| | | Re <<Did you deploy cheap puts?>>

Yes, following on to Message 33114798 I did below ...

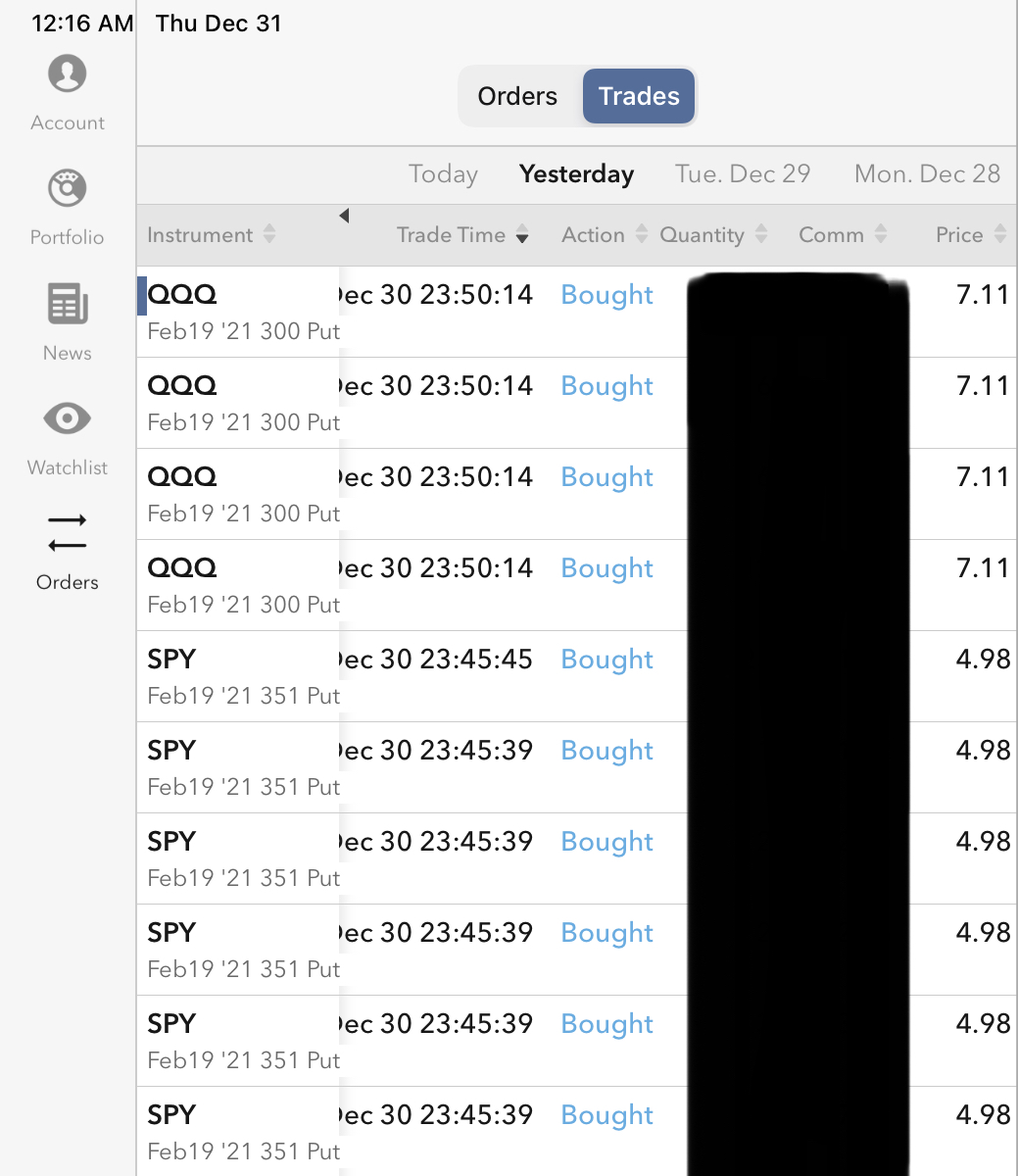

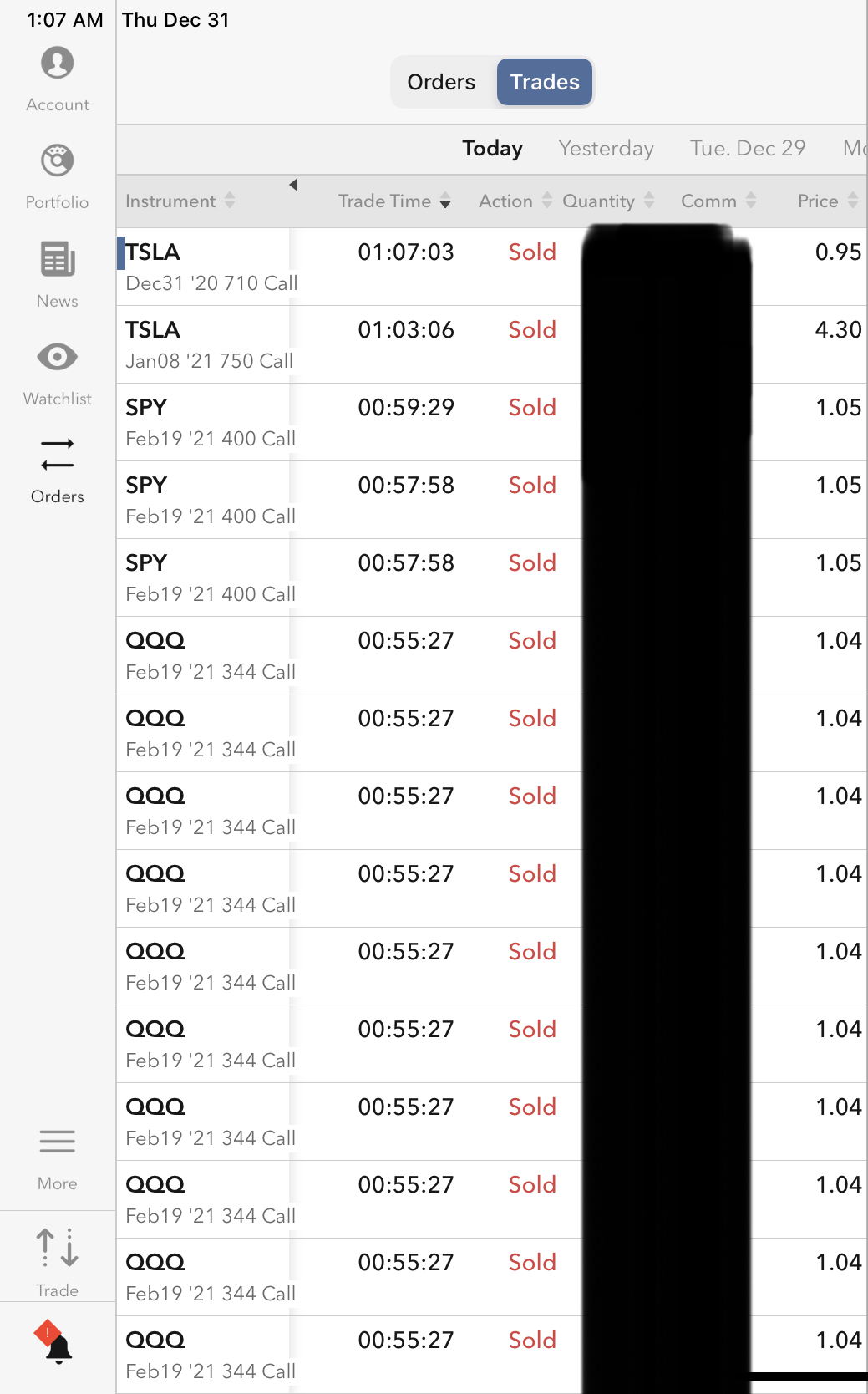

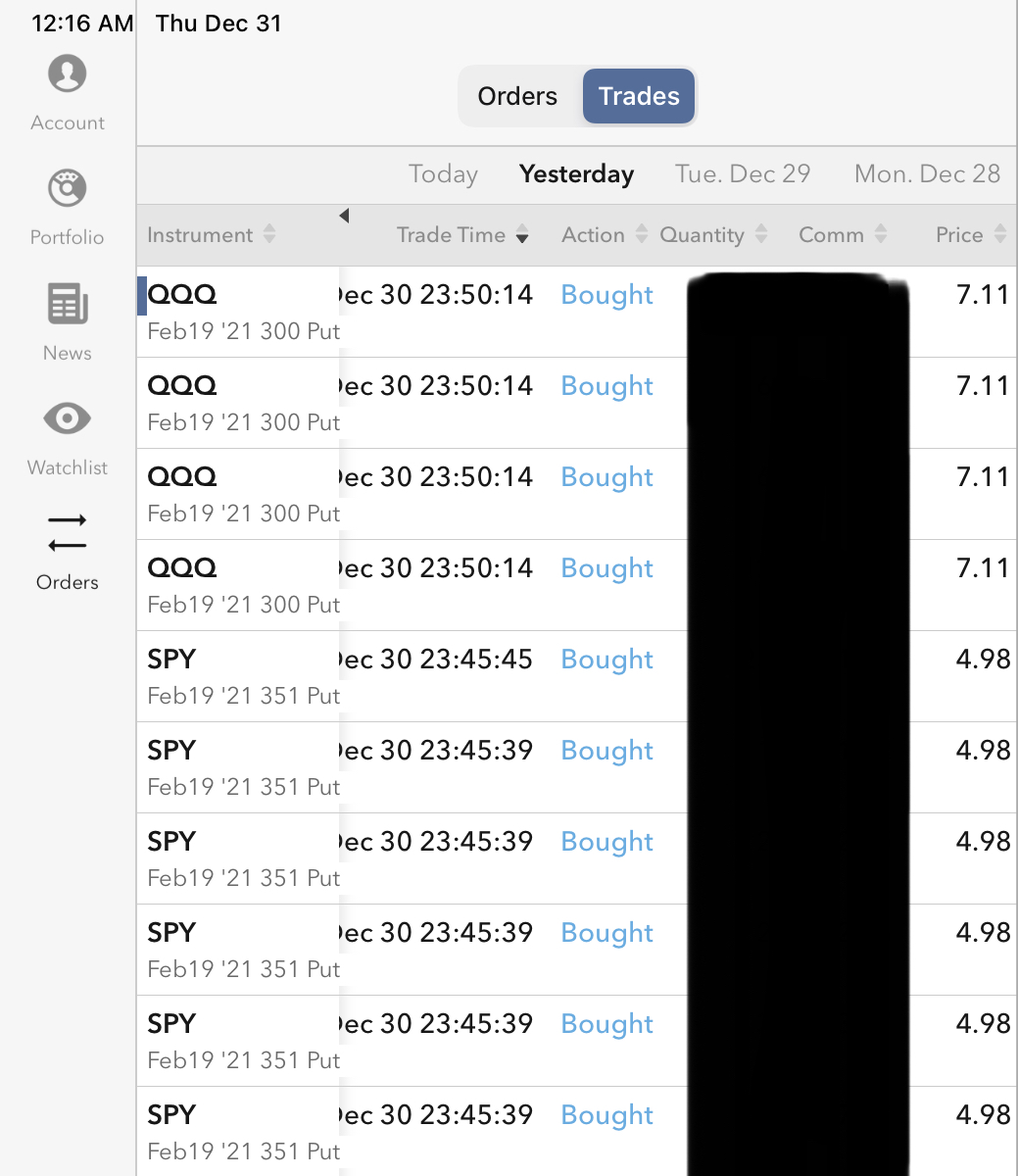

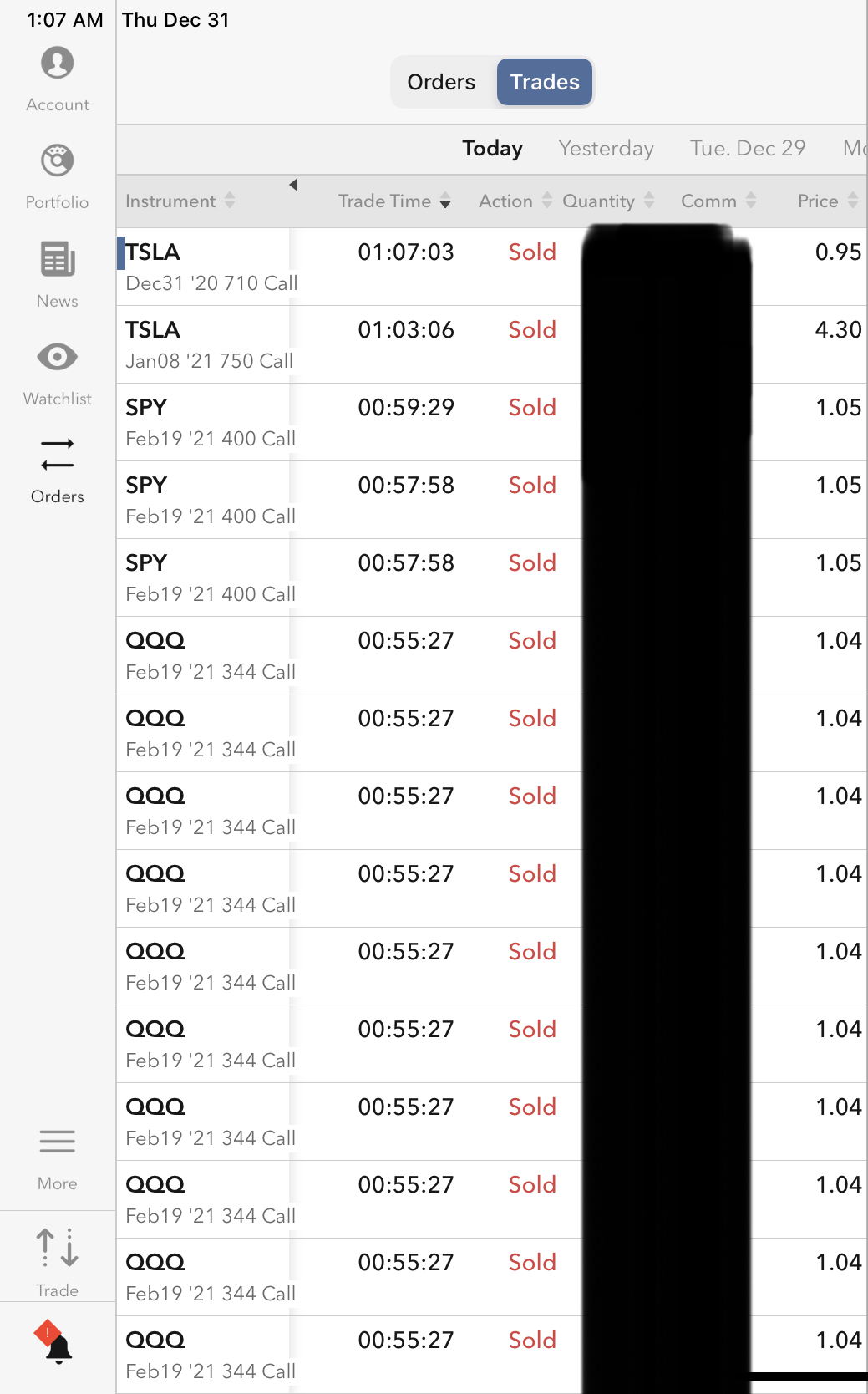

I purchased puts on QQQ and SPY both, and I financed the long positions by shorting calls of QQQ, SPY, and TSLA, my go-to negative-carry funding currency, trying for a win-win outcome. Had to deploy more naked-short TSLA expiration tomorrow and 8th January call strikes-710 & 750 as I could not reasonably finance 100% of the SPY & QQQ Put purchases by shorting SPY & QQQ calls alone.

Was thinking that ...

Given the volatilities and valuations of QQQ, SPY and TSLA, I am more confident to be able to roll the short TSLA call positions (to either higher premium and/or higher strike) than I am certain about doing same w/ QQQ and SPY positions.

In any case ...

Bottom line, yes I want to guard against market-wide drubbing to end-Feb 2021 (the volatility-splash should be reflected in the 19th Feb Puts even as we near the expiration) but no, I prefer that someone else pay for the play. I get what Trump said, about Mexico and the wall, but not so much re China and tariffs.

Should the expected not materialize, as many expectations do not work out, I am guessing that I shall play one more round, to end-May, for reasons other than Georgia and regime-change splashing. I am also mindful the the Fed means ‘whatever it takes’ as it is guided by edict of inflation-targeting.

Could have been cute and sell some GBTC to finance the entire undertaking, but that would make the exercise very expensive, I fear, as bitgold likely to rise further. I do not want to do the short bitcoin <=> long pizza trade :0)

Let us see how it works out.

30K in gunsight ...

|

|