Re <<games>>

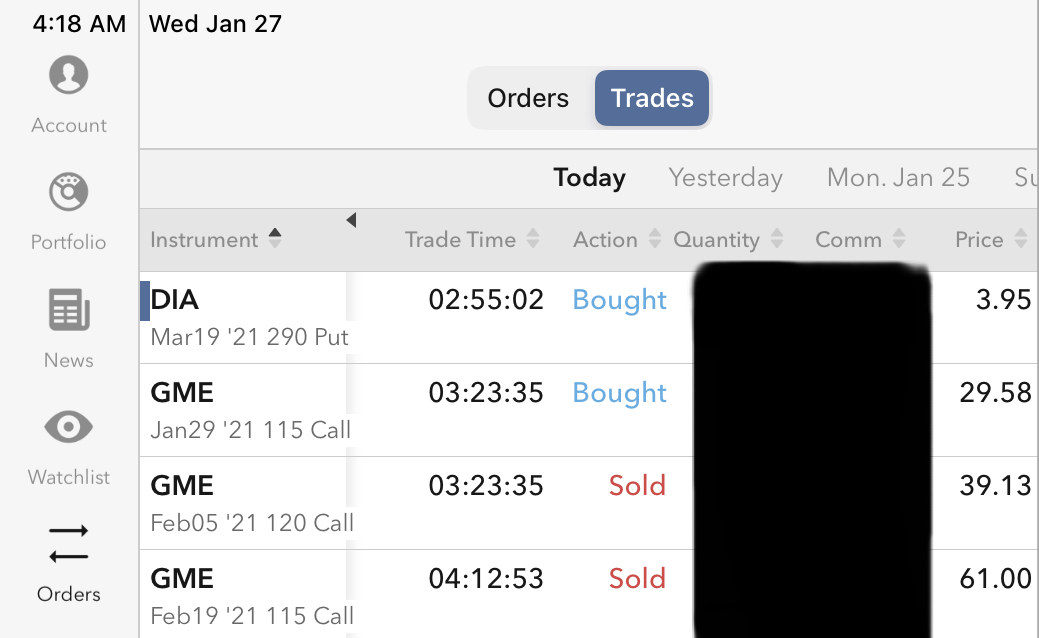

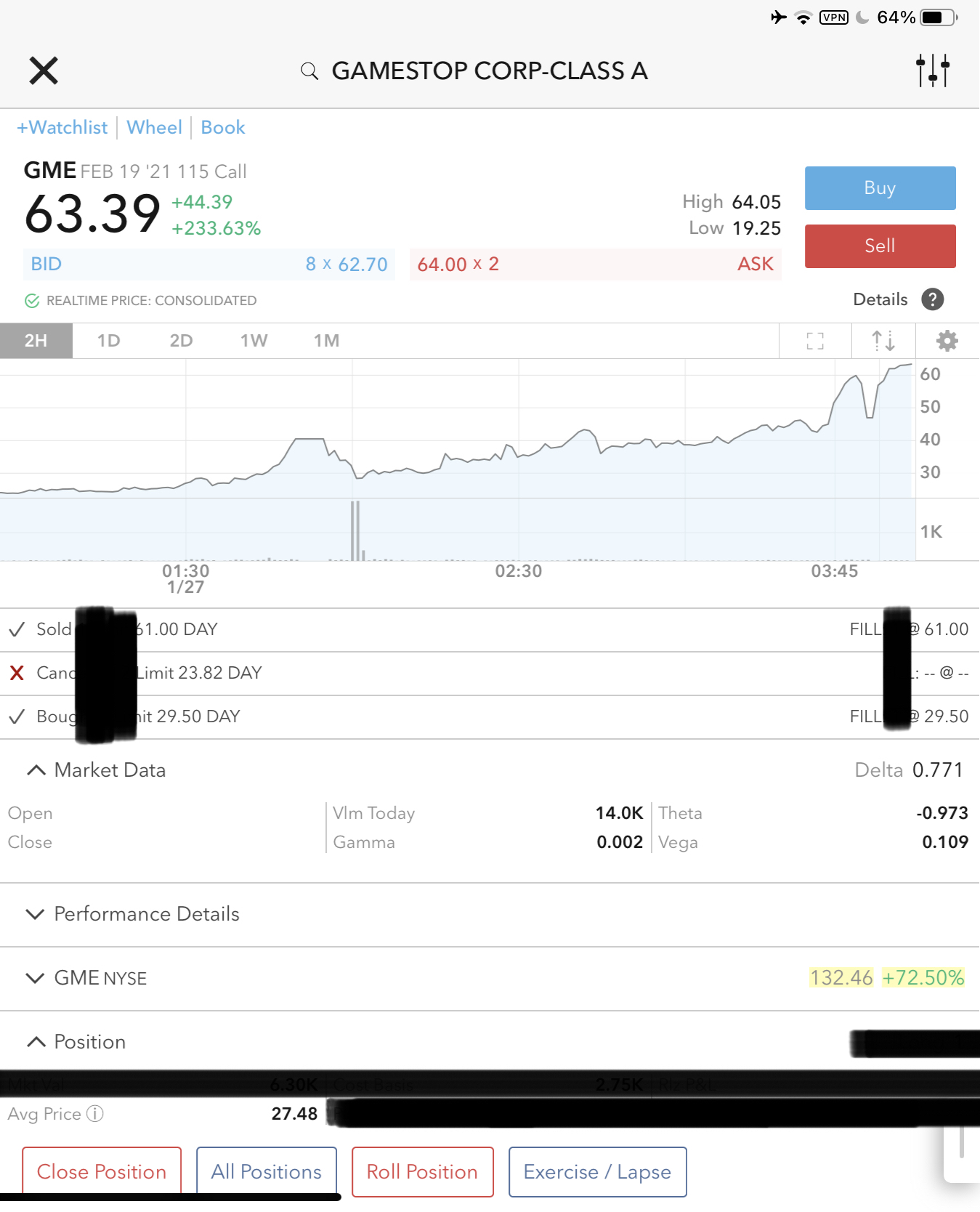

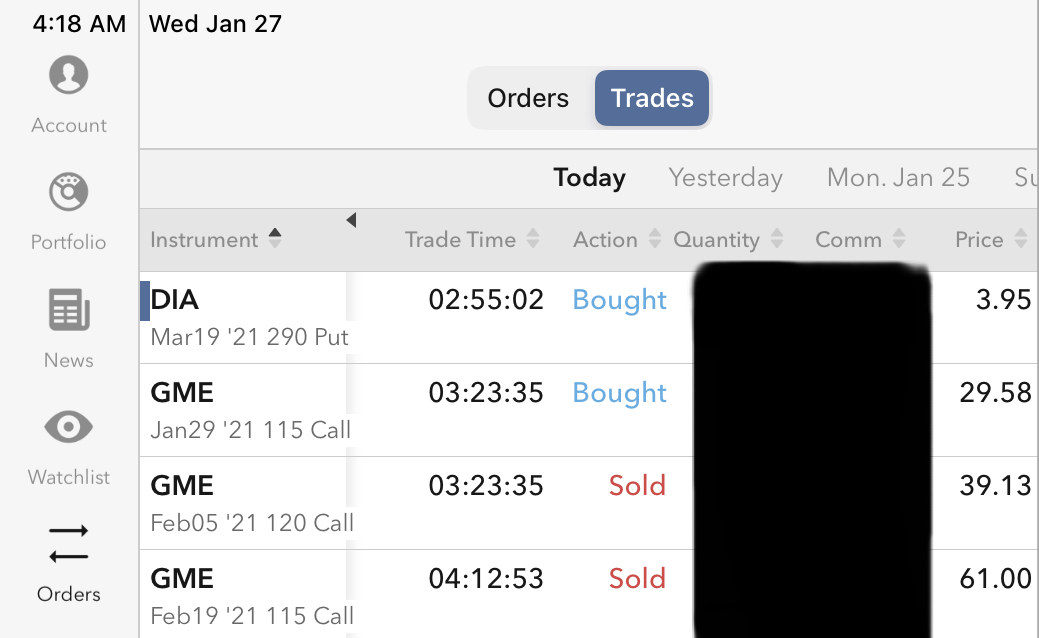

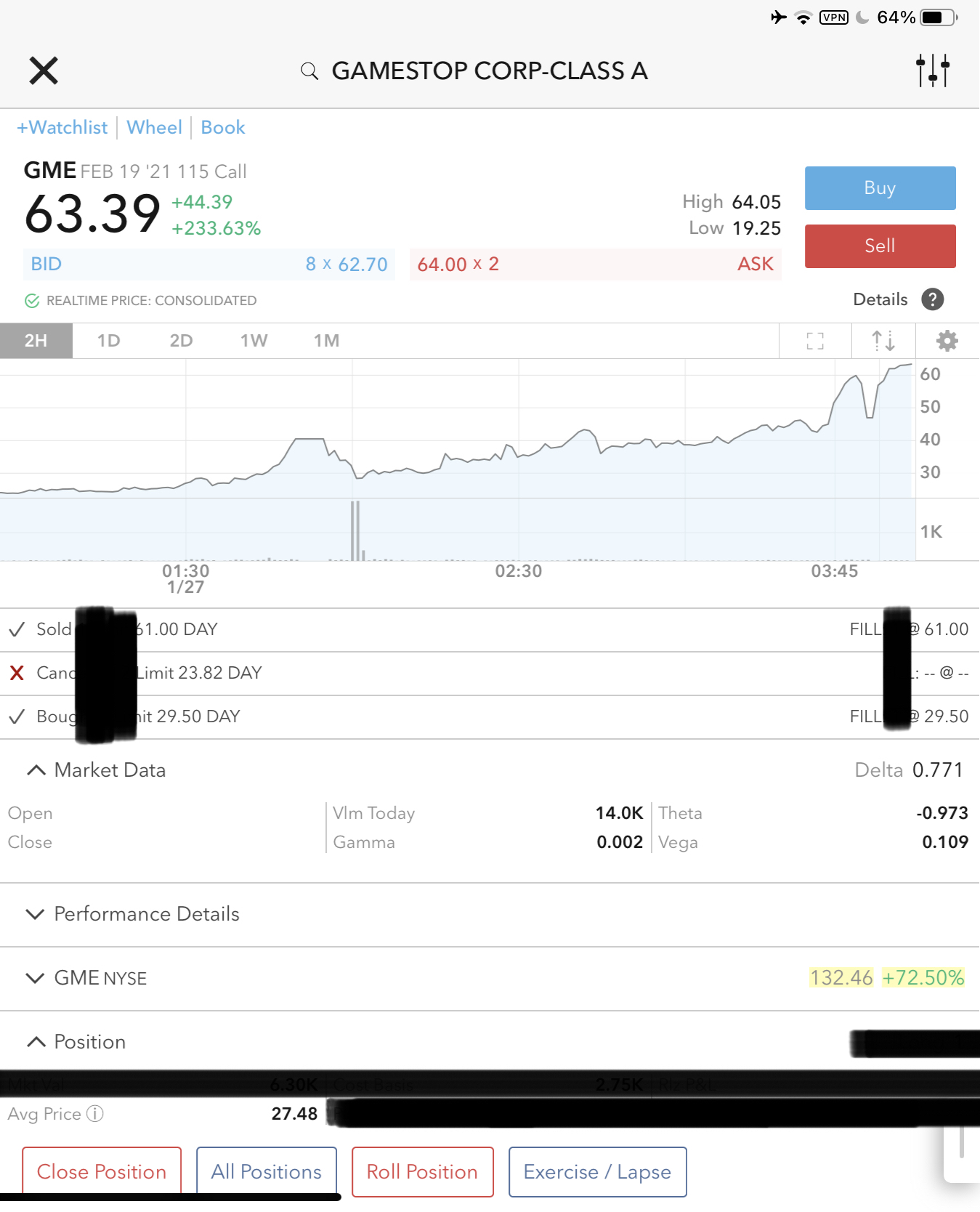

EDIT: A FEW MINUTES AFTER I POSTED ORIGINALLY JUST NOW, JUST NOW-NOW I REGRETTED HAVING ENGAGED WITH THE LATEST GIGGLE ON THE LONG-SIDE AND SO OFF-LOADED AT 61.00 FOR 100% GAIN, LEAVING THE INITIAL GIGGLE IN PLACE TO GENERATE MORE GIGGLES TO FEBRUARY EXPIRATION. NET-NET HAVE EXTRACTED (61 - 29.50 + 3.15) = 34.65 OF GIGGLES.

The 200’s are out, meaning there might be more and larger pain for the professionals as the retail army insurrection exacting casualties. Cannot short this crazed market without belt & buckling. Vol at 300+% for GME is very gamey.

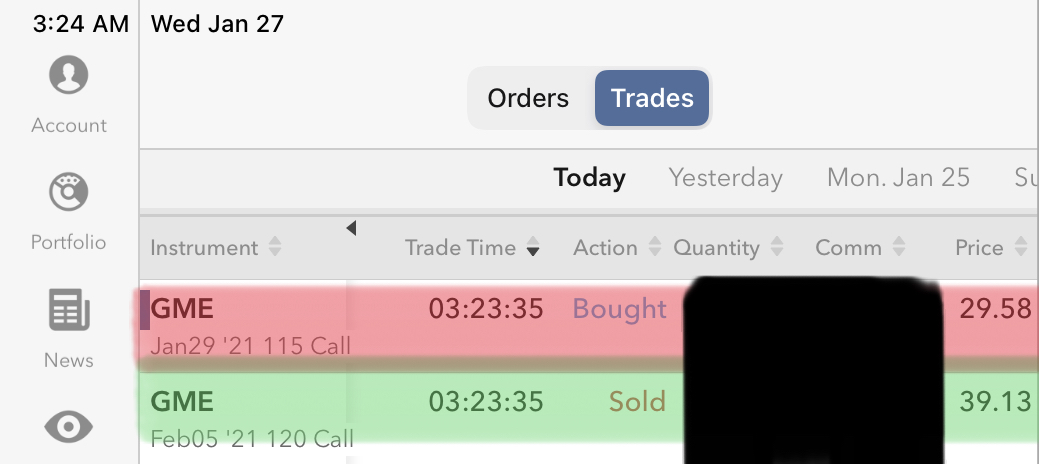

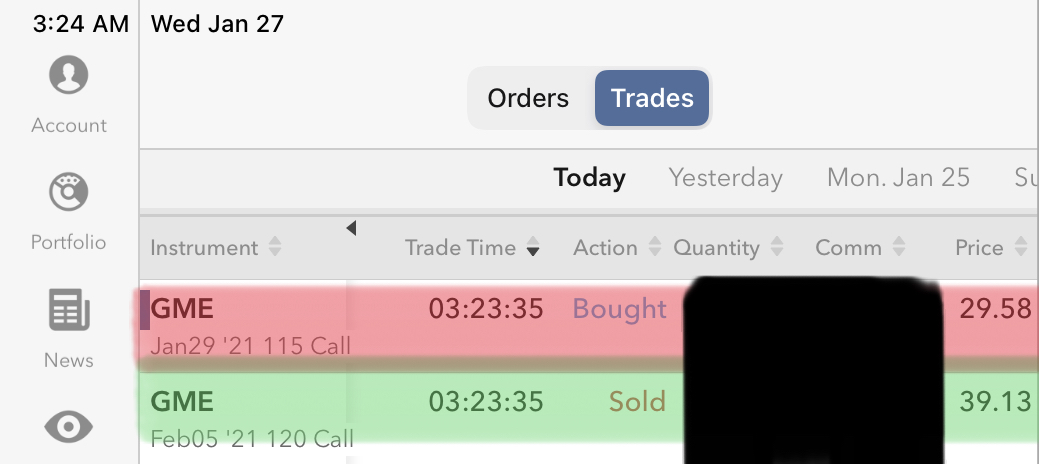

Still for giggles, have just rolled the short GME Call 29th January strike-115 position to 5th February strike-120, and liberated another $9.55 from the cloud-ATM mechanism.

Together with the original $19.05 freed from somebody, tallies to 28.60 total loot, to finance the $25.45 sacrificed going long GME Call 19th February strike-115 position, which is doing well in the arena at the moment. Net net take home $3.15 should increase as the rolls again then once more.

There can be several more rolls until we extinguish the entire construct or go wildly naked one or another way. The house money is now all free for the taking and losing.

Not a clever game, but a fun game, like roulette w/ an automatic pistol, loaded w/ blanks only.

Only for giggles as opposed to laughs or chortles, and certainly not knee-slippers. But am wondering, why not?

The original trade initiation Message 33162722

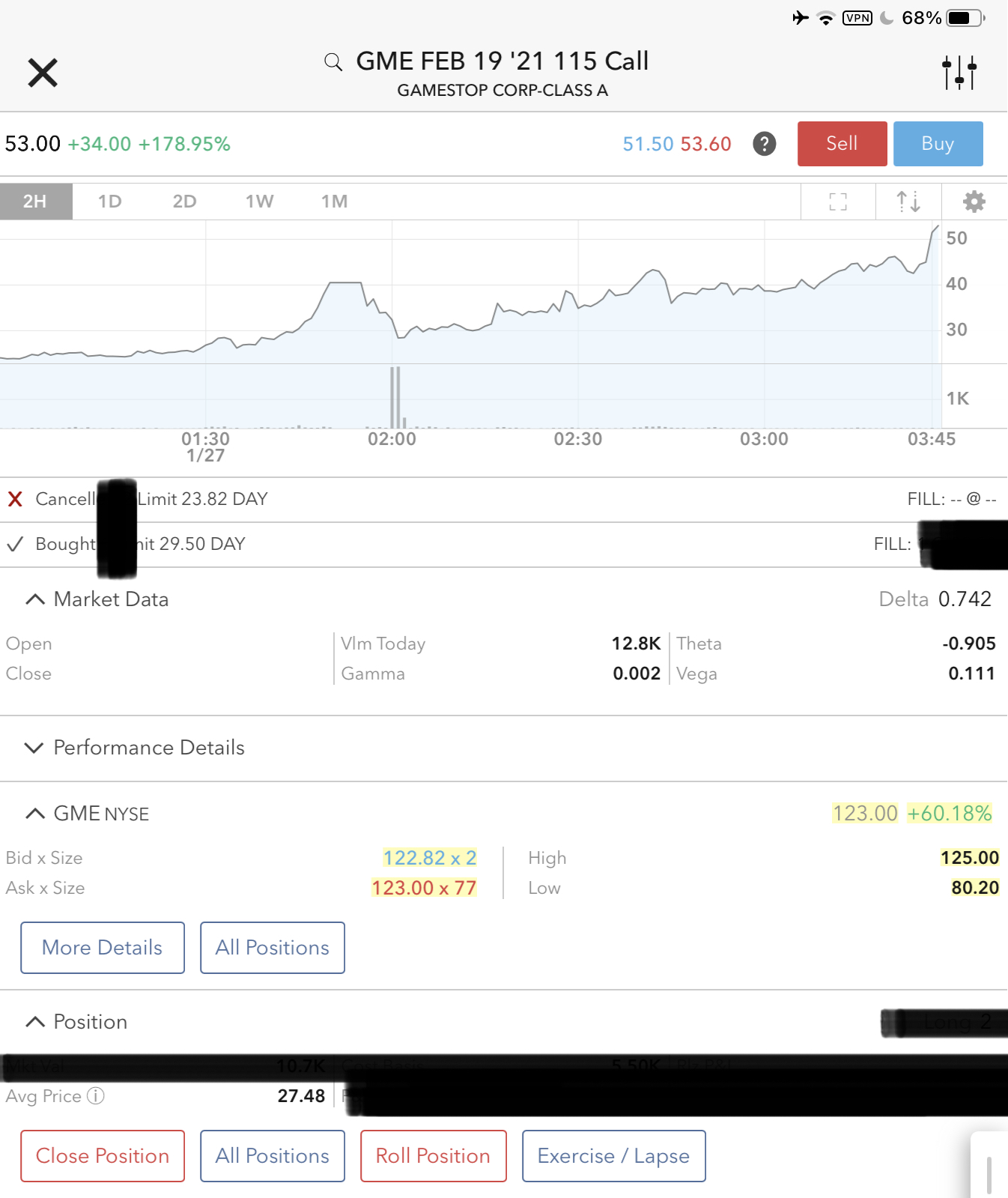

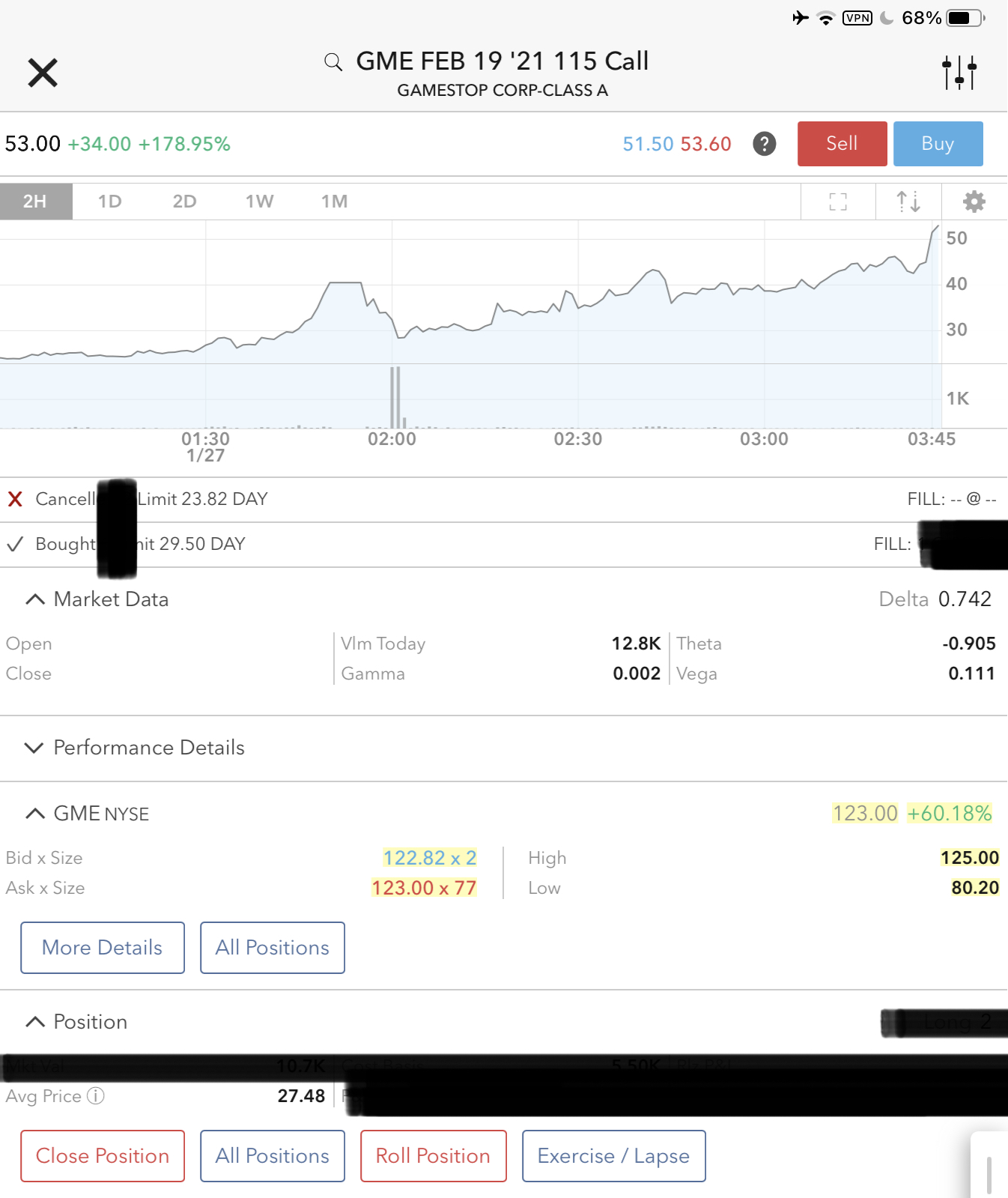

The current long GME Call position (yes, I wished to add another giggle at 23.82, changed my anachronistic and prudent mind, regretted, got modern, swapped-in RobinHood mindset and asked for fill at 29.50. No harm done, as the giggles are at 50, giggling.

|