Re << Looks like Au and BTC hedge each other, lol.>>

New-New-Normal.

Had you uttered the thought just a few months ago all would have thought you mad.

To think, amorphous BTC, just a crypto string invented by someone who might as well be from the Twilight Zone, an institutionally accepted hedge for massively dense gold - how absurd; and yet ... NFTs instagram.com

... and I never and do not understand what anyone saw in Lindsay Lohan.

bloomberg.com

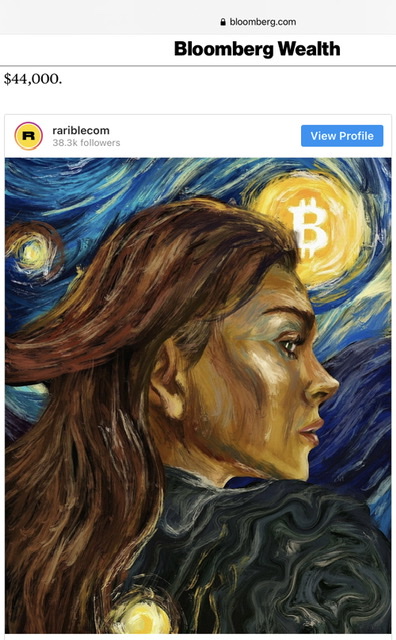

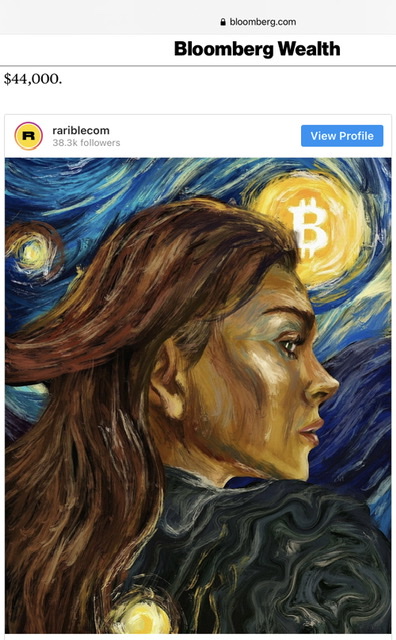

Should You Buy a Bitcoin-Inspired Image of Lindsay Lohan?

Crypto artworks featuring the likes of Biden, Trump and a cartoon cat are all the rage. Here’s what you should know about such collectibles, called NFTs.

Katharine Gemmell

March 8, 2021, 7:30 PM GMT+8

Great art usually defies easy explanation. Perhaps that’s why it’s seemingly inexplicable that the surge in Bitcoin and other cryptocurrencies has given rise to its own world of masterworks.

Lindsay Lohan starred in a beloved piece of art — “Mean Girls” — 17 years ago, but these days she’s minting and selling her image for thousands of dollars through another artform: non fungible tokens, or unique digital collectibles. Musician Grimes (and partner of Bitcoin fan and mega-billionaire Elon Musk), Dallas Mavericks owner Mark Cuban as well as scores of other famous and non-famous people around the world are getting in on the action around such NFTs.

These digital collectibles — in myriad iterations such as memes, pictures, animations and videos — have been getting made and sold for several years, but were relegated to the realm of hardcore crypto enthusiasts until recently. Their connection to digital currencies is that the same technology ( blockchain) underpinning virtual coins also helps ascribe ownership and authentication to these artworks.

Over the past few months, interest in NFTs has exploded as cryptocurrencies gained mainstream acceptance and pop-cultural cachet. Prices have hit eye-watering heights, with total sales topping $60 million last month versus less than $250,000 a year earlier.

Should investors who have long turned to art as a tangible way to enliven both their collections and portfolios now consider buying a GIF animation rather than, say, a bronze sculpture? After all, established financial institutions are increasingly warming to the idea of putting money into digital currencies, so why not invest in a work associated with crypto, you may wonder.

Here’s what you need to keep in mind if you are considering taking the plunge:

How are NFTs doing?The current size of this nascent market is hard to estimate because of the way NFTs are structured. In essence, every piece is its own individual market. Still, an annual report by NonFungible.com, a blockchain gaming and crypto collectible database, estimated that the overall NFT market was worth more than $250 million last year (up 299% from 2019), even before the recent surge in interest.

What’s clear is that people are willing to pay big money for NFTs. One collector who calls himself a “digital asset investor” recently resold a digital artwork of Joe Biden and Donald Trump nude for $6.6 million. Meanwhile, the iconic Nyan Cat GIF and a video of LeBron James separately fetched hundreds of thousands of dollars. Grimes sold $6 million worth of digital art in late February, and one picture of Lohan’s face went for $17,000. Another fetched about $44,000.

Much like a prime Picasso, it’s the scarcity of NFTs that allows them to command such high prices. Unlike regular content that can be endlessly copied and replicated online, the blockchain tech behind NFTs allows unique signatures confirming authenticity as well as proof of ownership to be assigned to digital artworks, making each collectible one of a kind.

“There wasn’t a way to own things or know that you owned them online before this,” said Matt Hall, the co-founder of CryptoPunks, one of the earliest crypto art blockchain projects that was created by Larva Labs in 2017. “The miracle of digital is that copying was perfect and free. This is reversing part of that — which is kind of weird.”

If you’re questioning whether this trend will catch on in the traditional art market, know that even establishment darling Christie’s is getting involved. It’s the first major auction house to offer NFTs and is accepting cryptocurrency as payment.

What’s the case for buying? If you think NFTs are the future. Ownership of digital art has proved a thorny issue since the advent of the internet. NFTs could potentially solve this by allowing for a secure way to store digital assets and prove ownership. Meaning you also won’t need to keep your new artwork in the family safe.

And some say we could be seeing the future of blockchain technology at work. “NFTs are a big statement on the longevity of blockchain technology, cryptocurrencies, and the monetization of content creation,” Douglas Boneparth, president of Bone Fide Wealth, a New York-based financial advisory firm, said.

The rock band Kings of Leon is releasing its latest album as a non-fungible token. Proponents of NFTs say that they even have the potential to expand to other areas like property, and that maybe one day anything could be tokenized.

If you think they democratize access to owning art. Investing in art has traditionally been the reserve of the upper-classes who can afford to invest in something that is likely to lose value. Crypto art could provide a way for those with less capital to invest in works.

Practically speaking, those who may want to invest in art, but have nowhere to put it up, could be interested in NFTs as an alternative. “You don’t have to think about where to put it when you want to buy it,” said John Crain, the chief executive officer of SuperRare, an online platform for the creation and collection of crypto art. “It’s expanding the market.”

If you think NFTs are less risky than buying traditional art. Investing in art can be inherently risky — how do you know it’s legit? Some think that investing in crypto art and NFTs may prove to be less so.

“Investing in an NFT, if you believe in the value, is in a way not very risky. You know that it’s an authentic piece, you know who made it, you know whether it’s an edition or not,” said Nanne Dekking, former Sotheby’s vice chairman and founder of Artory, a registry that records artworks on blockchain technology. “All the questions that you as a buyer of art will have to ask yourself when you buy traditional art are already part of the art work that you will be buying.”

If you’re interested in buying fractionally. Fractionalizing is an increasingly popular way to buy art in recent years, as it allows owners to buy shares in the same piece. The same argument for NFTs being less risky also applies to why it could be ideal for tokenization. Through blockchain technology, fractionalization can actually be part of the digital artwork itself.

“The reason why NFTs are so easy is because all the information is correct. If you start to fractionalize or tokenize an artwork — let’s say a Monet — it’s hard to know for sure you’re actually investing in the right Monet,” Dekking said.

…and what are the reasons to steer clear?If you think NFTs are mostly hype. There’s been a huge amount of noise around NFTs in the last few weeks. Naysayers argue that this could all just be hype, pushing prices up and inevitably ending in a crash. Data provided to Bloomberg by CryptoPunks showed that a large portion of the total value of its transactions came over the last four weeks.

CryptoPunks NFTs

Courtesy: Matt Hall and John Watkinson

Since 2017, CryptoPunks works have made about $95 million — of which around $81 million was in the past month.

“It may be a bubble, we don’t know. There’s been all kinds of art streams and art movements that in the end turned out to be, at least financially speaking, stuck in a bubble,” Dekking said.

If you don't understand them. It probably goes without saying that you shouldn’t invest in something you don’t understand. The main argument against crypto art and NFTs is that there’s simply no point to them. Critics ask why you can’t just make do with a screenshot or a print-out of a piece of digital art. Some just don’t see the value in being able to prove uniqueness and ownership of something inside a computer.

“You have to be very careful unless you’re fully au fait with how blockchain and crypto tokens work. It has to be considered a specialist investment,” said Andrew Shirley, who created and compiles the Knight Frank Luxury Investment Index, which tracks the value of 10 asset classes including classic cars, art and wine.

If you believe that passion investments have to be tangible. When investing in art, the expert consensus is that you should always invest in something that you actually like looking at. With crypto art, yes you can carry it around on your phone or laptop, but you can’t hang it up in your living room or impress guests with it.

Shirley urges caution on calling crypto art a passion investment in the way traditional art fits this category. For luxury investments, he says it’s better to focus on the practical aspect of things.

“If you’re investing in art, buy art that you’re passionate about and enjoy looking at. Buy a car that you’re going to enjoy driving, buy jewelry that you’ll like to wear,” Shirley said.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |