I ‘test’ silver by clinking the two bits together. If true silver, purity begets a pleasing chiming note.

I do not ‘test’ my gold. I hold the gold and sense by feel of the Force. True gold feels different :0)

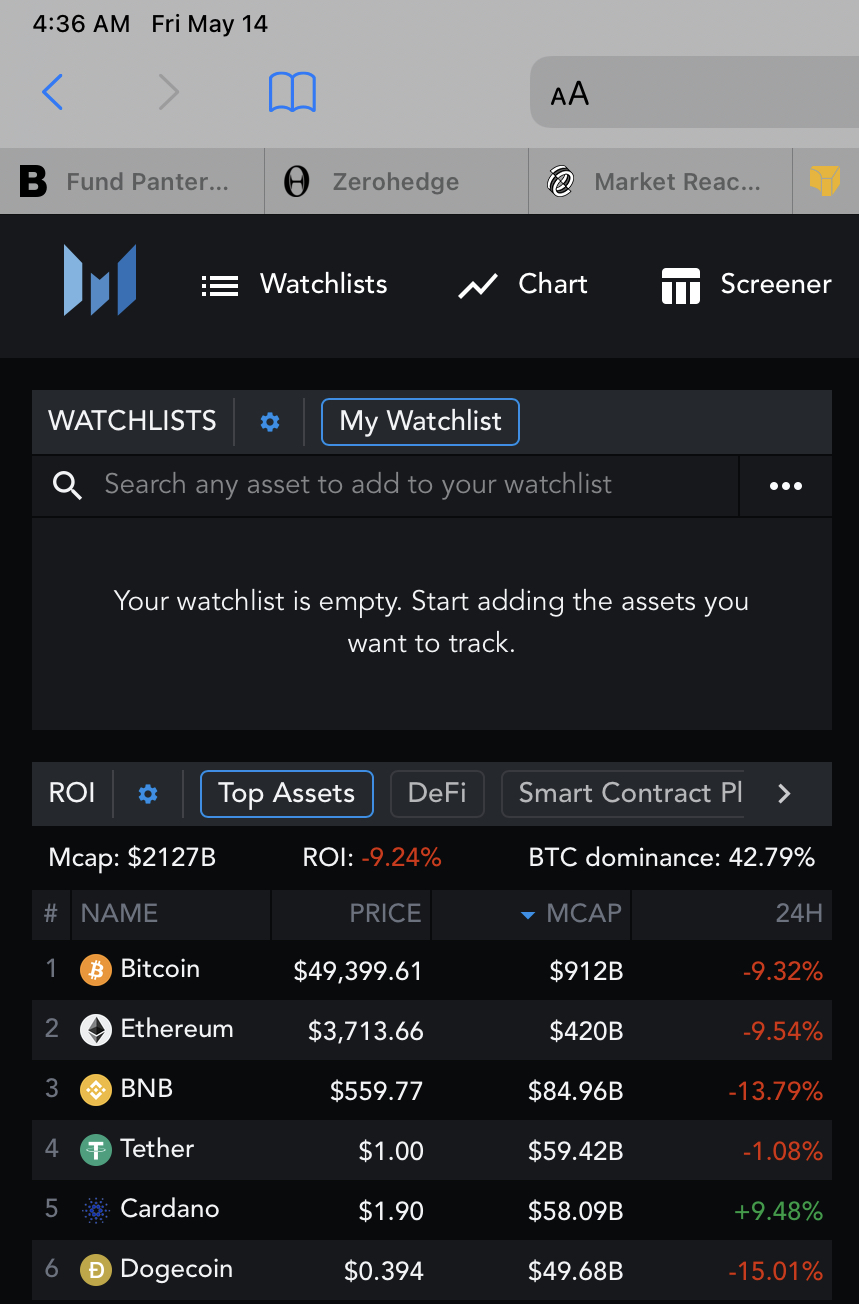

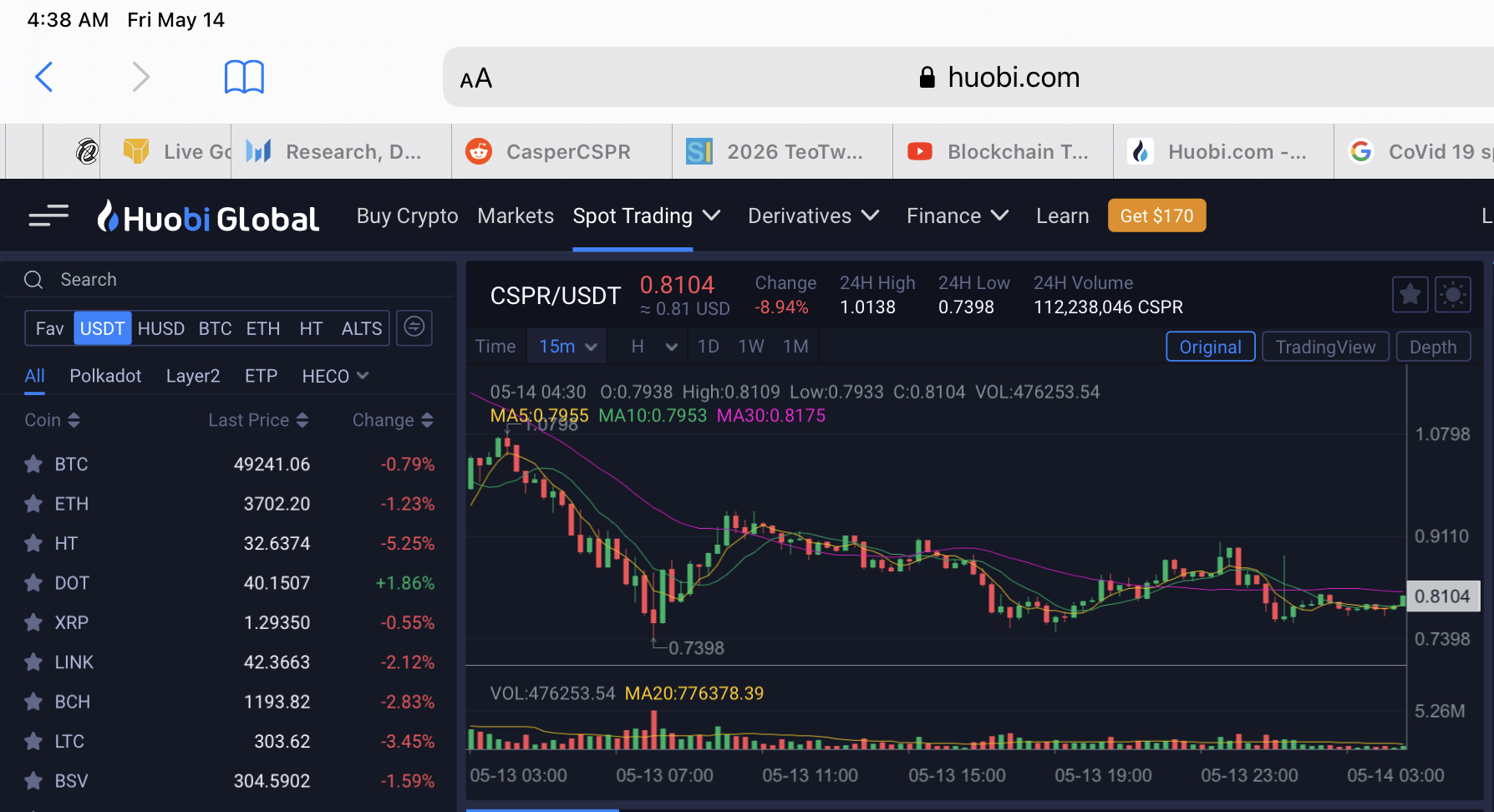

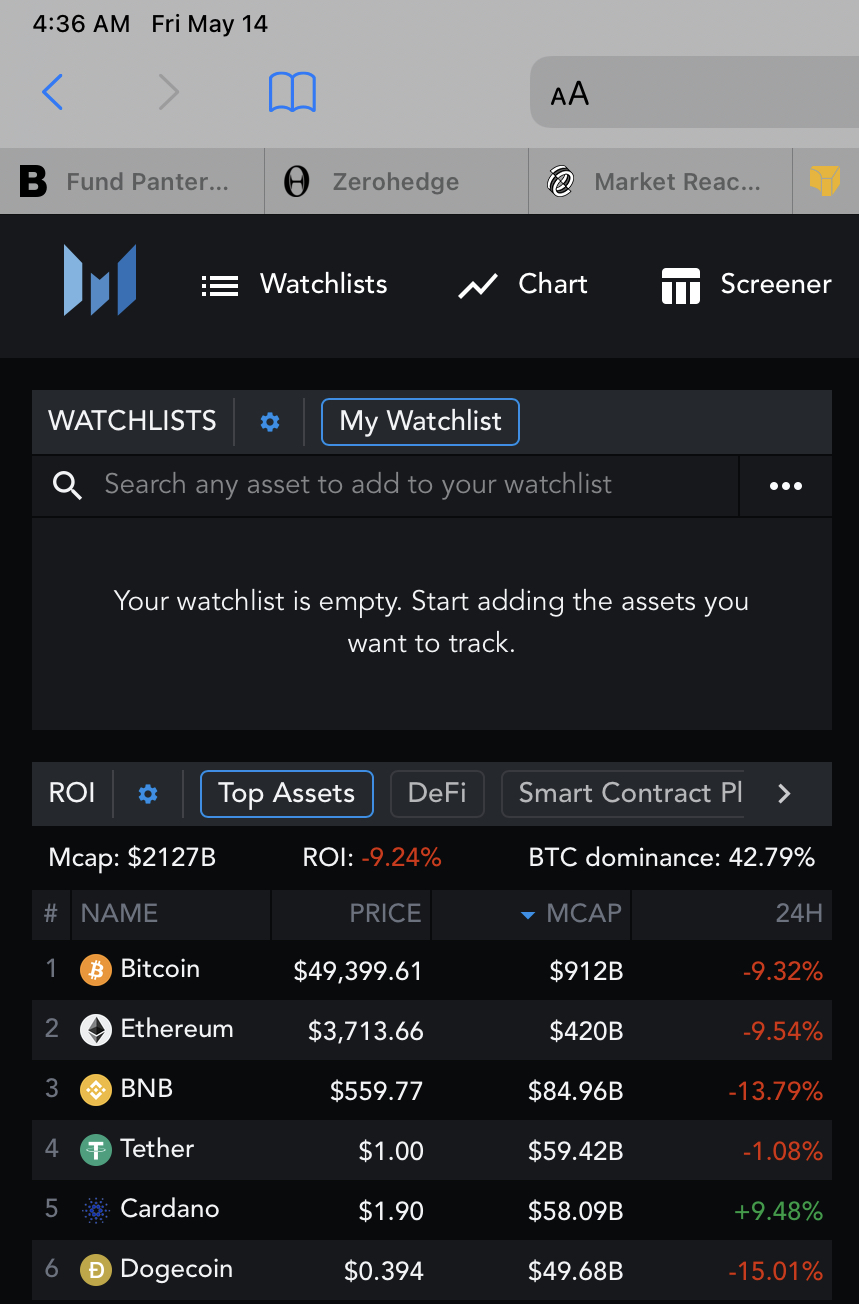

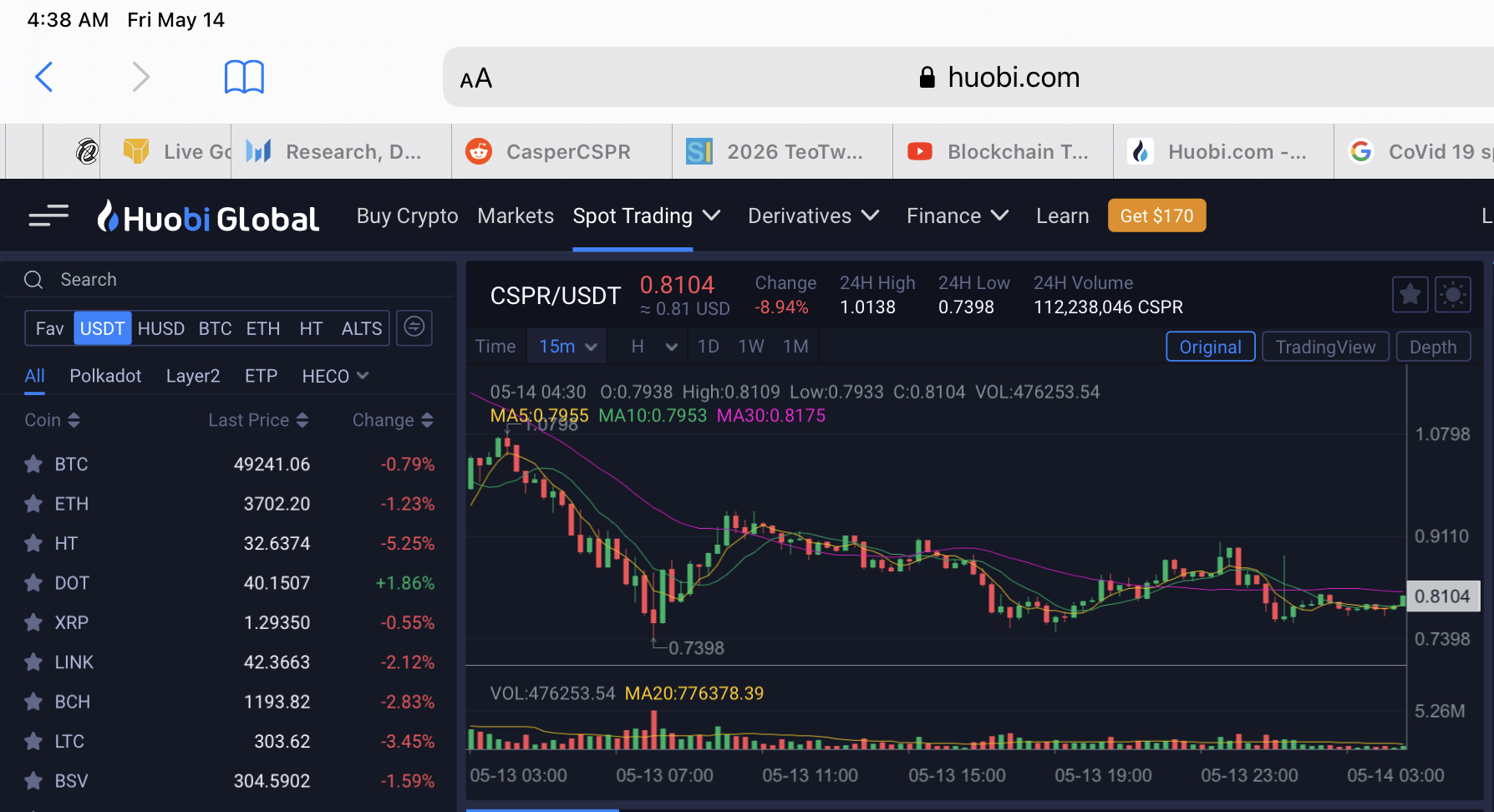

In the meantime I do test my BTC and ETH, CSPR, and whatever I have left over from DOGE, against each other, and this CSPR behaved best, DOGE got hit, but ETH did not do much better than BTC even though ETH is not BTC as far as energy etc and regulatory etc concerned. Shall check on Monero later, for that might be the go-to ‘currency’ should BTC be truly hit, as opposed to the entire crypto world hit.

Just checked, monero hit bad, so, issue is not just BTC but the entire metaverse except CSPR, my largest holding valued at zero on the books but worth a large % of NAV by open market transactions. IOW, all good.

I can make a reasonable case for adding ETH, hold on BTC, and watch DOGE.

But, yes, gold of the universe did well this trading session. As Carranza2 pointed out, a disturbance in the Force happening portending what we do not yet know. 2026 is still far enough away and the market for private assets still underwritten by the strong Fed, and the wealth must continue to flee fiats except in cases of margin call hiccup.

Let’s watch.

I do have a QQQ short that is tempering the drawdown of everything.

Can turn out to be ferocious unless someone authoritative, either Biden / Yellen or Powell take the lead that they so relish. Show us leadership.

Quotes gathered

bloomberg.com

Crypto Fund Pantera Says Bitcoin Energy Concern to Impact Market

Claire BallentineMay 14, 2021, 3:46 AM GMT+8

The head of crypto hedge fund Pantera Capital Management is still bullish on Bitcoin even if some of Elon Musk’s concerns about the token’s energy footprint are valid.

Dan Morehead said in an interview with Bloomberg TV that worries about the cryptocurrency’s environmental toll “will have some impact” on the market.

“There’s a point to think about how renewable the resources are that are used to process transactions on the Bitcoin brand blockchain, but it’s important to remember Bitcoin is only one of the many blockchains,” he said.

The largest cryptocurrency plunged on Thursday in the wake of Musk’s comments about Bitcoin’s energy use, in which he called recent consumption trends “insane.” The chief executive officer of Tesla Inc. said his company would stop allowing purchases using Bitcoin, while signaling the automaker would consider accepting other, less energy intensive tokens.

“The ESG concerns have come up more in the past three or four months,” Morehead said, referring to referring to environmental, social and governance issues. “It’s a topic no one talked about a few years ago. The space as a whole, the majority of the coins in the space don’t use electricity, so it shouldn’t be a big issue for the industry as a whole.”

Targeting $115,000Morehead is one of a handful of power players in the digital-token landscape. He founded Pantera in 2003 and launched the first U.S. crypto fund in 2013.

On Thursday, he reiterated his belief that Bitcoin could still double in the next five to six months, reaching $115,000 by August. Even if that doesn’t happen, his firm is still investing in other digital coins like rival blockchain Polkadot that don’t have the massive energy footprint of Bitcoin.

A Bloomberg report that crypto exchange Binance Holdings Ltd. is under investigation by the Justice Department and Internal Revenue Service also doesn’t worry him, he said.

“Criminals commit crimes, they were doing it for a long time before crypto came around,” he said. “While I’m sure there are criminals who do use cryptocurrencies, it’s a very very small percentage of the business in crypto.”

— With assistance by Erik Schatzker

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |