Macro effect fairly immediate given 'reaction function'

an instant 'downer' for inflation

zerohedge.com

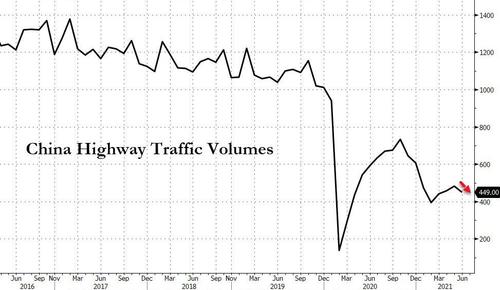

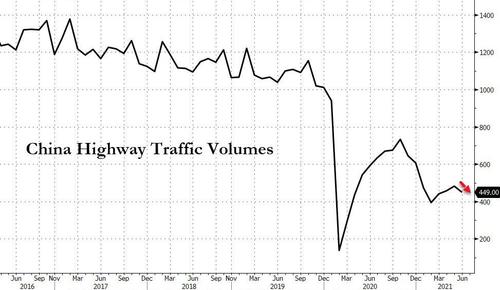

Quiet Roads In China Are Concern For Oil Markets Authored by Irina Slav via OilPrice.com,

Traffic congestion in Beijing has declined by 30 percent over the past week, and is falling in other parts of the country as well, as the spread of a new coronavirus variant gains traction, threatening the outlook for oil demand, Bloomberg reports.

[url=] [/url] [/url]

There have been multiple outbreaks across the country, and the situation remains uncertain, Vice-premier Sun Chunlan said earlier this week, as quoted by state news agency Xinhua.

As with the previous outbreak, which China stifled with a complete lockdown, the rise in infections is affecting movement and, consequently, fuel use.

“For those provinces and regions with severe cases, such as Jiangsu, we will see a hit in gasoline and diesel demand,” Bloomberg quoted one ICIS analyst as saying.

[url=] [/url] [/url]

Jet fuel demand will also suffer as the authorities suspend flights to stem the spread of the new coronavirus variant. Some bus, taxi, and ride-hailing services are also being suspended in some Chinese regions, adding to the negative effect on demand.

“This round of infection could potentially wipe out 5% of short-term oil demand,” a researcher from CNPC’s Economics and Technology Research Institute told Bloomberg.

A five-percent decline in oil demand will have a fast and sizeable effect on prices, especially as it couples with resurgence of the coronavirus in other key markets, notably the United States.

Oil has already retreated from highs hit earlier this year on the strong demand rebound and supply constraints.

At the time of writing, Brent crude was trading at a little above $70 per barrel, down by some $6 since the end of July. West Texas Intermediate was trading at some $69 per barrel, down by about $5 since the start of the month.

[url=] [/url] [/url]

China’s fast action on curbing the spread of the virus would affect oil demand, but the effect is likely to be short-lived if the curb is successful. In fact, according to one analyst cited by Bloomberg, demand for fuels could rebound as soon as September. |

[/url]

[/url] [/url]

[/url] [/url]

[/url]