A Look At 6 ETFs That Cover The Electric Vehicles Trend

Feb. 08, 2021 2:08 PM ETAAPL, BATT, BYDDF... 283 Comments158 Likes

Summary

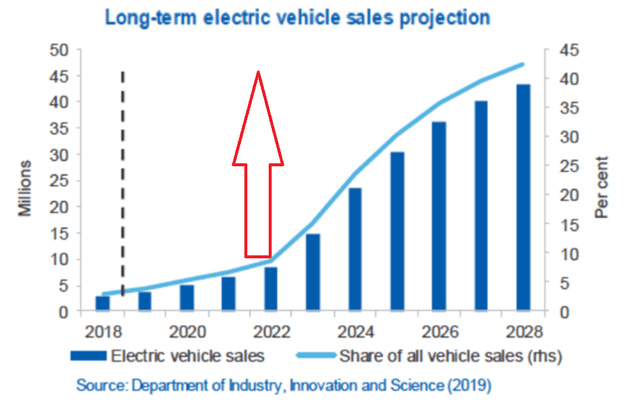

Global electric car market share is now accelerating and should go exponential from 2022.

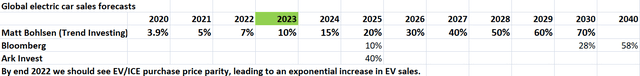

Electric car sales forecasts.

The real EV boom has only just begun.6 electric vehicle related ETFs to consider - 4 relate to EVs plus AVs and 2 relate to EV plus EV supply chain (battery makers, miners).

Risks, further reading and conclusion with my top picks. I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

This article first appeared on Trend Investing on Jan. 8, 2021, but has been updated for this article.

As we begin 2021, electric vehicles [EVs] are now becoming mainstream. By that I mean EV sales are now at the disruptive stage where they are soon to grow exponentially. The following quotes from my " EV Company News For The Month Of January 2021" highlights the disruption that is now taking place:

January saw December 2020 electric car sales hit more new records...Global electric car sales finished December 2020 with over 500,000 sales for the month, up 105% on December 2019, with a market share of 6.9% for December 2020, and 4.0% YTD (EV-Volumes has it at 4.2%). Full year 2020 sales of 3.24 million were up 41% (EV-Volumes has it at 43%) on 2019.H2 2020 will be remembered as the time when the serious EV disruption of ICE began. In yet another stunning record month for electric car sales, here are some incredible stats on electric car sales market share for December 2020: France ( 19%), Germany ( 27%), Sweden ( 49%), Netherlands ( 72%), Norway ( 87%) and for all of Europe (an incredible 23% market share)... China ( 9.4%).

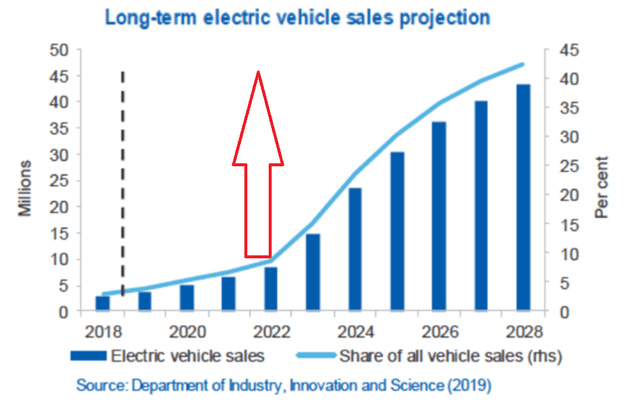

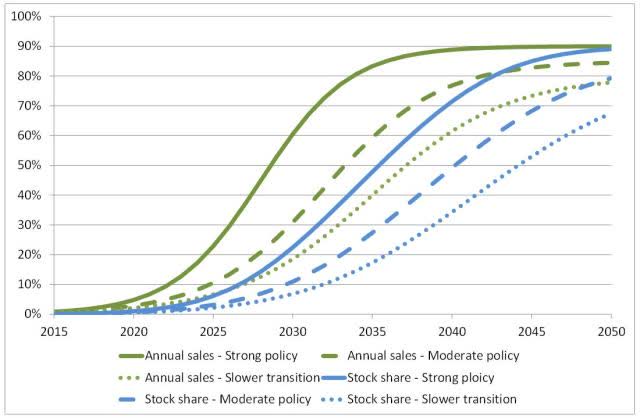

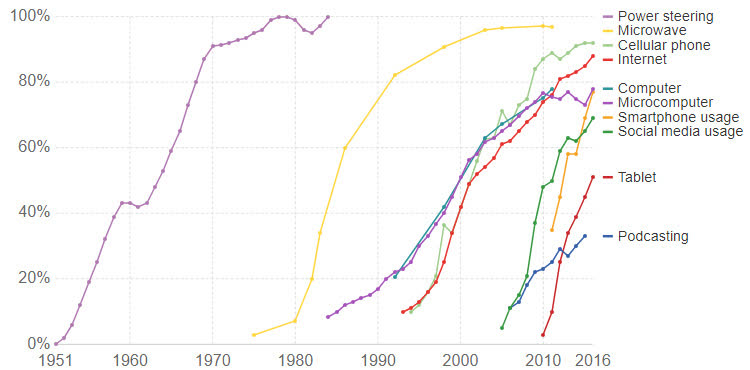

Global electric car market share is now accelerating and should go exponential from end 2022To put the above EV sales into perspective, 2019 global electric car sales reached just 2.5% market share. 2020 global electric car sales hit 4.0-4.2% depending the data source. Based on this, it is looking like 2021 global market share might reach 6-7%, and 10% in 2022. This is the prelude to the exponential growth in EV sales as shown on the forecast graph below and in my excel model.

Source

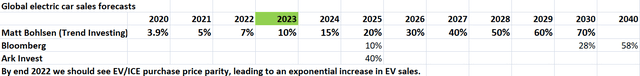

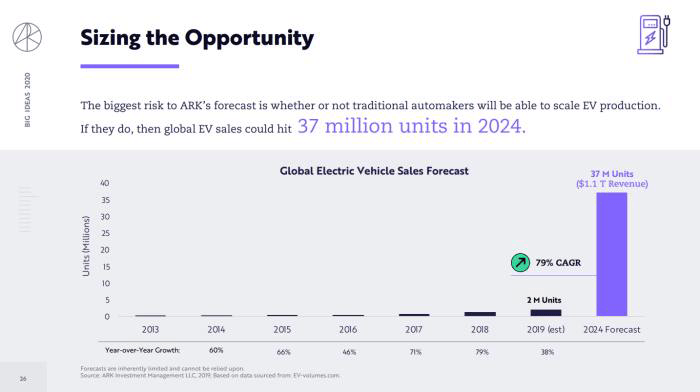

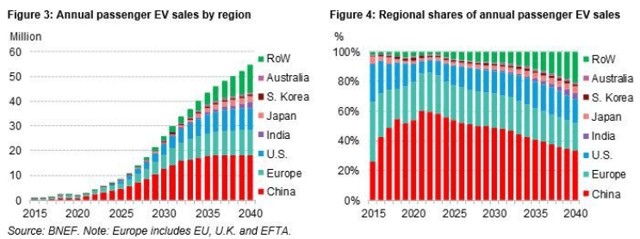

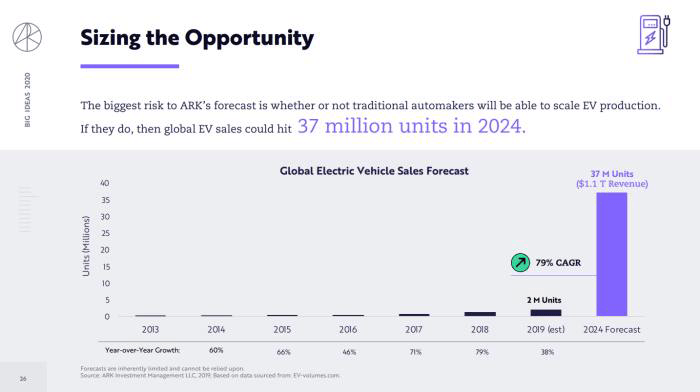

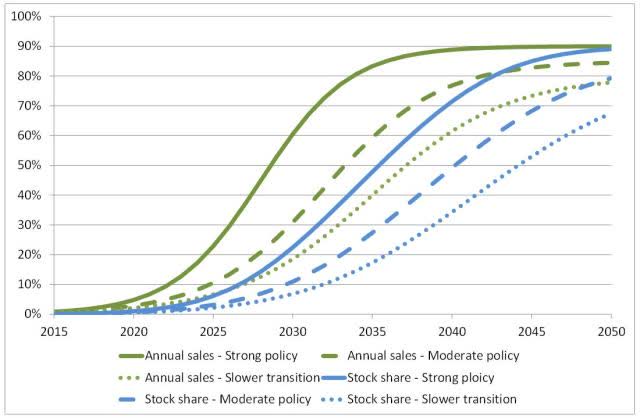

Electric car sales forecastsBNEF's mid-2020 forecast was for 8.5m sales by 2025 (10% share), 26m by 2030 (28% share), 54m by 2040 (58% share).ARK Invest forecasts global EV sales to hit 37 million by 2024, or about 40% by 2025.At Tesla's ( TSLA) Battery Day, CEO Elon Musk guided for global EV sales to reach 100% market share by 2030 with Tesla selling ~20m EVs pa by then. He also announced a US$25,000 Tesla electric car to be ready in 3 years (2023).

Note: My forecasts have recently been updated higher again as you will see in another article coming soon.

Source: My own compilation

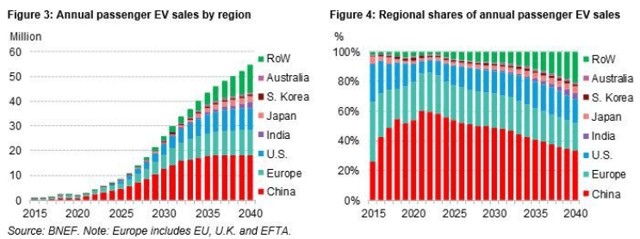

The BNEF 2020 forecast with the raw numbers and country share

Source: Bloomberg New Energy Finance [BNEF] 2020 EV report

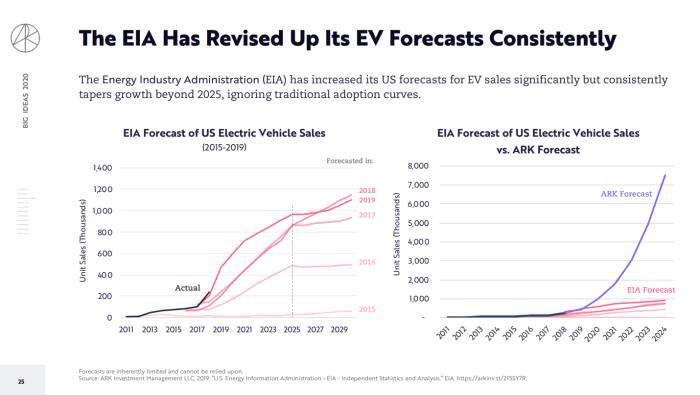

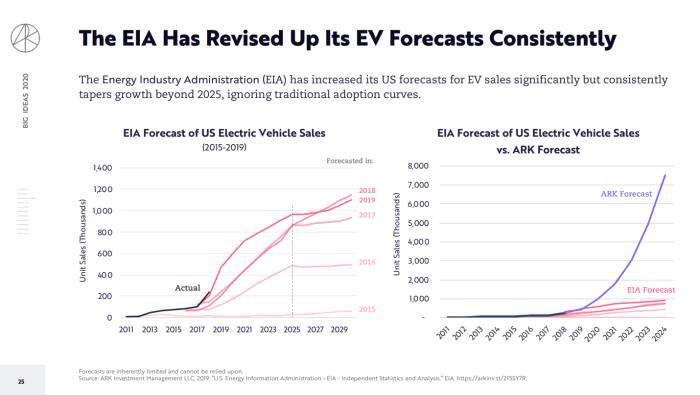

EIA and ARK Invest global electric car sales forecasts

Source: Financial Times

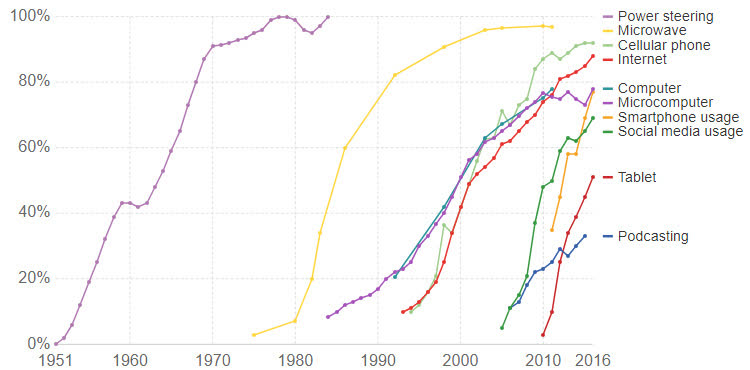

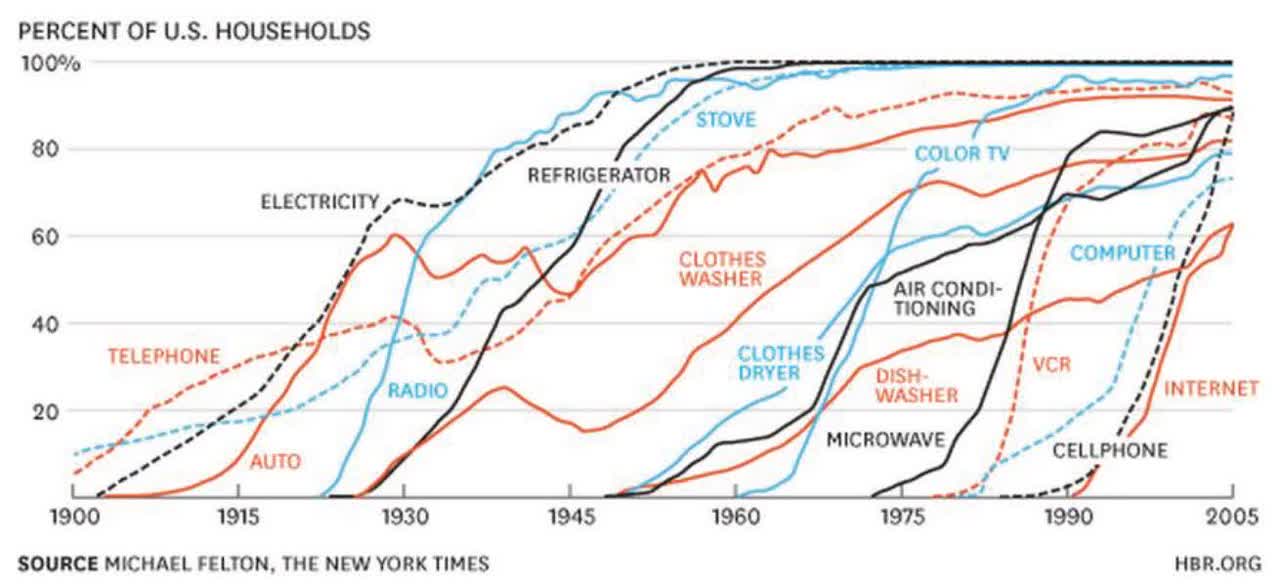

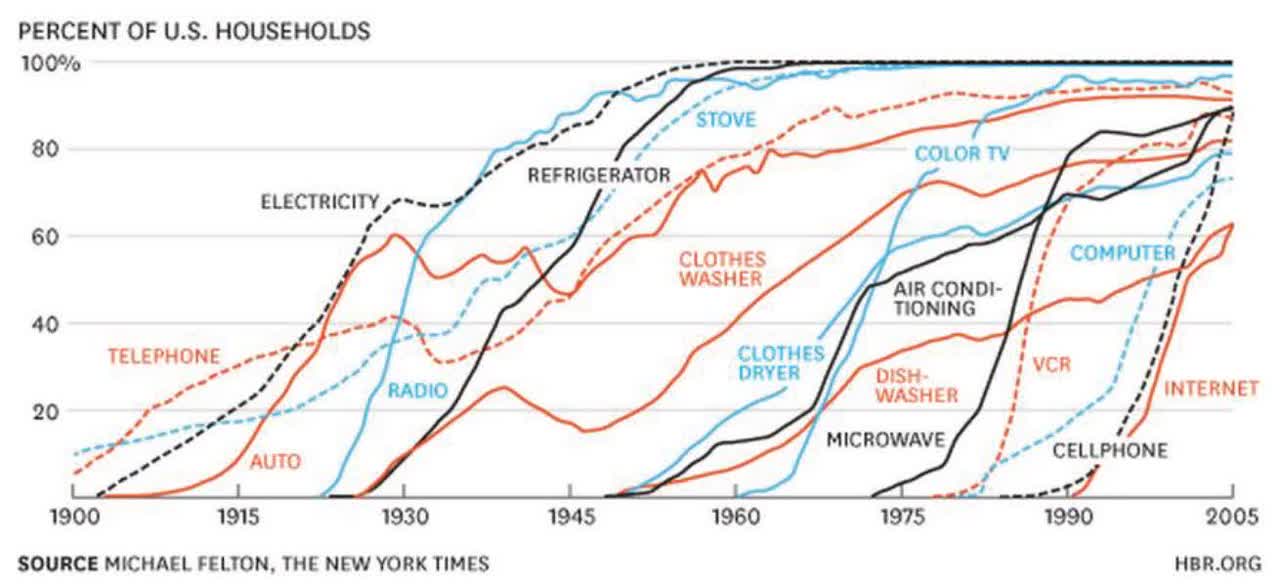

The real EV boom has only just begunNo matter which forecast proves to be correct, the H2 2020 global electric car sales surge shows the EV trend is now taking off. Or as I like to say, "the real EV boom has only just begun". December's global electric car sales market share of 6.9% gives a good indication of what to expect in 2021. Then by 2022, according to BNEF, " there will be over 500 different EV models available globally". By 2023 we will have EV/ICE parity and I then expect electric car sales market share to grow exponentially initially by about 5% each year accelerating to 10% pa from 2025, constrained by production not demand. The 2020s will be the era of the electric car, just like the smartphone grew in market share from near zero in 2007 to approaching 100% by 2020 (see chart below).

Disruptive new consumer goods now only take a decade to gain massive market share

Source: Visual Capitalist

Source

Global market share of plug in light vehicles forecast (a 2 decade disruption forecast)

Source: Onclimatechangepolicy

6 electric vehicle related ETFs to considerGiven it is now very realistic to view electric car sales rapidly increasing this decade, it is not yet too late to buy into some quality EV related ETFs or stocks. However, it should be noted that the sector has been running hot so investors could also keep some dry powder in case we get any stock price dips.

Below I discuss the various EV themed ETFs, noting none are really a 100% pure play on EVs and many also focus on autonomous vehicles [AVs]. I give my thoughts on this in the conclusion.

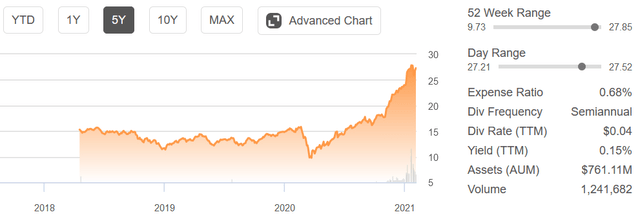

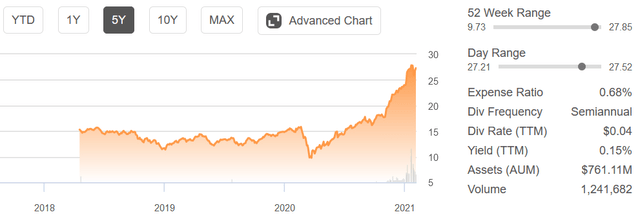

EVs + AVs and some supply chain ETFsGlobal X Autonomous & Electric Vehicles ETF ( DRIV) Price = USD 27.47

Source

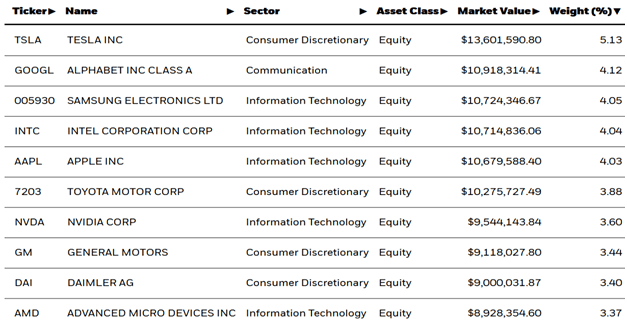

The Global X Autonomous & Electric Vehicles ETF seeks to invest in companies involved in the development of autonomous vehicle technology, EVs, and EV components and materials. Currently with 76 holdings, the fund seeks to track the performance of the Solactive Autonomous & Electric Vehicles Index. The DRIV ETF has country exposure of 59.3% USA, 7.3% China, 6.6% Japan, 5.0% South Korea, and 3.5% Germany.

After a great 2020 (up 62.5%), the fund is on a PE of 24.6 (YCharts shows a PE of 30.6). YCharts shows the dividend yield is 0.25%.

I rate the fund as an okay EV/tech fund with top ten stocks titled towards tech. Having Apple ( AAPL) may prove to be a positive given their recent moves towards making an autonomous EV. For those positive on the tech giants and chip makers with some EV flavor, I rate it as an accumulate.

Top ten holdings

Source: Global X ETFs

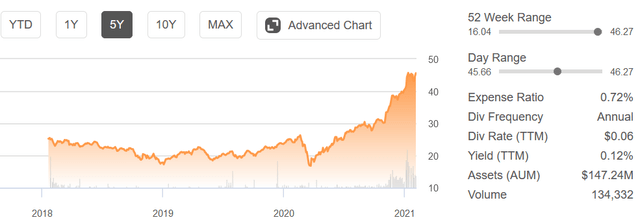

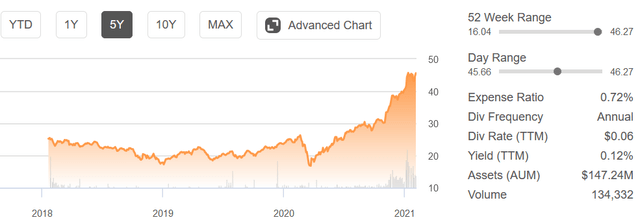

KraneShares Electric Vehicles & Future Mobility Index ETF ( KARS) Price = USD 46.01

Seeking Alpha

The KraneShares Electric Vehicles and Future Mobility Index ETF is designed to track the performance of companies engaged in the production of EVs and/or their components, or engaged in other initiatives that may change the future of mobility. This includes EV production, autonomous driving, shared mobility, lithium and/or copper production, lithium-ion/lead acid batteries, hydrogen fuel cell manufacturing and/or electric infrastructure businesses.

Disappointingly, the fund's top ten holdings only has one pure play EV company.

The KARS fund was up 70.7% in 2020. YCharts reports a weighted average PE of 28.78 and a dividend yield of 0.12%.

I rate the fund as an okay valued EV fund but lacking in the number of EV pure play stocks in the top ten holdings (plus no Tesla in the top ten), so hard to get too excited about it for now.

Top ten holdings

Source: KraneShares

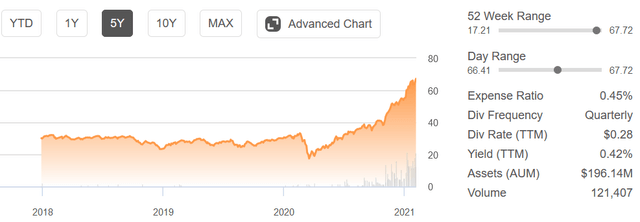

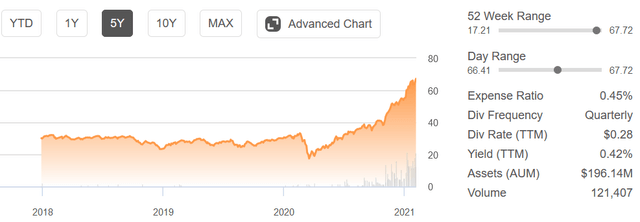

SPDR S&P Kensho Smart Mobility ETF ( HAIL) - Price = USD 67.17

Source

The SPDR S&P Kensho Smart Mobility ETF seeks to track the performance of the S&P Kensho Smart Transportation Index. This means that the HAIL ETF is focused mostly on autonomous and electric vehicle technology, commercial drones, and advanced transportation systems.

The HAIL fund was up 84.3% in 2020. HAIL has a PE (as of Feb. 4) of 20.95 and a dividend yield of 0.42%.

I rate the fund as a well valued EV fund, especially for investors looking to gain exposure to future mobility (AVs, robotaxis, ride hailing, drones, etc.).

Top ten holdings

Source: YCharts

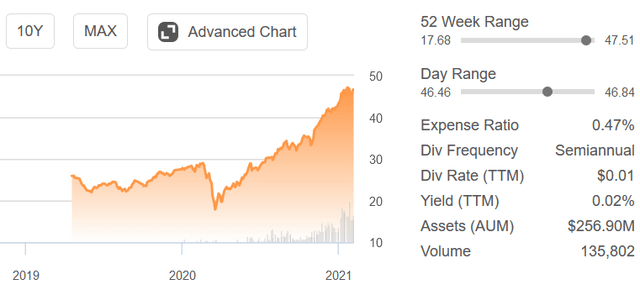

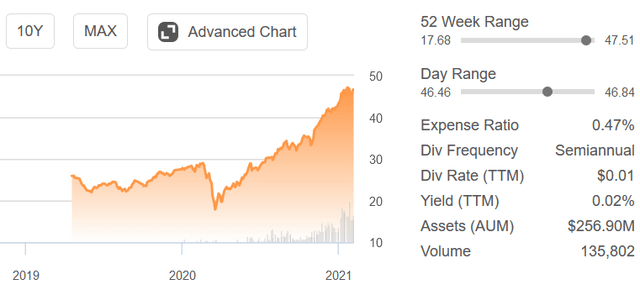

iShares Self-Driving EV and Tech ETF ( IDRV) - Price = USD 46.71

Source

The iShares Self-driving EV and Tech ETF as the name suggests is focused on both EV self driving and the tech behind it. iShares states that the IDRV fund:

"...seeks to track the investment results of an index composed of developed and emerging market companies that may benefit from growth and innovation in and around electric vehicles, battery technologies and autonomous driving technologies."

The IDRV fund was up 58.5% in 2020. IDRV has a PE (as of Feb. 4) of 26.29 and a dividend yield of 0.69%.

I rate the fund as fairly valued, especially for investors looking to gain exposure to EVs, self-driving and its supply chain.

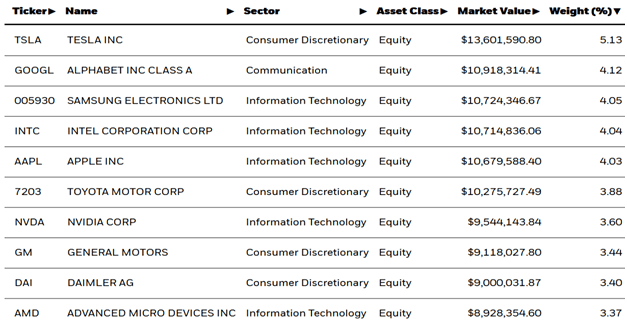

Top ten holdings

Source: iShares

Note: Some other similar ETFs are iShares Electric Vehicles and Driving Technology UCITS ETF (ECAR), Ideanomics NextGen Vehicles & Technology ETF ( EKAR), and SmartETFs Smart Transportation & Technology ETF ( MOTO).

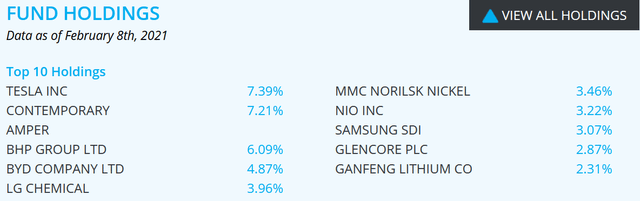

EV + EV supply chain (battery makers, miners) ETFsGlobal X Lithium & Battery Tech ETF ( LIT) - Price = USD 67.65

Source

LIT focuses on some EVs and the EV supply chain. LIT has a strong top ten focus on battery manufacturers and some lithium miners. The current PE is 36.12. I own the fund and it has had a tremendous 2020 gain. I rate LIT as a long term hold.

Source: Global X ETFs

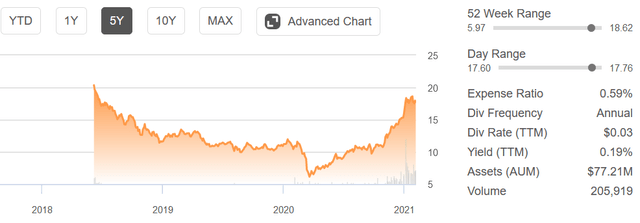

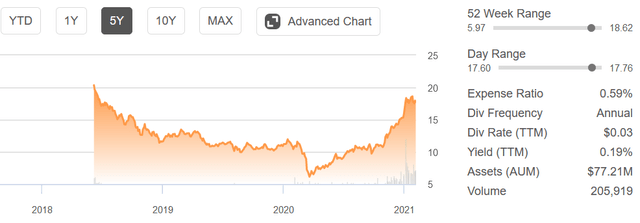

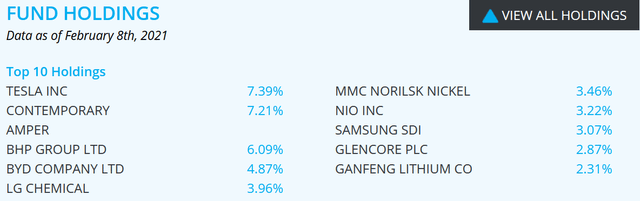

Amplify Lithium & Battery Technology ETF ( BATT) - Price = USD 17.75

Source

BATT focuses on battery storage solutions, battery metals & materials, and EVs. There is a strong top ten focus on battery manufacturers and some lithium miners (also nickel & cobalt miners). Country weightings have China the highest at 38.02% followed by USA at 13.71% and Australia at 12.94%. Valuation looks fair given the strong growth outlook, with YCharts showing the current PE as 34.8 and a dividend yield of 0.19%.

I really like their top ten holdings and the fact they have the top tier EV companies, battery manufacturers and EV metal miners. One of the best for sure. I rate BATT an accumulate.

Source: Amplify ETFs

RisksMacroeconomic events. As we saw in Q1 2020, EV sales were down as widespread lockdowns occurred.EV adoption rates may stall, EV subsidies may decrease, other legislative changes may impact the EV sector, technology change. Start-ups can fail and mergers can have problems.Autonomous vehicles [AVs] are still in the development stage, and while many are progressing fast, we cannot know for sure their future. AVs will also face regulatory and other risks.Business risks - Management, debt, and currency risks.The usual stock market risks (liquidity, sentiment, etc.). Sentiment towards EV related stocks and funds is currently high so in some cases valuations are stretched.ETFs do offer a much lower risk and a more diversified way to play the EV thematic; however, investors should still do their due diligence. ETFs can change their top ten holdings and investors may or may not like the changes made.Further reading The EV Disruption Will Really Take Off From End 2022 EV Company News For The Month Of January 2021 Increased Global Actions To Reduce Emissions Is Very Positive For Solar, Wind And Electric Vehicles Who Will Win The Lucrative Autonomous Vehicles (Robotaxis) Race? Top 5 EV Stocks To Buy Tesla hit by battery shortage amid rallying lithium, cobalt, nickel pricesConclusionThe real EV boom has only just begun so there is still time to get in, ideally sooner rather than later. With 2020 electric car market share at only 4.2%, this leaves plenty of room for growth this decade. My forecast is for 20% share by 2025 and 70% by 2030. Ark Invest is more bullish with 40% by 2025. Mid-2022 into 2023 is likely to be the start of exponential EV sales growth as we hit EV/ICE purchase price parity.

I have covered 6 EV ETFs in this article. The 6 ETFs can be broken up into 2 key groups, with plenty of overlap.

EVs + AVs and some supply chain ETFs - DRIV, KARS, HAIL, IDRV.EV + EV supply chain (battery makers, miners (notable lithium)) ETFs - LIT, BATT.They do give broad coverage to the EV and EV supply chain thematic, but none are really pure play EV funds. My view is that they are all worth consideration if you want exposure to the 'broader' EV thematic and supply chain thematic, and in several cases the AV thematic.

My top picks for now would be HAIL, IDRV, and BATT. If I was to choose my number one ETF from the group, then I would go with BATT at this time as I like their top ten holdings the most. I also like the battery manufacturer focus at a time when there is battery shortages across the industry.

Valuations are in some cases not cheap due to the recent run up in the sector, but given the growth ahead, they should still be worth accumulating and taking a 10 year time investment frame.

My personal preference is to hold some of these ETFs, but also to create your own purer play electric vehicle ETF by selecting your top 5 EV stocks. My top 5 are shown in my Sept. 2020 article " Top 5 EV Stocks To Buy". They were Tesla ( TSLA), BYD Co. ( OTCPK:BYDDY) ( OTCPK:BYDDF), NIO Ltd. ( NIO), Renault ( OTC:RNSDF), and Fisker Inc. ( FSR). To update my top 5, I would remove Renault and add in XPeng Inc. ( XPEV). I would look to accumulate these top names on price dips and to continue to hold them long term if their businesses were doing well.

As usual, all comments are welcome.

seekingalpha.com |