New Developments In Rail Transit Add To BYD Auto's Attraction

Apr. 19, 2021 9:05 AM ET BYD Company Limited (BYDDF) 70 Comments22 Likes

Summary

Recent company results show increasing profitability of BYD Auto and reflect its healthy balance sheet and profitability across its divisions.

2021 Developments in rail transit are exciting and may mean the substantial capex expended may start to see returns.

The time seems finally to have come for rail transit at BYD and its potential seems not to have been factored in by the market.

Some lack of clarity over the value of ongoing and potential monorail projects needs to be considered.

Pre-development agreement awarded in March for Sepulveda project in Los Angeles could be a massive game-changer for BYD.

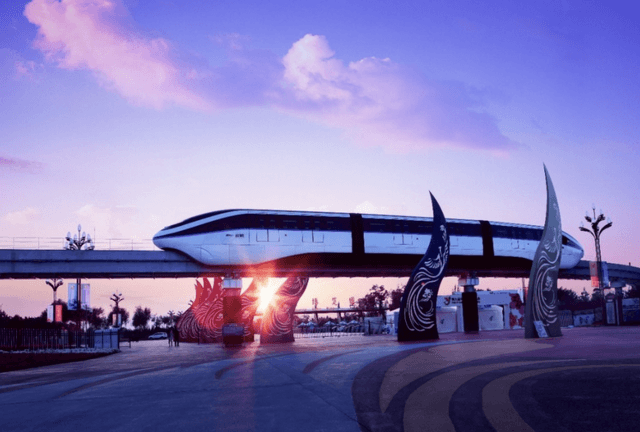

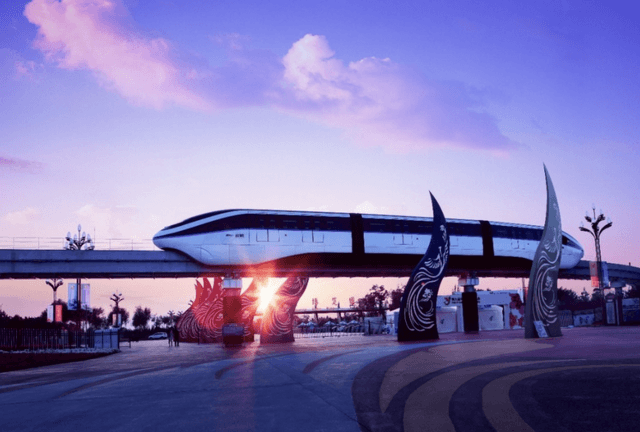

Photo by VCG/Getty Images News via Getty Images Photo by VCG/Getty Images News via Getty Images

BYD Auto (OTCPK: OTCPK:BYDDF) can be regarded as the world's most vertically integrated new energy transportation company. Media attention is mainly focused on its EV auto division. However, that is just one small part of the whole. The company is vertically integrated around:

* Battery manufacture which they are now starting to OEM.

* E-buses and e-trucks which I focused on in my article in February.

* Autos comprising both EV's and ICE vehicles.

* Solar panels.

* Energy storage.

* Semiconductors: this is key strategic advantage. It enables BYD to avoid the chip shortages being experienced by other auto companies. This was recently confirmed by the company. Again it shows the advantage of their vertical integration model. In addition, they are thought to be partnering with Huawei in that company's "Kirin" chips.

As my article in December last year detailed, they have a very wide international reach. This is accelerating quite rapidly.

The first 3 months of this year have shown developments in rail transit that could change the whole picture of the company's value offering. Their rail transit division has absorbed a lot of capex in recent years. It could though be the final piece in the jigsaw of a complete integrated new energy transportation entity.

Recent events have renewed the promise and potential of the division. The 2020 results released since my previous article are another new positive factor.

Results

The optimism about the ability to absorb any possible cost over-runs on rail transit is evidenced by the 2020 results. For full-year 2020 the company declared annual revenue up by 22.5% to 156 billion yuan ($23.8 billion). Net profit attributable to shareholders was up 162% to 4.23 billion yuan ($645 million). The net profit figure would have been a lot higher if not for one-off non-recurring items. The company declared a dividend and forecast Q1 2021 net profit to increase by over 100%.

Some analysts marked down the shares on the back of warnings about battery costs increasing. In my view, this is very much a mistaken short-term reaction.

In fact, long-term BYD gains inversely as it ramps up its "Blade" battery sales to other EV suppliers. The new battery is a key milestone for the company. In another new positive development, four new vehicles were launched in April with this new product. The company is continuing to ramp up its battery manufacturing capacity.

Revenue progress has continued into 2021. Recently announced Q1 sales for autos (still the company's most important revenue earner) saw sales up 69%. BEV percentages were up even more. The flexibility of the company is shown by the fact that last year they became the world's largest supplier of face-masks.

The one year stock chart as per Charles Schwab Inc is illustrated below:

Charles Schwab

This is on the back of fast-improving valuations and financial indicators. Some comparisons on the previous year:

Total revenues 2019 = $18.3 billion.

Total revenue 2020 = $23.8 billion.

Net income after taxes 2019 = $304 million.

Net income after taxes 2020 = $921 million.

Cash & Equivalents 2019 = $1.67 billion.

Cash & Equivalents 2020 = $2.1 billion.

Total current assets 2019 = $15.3 billion.

Total current assets 2020 = $17.1 billion.

Although the company has quite substantial long-term debts, its balance sheet is in good order. Revenue is increasing rapidly. The company continues to invest strongly in revenue-enhancing assets but within the scale of its revenue producing growth. They have in addition used their rising stock price to tap the capital markets for funding. In January they raised HK$29.9 billion ($3.8 billion) in a stock issue. The listing cited its usage for replenishing working capital, repaying debt and investing in R & D.

BYD Rail Transit Offering

The "rail transit" division of BYD is stated as one of the five central planks of the company. It was formed around "SkyRail", a driverless straddle type monorail model. There are other the types of monorail such as suspended systems and maglev systems. However, the SkyRail system is very competitively priced and technologically advanced. It is claimed to be easier to build and to optimise space better than competing systems. The biggest current and potential market are seen to be in the Asia Pacific region. As urbanisation expands and economies grow, environmental concerns increase and demand for public transport increases. This report forecasts a CAGR of 16% from 2020 to 2027.

SkyRail took 7 years research to develop and reputedly cost 5 billion yuan ($704 million). It has been greatly automated and improved in the past year in collaboration with Chinese tech titan Huawei. That is leveraging on Huawei's AI and 5G technology strengths. It has a unique energy storage system, another example of BYD's vertical integration advantages.

As a development on from the monorail, BYD has also developed their "Sky Shuttle" system, as detailed here on their website. This operates on rubber wheels rather than as a straddle type product. Including this product it is estimated that the company has invested US$1.5 billion in its rail transit division.

BYD SkyRail ProjectsI previously wrote about BYD's upcoming projects in March 2019.

They have installed several systems in Chinese 2nd tier cities such as the one illustrated below in Yinchuan which was commissioned in August 2017:

BYD Auto BYD Auto

There have been projects in Quan'an and in Xi'an. However, other domestic projects have been slowed down or halted altogether. This is apparently because of problems with Chinese secondary cities getting spending approvals from Chinese central government. This may be because of budgetary constraints or as part of a crackdown on corruption.

In May 2020 BYD signed a contract for the Line 17 project in Sao Paulo. That is Brazil and South America's largest city. This will span 17.7 kilometres across the city and carry 250,000 passengers daily. The project got delayed due to a legal challenge by a rival bidder. That was however overcome and work has now resumed on the line.

This follows on in Brazil from a contract signed in January 2020 for a SkyRail project for the city of Salvador in Bahia State. This will encompass 25 stations across a distance of 23.3 kilometres. It will link with the city's existing subway system. In April it was announced that the first carriages for the "Bahia SkyRail" project had rolled off the production line in Shenzhen. This was important news as it showed the project is going full steam ahead.

The Salvador line has certain special characteristics as it has been designed to pass partially over the sea. BYD management is optimistic this will be the start of further projects and tie-ups in the country.

With the extensive toll Covid is taking in Brazil one can only imagine that work on these projects has been slowed down. So the news of this progress can be seen as encouraging. The company's success in Brazil is another example of their successful vertical integration model. They have had a lot of success throughout Latin America in supplying cars, buses, trucks, batteries and have a PV factory in Brazil.

According to the BYD website, the company is currently delivering 12 new SkyRail projects concurrently, with four more under planning in the Americas. As I previously reported, the company had various MOUs and development projects overseas. These included Rabat in Morocco and Alexandria in Egypt. There were two MOUs signed for the Philippines. These were for a 7 kilometre track in Bataan and for a system in Iloilo. No doubt the year of Covid has been a significant delaying factor in a country badly hit by Covid. The company has not provided much in the way of updates. Investors would find more information useful although there might be client confidentiality reasons.

One potential new project would bring the rail transit division up to a whole new level. March saw a potential landmark decision for the company. It has been awarded a contract for further study for the massive Sepulveda project in California. The "LA SkyRail Express" project is tendered for the long-vaunted alternative to the much congested 405 freeway. The project is officially known as the "Sepulveda Transit Corridor Project PDA and RFD" and is overseen by the Los Angeles County Metropolitan Transportation Authority.

This is how the SkyRail Express website in the USA envisages the project:

SkyRail Express SkyRail Express

The "pre-development agreement" award of $63.6 million is for a 15 mile route encompassing eight stations in the first instance. BYD partners include construction company the John Laing Group from the U.K. and Skanska ( OTCPK:SKBSY) of Sweden, and U.S. architects Gensler.

This project would have a base cost of $6.1 billion as it links the San Fernando Valley to western Los Angeles with options to include LAX and UCLA. It is challenged by a $10.8 billion underground rail system headed by construction giant Bechtel. That has also received funds for cost and technical feasibility studies.

The BYD solution would of course be far cheaper than an underground alternative, and far quicker and less disruptive to build.

Monorails have a somewhat old-fashioned aura to them to the American eye. The SkyRail product is a far cry from the image of an old-fashioned monorail trundling around Disneyland. The details here illustrate that. From the BYD perspective, their rail transit division is an example of how they will help change the world through quiet and non-polluting transport.

The Los Angeles project would be a massive high profile job for BYD. I think it will though have to overcome strong political hurdles. The mainly political objections to it are exampled by this article. Already BYD comes under anti-Chinese political pressure over its e-bus factory in Lancaster in Los Angeles. The Sky Rail carriages would in fact be manufactured at Lancaster and not in Shenzhen. There has previously been a lot of disinformation in the USA, from lobbyists amongst others, about the efficacy of the e-buses of BYD. Such doubts have not been expressed elsewhere in the world where tens of thousands have been deployed. Hopes for further success may depend upon how the Sino-American relationship plays out under a Biden administration.

BYD SkyShuttle Projects

In what is thought to be the first full project of its type, the company commissioned its project in Chongqing in September last year. It was viewed under testing from official Chinese media sources here:

News.CN News.CN

In April it was announced that the Chongqing project had commenced passenger operations. The track runs for 15.4 kilometres across 15 stations. The SkyShuttle has a maximum speed of 80 kilometres per hour. Not many people in the West may have heard of Chongqing but it is an urban area of 32 million people. That illustrates the potential of SkyRail and SkyShuttle in China. The government is looking to such systems in China's second and third tier cities while looking at MRT systems in first-tier cities.

Risks to the Thesis* The SkyRail and Sky Shuttle systems may fail to perform as well as expected on the international stage.

* The Chinese government's delaying of domestic networks may last longer than expected.

* The company may decide the rail transit division cannot add meaningfully to the group's potential profitability.

* The company may become cash constrained and give priority to other more established divisions as it expands around the world.

* There may be profitability and bad debts associated with doing projects in Brazil in the current climate.

* Political tensions with China may negatively affect BYD's business in the Western hemisphere.

Conclusion

The first quarter of the year has seen the release of very healthy 2020 results and positive news on rail transit. I believe this has been underappreciated by the market. A recent DBS Bank bull case analysis of the company emphasised various points but in particular:

The monorail business is expected to become an important revenue contributor going forward

They are one of the few analysts who seem to understand the importance of the new developments in rail transit. One should never underestimate founder Wang Chuanfu's long-term vision and strategic planning. He plays a long game and has been very successful in developing the company's sectors. For that reason, I believe the risks to the thesis I outlined above are unlikely to inhibit the forward progression of the rail transit business.

It is still not clear what is the dollar revenue potential for the rail transit division. It is now realistic to envisage substantial revenues. The company informed this writer that they are negotiating numerous international SkyRail projects at the current time.

The company is some way off reaching the necessary economies of scale to make its rail transit division profitable. However, the international projects on which they are working and an expected increase in such projects domestically are promising. To me, the upside potential is far greater than the downside risk, and exciting developments this year make this very much underappreciated.

seekingalpha.com |

Photo by VCG/Getty Images News via Getty Images

Photo by VCG/Getty Images News via Getty Images