'They' are trying to scare us with a different angle, which might provide a nice buying moment

(1) Folks may have to sell in their existing wallet(s) that have been compromised by trails left through transactions

(2) Set up multiple / pristine wallets on different exchanges

(3) Re-purchase BTCs and take into different / pristine wallets

(4) Take BTCs so freshly acquired into cold wallets, and hide the wallets

(5) Stop trading BTCs, and hold for the true long term

bloomberg.com

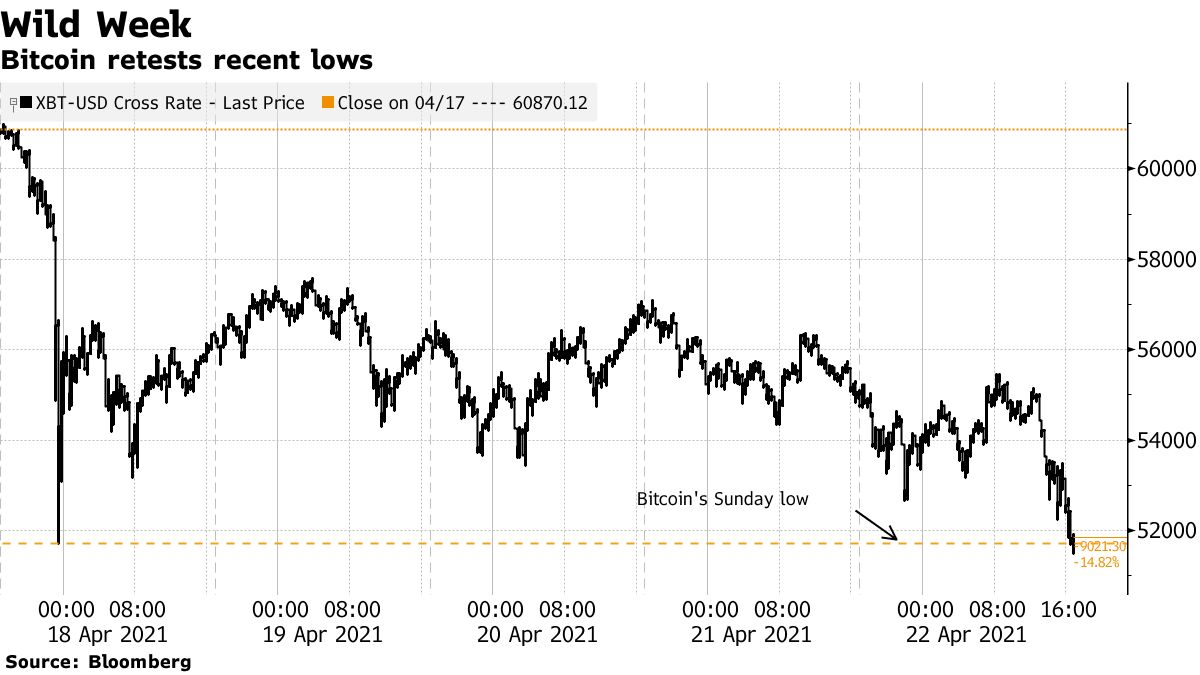

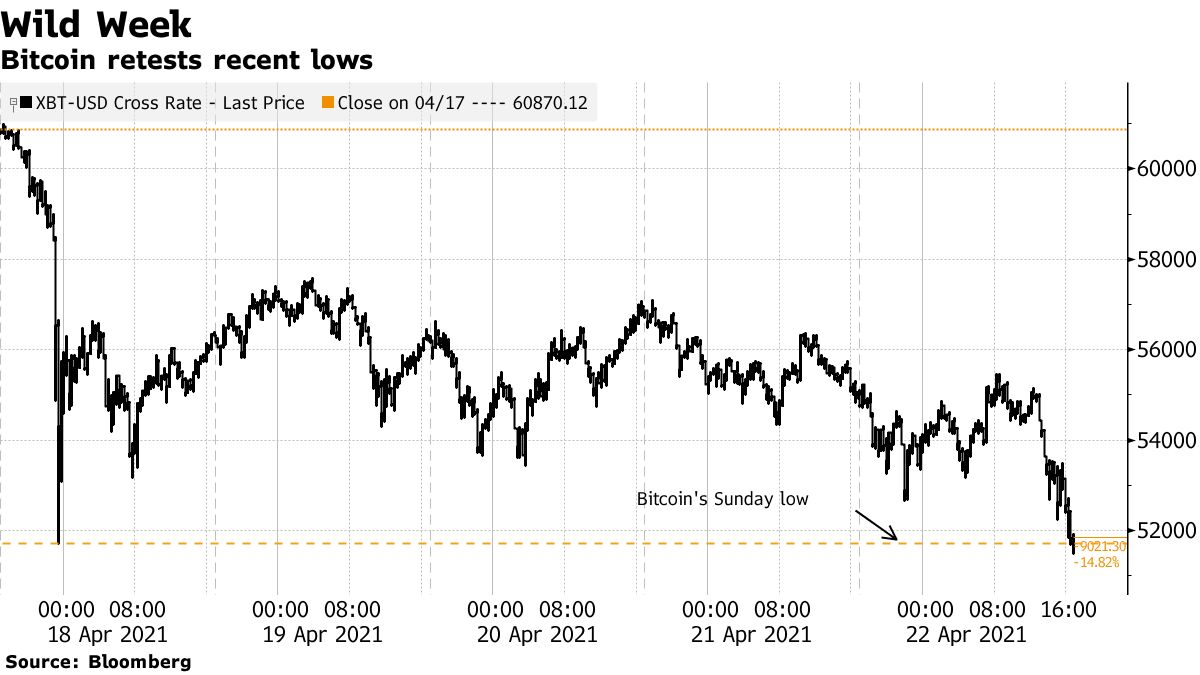

Bitcoin Retreats to Weekend’s Flash Crash Lows Amid Tax Anxiety

Vildana Hajric

23 April 2021, 05:34 GMT+8

Bitcoin declined for the sixth time in seven days, extending losses after President Joe Biden was said to propose almost doubling the capital-gains tax for the wealthy.

The slide pushed Bitcoin down as much as 8% to about $50,500, sending it below the low of $51,707 reached Sunday. The coin had tumbled as much as 15% over the weekend in the wake of a false report from an anonymous Twitter account that the U.S. Treasury was cracking down on crypto money laundering.

“One of the biggest things you have to worry about is that the things with the biggest gains are going to be most susceptible to selling,” said Matt Maley, chief market strategist for Miller Tabak + Co. “It doesn’t mean people will dump wholesale, dump 100% of their positions, but you have some people who have huge money in this and, therefore, a big jump in the capital gains tax, they’ll be leaving a lot of money on the table.”

Read more: Wall Street Starts to See Weakness Emerge in Bitcoin Charts

U.S. investors in the digital asset, which has advanced about 80% since December, already face a capital-gains tax if they sell the cryptocurrency after holding it for more than a year. But the coin’s been one of the best-performing assets in recent years -- anyone who bought a year ago is sitting on a 625% gain. For investors who bought in April 2019, that gain equals roughly 860%.

The IRS has stepped up enforcement of tax collection on crypto sales. The agency -- which began asking crypto users to disclose transactions on their 2019 individual tax returns -- asks taxpayers whether they “received, sold, sent, exchanged or otherwise acquired any financial interest in any digital currency.”

The nervousness among the crypto crowd can be seen in another rash of speculative tweets that popped up, just days after the earlier-debunked conjecture sent the market spiraling.

To be sure, Treasury Secretary Janet Yellen would very unlikely be taking the lead role for the administration when it comes to proposing policies, if that makes anyone feel better.

(Updates prices, adds quote and context)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |