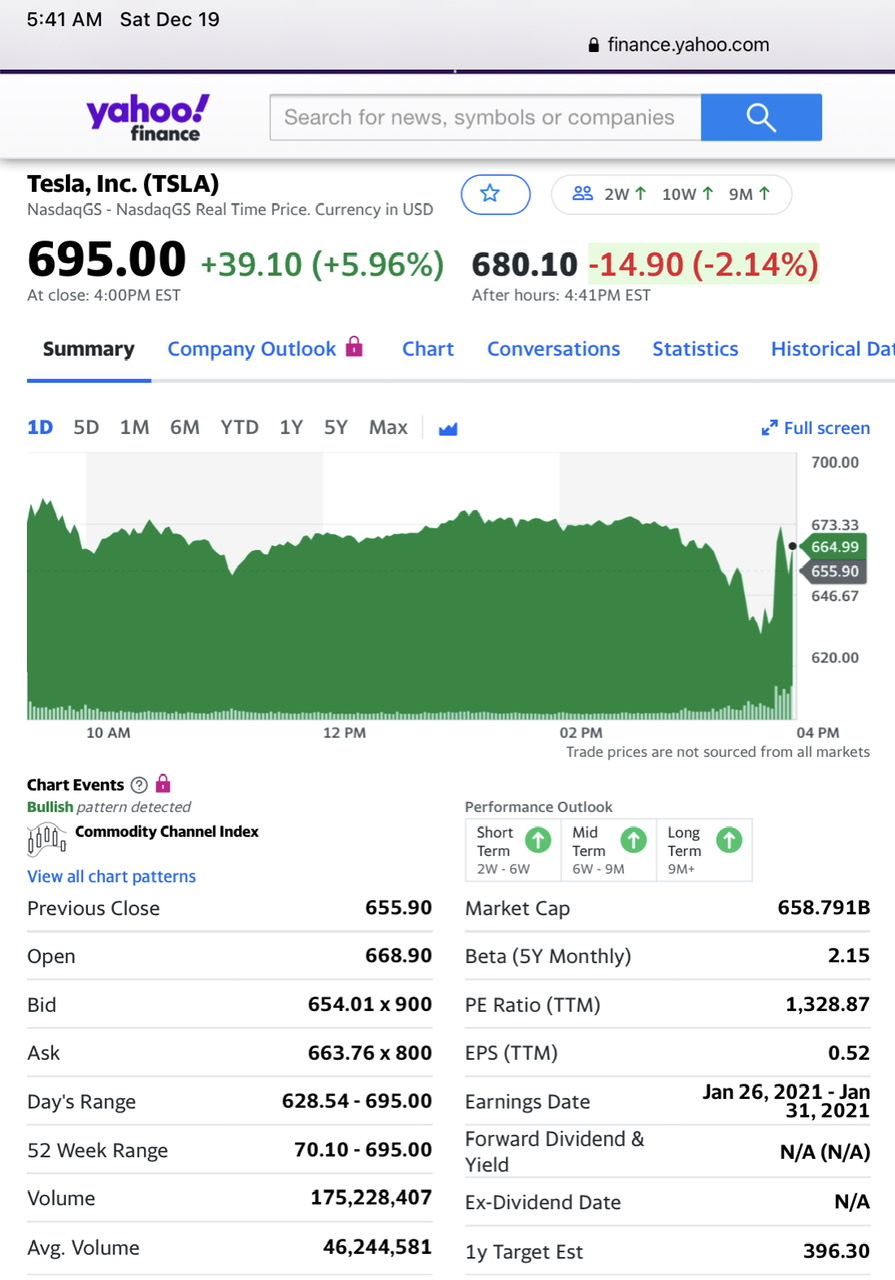

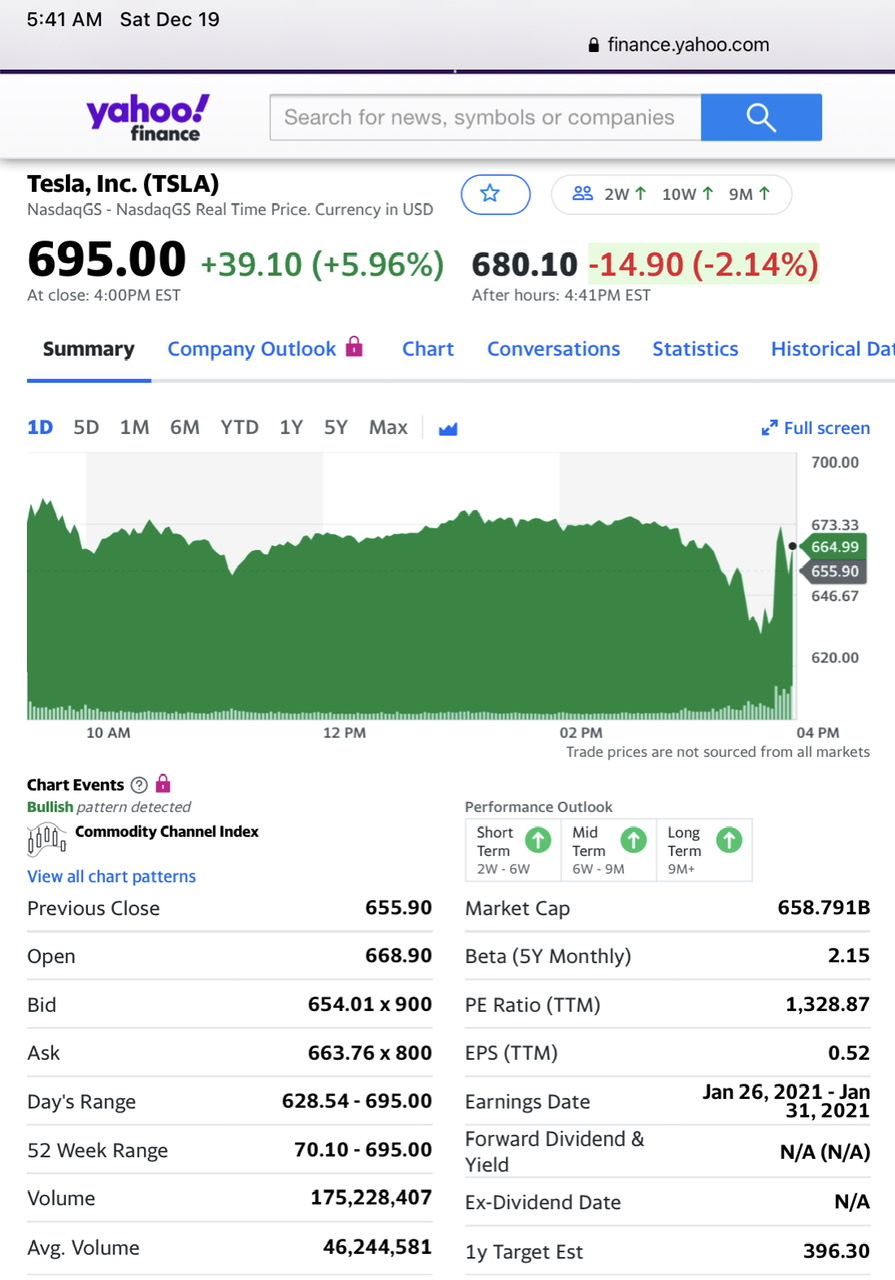

(3) Took nap and woke up to check on progress of the struggle between right and wrong. The TSLA shares did not do much dramatics (628 - 695, no more than usual) but the SoftBankesque-whale facilitated and RobinHooders-enhanced options gyrated all over the place in the intervening hours - super exciting.

Especially exciting were the moves of the Puts strike-600, which was melting all night from my short point 3.35 to dimes, and suddenly jumped up 4.00 even as the underlying shares essentially did nothing - someone must have gotten hurt and badly, on respectable volume - a/k/a last-blood

finance.yahoo.com

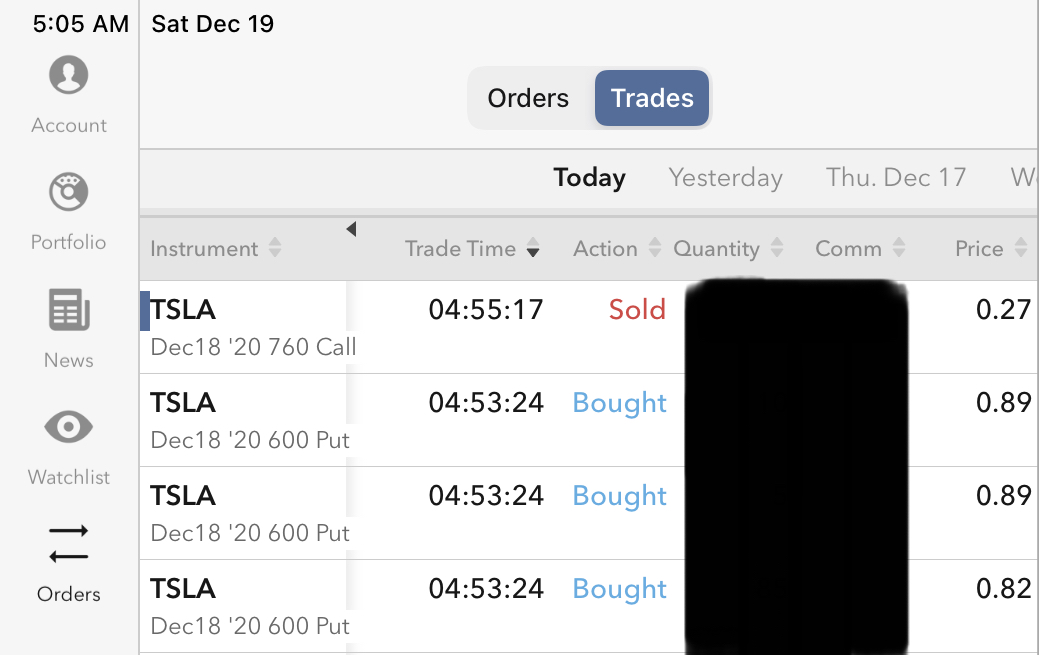

(4) I remained alert but deliberate, for minutes and browsed through the iPad at the world, and eventually closed my Put strike-600 at profit, not willing to wait for the bitter end, because as the Jack admonished, “anything can happen in the market”.

However, I did judge that whilst TSLA (at that time bouncing around 630) can drop through 600 and smear my shorted Puts, cannot likely zoom through 760, so after closing Put strike-600, I opened new front by shorting Calls strike-760.

The battle went well.

(5) TSLA closed at 695, and DRD at 11.92, my counterparties all got blown up.

I now focus attention on the long term future, 24th December 2020, one battle at a time in the TSLA campaign, may the campaign last forever.

Do not have any troops committed to DRD until January expiration point, and given its wide bid / ask, nothing to do in the interim until the week or even day of the meet-the-maker.

(6) Did not buy any GBTCs. Watch & brief, wait & see, stalking but in no hurry.

(7) Post-game forensic report:

(7-i) Definitely could have and thought about double-down in the final minutes when the TSLA Put strike-600 went from tens of cents to 4.00 at one moment. Unclear what the volume was at that moment.

(7-ii) Should have shorted more furiously the TSLA Calls strike-760 in the final moment for there was no risk (might have cratered the option even as it was dying fast).

(8) Conclusion? The RobinHooders are crazed, and must be put down by way of systematic search, hunt and eliminate. The data that RobinHood platform sells on its flock’s aggregate ‘gamified’ moves definitely worth money.

Make sense to open RobinHood account just to get a sense of the flow & stock, to improve targeting information leading to better gaming, akin to cheat codes, to gain access to effectively all-knowing forever health infinite ammo god mode.

(9) Welcome to the S&P500, TSLA and may TSLA live long and prosper, or at least have VW, Toyota, NIO, XPEV, and-and-and clean TSLA motors slowly.

Need TSLA as negative funding currency, to BuyMoreBitGold before transition to GetMore9999Gold. Shall take a small % of the profit to get some expensive physical gold, a good and enduring habit.

(10) TSLA should do well by buying a traditional auto company, for the cash flow and still-respectable profit.

(11) DRD probably bottomed; SBSW might ramp on Pt stock & flow; and best they work out a deal to exploit PGM tailings ponds.

(12) GBTC ought to but might not correct for awhile longer; should it correct from current level, buy-buy-buy without hesitation. |