C2, following up re Message 33169838

<<Meantime let’s see what if anything the cyber rebellion can do. If they cannot move the price of silver the way they do GME and BTC, then the insurrection is not yet ready for the main performance, but should they managed to move the needle irrespective of the details of how, then all have much to fear.>>

Message 33174938

<<silver puppy barking hard, Asia open front page of Bloomberg, for front-runners the chart looks piercing, ala 30 by tonight looking doable For fear is infectious, and terror is scary>>

... and downside seems limited as of right now. The fear ought to be on the other side for now, that fear is a survival trait.

The below Bloomberg take still doesn't get it, that it may no longer be about a rag tag Reddit insurrection, extinguishable by any or every combination of Fed, SEC, Capitol Hill, Potus, USA exchanges, and puny hedge funds, and small JPM

It might be titans behind millions of savings-aplenty global proletariats who do not wish to be QE-ed, and so aim to melvin (love the new verb) their tormentors.

bloomberg.com

Reddit Investors Piling Into Silver Drive Up Prices a Second Day

Eddie Spence

A one-kilogram silver bar.

Photographer: Chris Ratcliffe/Bloomberg

LISTEN TO ARTICLE

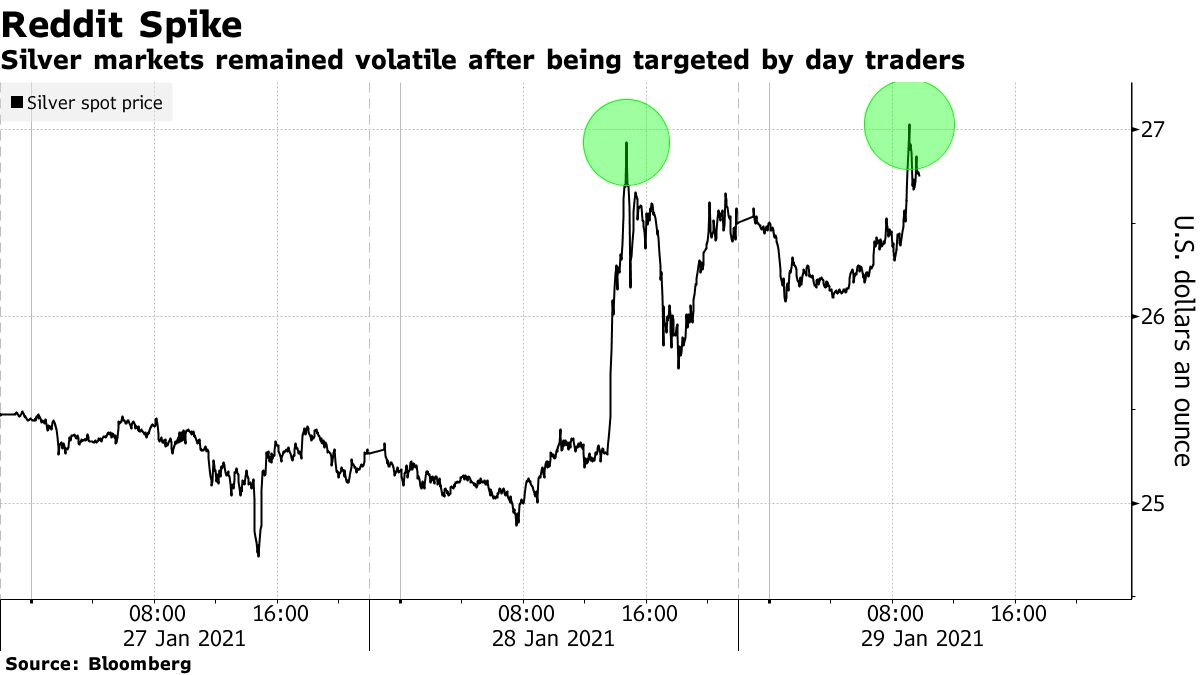

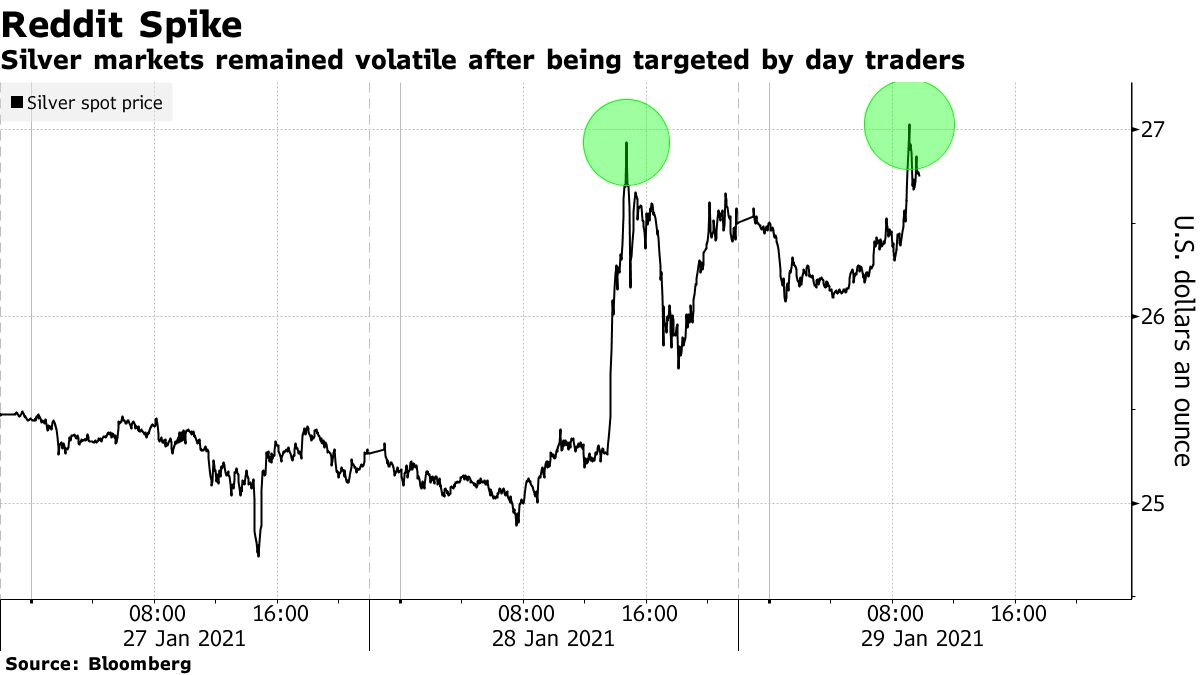

Silver jumped for a second day as the market remains on high alert after a call by Reddit posters to create a short squeeze sparked sharp moves on Thursday.

Spot silver rose as much as 4.3% as prices resumed an earlier climb after dollar gains eased. Silver futures increased as much as 7.1% on the Comex, and gold prices advanced.

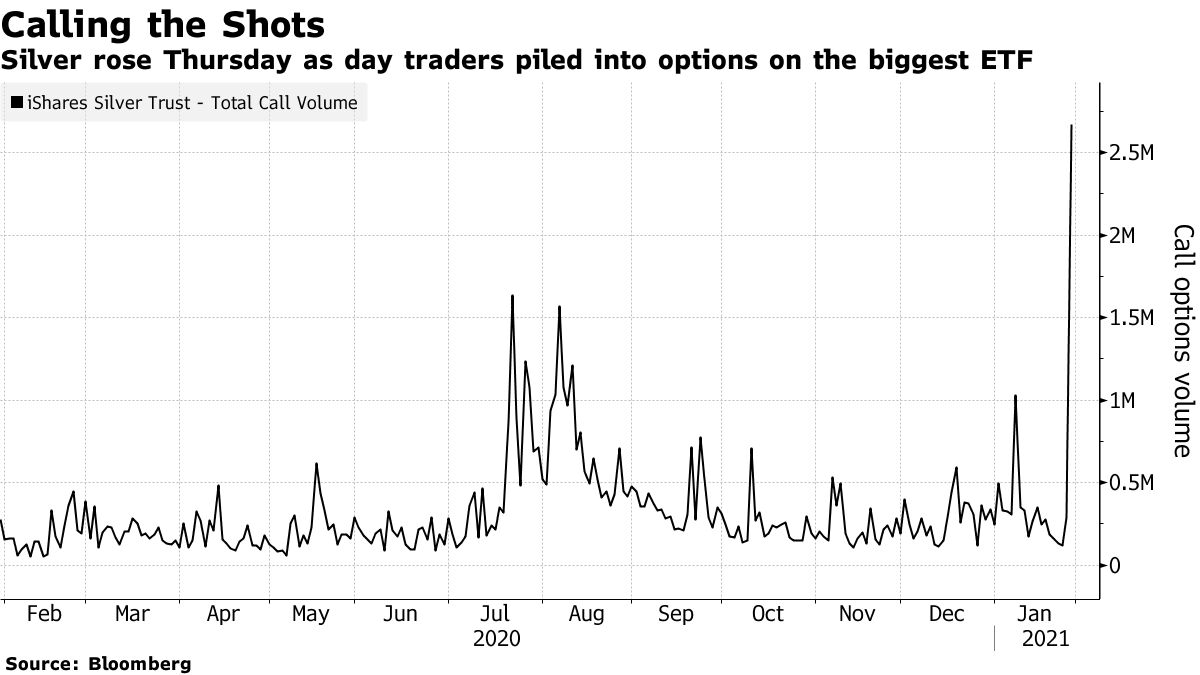

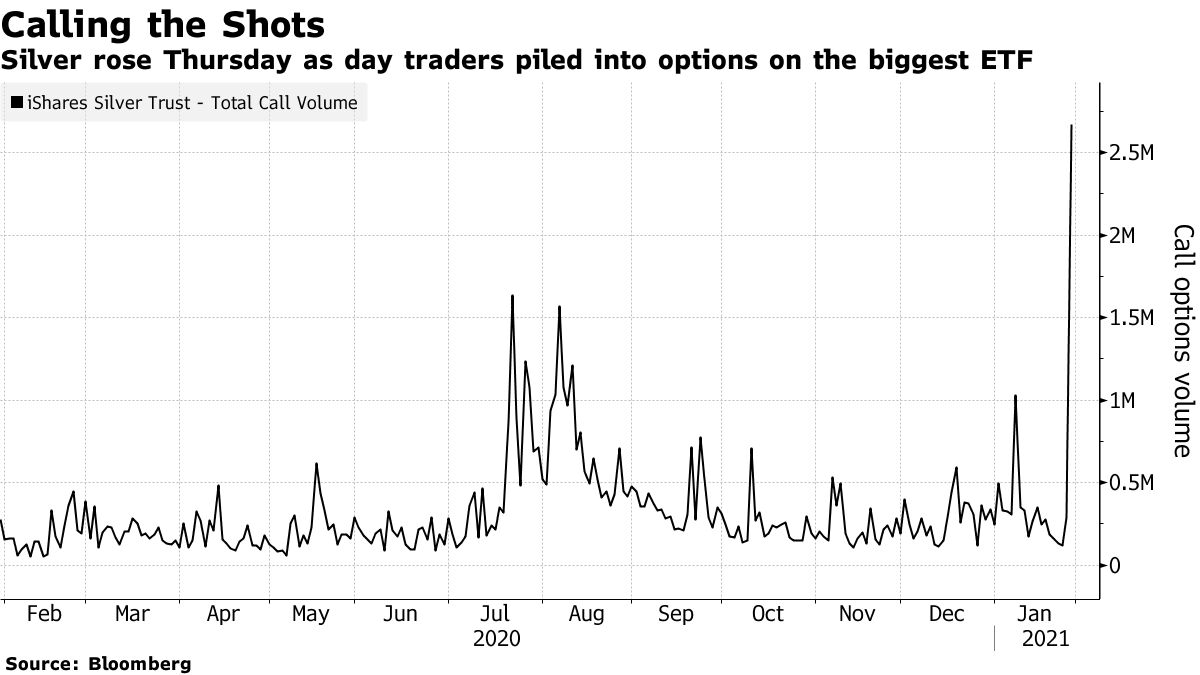

On Thursday, silver miners’ shares spiked and the largest silver exchange-traded fund, iShares Silver Trust, saw a frenzy of options buying after the market emerged as a target on the Reddit forum r/wallstreetbets. The moves “have been extreme in some cases and have had little fundamental justification,” Eugen Weinberg, an analyst at Commerzbank AG, said in a note.

“Retail investors who have been swapping tips on such information platforms have caused massive shifts in the prices of some shares,” Weinberg said. “We are confident that the influence of retail investors on silver will not last all that long, and that ultimately industrial and institutional demand will be the key factor in the longer term.”

Still, “in the very short term, I would think people would be cautious about holding a short in precious metals, irrespective of the fundamental view/what other markets are doing,” said Marcus Garvey, head of metals and bulks commodity strategy at Macquarie Group Ltd.

Comments about the metal began appearing Wednesday on the investor board that’s now famous for driving up GameStop Corp. shares this week. They centered on conspiracy theories long-held by the fringes of the precious metals world, alleging the metal’s price is suppressed by banks and the government to mask inflation.

If there’s another short squeeze, “I think it will be fairly muted,” said Jason Teed, Director of Research at Flexible Plan Investments Ltd. “A short squeeze on a mid-cap stock with heavy short interest is one thing, but the commodity markets are extremely vast.”

Spot silver rose 1.8% to $26.98 an ounce at 3:32 p.m. in New York. Futures for March delivery rose 3.8% to settle at $26.914 an ounce. Gold for immediate delivery rose as much as 1.8% before trading little changed. The Bloomberg Dollar Spot Index was up 0.3%.

Read More

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |