| | | Samsung and TSMC Seeking to Spend Their Way to Worldwide Domination of Advanced IC Technology

SHANNON DAVIS

1 DAY AGO

0218 VIEWS

IC Insights recently released its March Update to the 2021 edition of The McClean Report. In addition to presenting its 2021 IC market forecast revisions by product type and rankings of the top 40 IDM and top 50 fabless IC suppliers in 2020, the Update contains semiconductor industry capital spending forecasts by company for 2021 and the latest global forecast for spending through 2025.

Keeping up with producing leading-edge IC technology has become increasingly expensive over the past 25 years. The investment required to implement the most advanced process technologies for logic devices has now driven out all but three companies—Samsung, TSMC, and Intel—from the leading edge portion of the market. Moreover, of these three manufacturers, only two can truly be considered to be at the leading edge (Samsung and TSMC), with both in volume production of 7nm and 5nm ICs. In contrast, Intel is not expected to be in high volume production of 7nm devices, in its own fabrication facilities, until 2022, at which time Samsung and TSMC are forecast to be producing commercial quantities of ICs using 3nm process technologies.

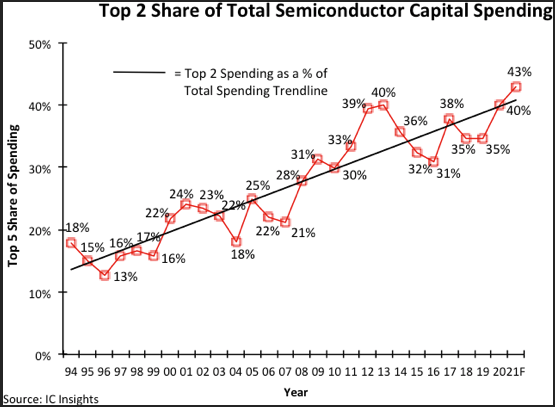

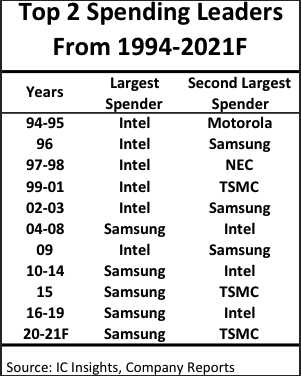

Historically, the IC companies that had the highest level of capital expenditures were also the companies that were able to produce the most advanced devices. Although Intel has been among the top two leading semiconductor industry capital spenders for 25 out of the past 27 years (Figure 1), the company spent only about half of what Samsung spent in 2020 and is expected to once again fall far short of what both Samsung and TSMC are expected to spend this year (about $28 billion each).

Samsung first spent more than $10.0 billion in semiconductor capex in 2010. After spending $11.3 billion in semiconductor capex in 2016, Samsung’s 2017 outlays for the semiconductor group more than doubled to $24.2 billion.

Samsung’s semiconductor capital spending has remained very strong since 2017 with outlays reaching $21.6 billion in 2018, $19.3 billion in 2019, and a massive $28.1 billion last year. The sheer magnitude of Samsung’s spending over the 2017-2020 timeperiod ($93.2 billion) is unprecedented in the history of the semiconductor industry! At $93.2 billion, this amount was more than double the $44.7 billion spent by all the indigenous China semiconductor suppliers combined over this same timeframe. Although Samsung has not provided guidance for its 2021 outlays, IC Insights estimates that the company will keep its spending essentially flat with 2020.

Figure 1

TSMC is the only pure-play foundry to offer leading-edge technology. It is seeing very strong demand for its 7nm and 5nm processes, which represented 47% of the company’s sales in 2H20. Most of its current investment is targeting additional capacity for its 7nm and 5nm technologies. Illustrating how quickly TSMC moved to more advanced processes, the company’s 5nm products represented 8% of its total 2020 sales ($3.5 billion), after essentially having no 5nm revenue in the first half of last year.

On January 14, 2021, TSMC dropped its “bombshell” news that it plans to ramp up its capital spending this year to $25-$28 billion, a 60% increase using IC Insights’ expectation for $27.5 billion in outlays by the company. At $27.5 billion, the company’s average quarterly capital spending rate this year would be $6.9 billion, more than double what the company spent in 4Q20.

It now appears that both Samsung and TSMC realize the golden opportunity that is currently before them. While Samsung began its spending surge in 2017, TSMC will begin what is likely to be a huge multi-year ramp of spending in 2021. Combined, IC Insights expects Samsung and TSMC’s capital expenditures will reach at least $55.5 billion this year and represent an all-time high percentage of total semiconductor industry outlays held by the top two spenders (Figure 2). With no other companies presently able to match these huge spending sums, Samsung and TSMC will likely put even more distance between themselves and their competition this year with regard to advanced IC manufacturing technology.

Figure 2

Can governments like the EU, U.S., and China invest in their indigenous IC industries and catch up in the IC technology race with Samsung and TSMC? Considering how far behind they are, IC Insights believes that governments would need to spend at least $30 billion per year for a minimum of five years to have any reasonable chance of success. Is there the willingness and/or ability to follow through on such a commitment? Moreover, for China, even if the money were available, they would certainly be hindered by trade issues prohibiting some of the most critical pieces of process equipment from being sold into the country.

Without extremely quick and decisive action by other IC producers or governments, Samsung and TSMC are well on their way to world domination of leading edge IC process technology, the cornerstone of all of the advanced consumer, business, and military electronic systems of the future.

P.S.

With Gelsinger in charge, I would never count out Intel

My WAG?

Cymer/HMI/Zeiss/ASML perfect EUV so well it becomes plug n play.

Litho-as-a-Service.

ASML |

|