Re << Any idea why MARA Jan 22 call spread 7 and 25 is quoted around 2.5 when stock is trading at 13+?

BTW, check out some Uranium miners...hooders are probably thinking they could mine bitcoins too.>>

Re <<Uranium>>

I was told folks are rightly expecting commodity inflation due to all sorts of good reasons. But as speculation is rife given season, best to be purist speculator, and stay with wagers on the short side and add what folks want in wallop size.

Actually, as only flow matters and fundamentals are dead, doesn’t really matter what we do, all have a chance to make money all different ways.

Re <<MARA>>

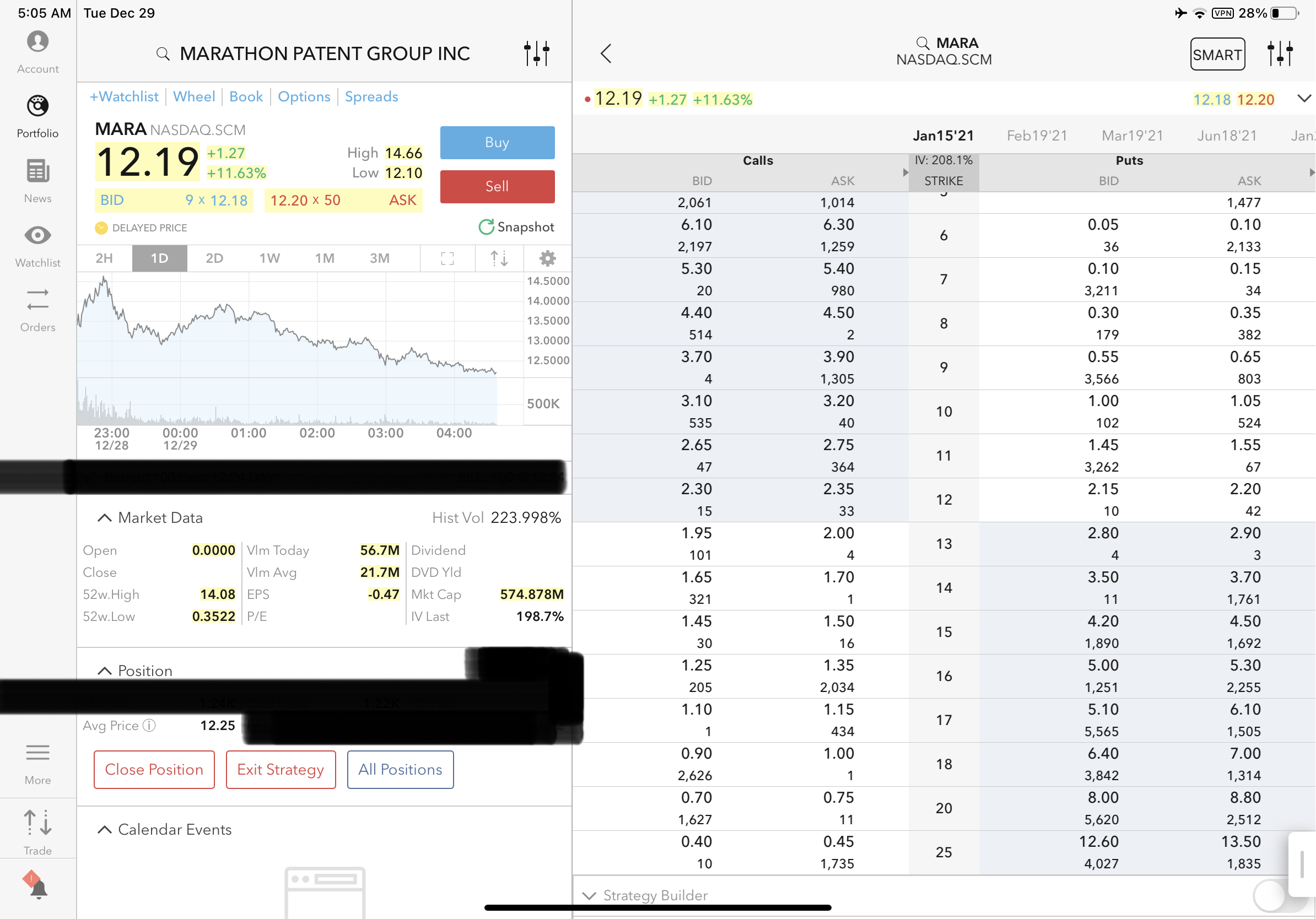

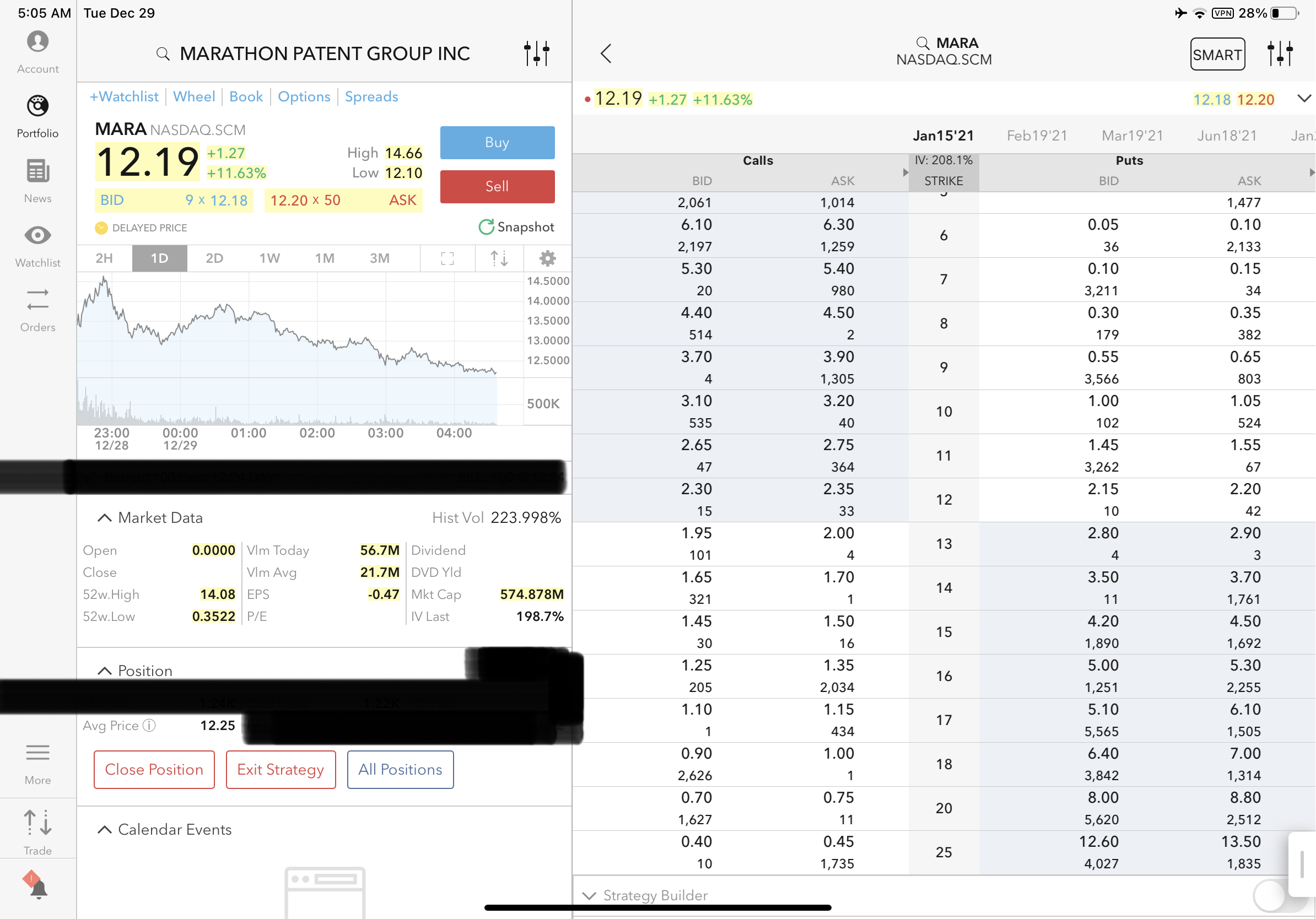

Dispatched armed recon into MARA finance.yahoo.com space to engage and experience, and make it out alive if able. Anything indicating 200% implied volatility is indubitably alive and dangerous, especially when most have little idea re whatever is going on.

Let us assume, safe, that MARA is over-valued, but might get still more unreasonable.

Let our macro premise be that we might experience a bad jolt, either by market-wide storm or bitgold-specific stormlette on this side of end-January. Unless of course the market storms higher, into March, and then melts. As Jack said to me re the market, “anything can happen”.

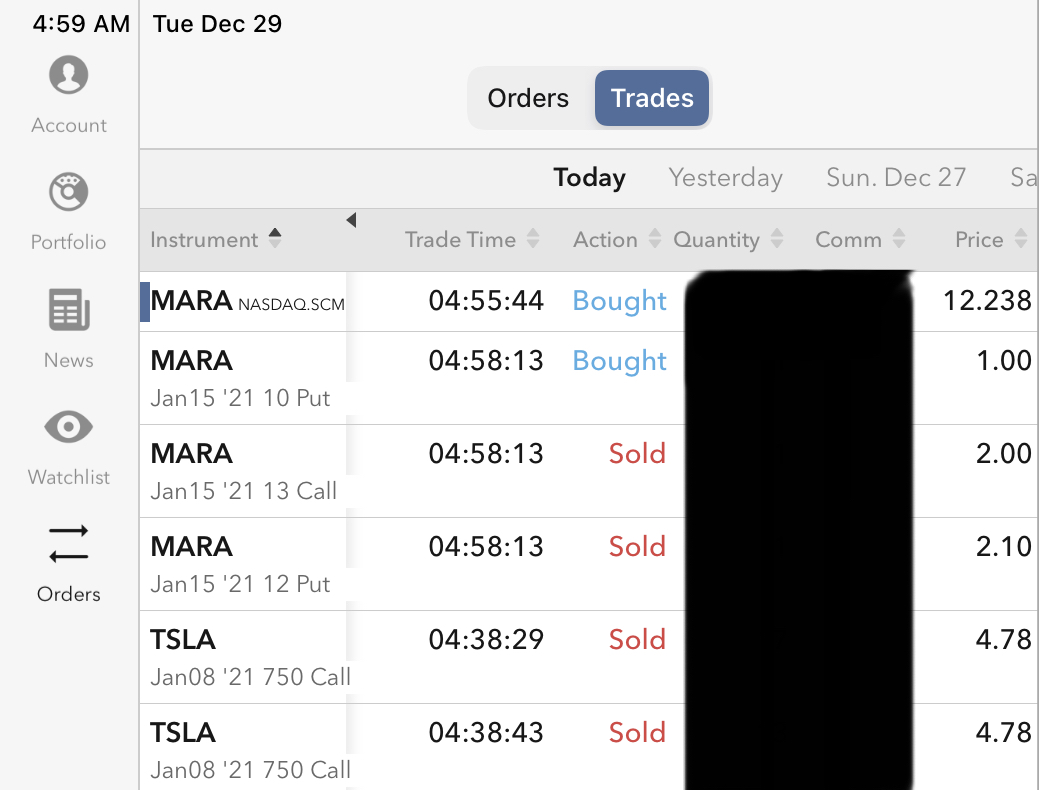

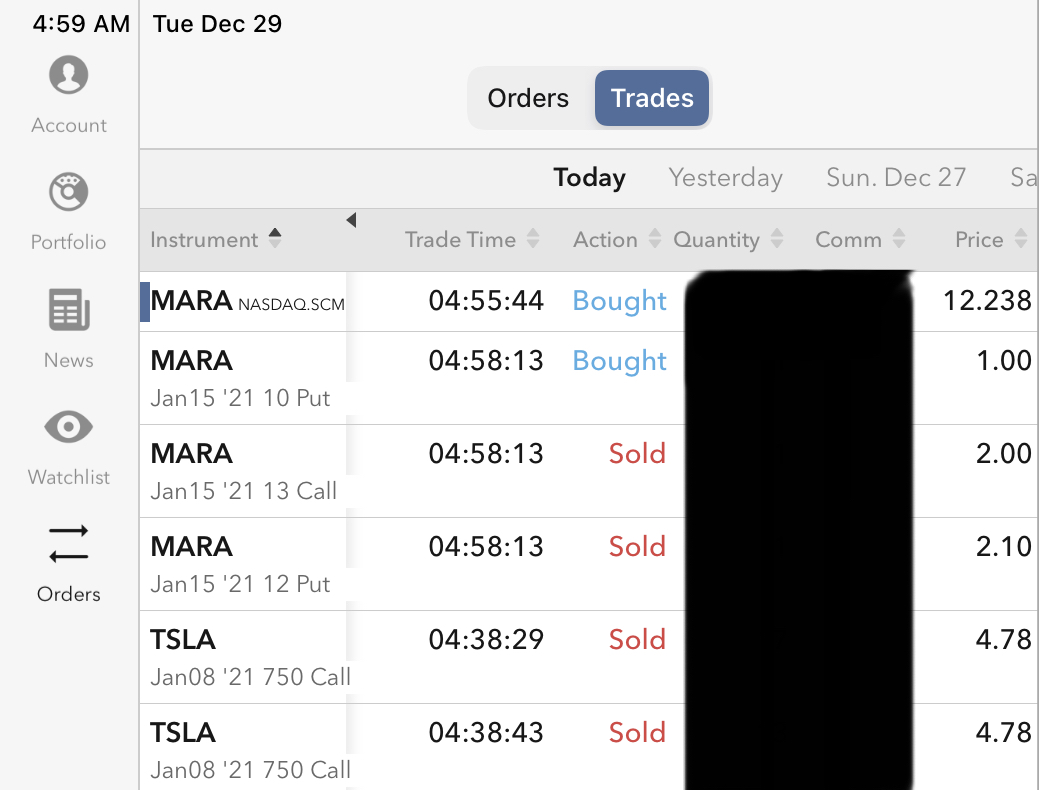

Given so, let us play, did below, shorted more TSLS for negative-carry funding currency, and went long MARA bracketed by complement of support troops. What the heck, it is all free, with leftovers for more CHL, DRD, GBTC, and gold, but later.

Because 200% IV is an invitation to explore ...

tipranks.com

finviz.com

|