<<Ethereum>> I bought this morning is in the money. BTC is doing what the Pantera flow model says it ought to do panteracapital.medium.com

Re <<DRD>> ...am in as well, even as I remain of the belief that a drubbing coming our way

Just hoping that maybe not a drubbing of everything

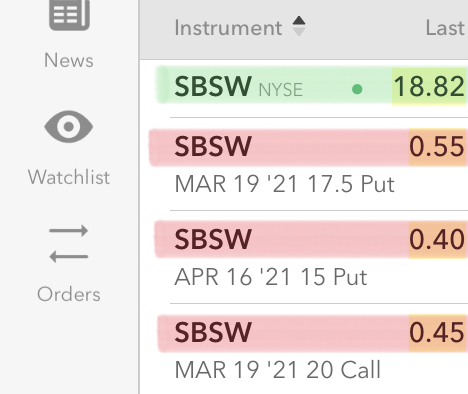

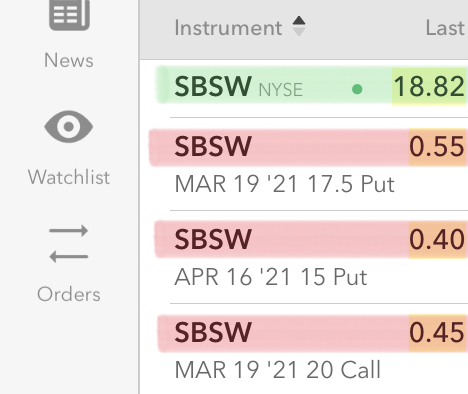

I note that the conventional belief seems to be that value shall outperform growth, and if valid, together with the other commonly held meme of supercycles of all that be metallic, then perhaps SBSW shall do okay being a debt-free dividend-paying ESG-green-organic-free-range valuable-growth stock that is also dirt-cheap

So, am in per below just now (green is long, red is short) at blend of 1:2:2:2 long sbsw, short its puts and short its calls.

If no puts / calls exercised against me next week, my cost basis drops from 18.82 to 16.82, and if no puts exercised mid-April, then drops further to 16.02. Shall aim to aggressively lower the basis down to 10 before the end of the year. Should be doable given the implied volatility indicated. In the meantime am naked-short one helping of SBSW given the short-call exposure. Should be rollable on the puts as well as the calls - liquidity is not horrible as in the case of DRD, and even DRD can be rolled near expiration times.

panteracapital.medium.com

Bitcoin Demand = 3x SupplyPantera Blockchain Letter, December 2020

Pantera Capital

SUPPLY & DEMANDA Tiger Cub friend/TMT investor: “We don’t invest in bitcoin because there are no cash flows to discount.”

Me: “Well, there’re no cash flows to EUR/USD either, but nobody thinks twice about trading it.”

How do you value bitcoin?

An answer is: Bilateral exchange rates are just supply and demand.

I realize for some, that’s an unsatisfying answer.

In this letter we’ve taken two perspectives on supply and demand.

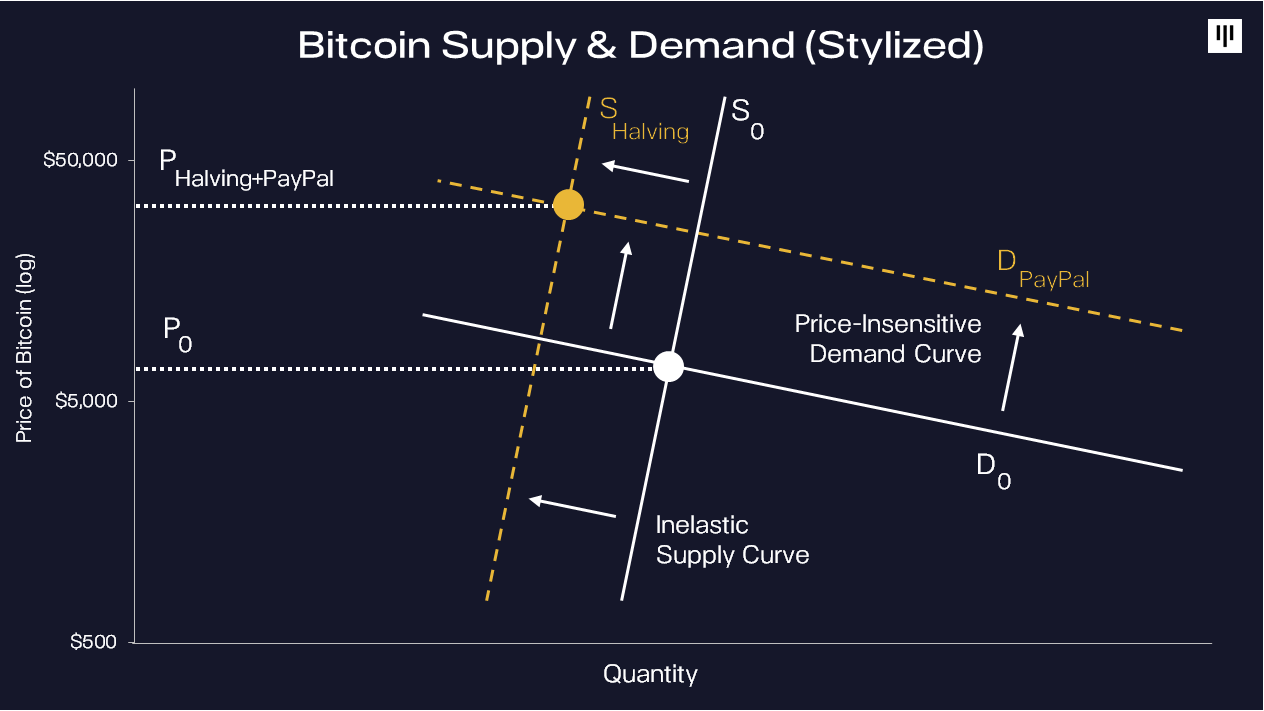

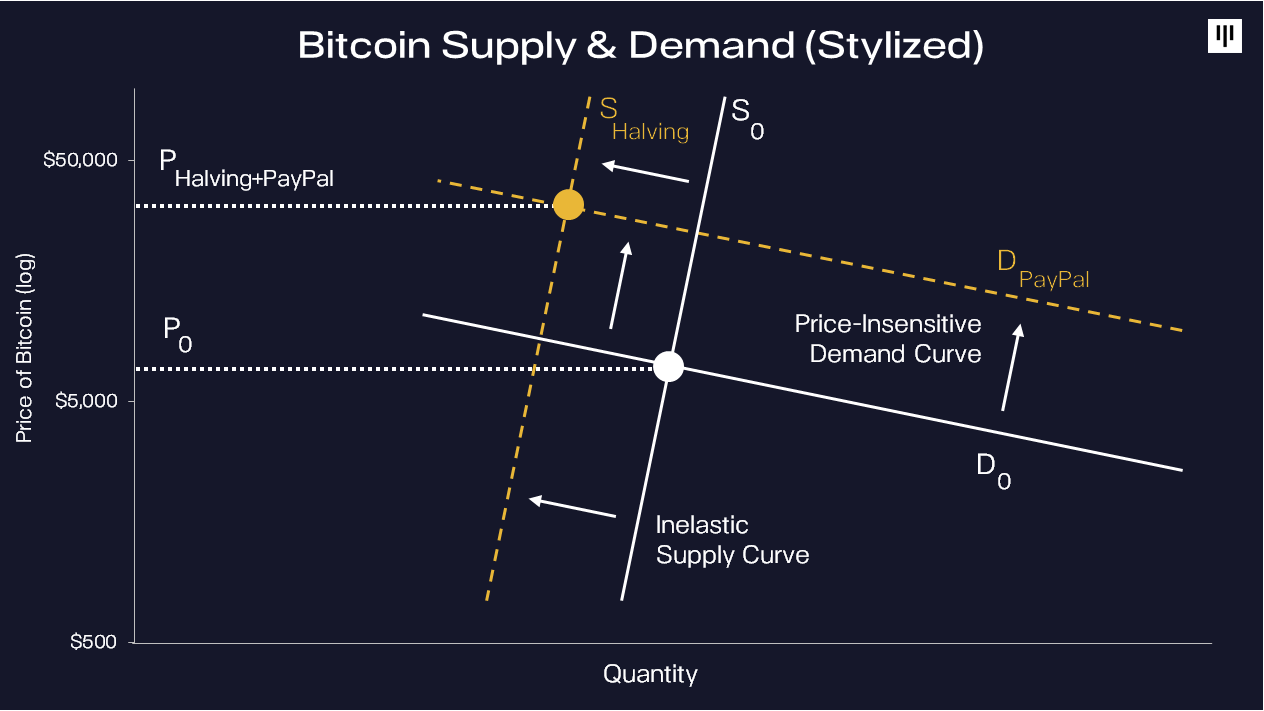

The first is an Econ 101-style supply and demand chart where:

Y-axis: BTC price

X-axis: quantity stylized — no numbers

The demand curve seems very price-insensitive. When people want in — like now — price doesn’t seem to have a large impact. On the graph, that yields a fairly flat line. On the flip side, supply seems very inelastic. Many holders of bitcoin hold it more for political/philosophical reasons than for price appreciation. It takes much higher prices to induce them to sell. That makes the supply curve very steep.

In the last seven months, we’ve had two huge shifts — one in demand, one in supply — both upwards. In the last seven months, we’ve had two huge shifts — one in demand, one in supply — both upwards.

On the demand side, we’ve had public companies like PayPal enter the market. That shifts the demand curve much higher.

At the same time, the supply of newly issued bitcoin was cut in half in May — as part of the every-four years Halving of bitcoin issuance. Fewer bitcoin are available.

We titled our previous investor letter, Bitcoin Shortage. The price acts like there’s a shortage.

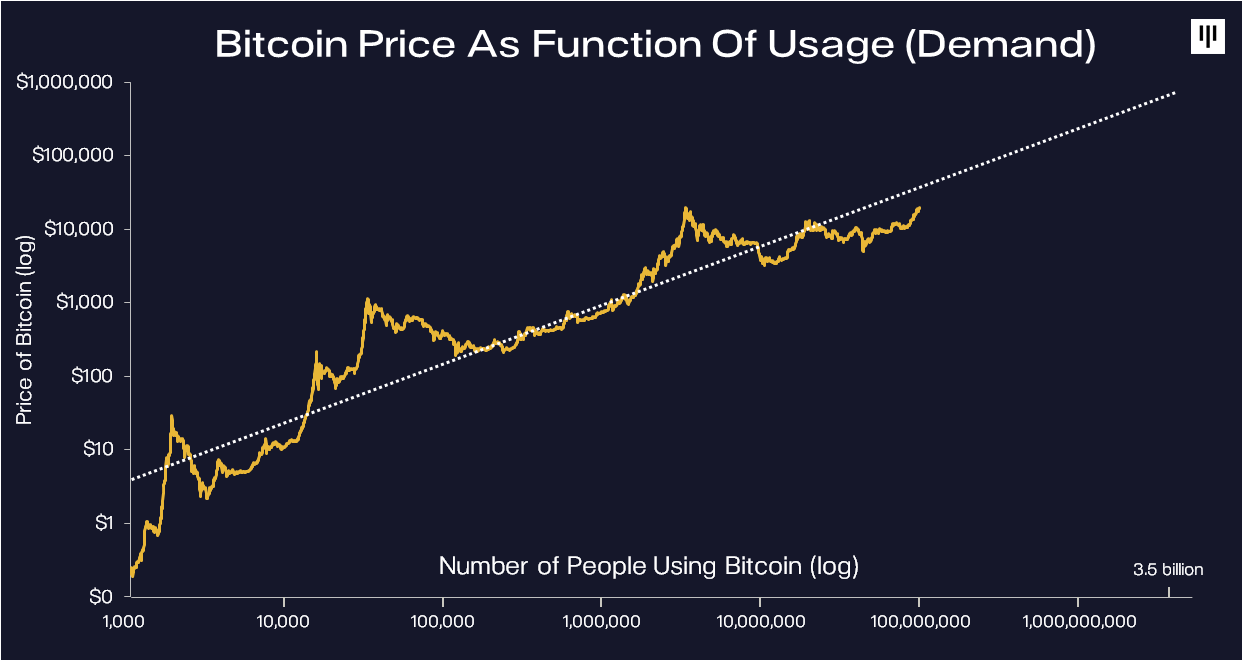

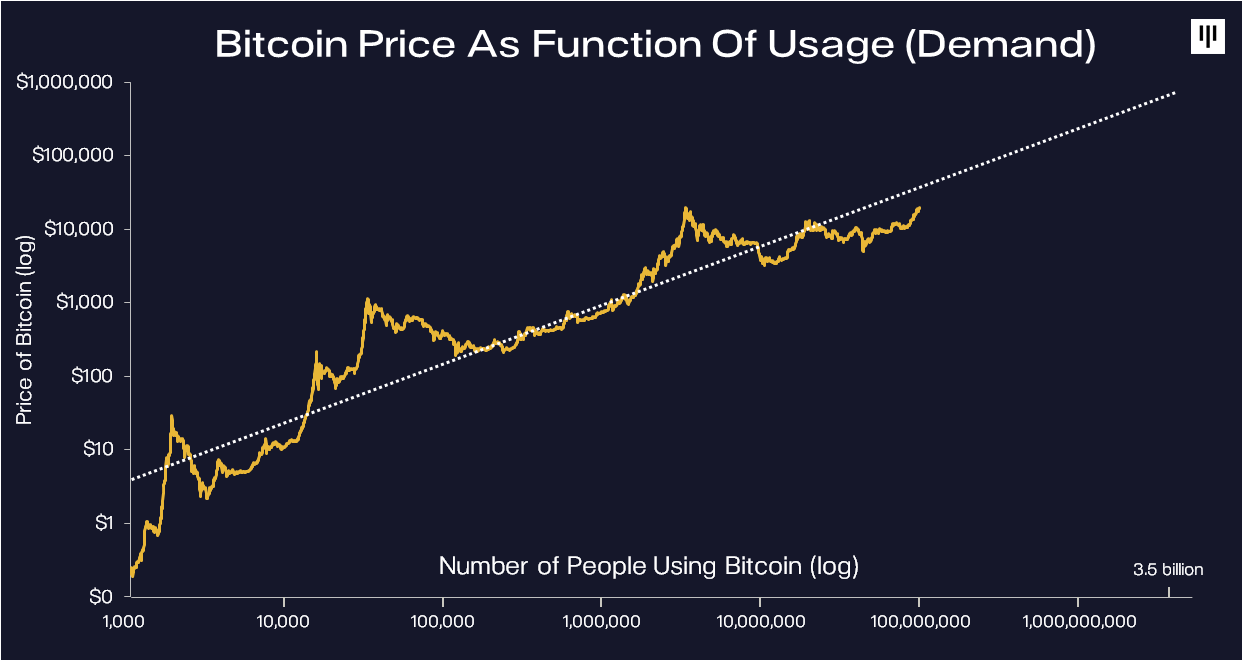

DEMAND OVER TIMEThe demand curve didn’t just shift once for PayPal — it’s been shifting like that for a decade as new entrants discover bitcoin.

Here’s our standard log price graph. In this we’ve stylized the x-axis as the number of people using bitcoin. When only a few hundred cypherpunks were involved, it was valued close to zero. When 10,000 people were using bitcoin, it was worth more. The price rose as a million people owned it. The number of people using bitcoin has been growing by an order of magnitude every couple of years. So has the price.

There’re approximately 100 million people using bitcoin now. I can imagine a world when ten times as many people use it. It just stands to reason, with ten times as many people buying something with a fixed quantity, the price will go up (a lot). There’re approximately 100 million people using bitcoin now. I can imagine a world when ten times as many people use it. It just stands to reason, with ten times as many people buying something with a fixed quantity, the price will go up (a lot).

3.5 billion people have a smartphone. A smartphone is the only requirement to use bitcoin. In the long, long run — it’s not obvious why most of those won’t use bitcoin. That’s not many more than share photos on Facebook.

I **know** there’re a billion reasons it’s not exact, but there are 3.5 billion reasons it’s a good construct.

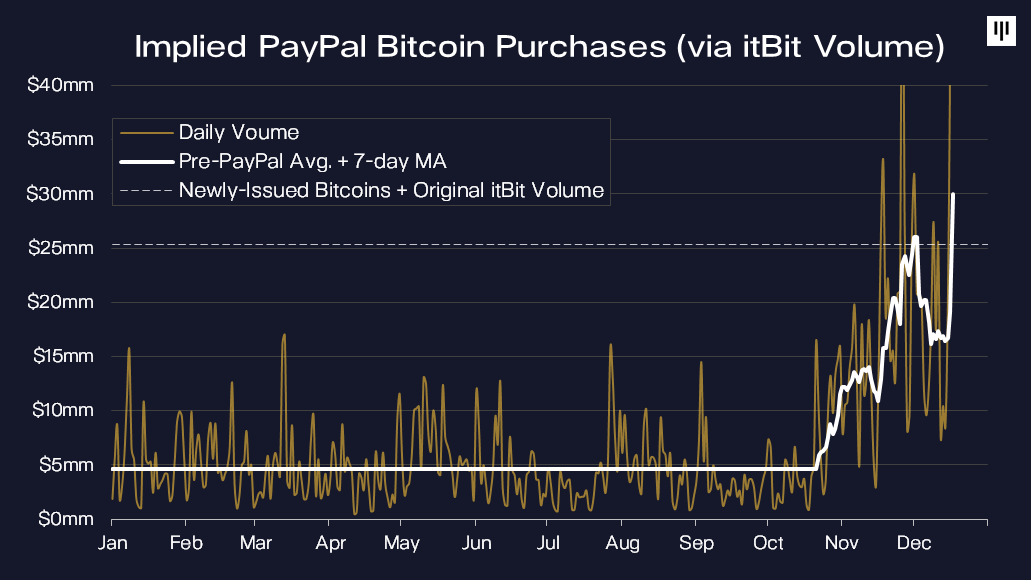

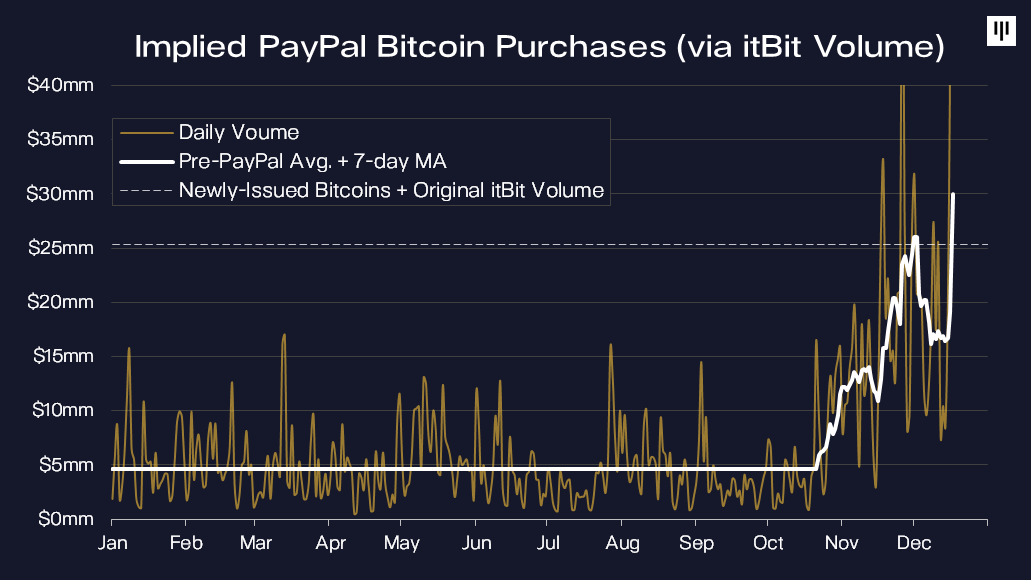

PAYPAL ALREADY BUYING MORE THAN 100% OF NEWLY-ISSUED BITCOINPayPal just launched their new service that enables customers to buy, sell, and hold cryptocurrency directly from their PayPal accounts. Last month we discussed the massive demand shift PayPal caused.

PayPal’s crypto infrastructure provider is Paxos. Prior to PayPal’s integration of crypto, itBit, the Paxos-run exchange, was doing a fairly constant amount of trading volume — the white line in the chart below.

When PayPal went live, volume started exploding. The increase in itBit volume implies that within two months of going live, PayPal is already buying more than 100% of the new supply of bitcoins.

MASSMUTUAL BUYS BITCOINMassMutual — the 170-year-old life insurance provider — joined the list of public companies who have purchased significant quantities of bitcoin. MassMutual bought $100mm of bitcoin for its general investment account. MASSMUTUAL BUYS BITCOINMassMutual — the 170-year-old life insurance provider — joined the list of public companies who have purchased significant quantities of bitcoin. MassMutual bought $100mm of bitcoin for its general investment account.

MICROSTRATEGY BETS A BILLION ON BITCOINMicroStrategy, a public company under the leadership of Michael Saylor, purchased $425mm worth of bitcoin in August and September of this year. The investment quickly paid off, with Bitcoin nearly doubling in price in the months after their purchase.

The company recently raised $650mm through the sale of convertible notes and intends to invest the proceeds into bitcoin. For reference, this represents a month’s worth of the new supply of bitcoins.

#BitcoinShortage

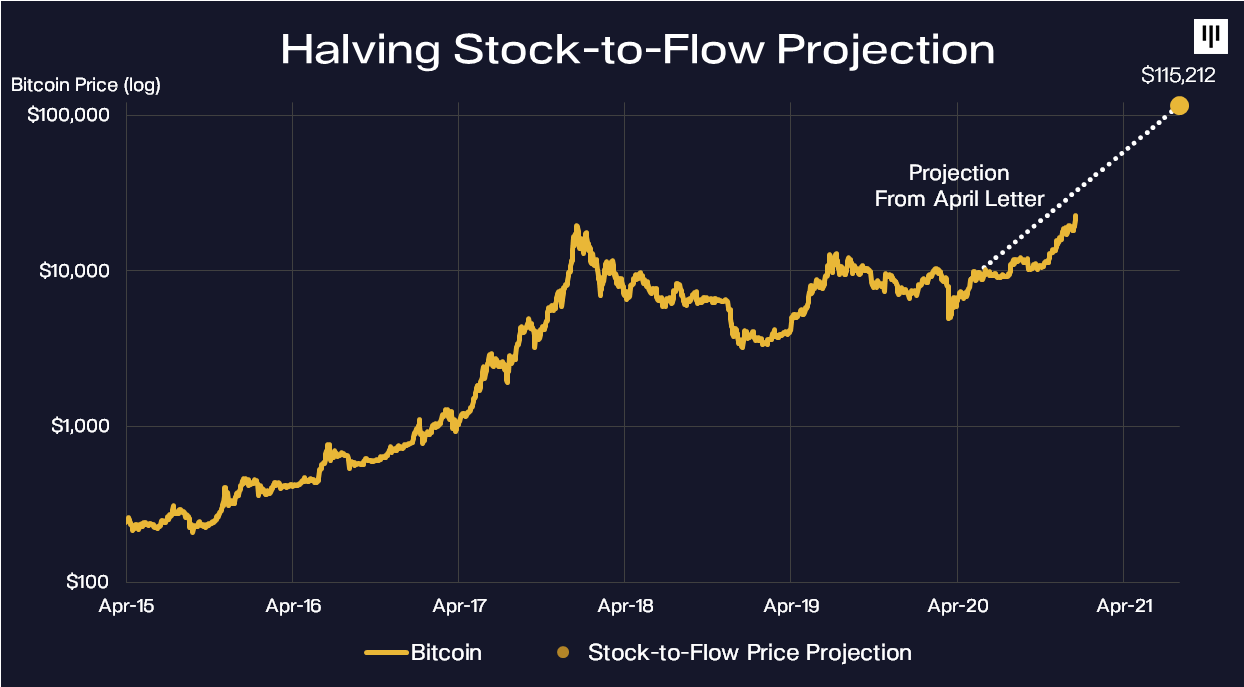

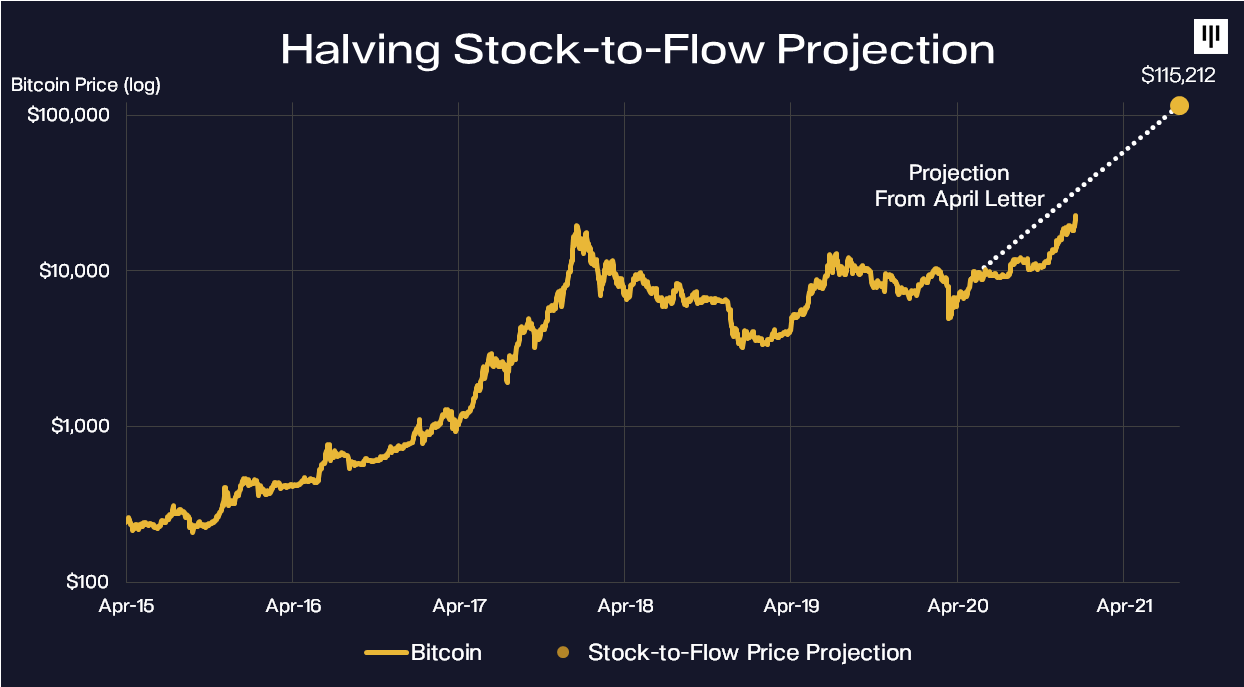

HALVING STOCK-TO-FLOW PROJECTIONIn our April letter, we published a potential framework for projecting the impact of bitcoin halvings on price based on an analysis of the bitcoin stock-to-flow ratio across each halving. The magnitude of the impact has been proportional to the scale of the decrease in supply.

If this cycle were to have a similar ratio as previous halvings, bitcoin could rise to $115,000 by August of next year. A constant growth path from the price in April to that point was graphed as the dotted line.

The actual price is behind that historical projection — but, not a ton behind. The price today is only nine weeks behind the pace to get to $115k. The actual price is behind that historical projection — but, not a ton behind. The price today is only nine weeks behind the pace to get to $115k.

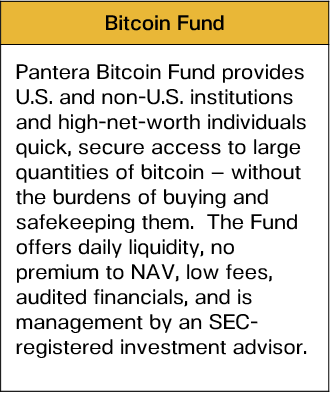

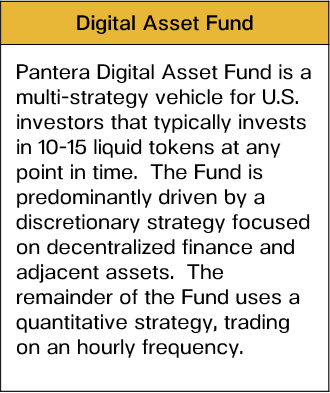

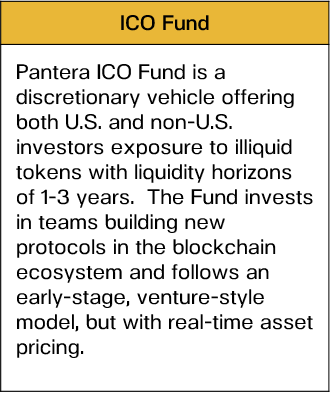

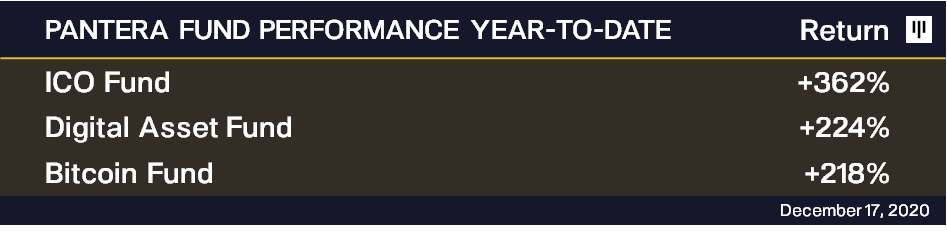

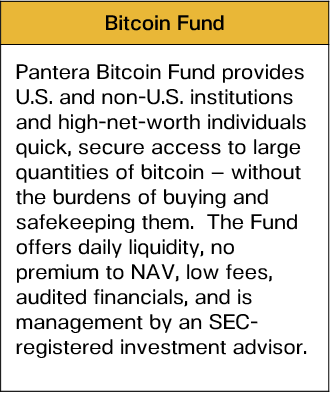

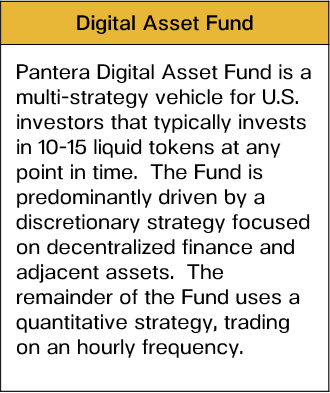

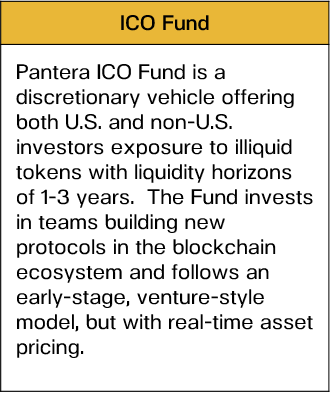

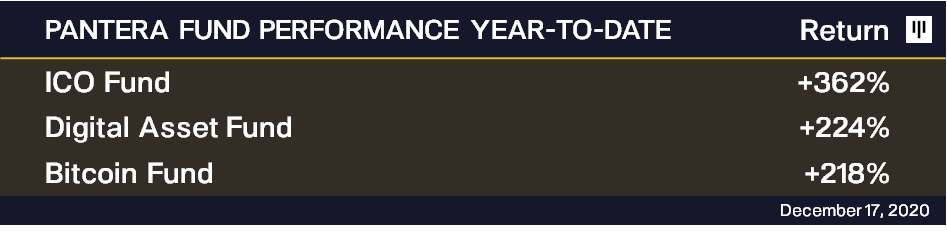

FUND PERFORMANCEPantera Funds are continuing to generate strong returns in what has been a seminal year for digital assets. We believe we are still in the early innings of a potential multi-year bull market fueled by strong macro tailwinds and growing fundamentals in the underlying technology. FUND PERFORMANCEPantera Funds are continuing to generate strong returns in what has been a seminal year for digital assets. We believe we are still in the early innings of a potential multi-year bull market fueled by strong macro tailwinds and growing fundamentals in the underlying technology.

Pantera funds are open to Accredited Investors. Pantera funds are open to Accredited Investors.

All of our funds can take investments via IRAs. We support a dozen providers, including Kingdom Trust, Millennium Trust Company, and Pacific Premier Trust Company.

Click on a Fund below for more information.

ir@panteracapital.com.

PORTFOLIO COMPANY UPDATES:Circle Partners with Visa on USDCoin-Powered Business Spending

Circle enables businesses to harness USD-backed stablecoins — blockchain-based tokens tied to US dollar reserves — for payments, commerce, and other financial applications globally. Circle provides transactional services, business accounts, and platform API’s powered by USD Coin (USDC). Circle and Coinbase created USDC — a regulated and fully-reserved stablecoin with over $3 billion in total circulation and $100 million in net new weekly issuance,

Circle recently announced a partnership with Visa to integrate USDC payment capabilities with select Visa card issuers, which will allow businesses to receive and spend USDC balances through their corporate card. By doing so, Circle opens up a path for USDC’s open financial network to onboard 60 million merchants from Visa’s customer base. To date, Circle’s platform has supported over 100 million transactions, with nearly 10 million retail customers and over a thousand businesses.

STANFORD INSTITUTE FOR ECONOMIC POLICY RESEARCH (SIEPR) WITH DAN MOREHEAD AND PROFESSOR DAN BONEHI had the honor of speaking at the Stanford Institute for Economic Policy Research. SIEPR is “Stanford’s thought leader for understanding the economic challenges, opportunities, and policies affecting people in the United States and around the world.”

Previous SIEPR speakers include:

Jerome Powell, Chair of the Federal ReserveJanet Yellen, Former Chair of the Federal ReserveJohn Taylor, Senior Fellow at Stanford’s Hoover InstitutionProfessor Dan Boneh (Head of the Applied Cryptography Group) and I discussed Monetary Policy and Blockchain.

Below are some highlights from the conversation. You can watch the full episode at info.panteracapital.com.

Q. The big vision for Bitcoin, and for cryptocurrencies in general, is that they would replace fiat currency, right? None of that has happened. I can’t use cryptocurrencies to buy things on Amazon. I definitely can’t use cryptocurrencies to buy tomatoes at the market. Is that a failure of the technology or how would you interpret that?

Dan: “That one I’ve heard for eight years. It’s an easy one. Bitcoin is going to do so many different things, and essentially the last thing it’s going to do is be good for buying a cup of coffee. Like you said, there’re 6 billion people that live in countries with terrible currencies, terrible banks, no access to banks, capital controls, often a citizen’s savings are confiscated in bank failures. It’s great for that. That’s why you see countries like China, India, Philippines really using Bitcoin. But buying a cup of coffee at Starbucks is not great for it. There’re a couple of reasons:

One is high volatility. It’s just a fact. It has 60%, 70% annualized volatility so it makes it bad for pricing as a unit of account. In 10 years, that will have calm down and it’ll be normal.

Another reason it’s bad for commerce like that is, if you think this asset will keep appreciating at these astronomical rates, you probably don’t want to buy anything with it because you’ll ultimately regret it. The first commercial transaction was a developer who bought pizza for 10,000 bitcoins. That’s $200 million today. The guy wasn’t a dope. He got two pizzas, so it was only a hundred million per pizza, but the punch line is that it’s not good spending bitcoin because it’s a highly appreciating currency. If you want to buy a flat screen TV, you can buy one today or 10 next year. So, you probably want to hold off and do it.

Q. The other point that people always bring up is Bitcoin has no value. It has no intrinsic value. It’s just bits on the computer, so why are we attributing so much value to it? How would you respond to that?

Dan: “Well, two perspectives. One is, it’s a utility. It’s useful. There’re a hundred million people that think it’s useful for something. Like you said, a lot of people in the developing world think it’s safer than their banks. You talked about the fact that it’s all protected by a cryptographic key. The way I think about it is if you live in a developing country where your banks are really not that trustworthy, you can have your entire net worth as a password in your head. That has enormous value. A hundred million people are using it and that’s given it the value that it has today.

“But if we had this conversation again in a decade, some central banks will have it on their balance sheet. It’ll have a 22-year track record. That’s the perspective I would have. For some reason, people pick number 79 on the periodic table to be where people store wealth. I think 30 years from now, every central bank will have Bitcoin and not every central bank will have gold.”

Q. What will prevent another cryptocurrency coming along and replacing Bitcoin as a new, better, faster cryptocurrency?

Dan: “It’s another very common, negative take. I did an interview with Andrew Ross Sorkin, where he said, he and his wife were walking down the street in New York, and some guy was pitching a cryptocurrency. So, they decided to make their own since it’s so easy to make a new cryptocurrency. So, Bitcoin can’t have any value because there’re 2,000 copies of Bitcoin out there. My answer to him was, ‘I got a better idea: photo sharing. If you can get two and a half billion people to share photos on your website, it’s going to be worth a lot of money.’ That’s basically the deal, if you can get more than a hundred million people using your new cryptocurrency, it is going to be better than Bitcoin, but it’s hard to get a hundred million people to switch from one thing to another. And Bitcoin’s already got a hundred million people storing $400 billion of value. It’s really, really hard to compete with that. Like Dan [Boneh] said, there are lots of other use cases that are really interesting applications, but the digital gold version of crypto, I think is already done.”

UNPRECEDENTEDIn our June investor letter, we mentioned the unprecedented use of the word “unprecedented”.

The Oxford English Dictionary recently announced that they couldn’t pick their signature “Word of The Year” this year because of the unprecedented use of so many words like “unprecedented”.

We wish you a wonderful — and very normal — 2021. |

In the last seven months, we’ve had two huge shifts — one in demand, one in supply — both upwards.

In the last seven months, we’ve had two huge shifts — one in demand, one in supply — both upwards. There’re approximately 100 million people using bitcoin now. I can imagine a world when ten times as many people use it. It just stands to reason, with ten times as many people buying something with a fixed quantity, the price will go up (a lot).

There’re approximately 100 million people using bitcoin now. I can imagine a world when ten times as many people use it. It just stands to reason, with ten times as many people buying something with a fixed quantity, the price will go up (a lot). MASSMUTUAL BUYS BITCOINMassMutual — the 170-year-old life insurance provider — joined the list of public companies who have purchased significant quantities of bitcoin. MassMutual bought $100mm of bitcoin for its general investment account.

MASSMUTUAL BUYS BITCOINMassMutual — the 170-year-old life insurance provider — joined the list of public companies who have purchased significant quantities of bitcoin. MassMutual bought $100mm of bitcoin for its general investment account. The actual price is behind that historical projection — but, not a ton behind. The price today is only nine weeks behind the pace to get to $115k.

The actual price is behind that historical projection — but, not a ton behind. The price today is only nine weeks behind the pace to get to $115k. FUND PERFORMANCEPantera Funds are continuing to generate strong returns in what has been a seminal year for digital assets. We believe we are still in the early innings of a potential multi-year bull market fueled by strong macro tailwinds and growing fundamentals in the underlying technology.

FUND PERFORMANCEPantera Funds are continuing to generate strong returns in what has been a seminal year for digital assets. We believe we are still in the early innings of a potential multi-year bull market fueled by strong macro tailwinds and growing fundamentals in the underlying technology. Pantera funds are open to Accredited Investors.

Pantera funds are open to Accredited Investors.