It is nice when the officialdom does our bidding, to stump on the riff raff and cull the pretenders

:0)

bloomberg.com

Cryptocurrency XRP Is in Free Fall With Exchanges Delisting Coin

Olga Kharif

30 December 2020, 02:04 GMT+8

A slew of exchanges delisted the coin following SEC lawsuit

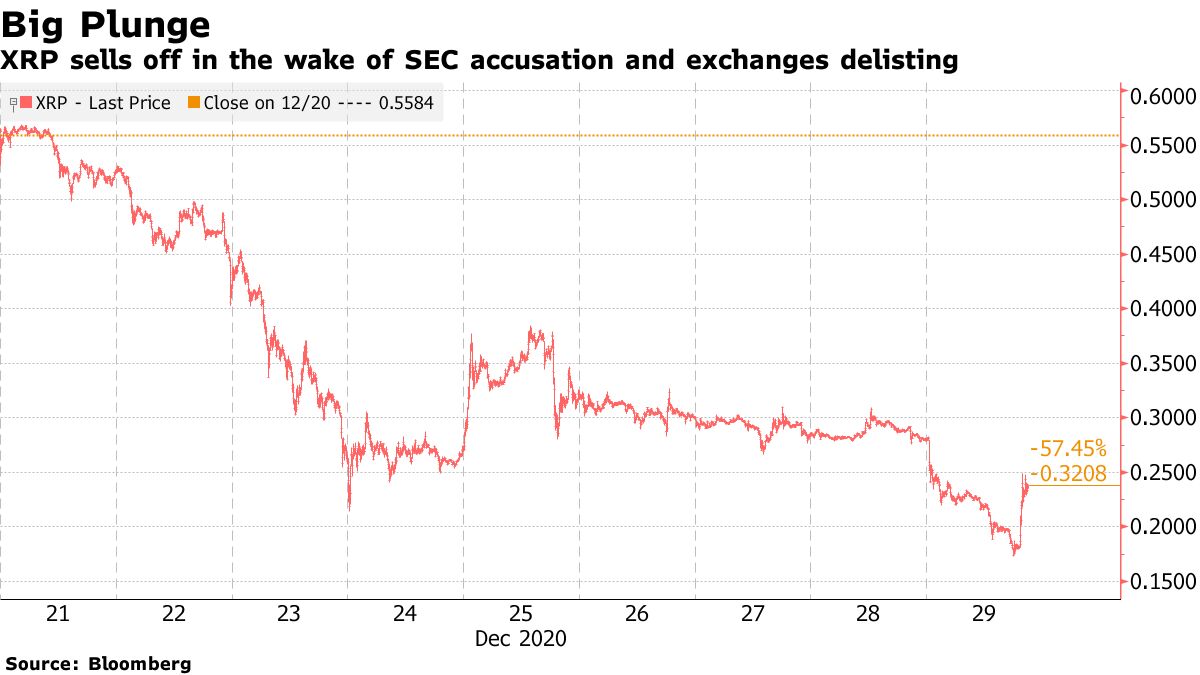

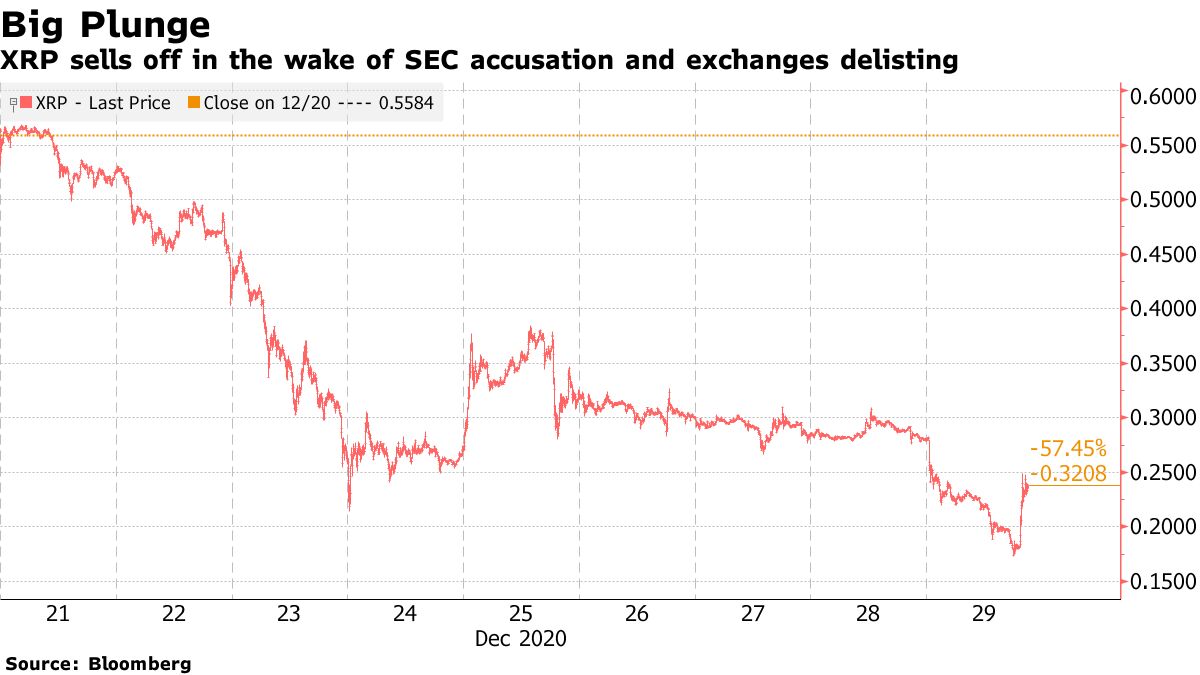

XRP continued its plunge after Coinbase became the latest U.S. crypto exchange to remove the world’s fourth-biggest coin in the wake of an SEC lawsuit against Ripple Labs Inc.

XRP tumbled 37% Tuesday, bringing its drop to 60% in the week since securities regulators accused Ripple of issuing more than $1 billion in unregistered tokens. Coinbase said Tuesday that it will fully suspend trading XRP on Jan. 19, but will continue providing custodial services for clients.

Customers will find it increasingly difficult to trade XRP after the largest exchange joined Bitstamp in delisting the token. Coinbase customers can move it to another exchange, but it is growing more likely that the regulatory challenge will lead other U.S.-based venues to follow suit. Last week, the Bitwise 10 Crypto Index Fund (ticker BITW) liquidated its position in XRP, which comprised 3.8% of its holdings.

“This is obviously bad for XRP across multiple dimensions: fewer potential buyers, and lower overall liquidity. For XRP to work as Ripple intends, XRP needs to be very liquid, so this particularly harmful,” said Kyle Samani, co-founder of Multicoin Capital.

The Securities and Exchange Commission said in last week’s suit that Ripple raised more than $1.4 billion through the sale of XRP without first registering it as a security with the agency, creating “an information vacuum” that mislead investors. San Fransisco-based Ripple has denied the allegations.

“The SEC has introduced more uncertainty into the market, actively harming the community they’re supposed to protect,” Ripple said in a statement on its website. “It’s no surprise that some market participants are reacting conservatively as a result. We’ll be filing our response in a few weeks to address these unproven allegations.” |