AI-powered ETF still all-in on stocks and finding more value: Alpha Tactics

Aug. 14, 2021 3:10 PM ETAZO, DHR...AI Powered Equity ETF (AIEQ), Alphabet Inc. (GOOGL), Appian Corporation (APPN)... By: Kim Khan, SA News Editor 31 Comments

Olemedia/E+ via Getty Images Olemedia/E+ via Getty Images

An ETF that chooses solely by IBM's Watson artificial intelligence is still keeping its cash balance to a minimum with the major averages at or near record highs.

The AI Powered Equity ETF (NYSEARCA: AIEQ) is trailing the S&P 500 ( SP500) (NYSEARCA: SPY) slightly year to date, up 17.5%, compared with a 19% rise in the benchmark index.

"Not only does it take a novel approach to stock selection versus its human counterparts, but it has a solid performance track record," DataTrek Research co-founders Nicholas Colas and Jessica Rabe write.

DataTrek, which owns a "small position" in the fund, recently took a look at the shift in the fund's approach.

It now holds 139 stocks, compared with 93 in mid-June and 98 during the end of April.

Cash is only 0.33% of the portfolio.

The top 10 holdings: Danaher (NYSE: DHR), 3.5%, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), 3.1%, DexCom (NASDAQ: DXCM), 2.7%, Autozone (NYSE: AZO), 2.5%, Rapid7 (NASDAQ: RPD), 2.1%, Protagonist Therapeutics (NASDAQ: PTGX), 2.1%, Appian (NASDAQ: APPN), 2%, Vicor (NASDAQ: VICR), 1.9%, CoStar Group (NASDAQ: CSGP), 1.8%, Walmart (NYSE: WMT), 1.7%.

"AIEQ has oscillated between tech and cyclicals this year, and today’s portfolio looks like more of a mixed bag and includes several less-well-known names," DataTrek says. "It does include tech heavyweight Alphabet, but also everything from a retailer and auto parts store to a biopharma company and conglomerate in many markets."

"AIEQ is fully invested in a larger number of positions, showing it is finding more value than during the last few months despite the S&P 500 closing at another record high today," DataTrek adds. "It is also cutting back on top positions to fund all the new companies it wants to include."

"The fact that it carries such little cash speaks to the algo’s conviction in its choices. The machine behind AIEQ is very selective and willing to hold fewer than 100 names, so adding nearly 50 over the past couple of months is a bullish sign at the margin."

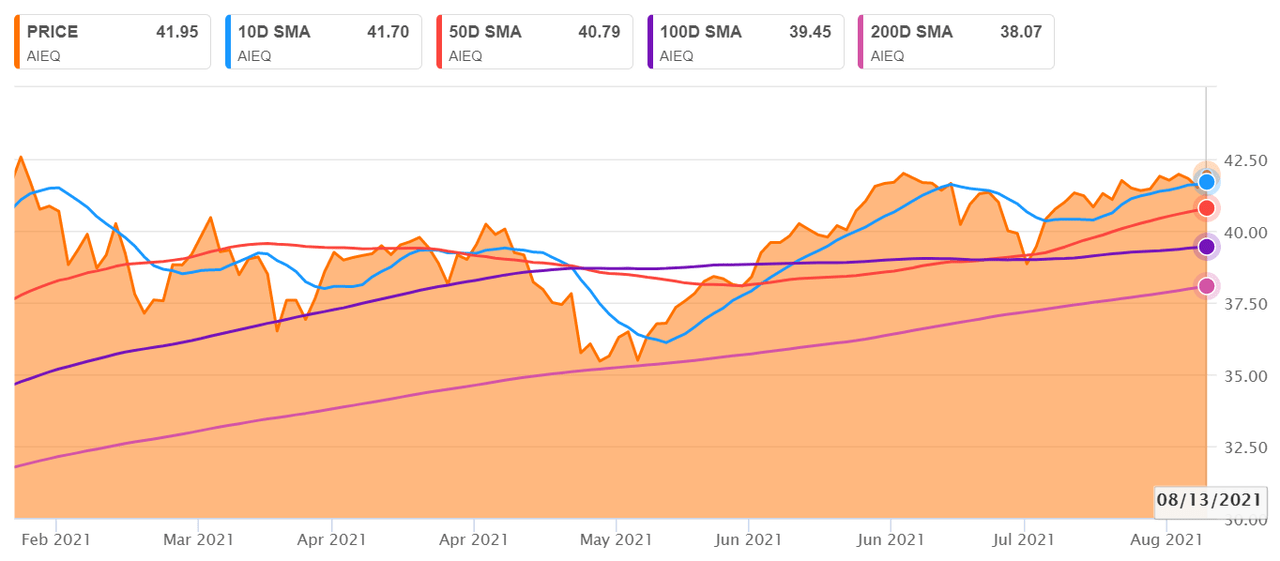

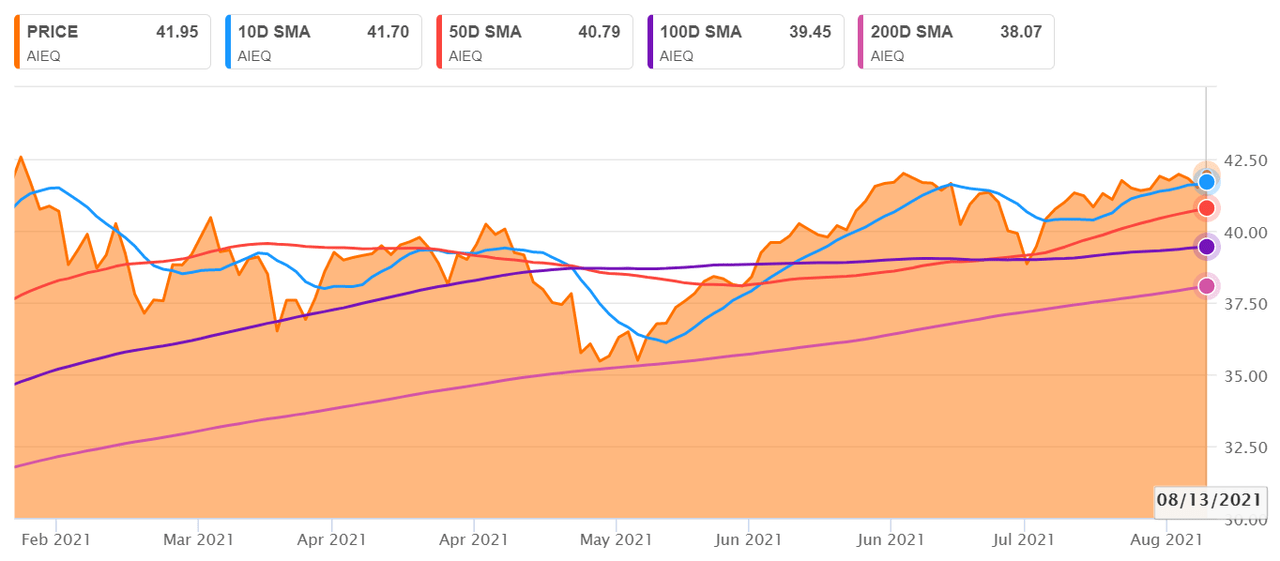

Momentum for AIEQ has been growing after the 50-day simple moving average crossed back above the 100-day in the middle of July.The relative strength index is high, just above 60, but still below the overbought level.  |

Olemedia/E+ via Getty Images

Olemedia/E+ via Getty Images