Re << You could still lose all your money >> ... and end up with a lot of fast and truegold, the other useless monetary concept of faith.

Both are memory, and serves to remember what we worked for and saved for a rainy day. One digital, a math thing, the other physical, a metal. Both difficult to make disappear but relatively easy to hide.

Yeup, bitcoin and all crypto can go to zero, and imo likely shall, what ever it may take the authorities, and amongst the roaches BTC would be the most difficult if not near-impossible to kill, albeit ultimately done-in.

Should BTC establish itself as an indestructible anti-fragile hive-mind large-denomination sovereign-free currency, its worth would not stop at 500K per coin.

Should any domain legally and unquestioningly allow the attachment of any portion of BTC stock to some stock of physical gold in custodian warehouse by way of Etherium, that resulting currency, call it XBTC, would be strong, especially if also tacked w/ a sovereign central-bank issued digital currency and guaranteed to be always tradable as legal tender any participating global financial center even if the financial universe should bifurcated universe. To give the XBTC real-world utility, make it useable for rare earths processing (but not for raw material sourcing) trade.

The currency would lay waste to FATCA, SWIFT, and KYC protocols and be a Trojan horse facilitating the regime-change of global reserve currency.

China, with the necessary # production capability, capacity, and actual output, can put the schema to trial run given the democratic BTC governance way, one CCP-party-secretary one vote.

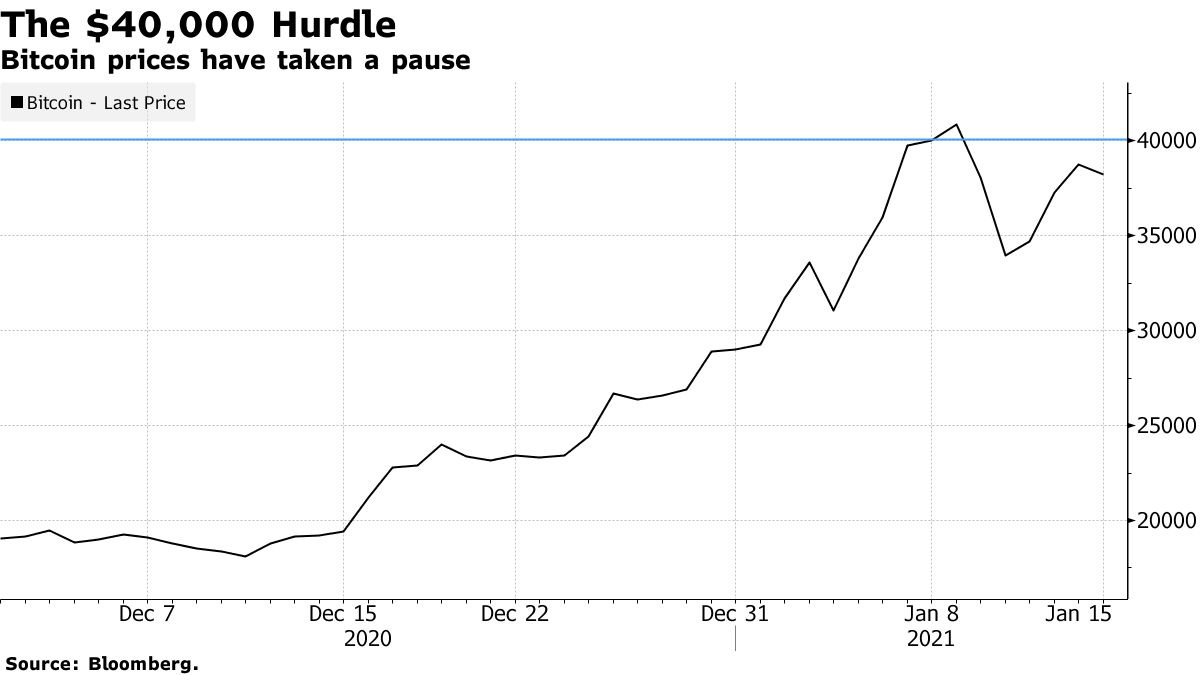

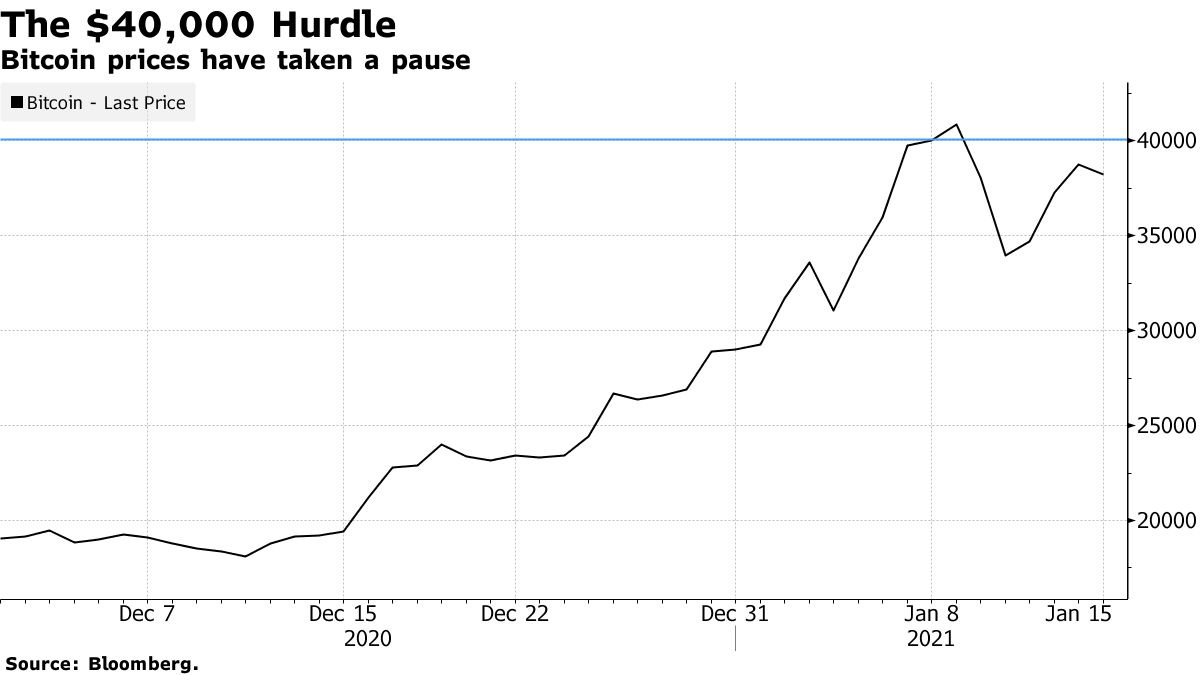

BTC has the potential of being either the biggest fraud of all times to date, 1 trillion worth, or the greatest invention ever until now. Whatever the case, 20-40K might just be a respite point, and before end-2021 see substantial rise.

I need BTC to trade back down to 20K, and ideally 15K, super if 7K.

bloomberg.com

UBS Wealth Warns Clients Crypto Prices Can Actually Go to Zero

Lynn Thomasson

January 16, 2021, 12:26 AM GMT+8

Strategists at one of the world’s largest wealth managers are issuing a warning to newbie crypto investors plunging into the record rally: You could still lose all your money.

Between regulatory threats and central bank-issued competitors, there’s nothing stopping a wipeout in big-name digital currencies eventually, according to UBS Global Wealth Management.

As Wall Street jumps on the Bitcoin rally like never before, the Swiss firm says prices may rise in the near term, but the industry faces existential risks over the long haul.

“There is little in our view to stop a cryptocurrency’s price from going to zero when a better designed version is launched or if regulatory changes stifle sentiment,” authors including Michael Bolliger, the chief investment officer for global emerging markets, said in a report Thursday. “Netscape and Myspace are examples of network applications that enjoyed widespread popularity but eventually disappeared,” the strategists wrote in response to rising client interest.

Wealth For You

Help us deliver more relevant content for you by telling us about yourself. Answer 3 questions to tailor your experience.

With Bitcoin slumping back to $35,000, the famously volatile asset class is stoking debate among the world’s biggest money managers. While famed investors including Paul Tudor Jones and Stan Druckenmiller are entering the industry, critics see gambling, scandal and manipulation.

In the near-term crypto prices could climb anew powered by market momentum, institutional adoption and limited supply. But over the long term, the market risks regulatory intervention, the strategists said, citing the U.K.’s decision to ban sales of certain crypto-derivative products to retail investors.

Like most firms, UBS Wealth is skeptical on the real-world utility of virtual tokens, but stop short of calling crypto prices a bubble, given the difficulty of determining a fair value for an asset without cash flows.

Other investors have put ambitious price targets on Bitcoin, saying it’s destined to keep rising as more institutional investors sell their gold holdings in favor of the digital currency in order to diversify portfolios. Scott Minerd of Guggenheim Investments said Bitcoin could be worth about $400,000, while JPMorgan Chase & Co. strategists see a case for $146,000 in the long run.

“Investors in cryptocurrencies must therefore limit the size of their investments to an amount they can afford to lose,” UBS Wealth said.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |