Google: Next Stop $2,100

Dec. 8, 2020 7:02 AM ET

|

130 comments

|

About: Alphabet Inc. (GOOG), GOOGL

Michael Fitzsimmons

Technology, ETFs, Renewable Energy, Oil & gas, Gold

(14,690 followers)

Summary

Google recently broke out of a technical cup and handle formation and looks likely to run significantly higher.

But the technicals aren't driving the stock - the fundamentals are. Google continues to dominate the global search, smartphone OS, and browser markets, while Google Cloud Platform grew ~45% in Q3.

Google generated $11.6 billion in free cash flow ("FCF") in Q3 alone. That's an estimated $16.85/share.

One of Google's "other" bets - AI-based Deep Mind - recently made a major breakthrough in computational biology with its neural-network based Alpha Fold algorithm.

Based a vaccine-related comeback in the economy and growth in its cloud business, I expect Google to easily hit $2,100 in 2021, up ~15% from here.

Google ( GOOG, GOOGL) shares recently broke out to the upside and are now hitting all-time highs. I added to my position anyway. That's because the Q3 earnings report demonstrated a strong rebound from the earlier pandemic impacted and weak results in Q2. Now the stock looks strong both in terms of its technical chart pattern and its business prospects moving forward. Specifically, Google Cloud Platform ("GCP") is likely to be a primary growth engine for years to come. In the meantime, the company ended Q3 with $132.6 billion in cash and cash equivalents (an estimated $193/share), while generating $11.6 billion in free cash flow ("FCF") in Q3 alone (an estimated $16.85/share). With ubiquitous assets and a vast net ecosystem that includes "Google it" search, Gmail, YouTube, Android, Nest, Chromebook, the Pixel smartphone and Maps, Google is simply one giant FCF-generating machine.

And yes, I know the parent company is technically "Alphabet" - which consists primarily of Google and as a holding company for the "other" bets. Call me old-school, but throughout the rest of this article, I will refer to both interchangeably simply as the stock symbol infers: "Google."

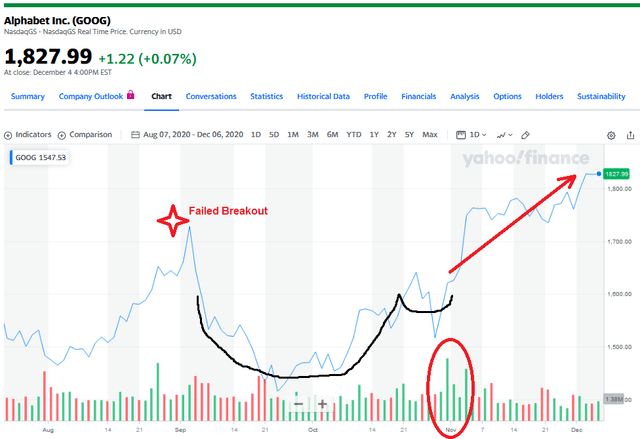

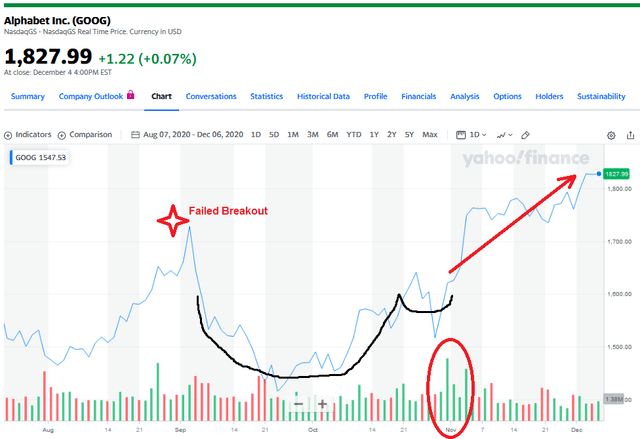

The Stock Chart From a technical point of view, Google appears to have broken out to the upside from a classic Investor's Business Daily cup and handle formation:

(Source: Yahoo Finance; annotations by author)

As can be seen, the prior strong uptrend into the cup was followed by a sharp pullback during the March sell-off. Recovery into the handle was followed by a strong breakout, on increasing up-volume that drove the stock practically straight up from $1,600 to $1,700. GOOG is now trading at or near all-time highs.

Now, some of you might think it's too late and say, "Mike, why didn't you give us the heads-up at $1,600?" However, note that back in early September, GOOG had broken out and then failed miserably - correcting ~18%. The current breakout has been sustained and appears to be "the real thing". Note that this weekend, Investor's Business Daily also said that GOOGL is a Buy.

Why Buy At All-Time Highs? The simple answer is because GOOG is going higher. The more detailed answer is because:

The Google Cloud Platform ("GCP") will be a growth driver.The Android operating system, the #1 global OS for smartphones, will continue to drive mobile search.Google Search will continue to thrive, with advertising revenue likely to rebound strongly in 2021 as vaccines penetrate the population.The significant cash position ($132.6 billion at the end of Q3) and the company's strong FCF generation enable Google to continue to invest in innovation and long-term growth opportunities. Earnings In late October, Google (i.e., Alphabet) released its Q3 earnings report that showed the company had recovered from the prior two quarters of relative stagnation that led to my September Seeking Alpha article, " Google: FANNG's Red-Headed Stepchild." The Q3 revenue breakdown:

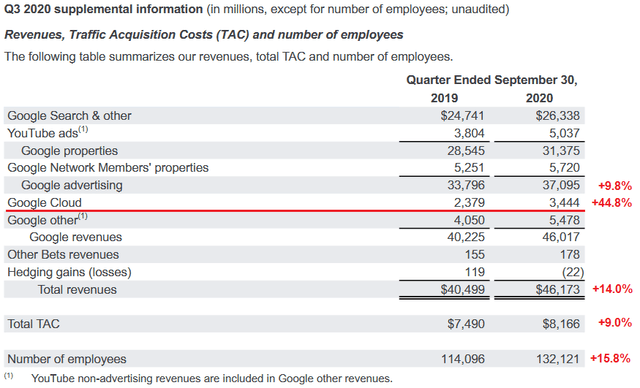

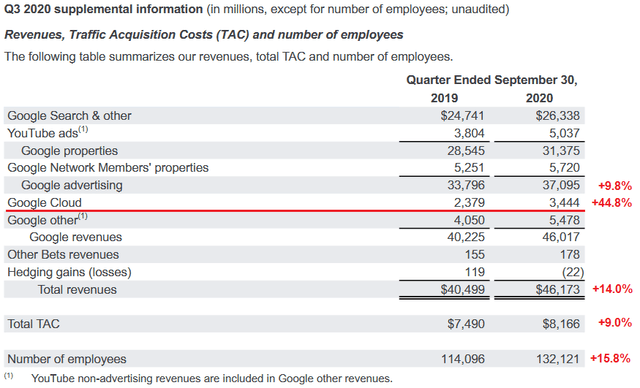

(Source: Q3 EPS Report)

As can be seen in the graphic above, Google advertising revenue was up 9.8%, Google Cloud hit it out of the park with revenue up nearly 45%, and total revenue was up 14% yoy. This was achieved by TAC growing only 9%. However, it was still somewhat concerning to me as a shareholder that the number of employees grew by almost 17% yoy.

Sequentially, Q3 total revenue was up 21% from Q2's $38.297 billion. Google Cloud growth of 44.8% in Q3 accelerated from Q2's 43.2% yoy increase.

Meantime, "Other" income swung from a loss of $549 million in the year-ago quarter to positive income of $2.15 billion, largely due to gains recorded in GOOG's equity securities holdings.

Operating margins of 24% rose a full percentage point as compared to the year-earlier quarter. Bottom line fully diluted EPS came in a $16.40/share: up 62% yoy.

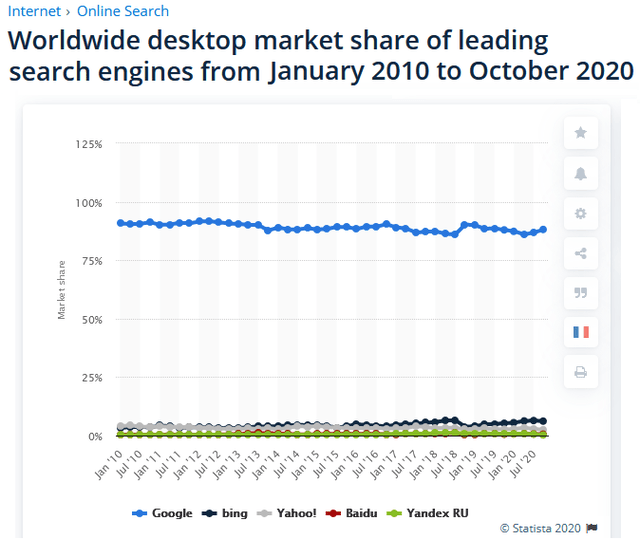

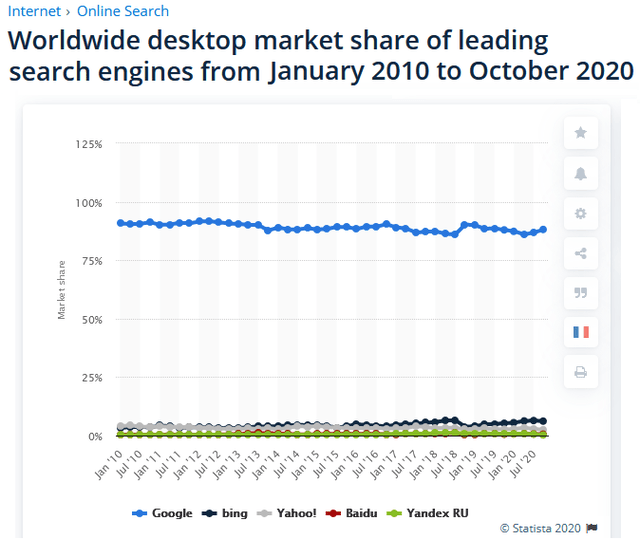

Going Forward Obviously, the Google Cloud Platform ("GCP") is the company's fastest-growing segment. But at $3.44 billion of Q3 revenue, GCP equates to only 7.5% of GOOG's total revenue. That being the case, it is good news that Google Search still dominates the global search market and actually ticked up to an 88.1% market share in October - leaving second-placed Bing ( MSFT) (6.2%) in the dust:

(Source: Statista)

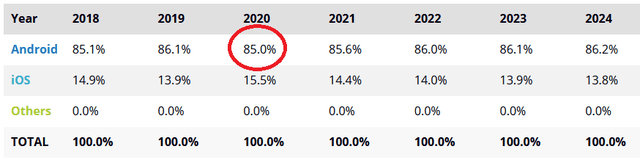

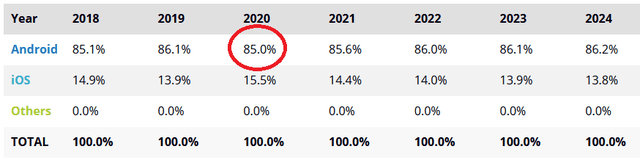

In addition, the Google Android operating system continues to dominate the global smartphone OS market. That doesn't look to change anytime soon, as Android's market share is actually expected to marginally increase over the coming years:

(Source: IDC)

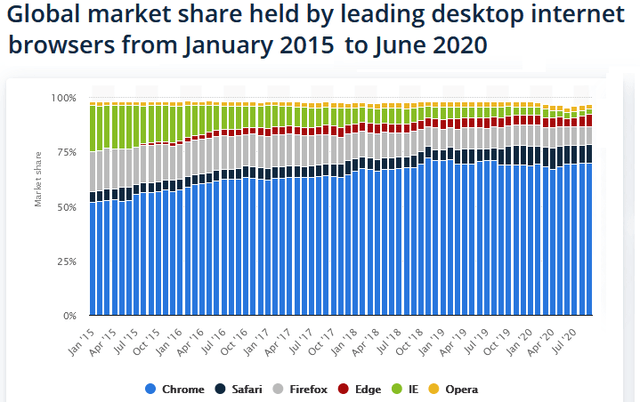

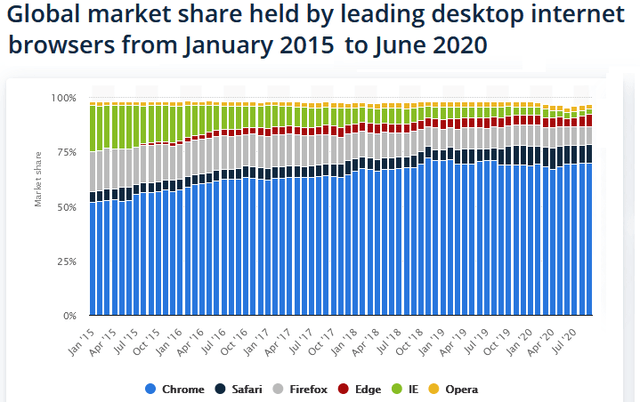

In an oft-neglected part of GOOG's ecosystem, note that its Chrome browser also dominates the market. It's just another way that GOOG can acquire user data and then use techniques such as AI and machine learning ("ML") to optimize monetization of that data - primarily through advertising revenue.

(Source: Statista)

Given its already dominant market share the global search, smartphone OS, and browser markets, it's only logical that Google concentrates on growing its cloud business. Sure, it's concentrating on "other bets" too, but GCP is currently delivering the best revenue growth.

The company's cloud strategy is three-fold:

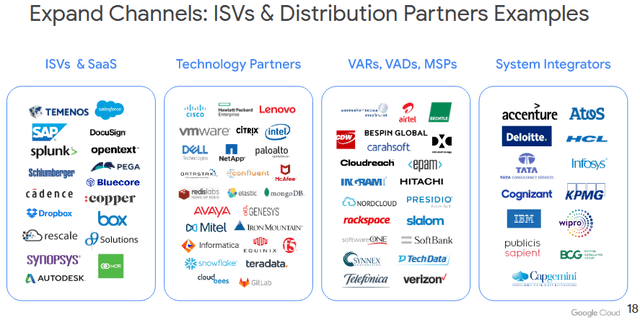

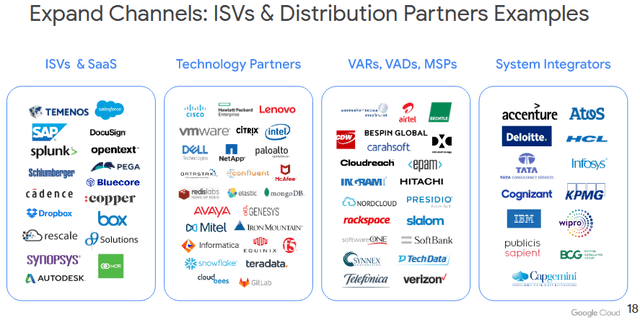

Deliver a Distributed Infrastructure as a Service (Public, Hybrid, Edge)Provide a Digital Transformation Platform (Apps, AI & ML, Analytics, Collaboration).Provide Industry-Specific Digital Transformation Solutions (Retail, Health Care, Industrial, Financial Services, Media & Entertainment). One of the primary ways Google is working to drive GCP growth is by expanding distribution channels by developing new - and deepening existing - partnerships:

(Source: Goldman Sachs Presentation)

The bottom line is that the company is growing its GCP business because it is expanding the total addressable market ("TAM") by developing new product enhancements and delivering enterprise level solutions that are attractive to its customers. At the end of the day, it's all about making GCP the easiest to do business with. That leads to high customer renewal rates and multi-year recurring revenue agreements.

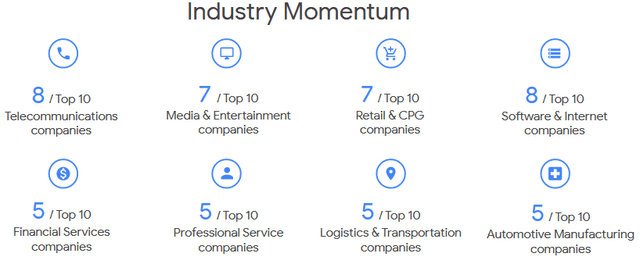

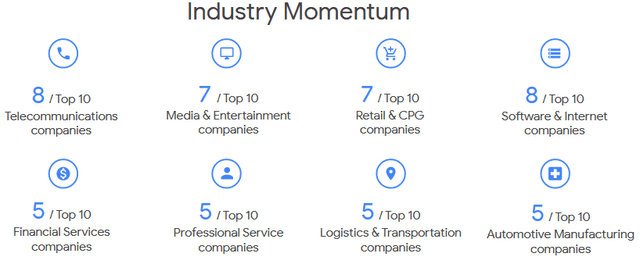

GCP is building on its momentum in every country and every industry:

(Source: Goldman Sachs Presentation)

For a more detailed discussion on how the GCP team is working with customers like Shopify ( SHOP) and the Mayo Clinic and with governments around the globe, consider reading the RBC Interview Transcript (11/17/2020) with Thomas Kurian - the CEO of Google Cloud.

"Other Bets" Google is often criticized for investing money on "long-shot" research that may have little chance of generating near-term revenue. That is short-sighted, in my opinion.

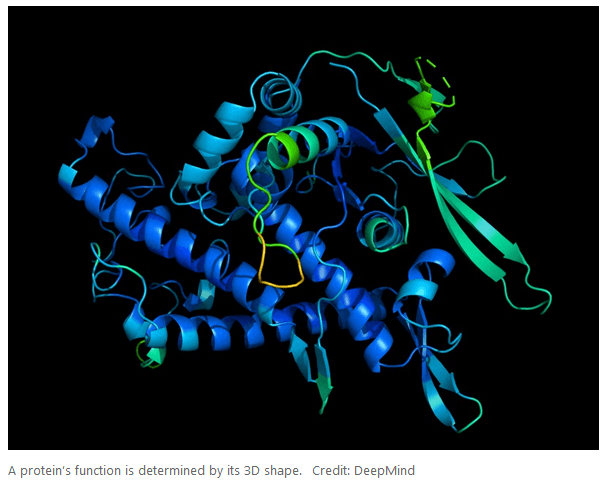

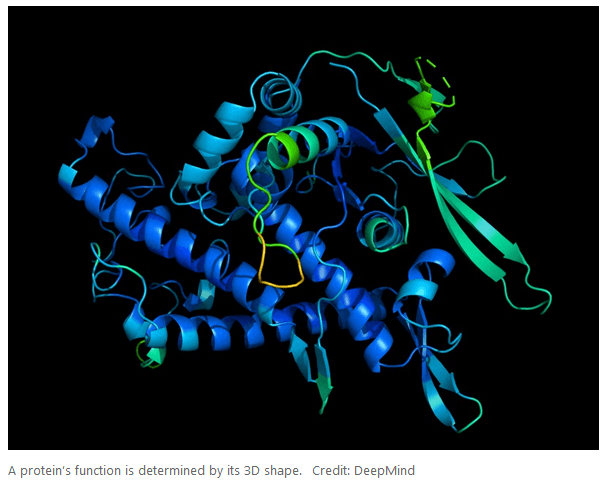

(Source: Nature.com)

On November 30, Deep Mind - Google's AI Lab - announced it had cracked the code on the " protein-folding problem" (see graphic above) with a neural-network based algorithm called Alpha Fold. This is considered to be a major breakthrough that one evolutionary biologist Andrei Lupus told Nature is “a game changer. This will change medicine. It will change research. It will change bioengineering. It will change everything.”

This kind of "other" research is exactly what a company like Google should be investing in considering its massive cash position and excellent ability to generate FCF quarter after quarter.

Also, consider that Waymo - Google's autonomous driving business - still has relatively little revenue but was valued at $30 billion earlier this year. While that is down significantly from past valuation levels, it nonetheless shows the potential of investing in emerging technologies.

Google is also investing in smart homes with its Nest brand, using technology for better health (Verily), and high-speed internet (Google Fiber).

Meanwhile, Wall Street Breakfast's week-ahead report says that GOOG is expected win approval from the EU for its takeover of Fitbit ( FIT).

Valuation The following chart shows the valuation levels of the three leading cloud providers: Google, Amazon AWS ( AMZN), and Microsoft Azure. Amazon is in a class all by itself, for obvious reasons:

| TTM P/E | Forward P/E | | Amazon | 92x | 92x | | Microsoft | 35x | 32x | | Google | 35x | 36x | (Source: Seeking Alpha)

And in addition to its amazing retail and advertising business, Amazon is still the acknowledged leader in cloud computing, with AWS delivering $11.6 billion in Q3 revenue. Note that AWS delivered almost as much net-income as GCP has in sales.

Microsoft doesn't break out its Azure sales other than to say they rose 59% in Q3. These are obviously two strong competitors for Google in the cloud space, but all three companies are growing their cloud businesses at impressive clips - apparently there is room for all.

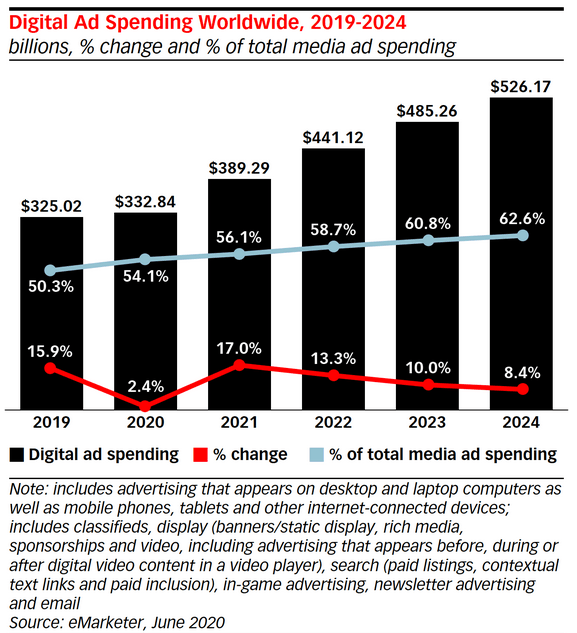

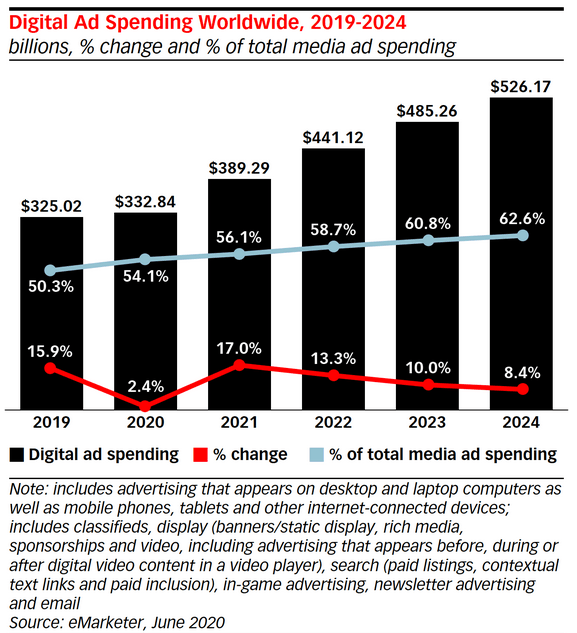

Annualizing Q3's $16.85/share in FCF gets to $67.40/share. At $2,100/share, that's only 31x that FCF estimate. This estimate is very conservative because it assumes no FCF growth next year over Q3's result - which hard to imagine with a rebound in AdTech revenue and GCP growing at 40%+. Note that Emarketer expects Google's AdTech revenue to increase by 20% next year and for overall digital ad spending to increase by 17% next year (see below).

(Source: WhatsNewInPublishing.com)

If Google can grow FCF by 10% next year, $2,100 equates to ~28x annual FCF. In my opinion, that's cheap for a company that dominates multiple global markets and currently holds ~$193/share in cash.

Note that both these estimates also neglect the favorable impact of share buybacks. Google spent $7.9 billion on share repurchases in Q3, with fully diluted shares down 1.8% yoy.

Risks Google's dominance in search makes the company an easy target for regulators. For example, the U.S. Department of Justice filed an antitrust suit against Google on October 20th for allegedly engaging in monopolistic practices in the online search market. This case will likely take years to resolve and could eventually end up at the Supreme Court.

The UK also plans to take steps to curb the company's dominance in AdTech. And Google also faces antitrust suits from a number of U.S. states that are targeting AdTech. As a result, headline risk is real and a headwind. However, as I pointed out in my previous Seeking Alpha article on Google (see article "Google: FAANNG's Red-Headed Stepchild" linked above), one could argue that Google is actually worth more broken up. But even that scenario would likely take years to play out in the courts, unless, of course, Google decided to spin off assets on its own.

In addition, and as noted earlier, many analysts criticize the company for spending too much capital in high-risk "other" areas that aren't likely to generate returns on capital anytime soon. However, the upside is that investors never know when one of these "moonshots" could lead to Google's next multi-billion dollar business. In the meantime, Google has demonstrated over the years that its FCF generation can easily fund these ventures while still significantly growing the bottom line.

Lastly, Google is still overly reliant on Search for the majority of its revenue and earnings. Competition from the likes of Facebook ( FB), Amazon, and Apple ( AAPL) could impact Google's advertising revenue. The company needs to diversify its revenue base (thus this article's focus on the GCP) and is another reason why it should continue investing in "other" bets.

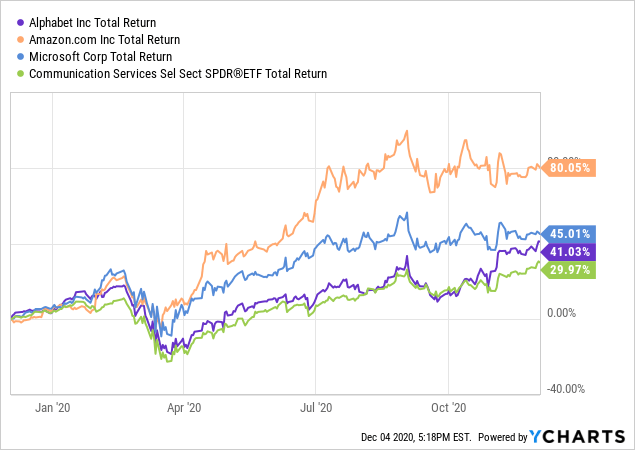

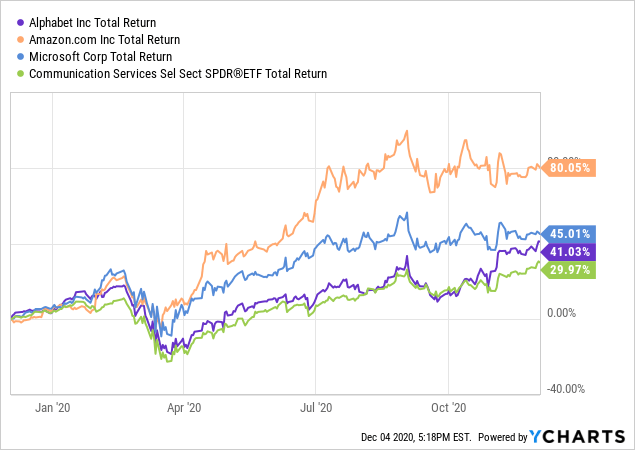

Summary and Conclusion Up until just recently, Google has been a laggard as compared to the other two large cloud providers and even the Communication Services Select Sector SPDR Fund ( XLC), of which it is a component:

Data by YCharts That will change in 2021 as Google plays catch-up. Next year, Google Search should benefit from vaccines and a more normal environment for "googling" travel bookings, restaurants, and entertainment (i.e., growing advertising revenue). Meanwhile, note that Google ended Q3 with $132.6 billion in cash and cash equivalents. That equates to an estimated $193/share in cash. The company also generated $11.6 billion in FCF in Q3 alone (an estimated $16.85/share). That's the real story that will drive shares to over $2,100 in 2021: the company is one giant FCF-generating machine. Data by YCharts That will change in 2021 as Google plays catch-up. Next year, Google Search should benefit from vaccines and a more normal environment for "googling" travel bookings, restaurants, and entertainment (i.e., growing advertising revenue). Meanwhile, note that Google ended Q3 with $132.6 billion in cash and cash equivalents. That equates to an estimated $193/share in cash. The company also generated $11.6 billion in FCF in Q3 alone (an estimated $16.85/share). That's the real story that will drive shares to over $2,100 in 2021: the company is one giant FCF-generating machine.

Disclosure: I am/we are long GOOG AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make. |

Data by

Data by