Intermission is over, set down your drinks, and get back into the theater, the show to 115K by end-Summer (+/- a few weeks) is about to start themarketperiodical.com per Pantera stock & flow blog.panteracapital.com

Should the model work again, 500,000 almost a sure thing. And if not, a lot of scared people on both bull and bear sides, as we go into no-map terrain.

Funnnnnn.

bloomberg.com

Bitcoin Rises to Two-Week High After Breaking Technical Barrier

Vildana Hajric

May 1, 2021, 12:40 AM GMT+8

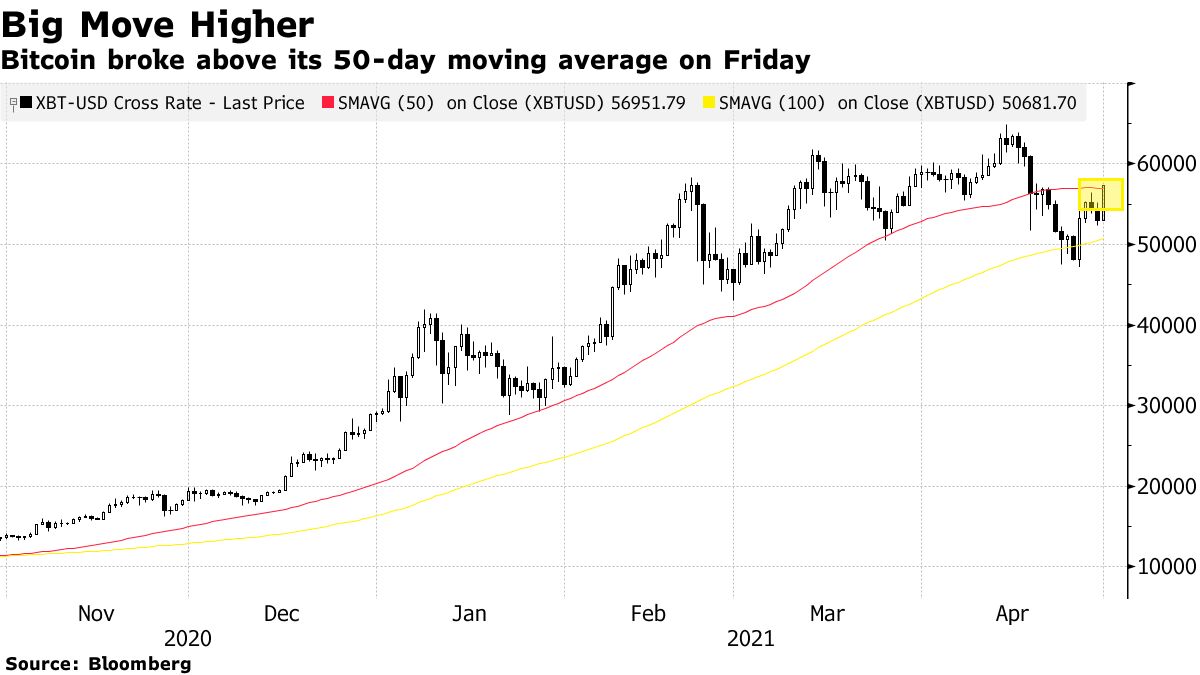

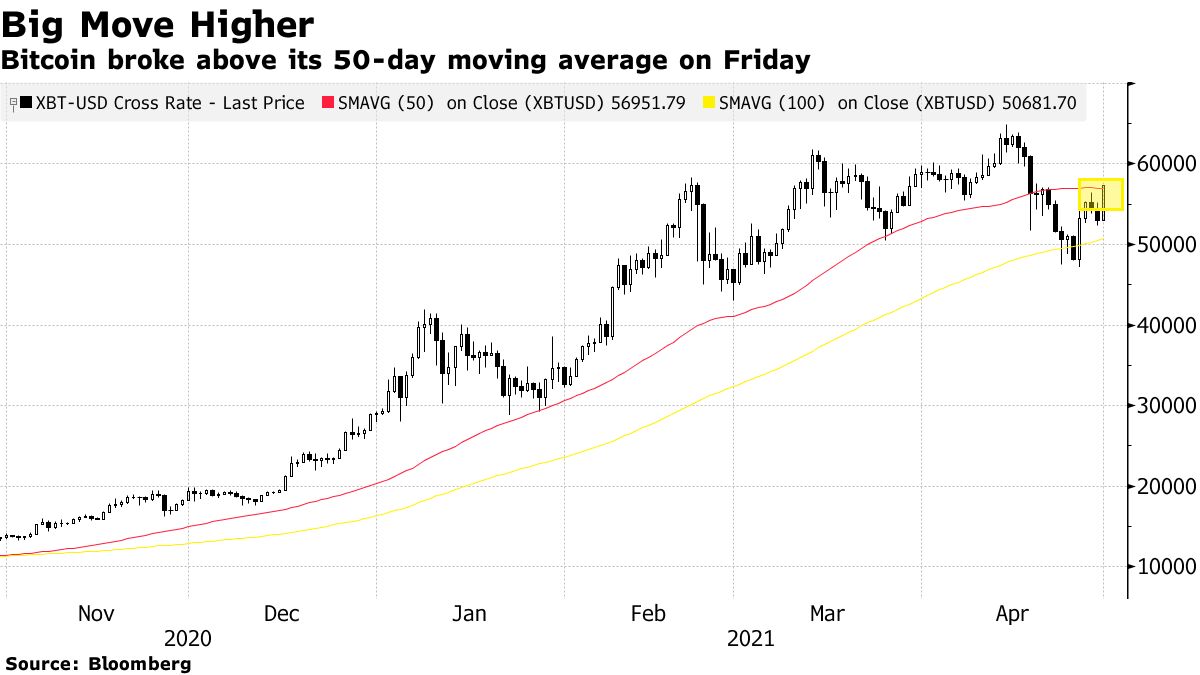

Bitcoin surged to its highest levels since mid-April after surpassing a closely-watched technical hurdle.

The digital token climbed above its average price over the past 50 days, a measure of its short-term momentum. For chart watchers, that had been an important level -- such a move usually portends further gains. Many analysts will now look to see if it can sustainably stay above it.

Earlier: Bitcoin Is at Technical Inflection Point Amid Recent Selloff

Trading in the world’s largest digital asset has been choppy in recent weeks after it hit a record high in mid-April above $64,000. It’s come down since then amid sessions that have clocked large intraday swings. On Friday, Bitcoin was up about 7.6% to $57,006 as of 12:29 p.m. in New York.

What's moving marketsStart your day with the 5 Things newsletter.

But despite recent turbulence, interest in cryptocurrencies has skyrocketed amid Bitcoin’s trek to all-time highs. A growing number of traditional Wall Street firms have warmed to it and it’s received endorsements from celebrities like Elon Musk. Assets in digital-asset products listed globally, including ETFs and ETPs, reached $9 billion at the end of the first quarter, a record high, according to ETFGI.

“If you make an investment today or you make an investment in early December, like we did, you have to expect multiple 20% to 30% pullbacks in the bull-market phase,” Troy Gayeski of Skybridge Capital said this week on Bloomberg TV. “But that being said, I mean, the combination of extraordinary supply growth, we still think we’re in the early innings of the adoption cycle.”

Mike McGlone of Bloomberg Intelligence agrees that adoption is in its early days and says Bitcoin appears to be the right fit for today’s rapidly changing digital world. He sees catalysts that could take it to $100,000.

“Diminishing supply juxtaposed with historically low interest rates and the substantial amount of money being pumped into the system is a solid foundation for Bitcoin price appreciation, if the rules of economics apply,” he wrote in a note.

— With assistance by Kenneth Sexton

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |