Elon is soooooo funny, as in humorous - BTC for Tesla car :0)

Wait till he and Michael Saylor of MicroStrategy (MSTR) figure out that they can buy each other's shares by borrowing on their respective BTCs

bloomberg.com

Tesla’s Bitcoin Adventure Promises an Even Wilder Ride

Adding more digital currency to the automaker’s balance sheet is enough to give an equity analyst nightmares.

Mark Gilbert

25 March 2021, 14:00 GMT+8

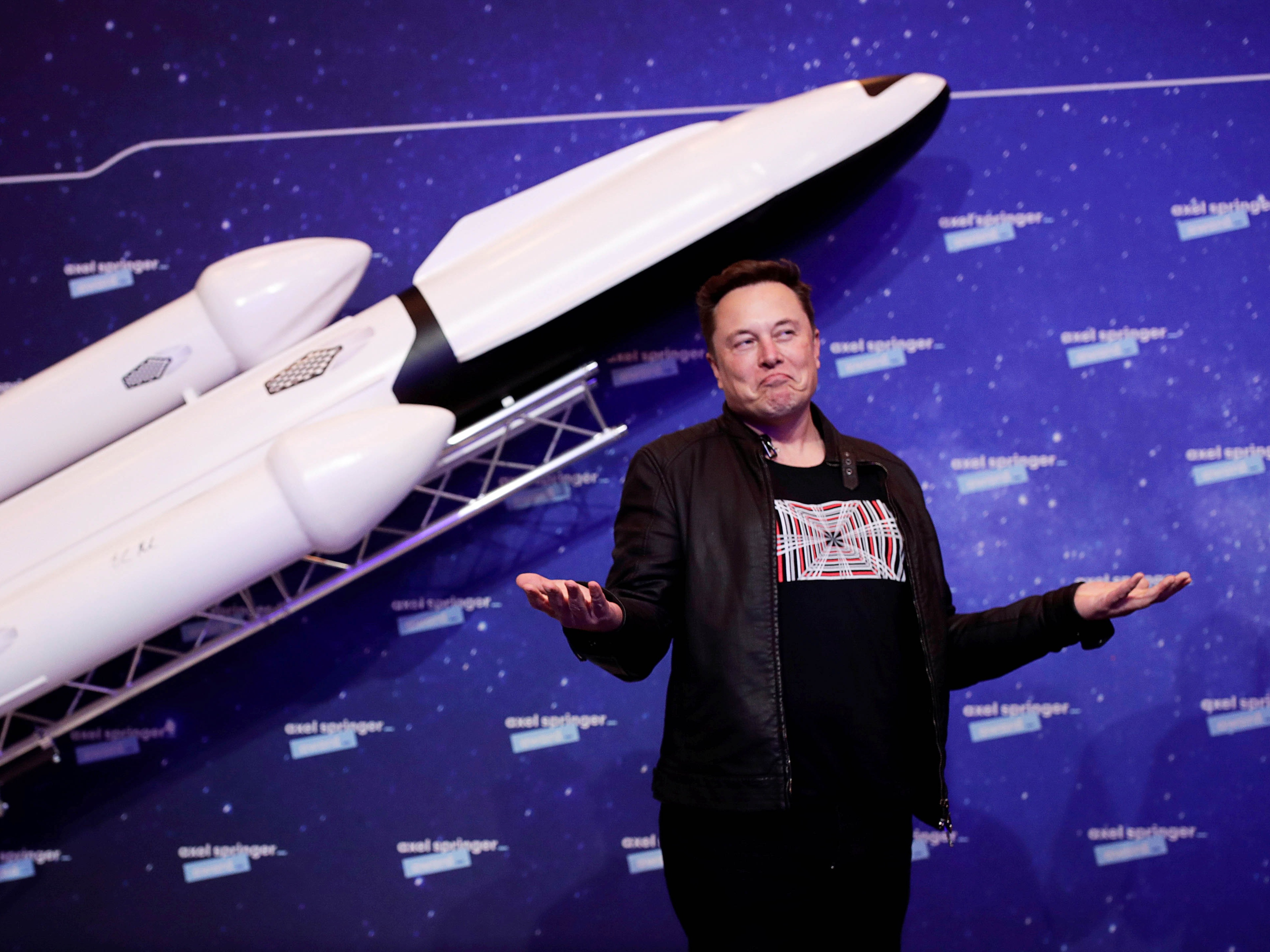

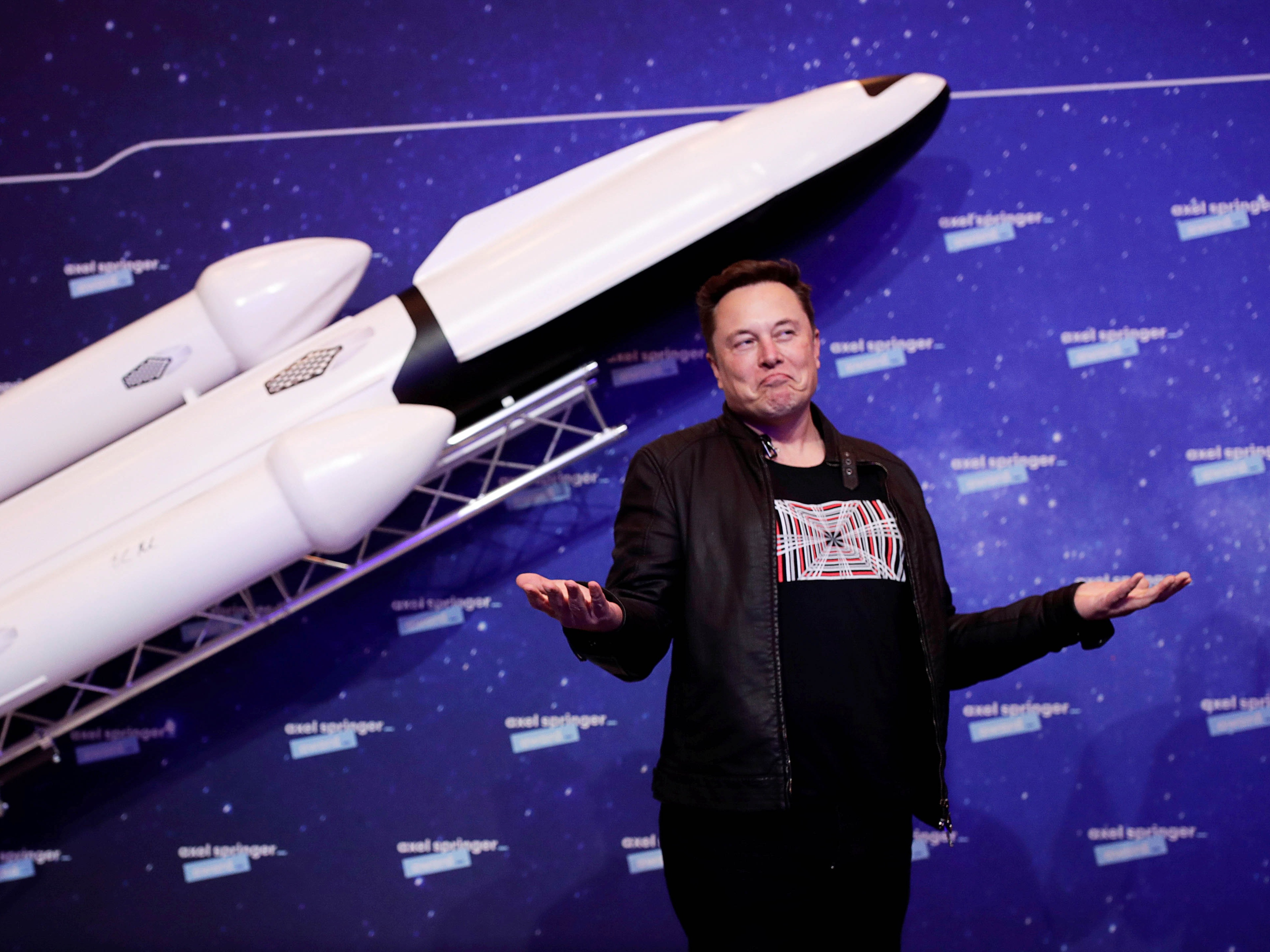

Aren’t we going to the moon?

Photographer: Hannibal Hanschke-Pool/Getty Images

Elon Musk, the Technoking of Tesla Inc., says the electric vehicle maker will now accept payment in Bitcoin for its cars. Adding more of the capricious cryptocurrency to the balance sheet of one of the world’s fastest growing companies by market capitalization could prove explosive.

Bitcoin has doubled in value this year, after more than trebling in 2020, and reached a record of almost $62,000 earlier this month. But its journey has been far from a one-way ride. With Tesla’s 12-month price target estimate already producing an almost 800% divergence between the most bullish and bearish forecasts, increasing the company’s exposure to digital currencies will make valuing the company even harder for analysts and investors alike.

Source: Bloomberg

A few weeks ago, I suggested that adding Bitcoin into a traditional portfolio that allocated 60% to stocks and 40% to government bonds could be one way of defending against a decline in equities at a time when the fixed income side was at risk of failing to protect returns. I noted that this was likely to increase the volatility of an investment portfolio, but I hadn’t appreciated by how much.

Joseph Albert, a retired computer scientist in Oregon who spent part of his career working in financial services, wrote to me pointing out that “Bitcoin is so volatile that even a 5% allocation dominates portfolio volatility” — an argument he backed up by using the website portfoliovisualizer.com to test what just a small allocation would do to both returns and volatility.

Adding the cryptocurrency certainly generates more profit. But volatility, as measured by the standard deviation from the mean, also surges, even with just a 5% allocation. And that’s true whether the allotment is taken from either the equity or the bond division. Double-digit volatility makes the tweaked portfolio much more risky.

Increasingly, Wall Street is being forced to take digital currencies more seriously, albeit with a healthy dose of skepticism. A report by Bank of America Corp. last week concluded that there was “no good reason” to own Bitcoin other than to speculate on a further gain in prices, with the virtual currency deemed “impractical as a store of wealth or payments mechanism.”

Tesla’s new payment method was announced in a tweet by Musk, and it’s far from clear how Tesla plans to deal with Bitcoin’s volatility or how many customers are likely to use it. At current values, you could buy a top-of-the-range Model X SUV Plaid for about two Bitcoins; at the start of the year, the same car would have cost about four Bitcoins based on its dollar sticker price.

Moreover, Musk says Tesla will keep any customer crypto payments in the digital realm, rather than converting them into dollars, adding to the $1.5 billion it invested in Bitcoin in February. Valuing Tesla has always been as much of an art as a science; adding more Bitcoin to the company’s balance sheet is the stuff of equity analysts’ nightmares.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Mark Gilbert at magilbert@bloomberg.net

To contact the editor responsible for this story:

Nicole Torres at ntorres51@bloomberg.net

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |