A moment for deliberation:

(1) Should we subscribe to "Fiat Inflation In France" mises.org , and I do repeatedly read the book, then we understand that we are not in new-paradigm-anything but in something quite old, as old as money, that which we might term a bubble for simplicity even as bubbles are complicated

(2) If we are in a bubble, we might ponder whether it is a bubble of somethings or of everything. Should I be pushed to tell, I say "of everything, except gold"

(3) But we know even and perhaps especially gold goes down whenever a bubble finds a pin, as all books are reduced to bare fundamentals, until the central banks ride in w/ more debt to reflate. We are certainly conditioned to believe so. At least I am conditioned to believe so

(4) Then it comes timing, that which we might term speculation, and which is difficult

(5) Most of what many people including myself have are not liquid to the extent of scalable by keyboard tapping, which essentially means need to look ahead, and try to discern what might be, and our only ways really are just taking stock of where we are, temperature of society(ies) including politics that affect monetary / economic measures and feedback-loop issues, and reason out where we ought to go so as to end up in a better place than people going w/ the flow

(6) Most people have nothing, and they riot, and the politicians, whether they know it or not, and if not, know it late, are concerned when having to deal with street-level kinetics.

I am not even referring to whatever just happened in Washington DC, but much more broadly, and yes, in every episode of kinetics there are those that stir the pot.

Given their visibility folks often 'blame' the media. Media is just a reflection of the complicated nature of societies.

Others quickly 'blame' politicians. Politicians are only symptoms.

Some blame central banks. Central banks are only doing what they are supposed to do, what they were told to do. At each juncture, whatever they must best do. Per "Fiat Money Inflation in France".

(7) When do we get off of the bus that is heading the wrong way? In a universe composed of assets and liabilities there are no borders. There is only the universe. How to even do it, getting off of the bus that is the universe?

(8) Speaking of bus, need to consider, or reconsider, or pause and ponder, for example, BTC / GBTC.

(9) If not ponder for myself, then for the kids' play portfolios, for what kind of a lesson do I want them to learn?

Also for my assistant's savings portfolio. It is comprised of real savings.

(11) The kids' primary play portfolio started at beginning of 2020, at $10,000 each, of play-money

The kids' secondary portfolio is a play-money birthday gift started ~October, set to terminate 2021-02-19 option expiration day, and they simply pick whatever they pick out of a set of possibilities and hold until that date. These portfolio do not allow fidget-fidget, so just a learning exercise.

(12) The (Erica) assistant's portfolio was started many years ago and the gains are real. The portfolio had started with whatever the sum and recently had injected $5K of fresh money after years of no injection. The 5K remains in cash form

(13) None of the a/c are taxable.

(14) I am thinking that the assistant's a/c ought to - here is the hard part - the holdings are all 'good' stuff! - do what?

- unload 50% of GBTC and do nothing else

- unload 50% of GBTC and re-deploy to what?

- unload 50% of everything and stay in wait

(15) None of the a/cs handle options (not a feature of the App, and not doable in Erica's a/c). The App can handle short positions and of course can handle Long inverse ETFs.

(16) In any case I am thinking the kids should be alerted to choose to whether or not reduce book by 50% across the board (they are not supposed to short for that would be gambling), or even go negative (by going long inverse ETFs) as a lesson but I hesitate on this chapter

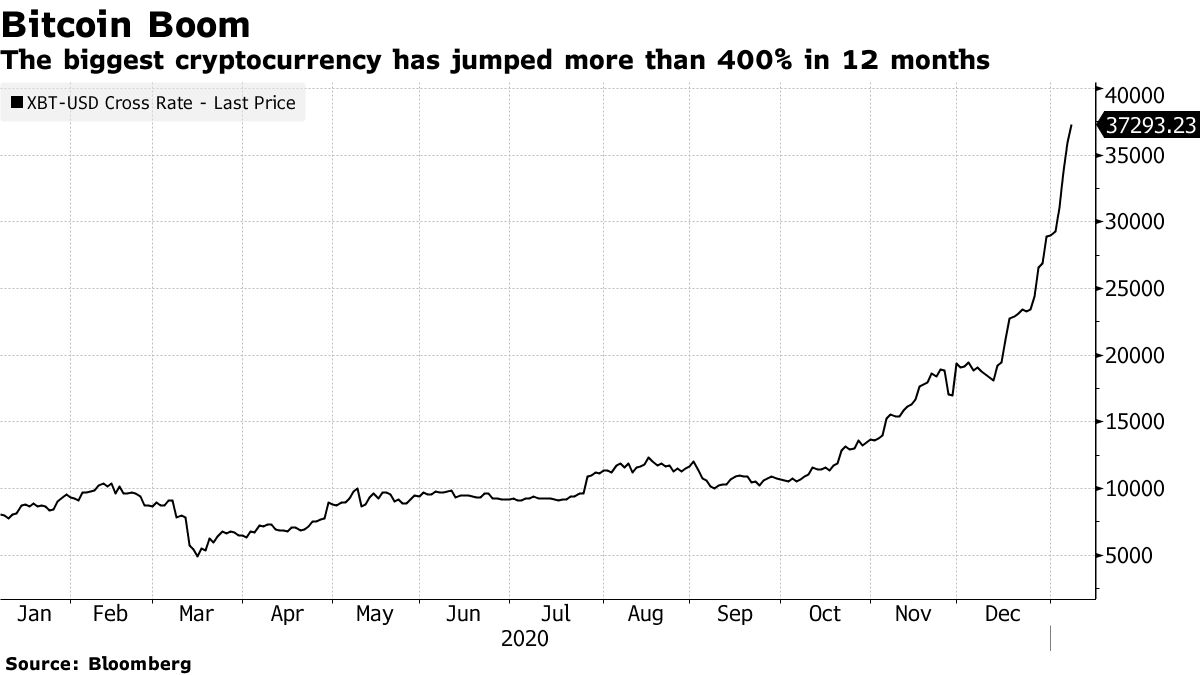

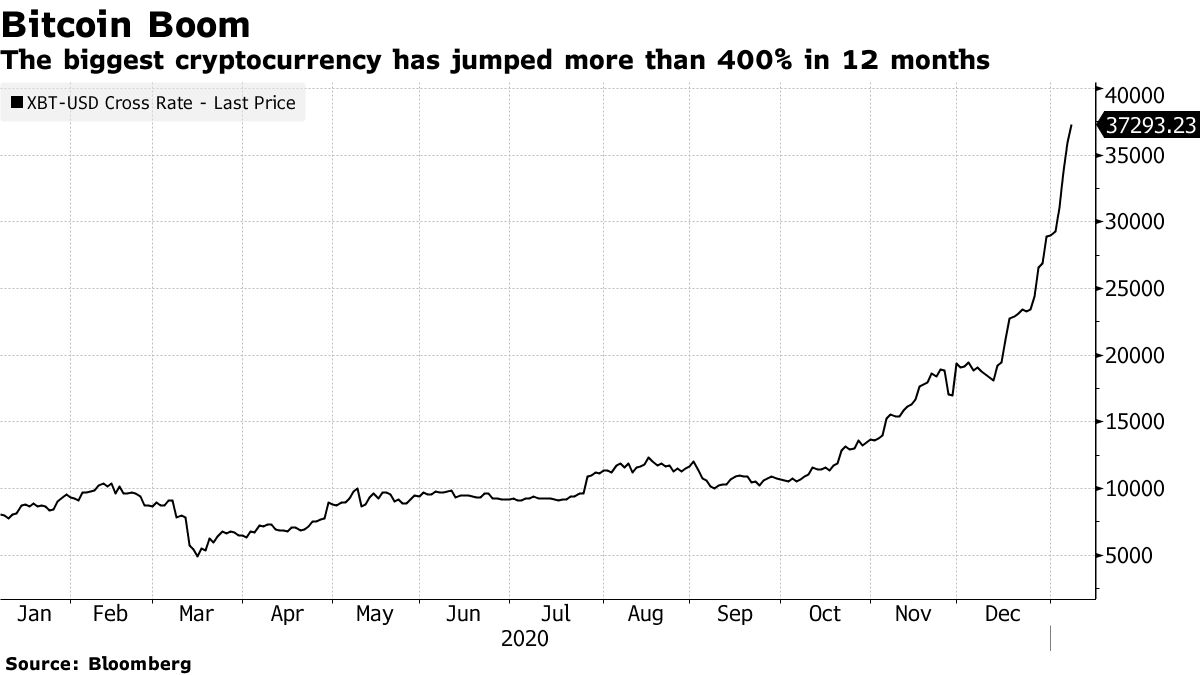

My thoughts are triggered by below article. When such facts are reported, the fever is advanced.

bloomberg.com

Broker Touts Exotic Bitcoin Bet to Squeeze Income From Crypto

Viren Vaghela

As cryptocurrency pushes into mainstream finance and attracts billionaire tycoons, one U.K. brokerage is offering the merely wealthy a potentially safer way to play Bitcoin. The price: giving up any hope of the kind of stratospheric gains the digital coin is famous for.

London-based Marex Spectron Group Ltd. is selling a structured product known as an autocallable to people with at least $200,000 to invest, according to a term sheet. If the cryptocurrency stays relatively stable for awhile, Marex claims investors could reap an annualized return of as much as 70% via monthly coupons.

If Bitcoin keeps multiplying in value, autocallable investors don’t get to participate in that upside: they’ll just get their capital back early, plus their coupons. And if Bitcoin crashes again -- as it did three years ago -- investors would lose, but less than they would by trading Bitcoin directly.

“The idea that you want to sell out all the upside in order to get a coupon and 30% downside protection seems pretty unintuitive -- but these kind of structures in general are wildly popular,” said Benn Eifert, chief investment officer of hedge fund QVR Advisors. “I imagine they’ll find demand.”

Marex Solutions began marketing the autocallables this week, according to Nilesh Jethwa, who heads the division. Marex Spectron, which is active in the commodity and energy markets, is owned by JRJ Group, the private-equity firm of former Lehman Brothers bankers Jeremy Isaacs and Roger Nagioff.

“Bitcoin is becoming mainstream,” said Jethwa. The Marex product is reserved for professional investors and is being distributed via private banks and family offices.

The popular autocallable structure gained notoriety about two years ago when Natixis SA lost $200 million on the products in Korea after mismanaging the risks of equity market turmoil. Still, the products are a mainstay of the structured products universe, and attract retail investors, especially in Asia, who have large piles of savings and seek regular income.

Bitcoin rose as much as 12% on Thursday -- surpassing $40,000 and setting a record high. It has more than quadrupled in the past year, with prominent money managers like Guggenheim Investments’ Scott Minerd predicting the gains have just started.

That kind of return far exceeds what Marex’s autocallable can provide. But that’s a reasonable trade-off for the reduced downside, Jethwa said.

“We are transforming the risk from a speculative investment,” he said. “Investors can decide how much appetite they have for a crash and the yield they want.”

Read More: All Aboard Billionaires’ Bitcoin Bandwagon?

The development highlights how Bitcoin’s months-long rally is luring new investors far from its roots in the tech community, day-traders and people of an ideological bent that sought an alternative to conventional currency. Last year, the Chicago Mercantile Exchange started offering options contracts on Bitcoin futures.

Hedge funders like Alan Howard are becoming involved in an asset class that was once too fringe for the mainstream, betting that crypto is a gold-like hedge against pandemic-driven loose fiscal and monetary policy debasing fiat currencies.

”The reason to own Bitcoin is because things like this can always go up a lot more than they can go down,” QVR’s Eifert said. “They’re quite unlikely to remain stable over any material period of time.”

— With assistance by Donal Griffin

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |