Gold: Everything Revolves Around

When I give presentations to “newbie” gold investors, I lead off with a simple question:

|

What is an ounce of gold worth today?

The answer: An ounce of gold.

|

I follow that up by noting that the dollar, on the other hand is currently worth about 1/1,750th of an ounce of gold.

See the difference? As the natural, immutable standard of value — the ultimate money — gold doesn’t fluctuate in value. Everything else fluctuates against it.

Like Copernicus’ discovery that the earth revolves around the sun, once you adopt this gold-centered view of the financial universe it changes everything.

It’s a lesson, frankly, that even many long-established gold investors need to learn. Because once you have a deep understanding that all values are relative, and relative to gold, you no longer worry about the daily fluctuations in the “price” of the yellow metal.

Instead, you see the prices of everything else fluctuating.

|

Your Window Into A Gold-Centric Model

|

It’s actually quite revealing, and even liberating, to look at the world through the lens of gold — because it’s an entirely new world.

A wonderfully illuminating website is PricedInGold.com, which shows historic charts of dozens of different assets and items priced, as the name implies, in gold.

For example, we know that the U.S. stock market has been soaring for years, as the Fed has adopted extraordinarily accommodative monetary policies.

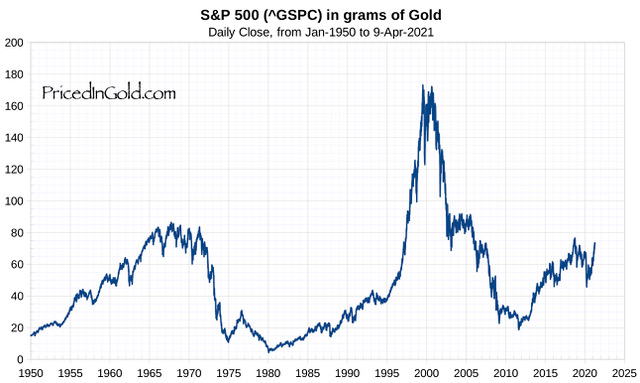

But the following chart of the S&P 500 from PricedInGold.com tells a very different story.

| | |

As you can see, when measured against the golden standard, the U.S. stock market is now lower than it was in the 1960s! Despite the headlines, it hasn’t gone anywhere for decades.

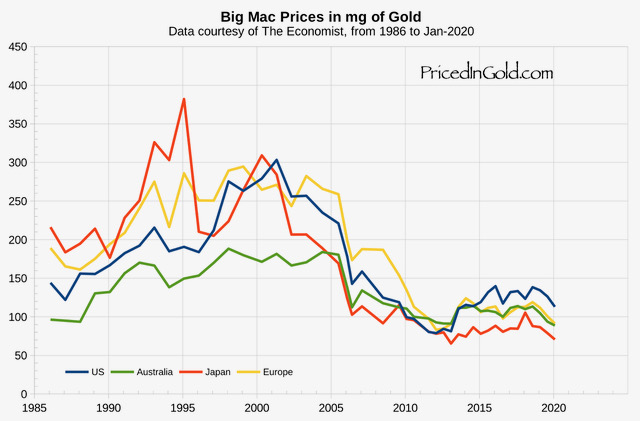

The same effect can be observed in dozens upon dozens of other prices. Check out the ubiquitous “Big Mac” gauge of price inflation when measured in gold:

| | |

Contrary to popular belief, the price of a Big Mac has been steadily decreasing around the world — if you measure its price in gold.

As you know, I stress to every investor, and especially investors just getting started in precious metals, that they need to own physical gold and silver as wealth insurance.

The big difference between this kind of insurance and, say, home insurance, is that in the latter case you’re insuring against the possibility of a fire or other damage.

In contrast, with gold and silver you’re insuring against an inevitability — the ongoing and inevitable loss of purchasing power for the dollar and other fiat currencies.

A prime driver of this currency depreciation is the massive and ever-growing levels of sovereign debt. So let’s take a look at the U.S. federal debt as denominated in gold.

| | |

Here the story is a bit more complicated. Even priced in gold, the federal debt has been growing steeply for decades. But something happened in the early 1970s (I wonder what?)…and all of a sudden the steep growth in debt priced in gold stopped, and started falling.

|

Of course, what happened was that the price of gold in the U.S. was finally allowed to rise (thank you, Jim Blanchard!), and therefore gold was able to protect people from the effects of this gross government mismanagement of the public fisc.

|

After 1980, debt priced in gold began to rise before beginning another sustained descent around 2000.

Of course, that coincided with the great gold bull market of the 2000s, and the following 11 years provided an opportunity to build generational wealth in junior mining stocks.

Which brings us to today.

As you can now see, federal debt as denominated in gold has once again begun to fall, signaling what I believe is a new, secular bull market in the metals. And another opportunity to build fortunes in highly leveraged mining shares.

Now, this chart has not been updated past 2020, and the tremendous spending plans just enacted are blowing out the federal debt in terms of dollars. So this chart, if updated to today, may look a bit different given gold’s lackluster recent performance in dollars.

|

But that also tells me that gold has some catching up to do. And the recent price action indicates that it’s in the process of doing that right now.

|

In short, the gold-centric view of the financial world is telling you that now is the time to exchange dollars for gold.

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

|