‘They’ are blaming the hack on the … (drum roll) … Russians bloomberg.com “Hacking Outfit Linked to Russia Is Behind JBS Cyberattack“

And the same ‘they’ point out China is the most hurt by the hack, even though the facilities are in USA and Australia.

I think it can be a lot of parties acting independent or as cabal.

bloomberg.com

China May Have Most to Lose From Prolonged JBS Meat Shutdown

2 June 2021, 14:28 GMT+8

Subscriber Only NewsletterGet access to Bloomberg's Joe Weisenthal and Tracy Alloway as they talk about the weird patterns and the latest market crazes in the weekly Odd Lots newsletter.

A prolonged shutdown at global meat supplier JBS SA could hit China the hardest as the country is the world’s biggest beef buyer and accounts for almost a third of the producer’s export revenue.

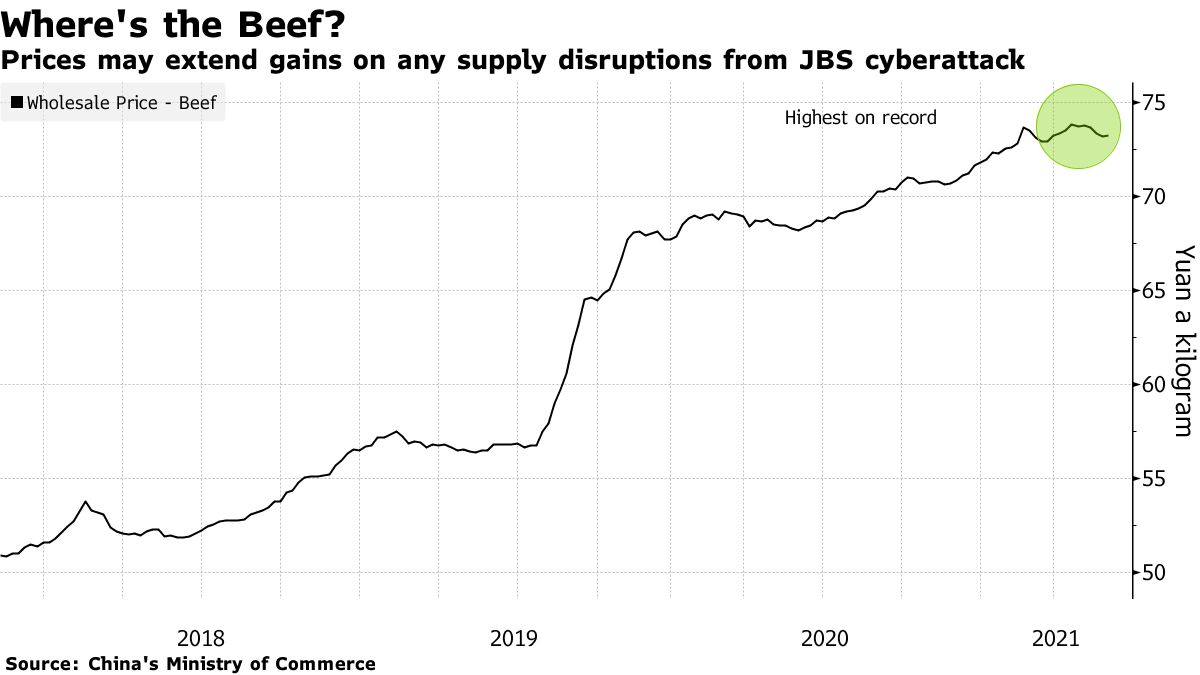

China is also an important market for beef shipments from Australia, where a devastating cyberattack has halted JBS slaughter houses since the weekend, along with all its plants in the U.S. and at least one in Canada. Beef prices in China are already near a record, and any lengthy supply disruption could push up prices even more and stoke food inflation fears.

JBS, the world’s largest meat producer, said it’s made “significant” progress to resolve the attack and will have most facilities operational on Wednesday. It’s still unclear which plants will come back, and there’s a chance some places may face meat shortages and rising retail prices. Operations at the Longford plant in Australia’s Tasmania state are set to resume on Friday.

“It’s going to certainly put a hiccup in the system with JBS being taken out for any length of time because they are such a major player,” Matt Journeaux, the Australasian Meat Industry Employees Union’s Queensland branch secretary, said by phone. “Once that product becomes unavailable in the international market, it will have an impact for sure.”

It’s not a risk Beijing will take lightly. Food security has been at the forefront of China’s political agenda, especially ahead of the 100th anniversary of the founding of the communist party this year. Floods, epidemics and trade tensions have raised pressure on the government to safeguard food supply, with efforts ranging from increasing output to boosting imports. Still, prices of pork, the nation’s staple, have dropped, which may offset some of these fears.

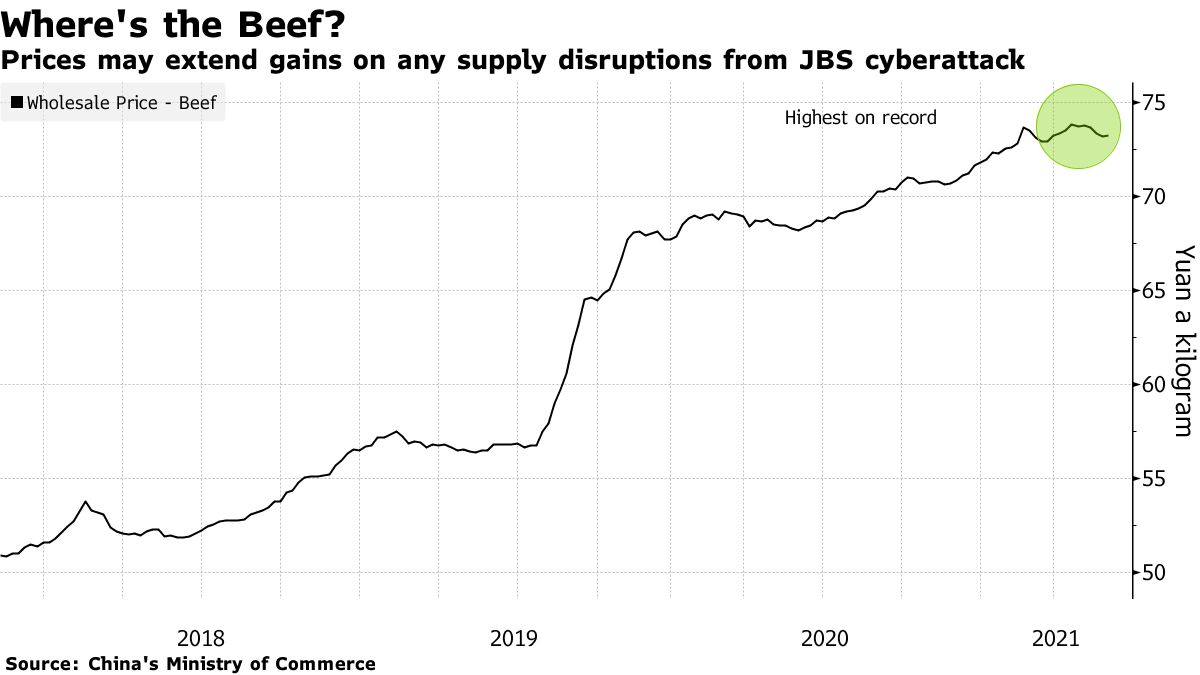

Lion's ShareAsia accounts for half of JBS's total exports, with China the top market

Source: Company filings, data compiled by Bloomberg

Sao Paulo-based JBS owns facilities in 20 countries. The company is the biggest meat and food processor in Australia and its Dinmore facility is the largest beef plant in the southern hemisphere. In the U.S., JBS plants account for almost a quarter of American beef supplies.

While Beijing has banned products from several Australian abattoirs amid rising bilateral political tensions, JBS remains the top supplier of beef to China. On a global basis, Asia is the destination for about half of JBS’s exports, with China accounting for about 31%, Japan for 11% and South Korea for around 8%.

— With assistance by Jasmine Ng, Shuping Niu, Sybilla Gross, and James Thornhill

(Updates with additional details from third paragraph)

Sent from my iPhone |