Must reinforce-info my son Jack (10) that 80% of the gains in a bubble, most bubbles, take place w/i the last 20% of the mania, when trajectory goes vertical, and events go pear-shape

As the proof-of-concept-pilot short of GME is going well even as 2 rolls remain w/i capability / capacity, the giggle is getting funnier, edging towards absurdity and rapidly

zerohedge.com

Musk Tweet Sends Gamestop Soaring (Even More) After Hours

Update 4:40pm: Well that escalated quickly. Just 20 minutes after Musk's tweet, GME exploded to $240...

* * *

Update 4:20pm: Just one hour ago (see below) we said that it is "increasingly likely that GME will hit $200" thanks to the stock entering the peak OTM vol "gamma gravity". Well, moments ago, GME just hit a new all time high $194.50, surging about $44 after hours and nearing the $200 gamma level on, drumroll, an Elon Musk tweet that merely said...

... That one tweet alone added over $3 billion in market cap to Gamespot (or perhaps GammaSpot) whose stock price may crush not just hedge fund but also dealers who are painfully short gamma in the name and will be forced to buy a lot more either now or when the stock opens for trading tomorrow.

In short, we are almost certain to see a $200+ print tomorrow.

* * *

For the third day in a row, Gamestop has exploded higher, and after a brief period of rangebound trading the stock has almost doubled, surging from $90 to as high as $144 (at which point it was halted), dropped and resumed its move higher.

While there has been nothing fundamental to explain the latest move higher - the bullish tweets by Chamath Palihapitiya and Cameron Winklevoss were discussed earlier - the main reason cited for the latest melt up, in addition to a continued short squeeze of course, is that GME has now fallen in the notorious "gamma vortex", and one look at the highest strike price in this Friday's expiring options confirms this: with less than 300 $200 Jan 29 puts traded, there has been an absolute frenzy of calls, which at last check were above 70,000 and rising rapidly.

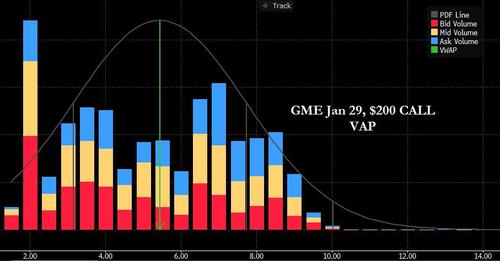

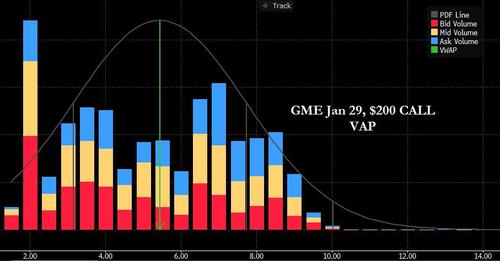

A quick look at the volume at price for the $200 calls shows the insanity that is being unleashed here...

... and with dealers clearly short gamma, they are now rushing to buy the stock creating the infamous feedback loop where the more OTM call activity takes place, the higher the stock rises (amid dealer delta hedging), leading to even more call buying and so on.

What this means in English is that at this point it is increasingly likely that GME will hit $200 as the gamma gravity is activated (and for those who still need an explainer, please read " All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows").

The only question we have is whether Melvin Capital is still short the stock, and whether it is about to need an even bigger bailout from Citadel and Steve Cohen. And, as a follow up, at what GME price will Citadel and Point72 themselves require a bailout from the NY Fed...

Sent from my iPhone |