Re <<ransomeware>>

... speaking of which, opportunity might make appearance this night HK time, as Teams Apple and Huawei helping the returning sovereign to take down but likely not apart DiDi.

Any price <$5 likely safer than any price above 9, assuming app is important to the Uber and Didi of this galaxy.

finance.yahoo.com

bloomberg.com

China Blocks Didi From App Stores Days After Mega U.S. IPO

5 July 2021, 06:22 GMT+8

China’s cyberspace regulator ordered app stores to remove Didi Chuxing, dealing a major blow to a ride-hailing giant that just days ago pulled off one of the largest U.S. initial public offerings of the past decade.

The Cyberspace Administration of China announced the ban Sunday, citing serious violations on Didi Global Inc.’s collection and usage of personal information, without elaborating. That unusually swift decision came two days after the regulator said it was starting a cybersecurity review of the company.

That effectively requires the largest app stores in China, operated by the likes of Apple Inc. and smartphone makers Huawei Technologies Co. and Xiaomi Corp., to strike Didi from their offerings. But the current half-billion or so users can continue to order up rides and other services so long as they downloaded the app before Sunday’s order.

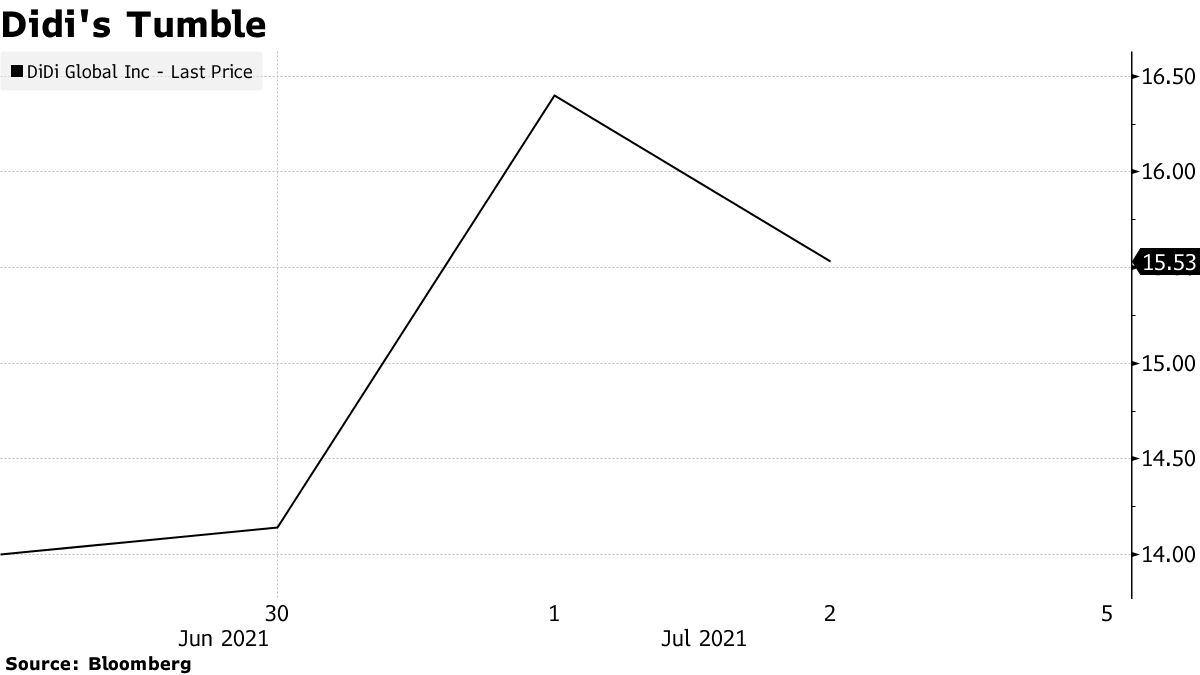

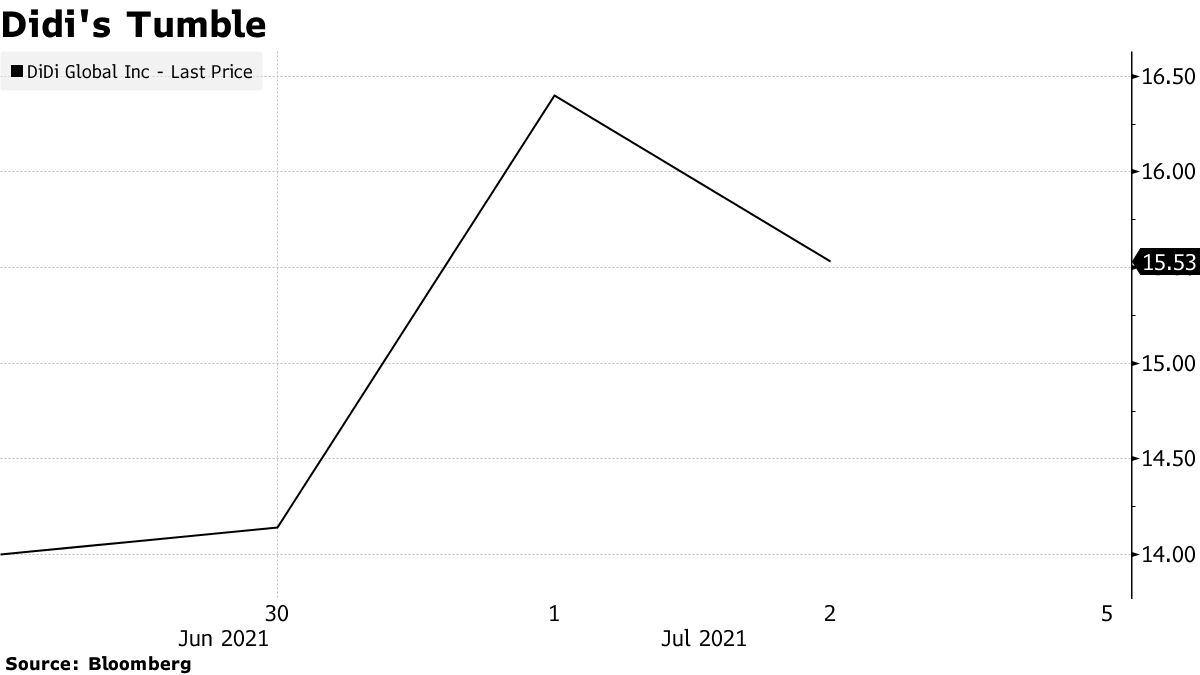

The surprise probe and rapid decision by China’s powerful internet regulator piles on the scrutiny of Didi over issues ranging from antitrust to data security. The company has been grappling with a broad antitrust probe into Chinese internet firms with uncertain outcomes for Didi and peers like major backer Tencent Holdings Ltd. It lost as much as 11% of its market value at one point on Friday, after the watchdog revealed its investigation.

More broadly, Beijing has been curbing the growing influence of China’s largest internet corporations, widening an effort to tighten the ownership and handling of troves of information that online powerhouses from Alibaba Group Holding Ltd. to Tencent and Didi scoop up daily from hundreds of millions of users. The regulator on Sunday ordered Didi to rectify its problems following legal requirements and national standards, and take steps to protect the personal information of its users.

On Sunday, the company said on social media that it had already halted new user registrations as of July 3 and was now working to rectify its app in accordance with regulatory requirements.

In a follow-up statement, Didi said the regulatory move may have “an adverse impact” on its revenue in China.

Didi’s IPO was led by Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. In all, the ride-hailing firm appointed 20 advisers to manage the float.

For more on Beijing’s crackdown and Didi

The CAC didn’t specify on Friday what it will look into. But the timing of its announcements was significant, coming not just on the heels of Didi’s IPO but also the Communist Party’s 100th anniversary celebrations in Beijing.

Didi, one of the single largest investments in SoftBank Group Corp.’s portfolio, defeated Uber Technologies Inc. in China in 2016 before embarking on an ambitious international expansion. It started trading on Wednesday in New York after a $4.4 billion initial public offering, pulling off the largest debut by a Chinese firm in the U.S. after Alibaba.

But Didi had to settle on going public at a far lower market value than previously targeted. It debuted at about $67 billion, barely up from its last round of funding in 2019, and far short of the most bullish expectations for $100 billion -- a reflection of the regulatory scrutiny that’s hounded it ever since a pair of murders in 2018 that founder Cheng Wei has called its “darkest days.”

The Beijing-based firm responded to the subsequent crackdown with a fusillade of efforts to improve security across its network. It began to explore new businesses to offset slowing ride-hailing growth, from car repairs to grocery delivery. That served it well during the coronavirus pandemic, when whole cities came to a standstill. The company delivered an $837 million profit in the March quarter -- a rarity among recent high-profile IPOs like Kuaishou Technology.

The latest move against Didi underscores the uncertainty surrounding the Chinese government’s crackdown on the internet sector. Earlier this year, the State Administration for Market Regulation announced it was looking into alleged abuses -- including forced merchant exclusivity arrangements -- at Meituan, also days after China’s third-largest internet company raised $9.98 billion from a record share placement and convertible bonds sale.

“This is deeply unfair to investors,” Brock Silvers, chief investment officer at Hong Kong-based private equity firm Kaiyuan Capital, said on Friday. “And as a crucial matter of market integrity, China’s regulators should cease allowing companies to list while under investigation.”

— With assistance by Coco Liu, Jessica Sui, and Anand Krishnamoorthy

(Adds detail on revenue impact in seventh paragraph.)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |