Re <<Gold>> and by implication, silver, platinum, and palladium, as well as BTC, i do not care a great deal what the physical pricing is until final (exam) redemption day.

In the meantime I just like it better that they move, up or down, a lot, and admit that up is easier to play than down, but down can be played well as well.

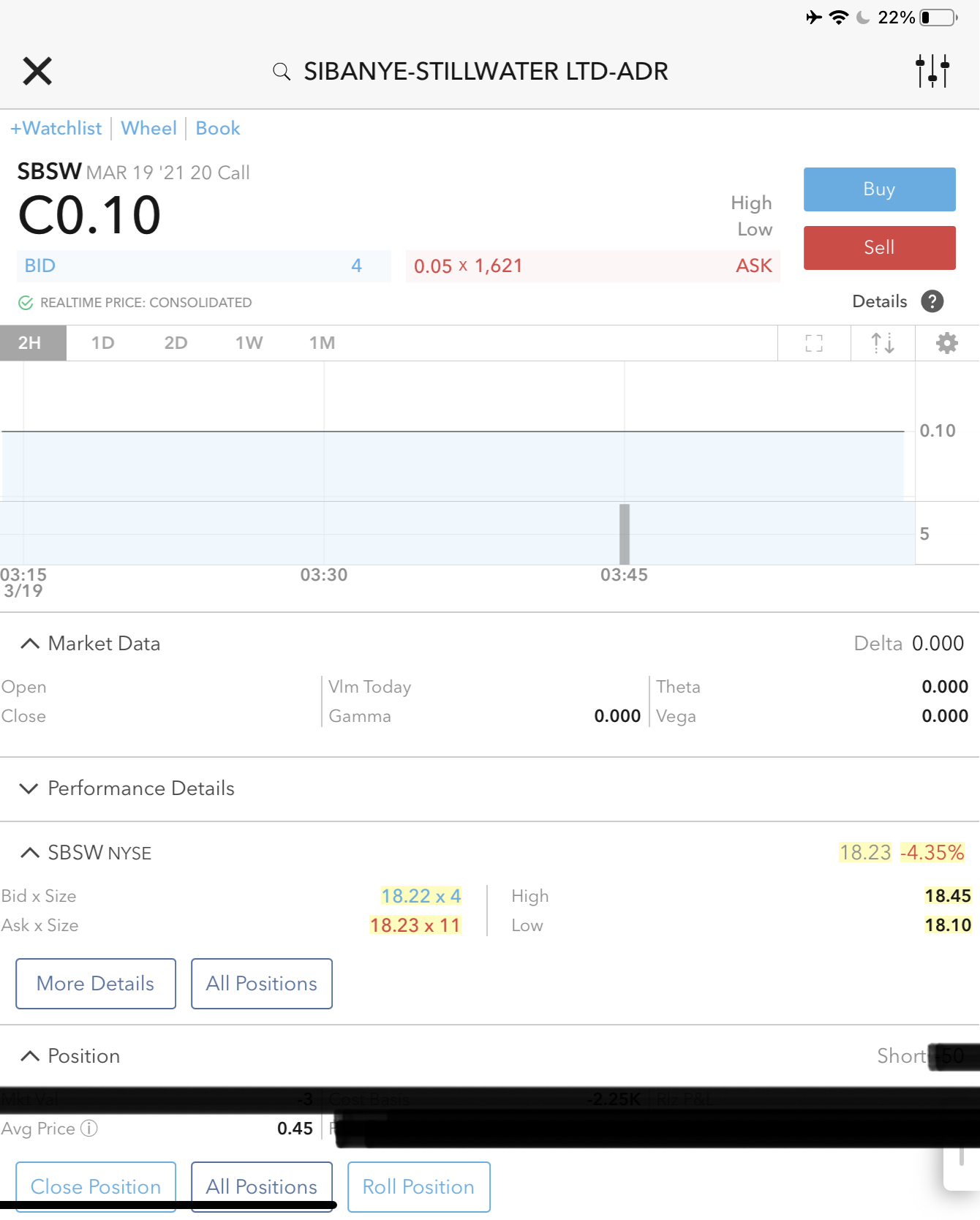

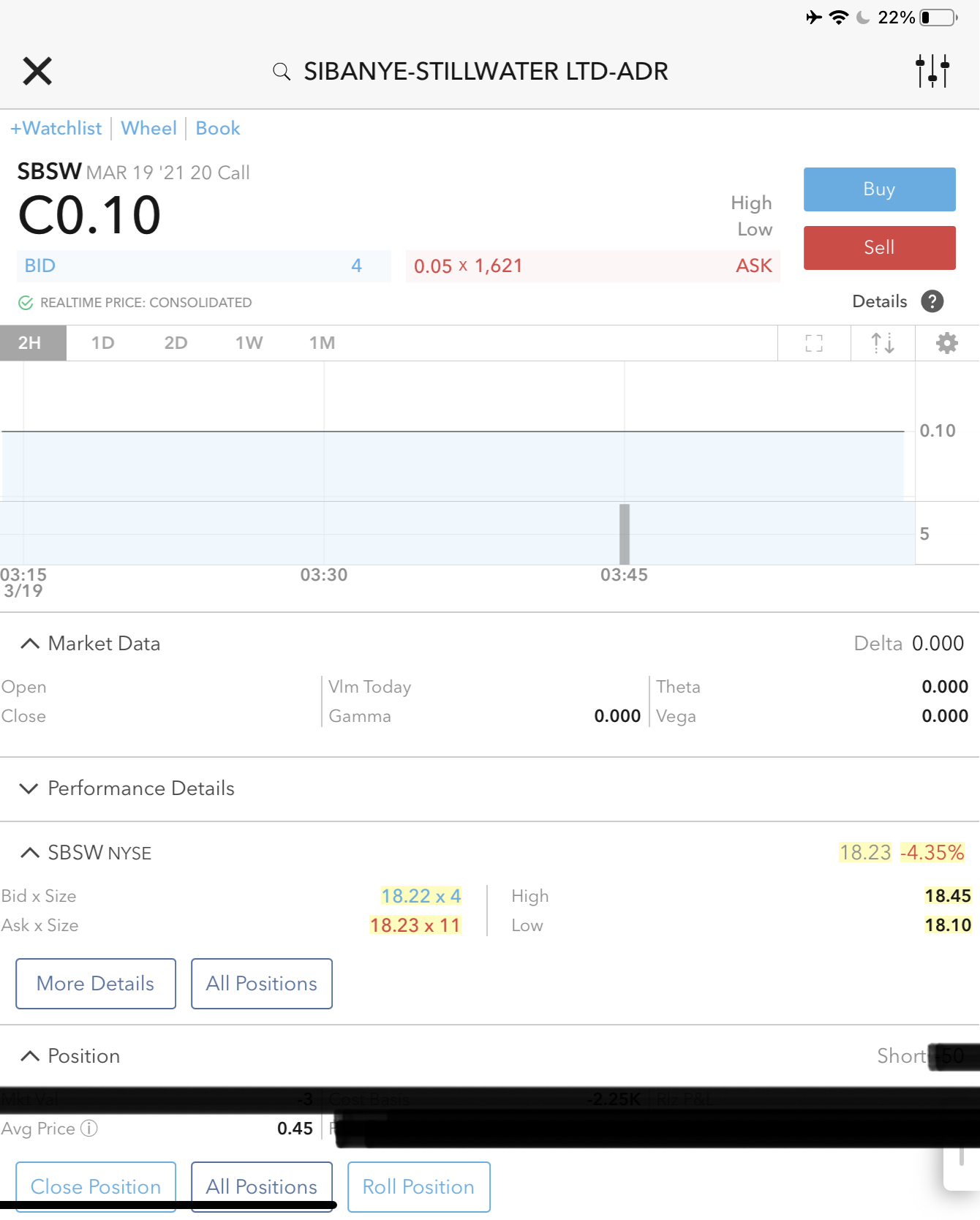

Right now, today, i no longer have to concern myself w/ SBSW as long as it does not breach 20 even though I own a lot of SBSW equity. I ledger the recent dividend, book today’s premium profit, and look forward same profit again next month as the time-decay takes hold and does wet work.

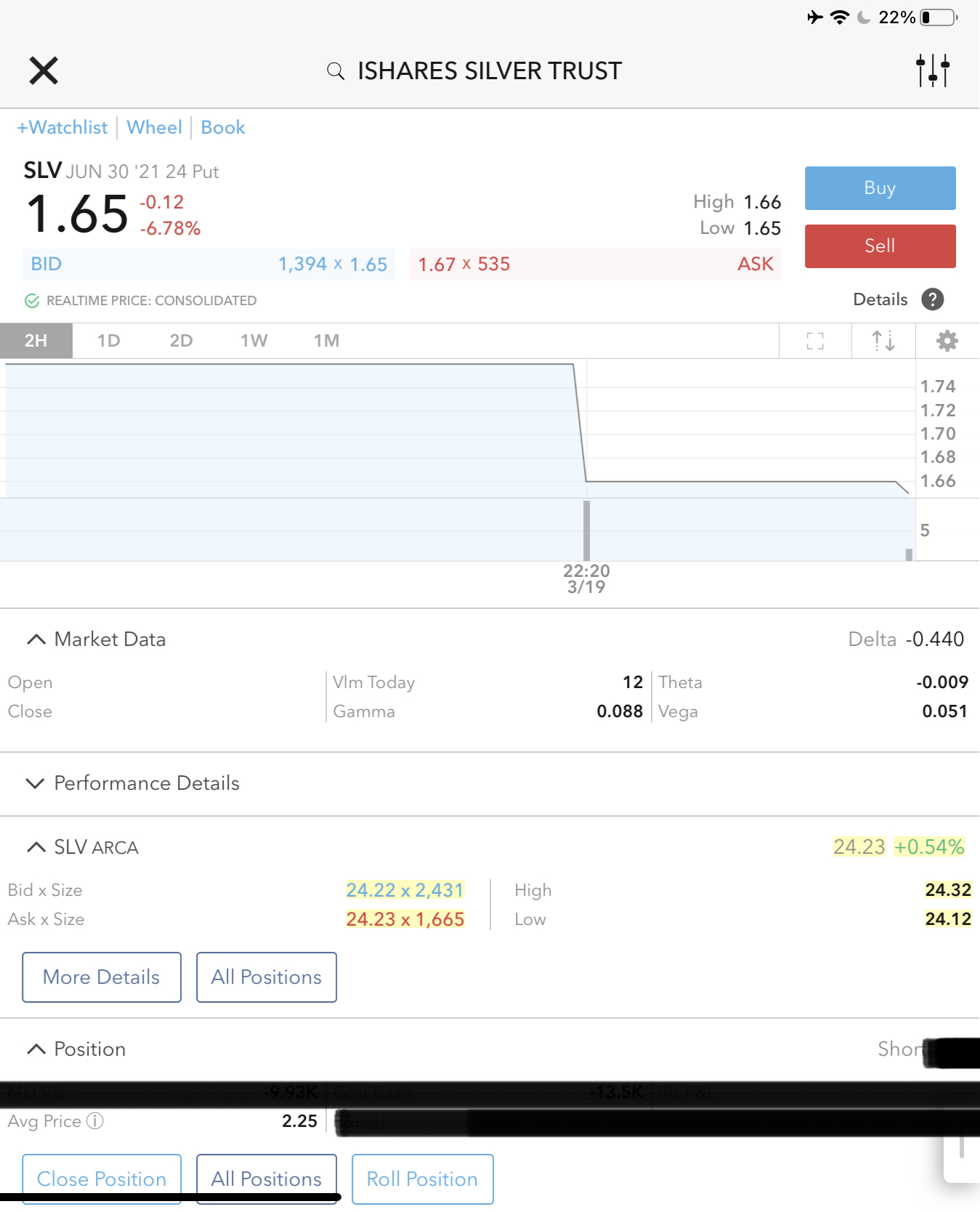

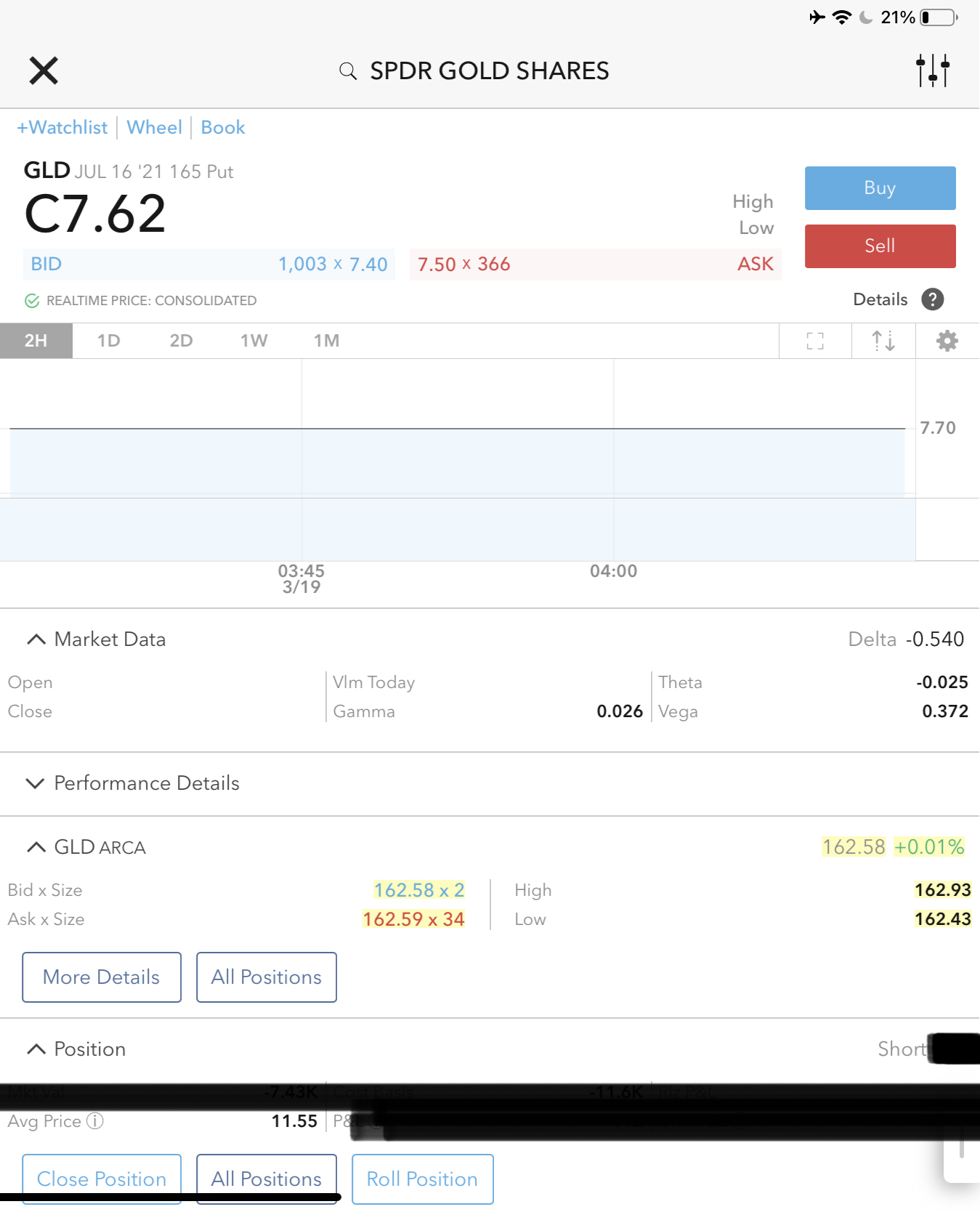

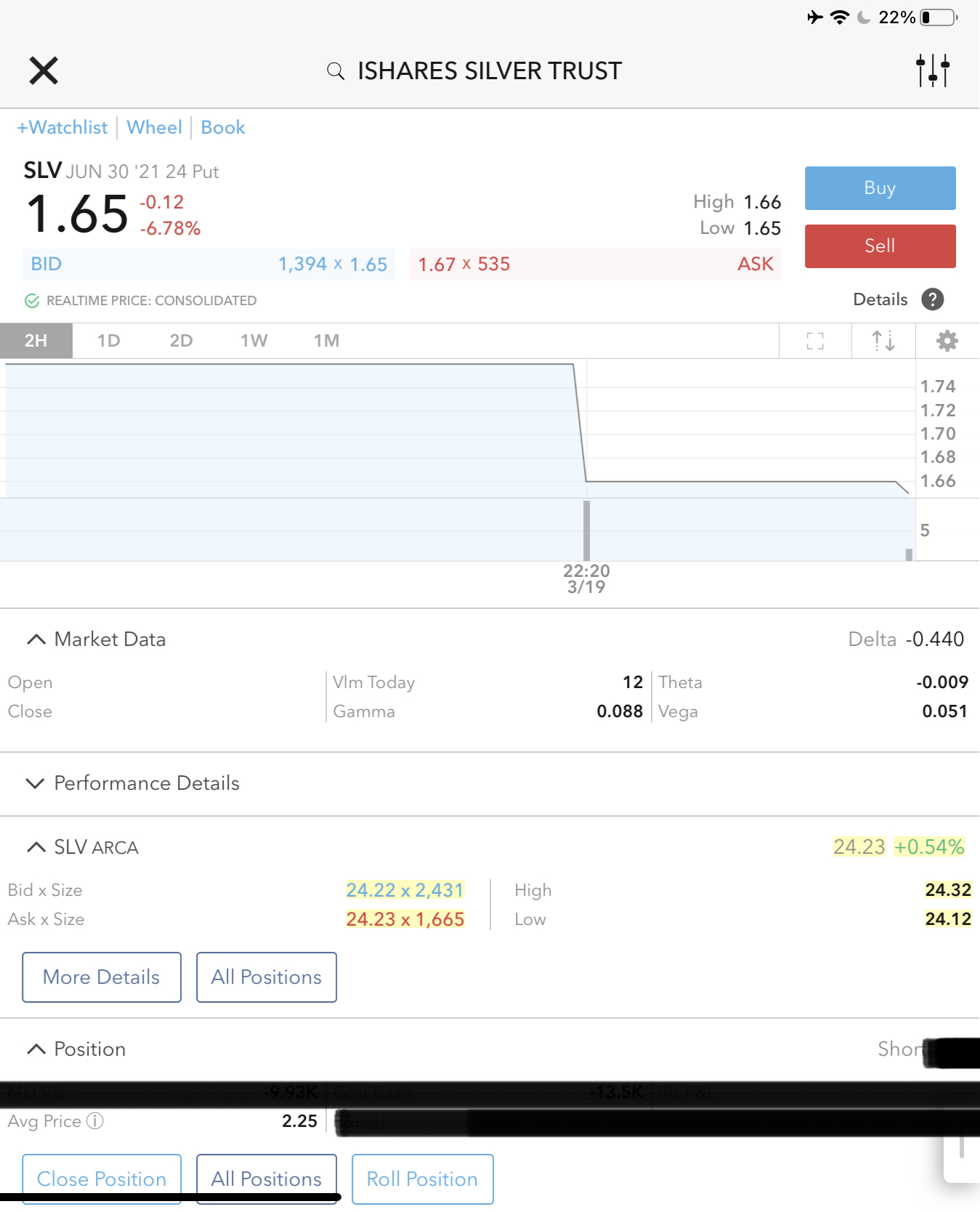

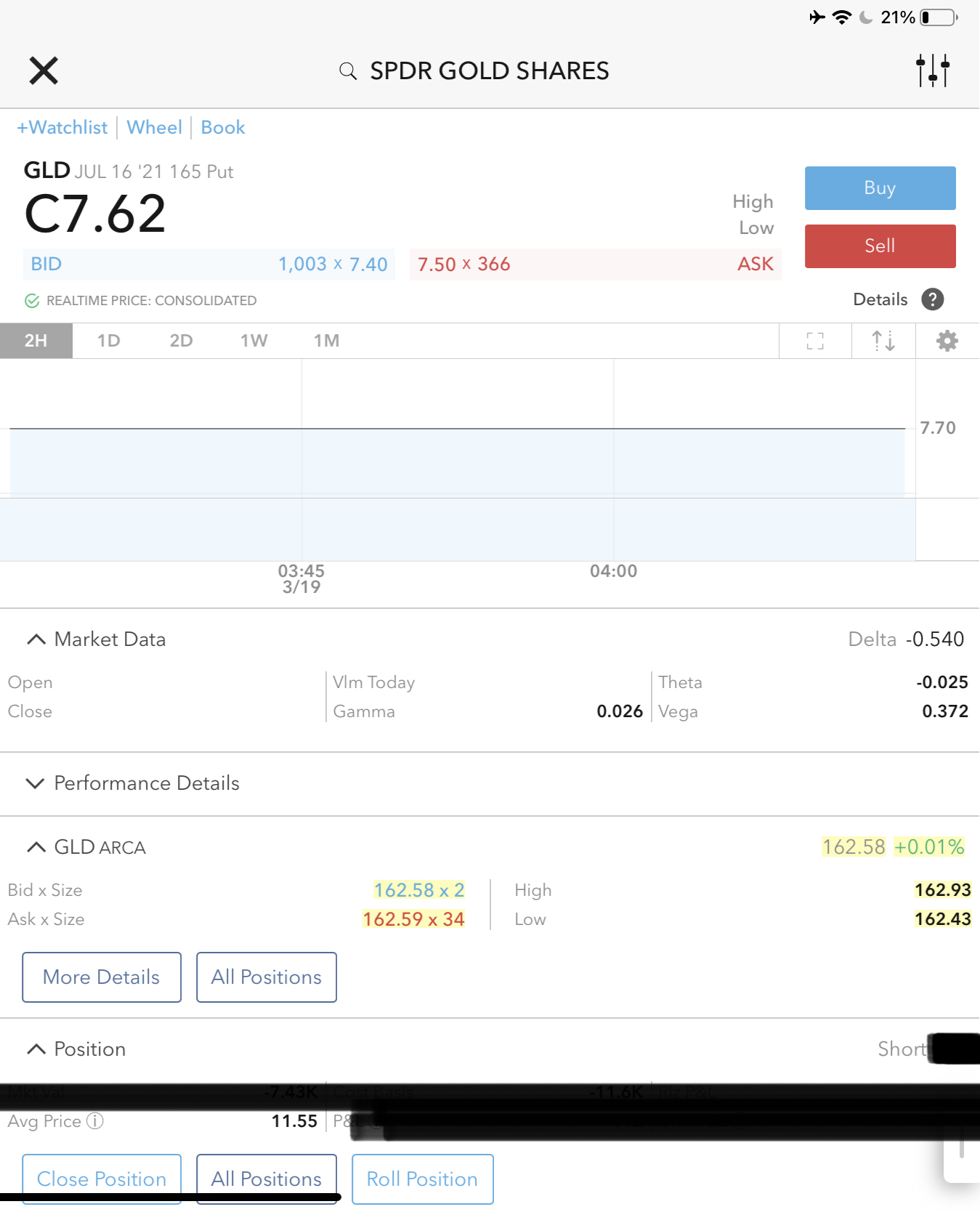

Am also assessing what if anything to do about GLD and SLV positions, like take profit or wait, on the derivatives. I do not have either equities and am only positioned in derivatives. The profit goes to play another day or taken into physical cold storage wallet.

The thought that gold can go to 300 sounds exciting even though might be too good to ever come true. Should it happen, buy, I am guessing. Yes, all possible, since paper oil can go to negative when it transforms into physical, so i guess paper gold can go to 300, then zero, on the day ‘they’ outlaw ownership of ‘make-belief gold’ and true gold. I wonder what the physical would be at on that exciting day. Maybe the day ‘they’ outlaw BTC ownership would provide us a preview.

|