Japan’s Price Declines Ease as BOJ Heads for Policy Review

Yuko Takeo

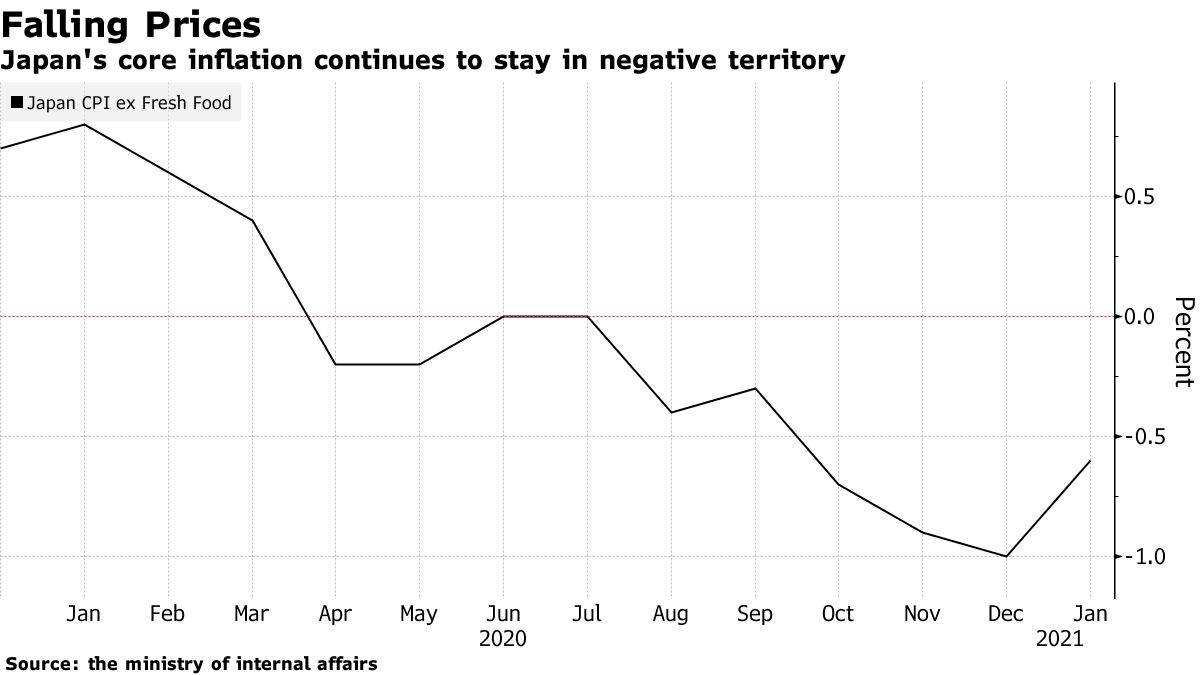

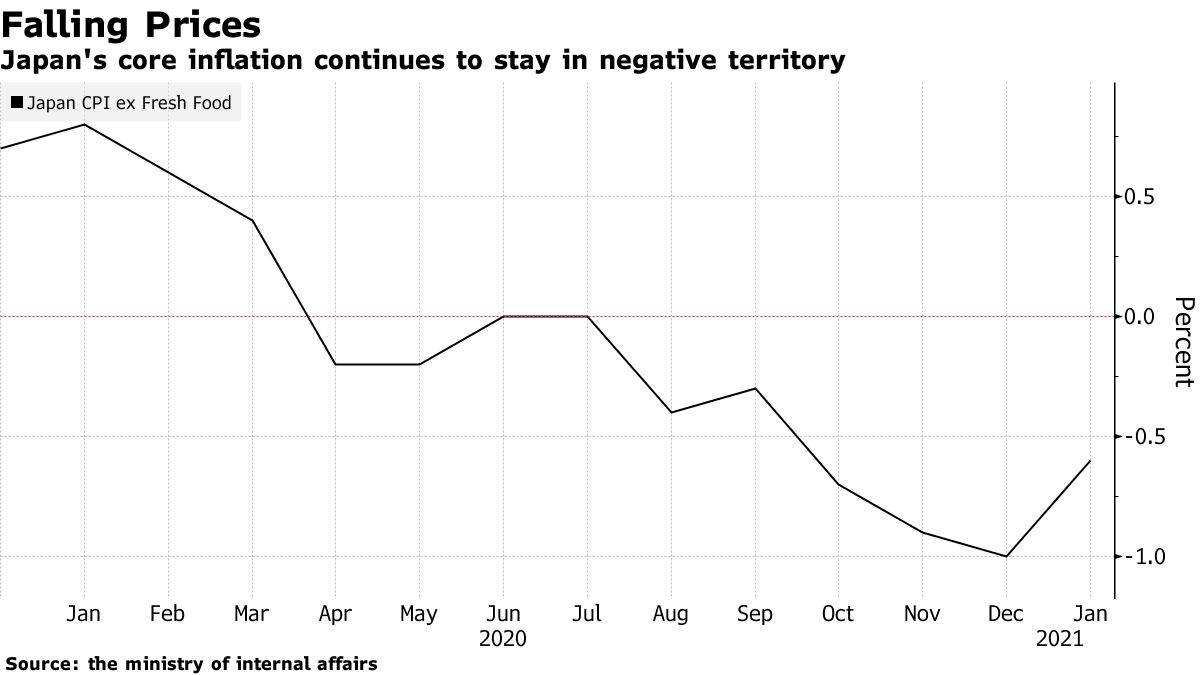

Declines in Japan’s key inflation gauge eased in January after rising coronavirus cases forced the government to suspend a tourism discount program that has hit prices for months.

Consumer prices excluding fresh food fell 0.6% from a year earlier, improving from a 1% drop in December that was the steepest in a decade, the ministry of internal affairs reported Friday. The result matched the median forecast from economists, with the drop moderating before next month’s Bank of Japan policy review.

Prices actually gained once energy costs were also excluded from the calculation. That, combined with the smaller drop in the core index, supports BOJ Governor Haruhiko Kuroda’s view that recent price weakness has been largely due to temporary factors including softer oil markets and government discounts to help the hard-hit tourism industry.

Key Insights“Prices are not gaining downward momentum when you exclude policy factors like the Go-To-Travel program,” said economist Mari Iwashita at Daiwa Securities Co. “The data match what Kuroda has said, and he can say that the BOJ is doing everything it can.”While the BOJ’s latest forecasts see prices rising out of negative territory in the business year that starts from April, it’s also clear the pandemic has hurt longer-term momentum toward the bank’s 2% inflation target. Kuroda this week said the BOJ now won’t hit its goal before 2024.The bank is set to hold a review in March to tweak its policies so they can be maintained for even longer, now that its inflation goal looks more distant. In the short-term, the BOJ’s focus has been keeping markets stable and ensuring businesses have access to cash amid the crisis.Even if current price declines are temporary, there’s still a risk that consumers will come to expect more of them, a negative for inflation momentum. Pay cuts for workers could reinforce that sentiment and limit the ability of businesses to raise prices after the pandemic passes.What Bloomberg Economics Says...“Looking ahead, we expect the core gauge to remain in deflation around -0.5% in 1Q. Further out, we expect price declines to narrow gradually as business activity recovers after the state of emergency ends on March 7.” |