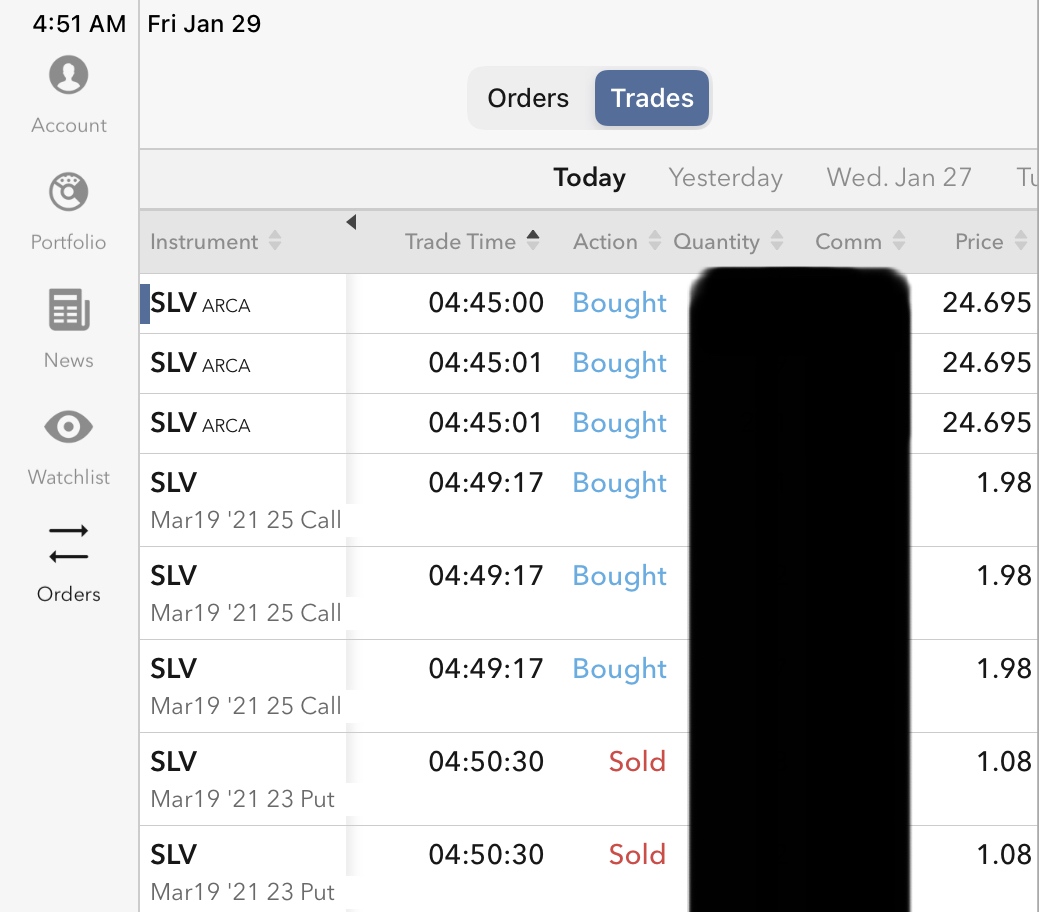

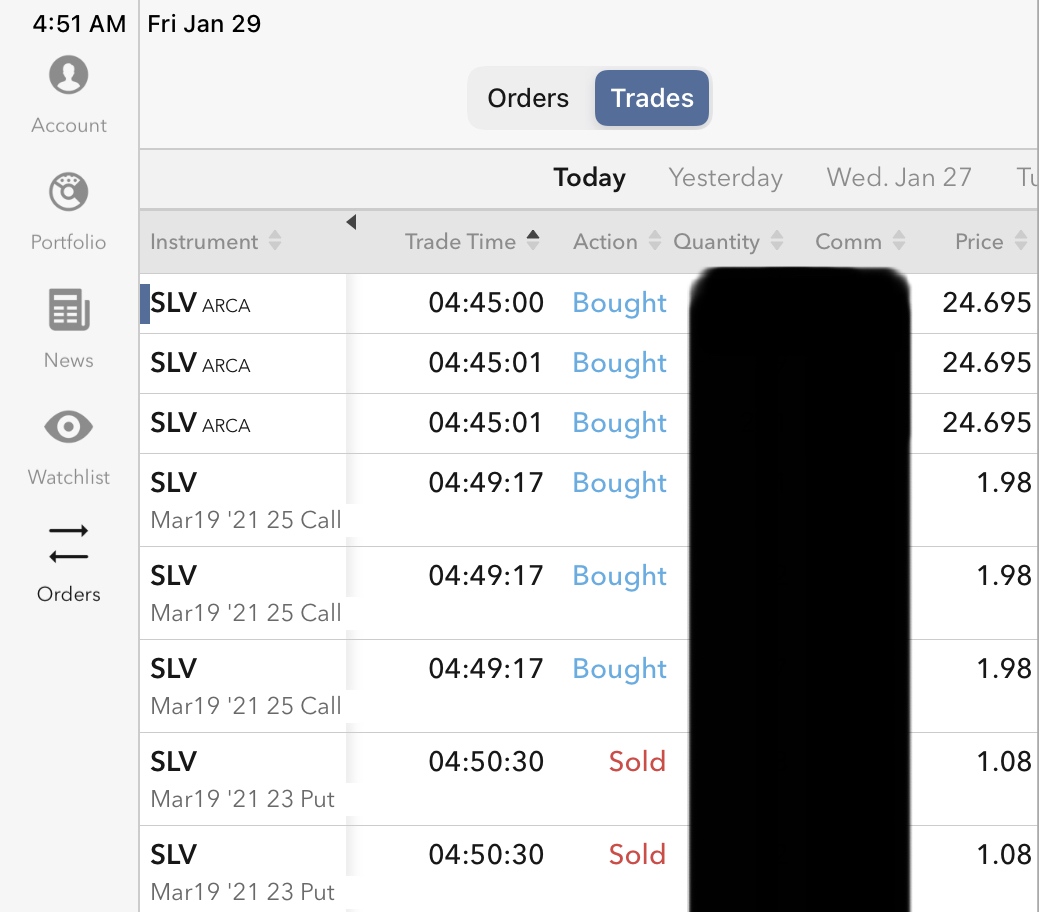

Had for some time thought i should own some paper silver, to go w/ my paper gold Message 33148184 position by way of short GLD Puts (which in turn supported by the sell down of GBTC Message 33153255 , for the eventuality that paper gold & silver should come in handy to trade for stuff, and this morning meaning just now HK time, I went long a blended basket of long 2X SLV @ 24.695, long 5X SLV Call March-19 Strike-25 @ 1.98, and short 5X short SLV Put March-19 Strike-23 @ 1.08

The call option premiums are high given sudden volatility rise, and may collapse should the insurrection fail, triggering the put option, but as I am in an aggregation mode, okay.

My intention is to LT hold SLV until whatever whenever, together w/ any GLD that might be put to me even as looking unlikely unless financial market crashes which can certainly be. Depending, might average down or up, on price of gold, interest rate, and etc etc etc.

Meantime let’s see what if anything the cyber rebellion can do. If they cannot move the price of silver the way they do GME and BTC, then the insurrection is not yet ready for the main performance, but should they managed to move the needle irrespective of the details of how, then all have much to fear.

bloomberg.com

Silver Is the Latest Market Hit by Reddit Day-Trader Frenzy

Yvonne Yue Li

Reddit investors have discovered silver, with everything from silver miners, silver ETFs and the actual price of the physical metal itself soaring on Thursday.

The first signs came late Wednesday, when comments appeared on internet chatroom r/wallstreetbets, the same investor board that started the wild short squeeze in Gamestop Corp. and other companies. The comments centered on iShares Silver Trust, the biggest exchange-traded instrument backed by the metal, calling it “THE BIGGEST SHORT SQUEEZE IN THE WORLD,” and citing banks manipulating gold and silver prices.

Precious metals have long been the home of conspiracy theorists ranting against central banks and big government, which may make it fertile ground for retail investors’ rage against the financial machine. While commodities markets are hardly immune from wild swings, they typically have a much higher barrier to entry, so squeezes tend to come from actions by institutional, rather than retail, investors.

Small miners had the biggest moves, though the physical metal also rallied. First Majestic Silver Corp., which was cited as a short-squeeze target, soared as much as 39% in New York on Thursday, while iShares Silver Trust gained as much as 7.2% and spot silver gained 6.8%, the biggest jump since August.

“There’s a short squeeze going on in silver. The ‘hoodies are all rolling into silver and the party is on,” Phil Streible, chief market strategist at Blue Line Futures LLC in Chicago, said in a phone call. “All those other stocks like GameStop and AMC, they’re dumping because they’ve been restricted, and they gotta go into other short opportunities and silver is an easy identifiable target.”

The economic data that came out Thursday morning, which included a larger-than-expected drop in jobless claims, have become “a moot point” for traders, Bob Haberkorn, senior market strategist at RJO Futures said by phone. “This isn’t predicated on any global events, it’s just people on a message board putting all their guns towards the precious metals markets.”

Options markets were bid up in the frenzy, with traders and brokers seeing wide bid/ask spreads on the IShares and Comex contracts.

“The implied volatility being quoted in the options market at this moment is wider than I’ve ever witnessed.” James Gavilan, principal and adviser at Gavilan Commodities LLC, said in a phone interview. “The market is factoring in large swings in the silver price, and an already illiquid market is showing extremely wide quotes for options, which means that traders are concerned about the difficulty of hedging their positions.”

To see such wide volatility spreads is “mind boggling, breath taking, it’s shocking really,” said Gavilan.

The buying in silver and gold spilled over to the base metals complex on the London Metal Exchange, with copper erasing early losses, while “Chinese night desks buying” also helped the metal, according to Tai Wong, head of metals derivatives trading at BMO Capital Markets. Copper for three-month delivery rose 0.7% to $7,910 a ton in London.

— With assistance by Michael Roschnotti, and Eddie Spence

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |