Re << XPR money moved to BTC? >>

Dunno. Can only guess, and guessing ‘yes’ but more put at stake.

We might be witnessing THE awakening, as folks seek salvation from what they sense is on way, and try to engage w/ redemption for sins accumulated since the start of Greenspan’s reign.

Panic buy might happen on equity market open as more try to squeeze through a bottleneck that is GBTC

zerohedge.com

Forced Liquidations? Bitcoin Futures Open With Massive Gap After Xmas Spike

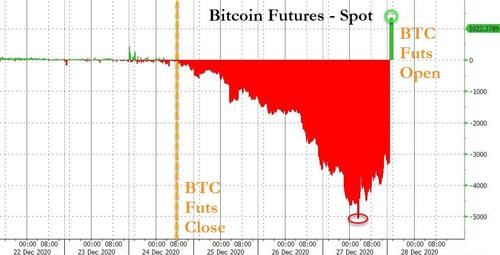

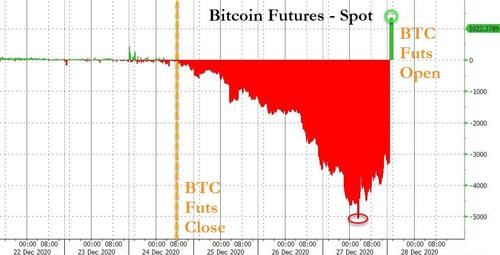

Update (1900ET): Bitcoin futures have opened dramatically higher than spot as the massive gap open appears to have triggered forced short liquidations(which makes sense as margin calls must be massive on a $4000-plus gap)...

Bitcoin Futures are up 19%, the biggest jump since June 2019...

And after spot gapped as much as $5000 from futures closing price, futures opened with a $1365 gap higher over spot prices...

That is the biggest spread since the contract's inception...

Will this drag spot higher?

* * *

Bitcoin has been stealing the spotlight in recent weeks as it has soared to record-er and record-er heights, but overnight saw a 'regime-shift' as Bitcoin topped $28,500...

Source: Bloomberg

...before crashing over $2,000 lower, only to be bought back...

Source: Bloomberg

Bitcoin's surge had pushed it above its stock-to-flow model estimate...

Source

Some still have even bigger plans...

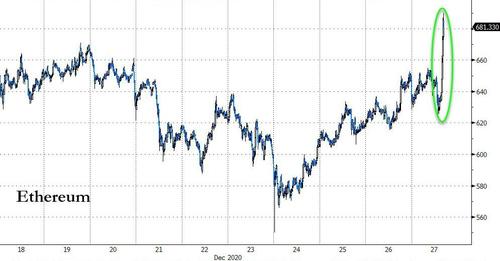

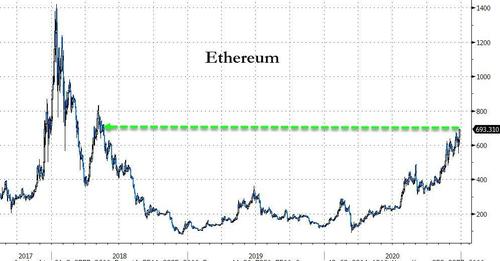

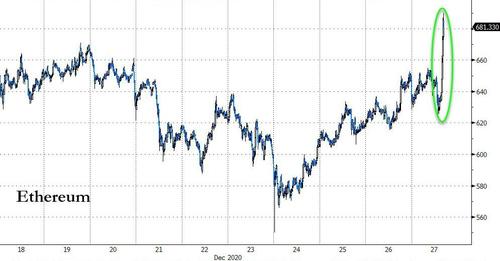

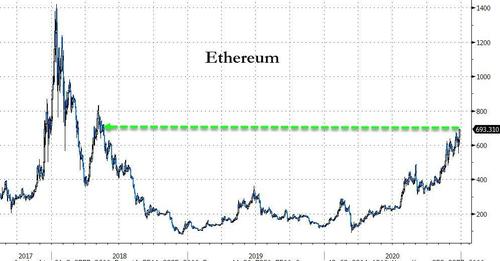

While Ethereum surge to a fresh cycle high...

Source: Bloomberg

Its highest since May 2018...

Source: Bloomberg

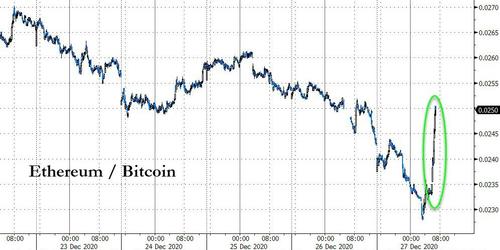

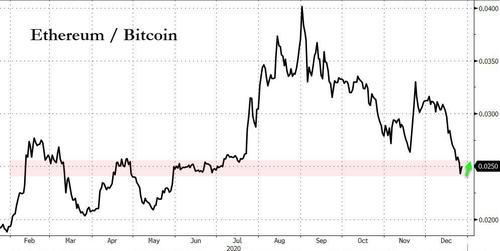

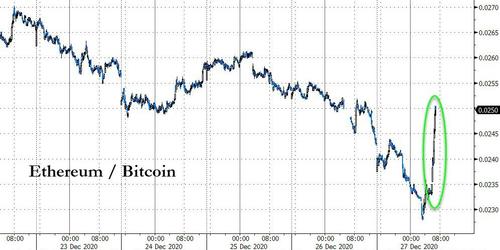

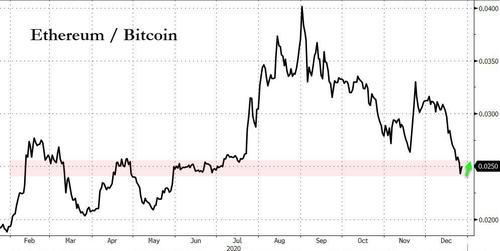

This was a very notable reversal in the recent trend of Bitcoin outperformance...

Source: Bloomberg

As Ethereum seemed to find support again at 0.025 Bitcoins...

Source: Bloomberg

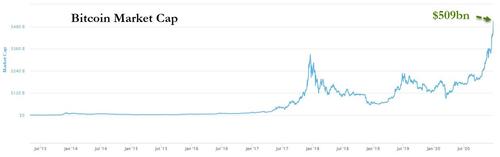

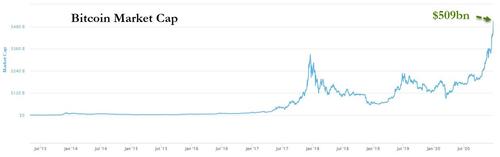

Bitcoin's surge in price pushed it above the $500 billion market cap level for the first time...

Source: CoinMarketCap

With institutional investors taking a break, talk turned to retail buyers fuelling the latest phase of the Bitcoin bull run.

“The bull cycle of bull cycles has started, as more and more players are starting to adopt towards Bitcoin and cryptocurrencies,” Cointelegraph Markets analyst Michaël van de Poppe summarized to Twitter followers.

But, judging by the GoogleTrends data, this remains an institutional story, very different from 2017...

Finally, this looks set to be the biggest gap open in Bitcoin futures markets ever as spot prices have surged an incredible $4000 since Bitcoin Futures closed on Thursday...

Source: Bloomberg

$2.3 billion worth of Bitcoin futures expired on Christmas day, which historically has led to choppy markets, but we suspect some serious margin calls are still on their way.

With the end of the year looming, some fund managers may also be buying BTC so they can brag next year about being smart enough to get in in 2020 while neglecting to say at which price they had done so.

Sent from my iPhone |