Re <<rates>>

the few basis points shall do nothing against the spirit of the equity market, I am guessing, because the rates cannot be allowed to go high-enough to matter

speaking of rates, spirit, and equity market, all in the singularity known as MSTR

Michael Saylor is perhaps using MSTR shareholders and bondholders' monies to boost BTC, that which he himself went long awhile ago, but hey, he must have received SEC nod.

bloomberg.com

MicroStrategy Boosts Bonds-for-Bitcoin Offering, Sets 0% Coupon

Katherine Greifeld

MicroStrategy Inc. boosted its convertible debt sale to buy Bitcoin by nearly half and cut the coupon to 0%, making it virtually a straight bet on the price of world’s largest cryptocurrency.

The software maker priced $900 million of senior convertible notes, up from the $600 million announced Tuesday, and gave an option for $150 million more within 13 days. The debt will pay no interest and the company estimates total proceeds of about $1 billion -- enough to buy about 20,000 Bitcoin at current levels.

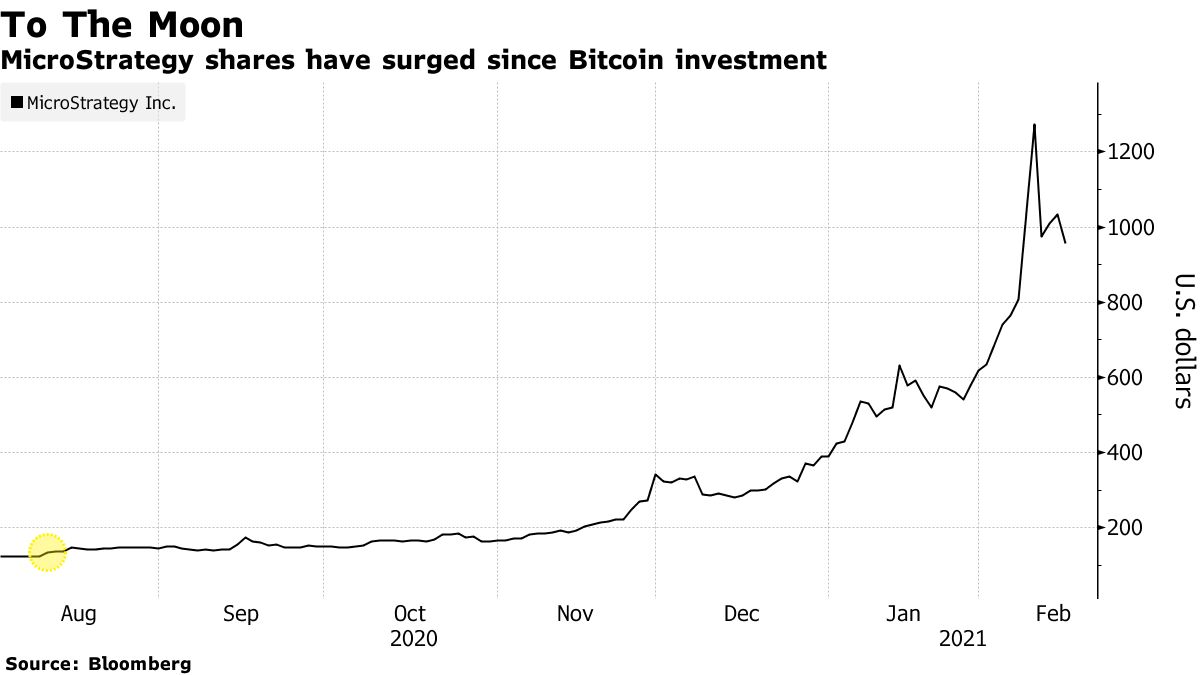

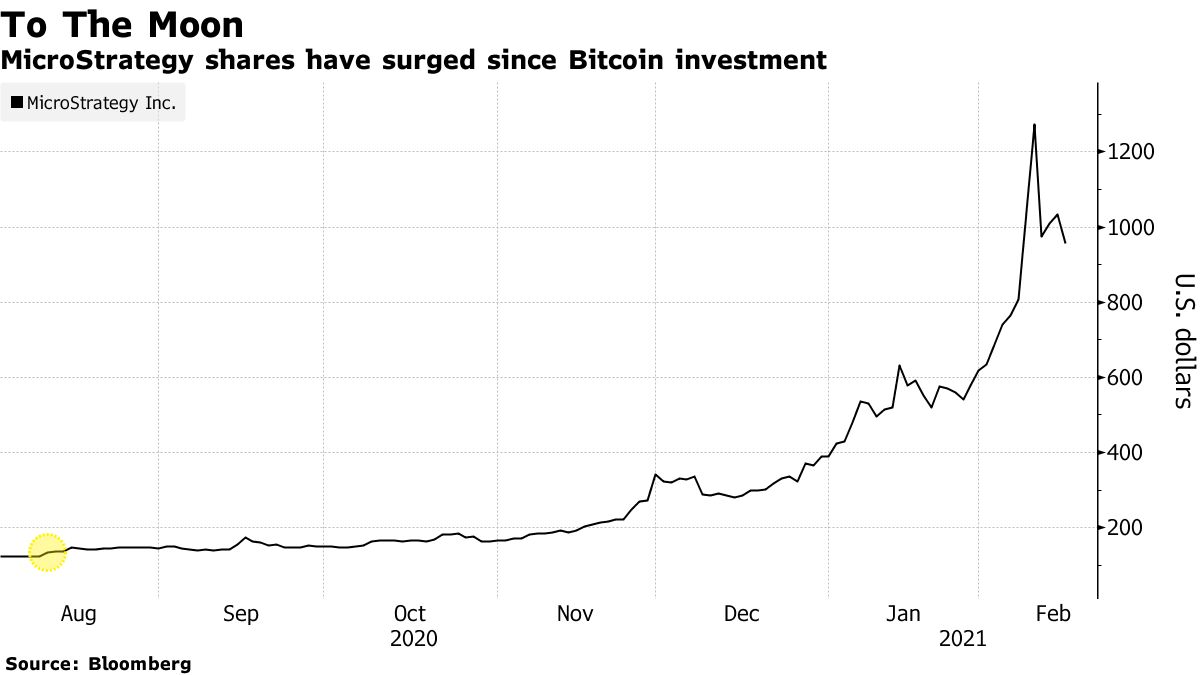

The scale of the offering’s increase speaks to the success of MicroStrategy’s bet on Bitcoin so far. The enterprise software company began buying crypto last summer using corporate cash, before issuing debt in December to amplify its bet past $1 billion. That stake has since tripled, as Bitcoin rallied 350% since it announced its first purchase on Aug. 11. MicroStrategy shares have surged over 600% since.

MicroStrategy has become so focused on speculating on cryptocurrency to boost its profits, its latest foray spurred the $9 billion company to add a second pillar to its corporate strategy: “to acquire and hold Bitcoin.”

Chief Executive Officer Michael Saylor has been proselytizing for Bitcoin for months, urging companies to shift part of the corporate treasury into the infamously volatile digital token to boost yield and protect against both inflation and a weakening dollar. So far, few have followed, though Tesla Inc. plowed $1.5 billion of its $19 billion cash pile into Bitcoin last week.

MicroStrategy’s ability to increase the size of its offering speaks to the strong demand among bond buyers to get a piece of the action in Bitcoin -- even if that comes at a premium to the token’s market price.

MicroStrategy declined to comment on the debt offering.

Wall Street has increasingly taken notice of Bitcoin’s meteoric rise. Morgan Stanley said one of its biggest private wealth funds would consider adding the token. MasterCard suggested some cryptocurrencies could soon be used to transact on its network, following a similar move by PayPal last year.

Read More: MicroStrategy to Add Bitcoin, Widening Premium of Shares

While the 0% coupon offers little in income, the promise of what amounts to a call on Bitcoin has drawn strong interest. Even after the December issue quickly moved into the money, none of the bonds have been converted as of Tuesday, according to data compiled by Bloomberg. Bitcoin has rallied 75% this year to roughly $50,850 as of 9:53 a.m. in New York.

MicroStrategy’s coupon will mark the 10th 0% issue this year, a phenomenon abetted by the Federal Reserve’s policy that has pinned short-term rates near zero.

Shares of MicroStrategy fell 2.9% to $927.51. The stock surged 172% last year.

(A prior version of this story corrected size of Tesla’s cash pile to $19 billion in sixth paragraph.)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |