5 Must-Read Lessons From Tesla's Historical Surge

Feb. 19, 2021 9:00 AM ET Tesla, Inc. (TSLA)F, GM, TM... 53 Comments24 Likes

Summary

* Tesla's surge has been one of the greatest ones in stock market history, turning from a $40 bln to a $800 bln company in less than two years.

* Incrementally learning in the stock market is how you become a successful investor. Without this I would have not rated Tesla a buy in 2019 as a value analyst.

* Tesla is a once-in-a-decade opportunity to enrich your market knowledge on how to identify great investing opportunities.

* In this article, I will discuss five invaluable lessons from the Tesla case you have to remember.

* Looking for a portfolio of ideas like this one? Members of Insider Opportunities get exclusive access to our model portfolio. Get started today »

The average investor reaches a depressed long-term annual return of 2.3%, significantly underperforming the S&P 500 ( SPY) index. Shocking. This is primarily caused by the inability of investors to learn from the lessons the market is providing them.

By incrementally learning from past mistakes and successes, I have been able to improve my value investing strategy significantly. As such, I identified great investing opportunities for my community which were unpopular among traditional value investors. One of them was Tesla ( TSLA), about which I wrote three bullish articles in 2019, followed by astonishing returns:

Tesla: How Margins Could Rise Significantly - 1676% return Tesla's Q3 Leaked Email: No Demand Problem - 1559% return Tesla: Structural Profitability Underway - 1246% returnI believe Tesla is a once-in-a-decade opportunity for you to enrich your market knowledge and become a more successful investor. Why did Tesla surge that much and how can this information help you to better identify future investing opportunities?

In this article, I will discuss five invaluable lessons from the Tesla case you have to remember.

(Source: Insider Opportunities with Tradingview) (Source: Insider Opportunities with Tradingview)

1. Don't let P/E ratios fool youWith around 3,800 stocks available in the market, investors need to make a cut-off point when looking for investing opportunities.

Value investors tend to look at the P/E ratio, a valuation metric which indicates how expensively the stock is valued compared to its last earnings. It's easy to calculate and understand and it is a common believe that one should look for stocks with a low P/E ratio and avoid stocks with a high one.

In reality, the P/E ratio as a standalone metric is useless. Let me explain this by discussing a basic principle of investing which is oftentimes forgotten by investors:

The intrinsic value of a company is the sum of all future cash flows discounted to today. If you pay less for the shares compared to this intrinsic value, you should generate strong returns in the long term.

Current earnings tell us very little about future cash flow generation. Many investors avoided (or in the worst case shorted) Tesla because of its negative P/E ratio in 2018 or very high P/E ratio in 2019/2020. But in fact, this P/E ratio tells us very little about Tesla's real intrinsic value.

Lesson 1: Value investing is about forward-looking intrinsic values, not about backward-looking P/E ratios.

2. Free cash flows > earningsWe were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.

I love this quote from Michael Dell, founder of Dell Technologies ( DELL). Managers and investors are oftentimes focused on earnings, while this is just an accounting measure with few underlying value.

It's the free cash flow, not earnings, which shows how much money is generated to pay out dividends, buy back shares or invest in future opportunities.

Earnings are fiction, while free cash flows are reality.

Most investors were focused on Tesla's profit and loss statement while they were ignoring the strongly improving trends in free cash flows. In fact, when I wrote my first article on Tesla in August 2019, its TTM free cash flow stood at $1.4 bln and Tesla was trading at a price/free cash flow ratio of 28x.

Over the past two years, Tesla's profits were negligible, while it generated $5.6 bln in free cash flows:

(Source: Insider Opportunities with SEC data; numbers in $ mln) (Source: Insider Opportunities with SEC data; numbers in $ mln)

There were three big drivers for this significant gap between earnings and cash flows at Tesla in 2019.

First, Tesla's stock-based compensation is very high ($898 mln incurred in 2019). A significant part ($275 mln) of this was attributed to Elon Musk's performance awards, which is based on revenue and EBITDA achievements. This is an accounting cost which reduces profits, but has no impact on cash flows. Thus, when you compare P/E ratios you are punishing companies for their stock-based compensation which is only paid out when milestones are achieved. Comparing free cash flow metrics solves this problem.

Second, deferred revenue (=money received for goods or services which can't be recorded in the P&L statement yet) reduced Tesla's profits by $801 mln in 2019. A significant part of its deferred revenues can be attributed to the Full Self Driving software. Tesla receives $10,000 up-front for this feature from customers, but only a part of it can be recognized as revenue instantly. By comparing P/E ratios, you are indirectly disadvantaging companies who receive money up-front. Comparing free cash flow metrics solves this problem.

Last, in 2019 Tesla invested $675 mln less in capital expenditures compared to depreciation and amortization (D&A) incurred. This can be a sign of either the scarcity of investment opportunities (stagnation) or the lower need for investments to reach similar growth (efficiency). To me, it was clear that Tesla was getting more efficient in building its second Gigafactory. By comparing P/E ratios, you are indirectly disadvantaging companies who are getting increasingly efficient in expanding their business. Comparing free cash flow metrics solves this problem.

In short, investors analyzed fiction (earnings) while ignoring the very strong reality (free cash flow) at Tesla. It's very common that investors are getting misguided by profits and consequently miss out on great growth opportunities.

That's why at our community Insider Opportunities we use the free cash flow yield in our algorithms as valuation metric rather than the P/E ratio.

Lesson 2: If you value a company, look at reality (P/FCF or FCF yield) instead of fiction (P/E or earnings yield).

3. The power of operating leverageAlright, so we should only look at the P/FCF (instead of P/E ratio) to analyze whether a stock is over- or undervalued, right?

No, we are not there yet. Let's take a step back and think about the definition of intrinsic value again:

The intrinsic value of a company is the sum of all future cash flows discounted to today.

It's not only today's cash flow that matters, but also future opportunities. Mature companies can see their cash flow vanish if they face high competition. In contrast, cash flows can grow very rapidly when a young firm combines high operating leverage with high revenue growth. Let me explain that.

Every company's cost structure consists of two types of costs. (Semi-)fixed costs depend little on the amount of units sold, while (semi-)variable costs have a close correlation with units sold:

(Source: Insider Opportunities) (Source: Insider Opportunities)

Most young companies are unprofitable because they don't generate enough revenues to cover fixed costs yet. However, if they incur low variable costs to be able to grow revenues, they can become cash machines very quickly.

Many investors look at gross margins (revenue - costs of goods sold) to analyze the profitability of one extra unit sold. At Insider Opportunities, we analyze the contribution margin to provide members the best growth opportunities in the market. This metric is more appropriate as it also subtracts marketing expenses which for some companies is a necessity to sell their product/service.

Below, I provide an example of two growth companies with only one difference: their contribution margin.

By combining high revenue growth and high contribution margins, company A turns its tiny profits in year A into huge profits in year B. In fact, profits increase by 5x while revenues only double. That's the operating leverage effect: The degree to which a firm can increase profits by increasing revenue.

In contrast, company B has a much lower contribution margin and thus benefits much less from this operating leverage effect.

(Source: Insider Opportunities) (Source: Insider Opportunities)

Back in 2019, almost all investors and analysts called Tesla overvalued. They supported this statement by comparing Tesla's P/E ratio, price/vehicle sold ratio, etc. to other car manufacturers like Toyota (NYSE: TM), General Motors ( GM), Ford ( F) and Volkswagen ( OTCPK:VWAGY).

Valuing a company like Tesla by comparing its metrics with other mature car manufacturers is like trying to explain stock market fluctuations by the economy. It makes no sense.

Tesla's strong revenue growth is one reason why, but the biggest reason is Tesla's operating leverage effect.

Tesla has much higher contribution margins compared to peers, caused by several factors:

Tesla spends literally zero money on marketing to grow their business, while peers spend billions of dollars each year to defend their market share.Unlike peers, Tesla sells its cars directly to consumers. Consequently, Tesla does not need to share its profits with the middleman.Tesla's production is almost entirely vertically-integrated which is much more cost-efficient compared to peers' outsourcing strategy. In particular, the manufacturing of its own battery packs (biggest cost for an electric car) is a significant cost advantage.Tesla sells software in its cars for autonomous driving, which is the reason why it is rather a tech company than a car company.

Let's dig a bit deeper into this Full Self Driving ("FSD") software as this is the major driver for Tesla's strong margins.

FSD is a feature currently sold at $10,000 per car (~20% of the average selling price for Tesla cars). There's a lot of skepticism around this feature, but the data speaks in Tesla's favor:

There are 9x less accidents per mile with FSD on compared to the average driver. This number keeps improving.Prices for FSD have doubled from $5,000 in 2019 to $10,000 today, implying that the value of FSD increases significantly over time. This trend should extend over the coming years as the neural network improves FSD capabilities exponentially. Research shows a high take rate for FSD of >25%. I expect this take rate to increase significantly as more drivers will be able to afford it when Musk introduces a subscription version of FSD in 2021.It's probable that in the near term Tesla will earn ~$10,000 per car from software ($20,000 per take, 50% take rate), which is ~20% of ASPs. Importantly, these numbers flow to the bottom line of the P&L statement as variable costs to offer the software are basically zero.

Despite its scale disadvantages, Tesla already reached contribution margins of 21% last year, approximately three times higher than peers General Motors and Ford. I believe this will increase to ~30% over the coming years, primarily based on battery cost and FSD improvements.

If Tesla can maintain its five-year annual revenue growth of 50% (which is its official long-term target), it will grow from breakeven to a cash machine in only a couple of years, as you can see in the chart below.

In fact, our model estimates that Tesla's profits will grow 5067% over the coming five years on revenue growth of 391%. That's the impact of the operating leverage effect.

I hope the underlying chart explains well enough why comparing Tesla's current P/E with stagnating car manufacturers like GM is useless.

(Source: Insider Opportunities expectations; numbers in mln) (Source: Insider Opportunities expectations; numbers in mln)

Our model includes the following assumptions for Tesla:

Revenue growth of 50% in 2021 and 2022 (Tesla's long-term guidance) and 30% beyondContribution margin to grow to 30%(Semi-)fixed costs to grow by 10% annually

(Source: Insider Opportunities projections)

Tesla was a mispriced stock in 2019, valued at 28x free cash flows and having huge upside based on the operating leverage effect. Today, many investors keep ignoring the impact of operating leverage on its valuation. If Tesla can deliver my expectations, the forward P/E based on 2025 looks pretty reasonable at ~25x.

Yes, my assumptions can be wrong, but even with more bearish assumptions the operating leverage effect will be profound over the coming years.

Lesson 3: High P/E and P/FCF stocks can be undervalued if they have strong operating leverage. Try analyzing the impact of operating leverage on future cash flows.

4. Don't underestimate the brand moatTo benefit from the operating leverage effect, a company needs to be able to grow sales significantly, which brings us to lesson 4.

Sales growth depends on two factors: The growth prospects for the company's market and the distinctive advantages of the company compared to competitors. The latter is called an economic moat, which can be achieved by the network effect, switching costs, patents, cost advantages and a strong brand name.

To understand the importance of an economic moat and why it's important to analyse for value investors, I would recommend reading my recent article - Successful Value Investing Changes Drastically In 2020.

Bearish Tesla investors oftentimes focused on the anticipated increase in competition. For many years, bears have warned about big competitors introducing new EV models such as the Volkswagen ID.3, Porsche Taycan, Audi E-tron, which would eat away Tesla's market share. It didn't happen in 2018, 2019 or 2020 and it won't happen in 2021 either. Why?

Tesla has an indestructible brand, aided by its unique cars and visionary CEO Elon Musk. Many people see Tesla as the No. 1 brand to combat climate change.

Sales have not been impacted by big news headlines like battery fires, FSD failure and paint degradation. Sales have neither been impacted by competitors who spent billions in marketing vs the zero marketing budget for Tesla.

These events should ring a bell.

Tesla has an iconic brand similar to Apple ( AAPL), Amazon ( AMZN) and Nike ( NKE). Such companies tend to stay market leaders for decades despite any disruption taking place. Ironically, these are oftentimes the companies who face the highest scrutiny from investors.

Tesla is here to stay.

(Source: Tesla logo)

Lesson 4: Put more focus on long-term economic moats (like brands) instead of analyzing short-term non-events like competitive releases.

5. The impact of market sentiment on pricesIn the summer of 2019, Tesla was valued at a market capitalization of $40 bln. Now, only 18 months later, Tesla is worth close to ~$800bln.

Other than Tesla's lead designer von Holzhausen smashing the Cybertruck armor glass, there weren't any unexpected events that occurred during that time frame.

(Source: Forbes)

So how did Tesla stock gain that much in such a short period? A major driver has been market sentiment.

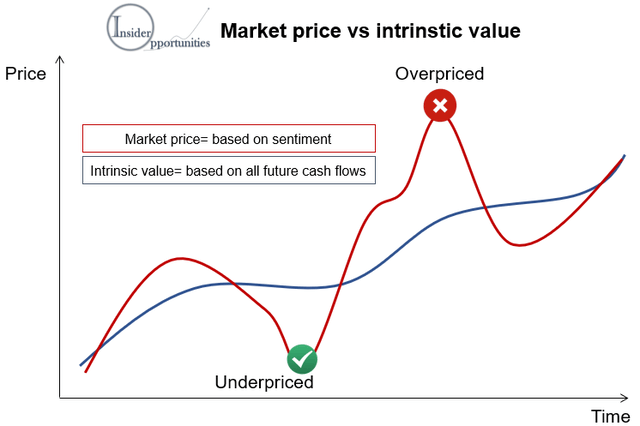

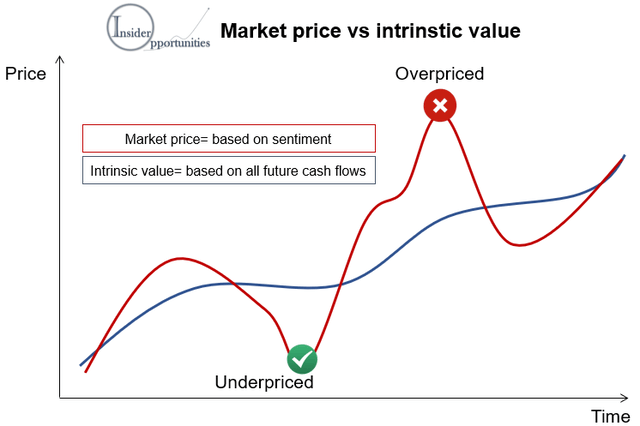

In the short term, stock prices can significantly diverge from intrinsic values due to market sentiment. However, in the long-term stock prices always revert to their intrinsic value.

(Source: Insider Opportunities)

Many investors were tricked in the extremely bearish sentiment around Tesla in 2019, including Goldman Sachs' sell rating with a price target of $32 (96% below today's price). That's when Tesla was significantly undervalued.

Today, investors get tricked in the extremely bullish sentiment around Tesla, including the same bank raising Tesla to buy with a price target of $780.

Investors who buy Tesla today will probably be disappointed with their returns. Tesla will need to deliver on all its growth initiatives to become worth $780 bln in the far future. There are many other stocks available today which provide more interesting risk/reward ratios than Tesla.

The key message here is to take advantage of both overly bearish (buying) and overly bullish (selling) sentiment. Don't let the media fool you.

This contrary approach is how we are able to find the best investment opportunities. We track stocks purchased by insiders (CEOs, CFOs, board members) who know the intrinsic value of their company better than anyone else. When a stock price falls significantly below this intrinsic value due to market sentiment, insiders purchase their shares. We then pick out the biggest opportunities from these stocks with our unique algorithms. Interestingly, Tesla was one of those stocks with strong insider activity in 2019.

Lesson 5: Contrary investing pays off. Try to buy great stocks during bearish sentiment and avoid getting caught by bullish sentiment.

seekingalpha.com |

(Source: Insider Opportunities with Tradingview)

(Source: Insider Opportunities with Tradingview)