"clear signals signed in blood"

Find it amusing that the explanation for the "face ripping" market moves... that occur without perturbing volatility as measured by the VIX hardly at all... all blamed on shorts covering... because of the record pace at which shorts all pile in... and then stampede back out again... all presented with a straight face right after they pointed out that short interest is at a twenty year low... and the last time short interest was this low was when:

"... a decline in interest rates increased the availability of capital. [8] The Taxpayer Relief Act of 1997, which lowered the top marginal capital gains tax in the United States, also made people more willing to make more speculative investments. [9] Alan Greenspan, then- Chair of the Federal Reserve, allegedly fueled investments in the stock market by putting a positive spin on stock valuations. [10] As a result of these factors, many investors were eager to invest, at any valuation..."

That was the Dot-com bubble of course, followed by:

"On April 3, 2000... Bloomberg News published a widely read article that stated: "It's time, at last, to pay attention to the numbers". [41] On Friday, April 14, 2000, the Nasdaq Composite index fell 9%, ending a week in which it fell 25%. Investors were forced to sell stocks ahead of Tax Day, the due date to pay taxes on gains realized in the previous year. [42] At its trough on October 9, 2002, the NASDAQ-100 had dropped to 1,114, down 78% from its peak. [51] [52]"

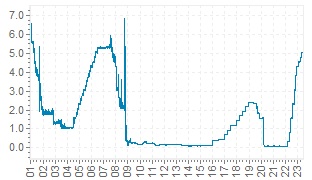

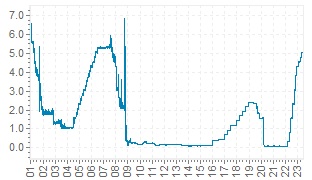

Today, markets are NOT in a panic because rates are rising again... but keep making new highs anyway... while the comparable LIBOR rates are 0.3% and less now... vs 5% to 6% then... that leaving no room for differential monetary policy to work by lowering rates again. Taxes are still low, but major tax hikes are being threatened... even though we're "just now coming out of" the worst depression we've had since 1929 because of a not yet resolved pandemic... while in spite of that reality, for no apparent reason, stock prices sustain higher valuations now, after the crash of 2020, than they did before the crash of 1929... and banks would still rather gamble in stocks going higher than lend money to businesses for nothing but risk in return... Low taxes don't fuel stock buying when no one is making money... so, maybe just give people free money instead ?

That narrowly focused bubble in 2000, versus the "everything bubble" we have now... was fueled by interest rates that plunged below 6% all the way down to 5% in 1996... but also by rules changes that enabled banks to cross the barrier erected between banking and trading that used to exist... for good reason. And, in result as a chart of interest rates show... the market has never really recovered from the dot.com bubble... or the subsequent banking frauds exposed and not corrected in 2008... also as prior attempts to restore normal interest rate functions brought the markets down again in 2007-2008 and 2019-2020.

But, of course... things are different this time...

|