Re <<It's going to be so much fun when bitcoin goes to zero.>>

Will today be the day? Doubtful.

What is less doubtful is that you and I both have been diluted in favour of the fellows and fellowettes who had invested their Uncle Sam-issued stimie checks in Dogecoins

Trust you still remember how you got diluted to this point, and am guessing the process shall accelerate going forward.

I attached some comments as they might be behind paywall

zerohedge.com

“It’s Totally Insane. Someone Made A Million On Dogecoin With His Stimulus Check

"By Eric Peters, CIO of One River Asset Management

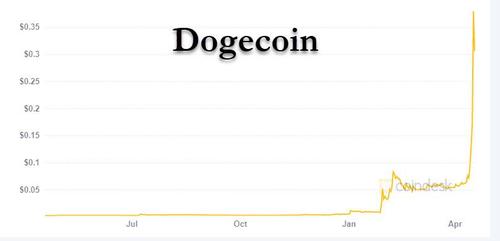

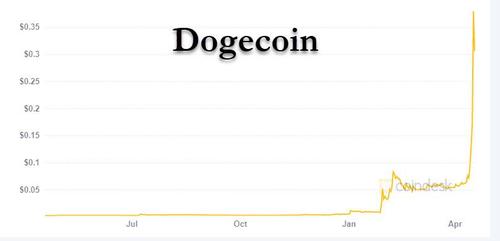

“What happened with Dogecoin Dad?” asked Jackson on FaceTime. I smiled. Dogecoin jumped from $0.06 to $0.47 - a 7.8x weekly jump to a $60bln+ market cap.

[url=] [/url] [/url]

“It’s totally insane,” he said Friday night, back from lacrosse practice, sitting down to study, life as a plebe. “Are your buddies trading crypto now?” I asked.

“One supposedly made a million on Dogecoin with his stimulus check,” said Jackson, eyes wide.

“Not possible Jax, at today’s panic high it was up just 77x this year, and you guys only got $1,400 checks,” I said.

“He bought it with last year’s stimulus,” explained Jackson.

“Still doesn’t add up. Dogecoin is only up 165x since the beginning of 2020,” I said, shrugging, the meaning of money quietly slipping away.

* * *

Those things that make the least sense are where you discover opportunity, risk too. They are opposite sides of the same thing: Change.

So any truly interesting conversation explores things that boggle the mind. My favorite enigma in the physical world is quantum entanglement, which I’m convinced hints at something utterly extraordinary. But I leave that mystery to those a million times smarter, which frees my time to search for things that might make money. Sounds shallow. Empty. I know. Mara reminds me often. But the human mind is the universe’s greatest enigma and when you connect 8.5bln of them the possible futures are more uncertain than any particle being split at CERN. When put that way, exploring the profound uncertainty flowing from mass human psychology seems less meaningless.

That’s not to say things always appear uncertain. Most of the time, tomorrow looks indistinguishable from today. Which is to say, boring. During those periods, leveraged investment strategies that bet on recent correlations persisting well into the future tend to do well. So in recent years, when massive firms built upon such strategies struggled for reasons few could quite explain, it was a sign of change. Risk. Opportunity.

When equity factors started experiencing 10,000-year floods every other month, it was another sign.

Our political division in a pandemic, a sign. The horned Shaman in America’s capitol. GameStop. Signs. Study market history and you find that in periods of quantum change, those things that make the least sense but show mysterious momentum (both up and down) present the greatest opportunities.

Beeple sold an NFT for $69.3mm in March. Literally everyone saw it as a sign of a bubble. Perhaps everyone is right. But I’m more interested in exploring whether the accelerating emergence of soaring valuations in things that make little sense represents a historic change, a future that few can barely imagine, let alone grasp.

Particularly when such powerful incumbent industries and institutions so vocally resist. And Coinbase went public, briefly touching a $100bln valuation.

|

[/url]

[/url]