I suppose <<expectation>> might also prove to be transitory transient, or transitory but loitering

In the meantime, to any and all on the thread who are able to see, meaning by ocular inspection, what might be happening on main streets anywhere, am told US economy, and by inference, lots of economies, softening.

I am currently experiencing a very expensive, and progressively more expensive economy. I cannot tell if it is hardening or softening, but the restaurants are full, streets crowded, people apparently spending, even as folks unable to spend it outside of the domain given travel hiccups.

I took my sun for his Sunday kung fu lesson yesterday, and lunch. We do not have steak very often (really only during BBQ time and the steaks are crowded by more familiar chicken drumsticks, lamb, sausages, and such. As result the Jack is not that familiar w/ steak.

Out of the blue he opted for Australian grass-fed tenderloin medium well. The 'restaurant' was the food court of a supermarket in Causeway Bay. The place was packed. I had a Wagyu burger. Jack's meal, which he actually finished, led him to discover that a single grain of sea salt on each chunk makes the chunk that much more tasty. The simple meal came to HK$ 448 (US$ 57). The only reasonable item we had were the two cherry coca colas. MacDonald's next time.

bloomberg.com

High-Frequency Charts Show U.S. Economy Softening From Delta

Steve Matthews

29 August 2021, 20:15 GMT+8

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The delta variant has muted the progress of the U.S. economic recovery from the Covid-19 pandemic, with consumers putting off some leisure spending and businesses delaying a return to normal operations, according to a number of high-frequency reports that show softness in August.

The following charts show how the latest outbreak is tempering the pace of recovery.

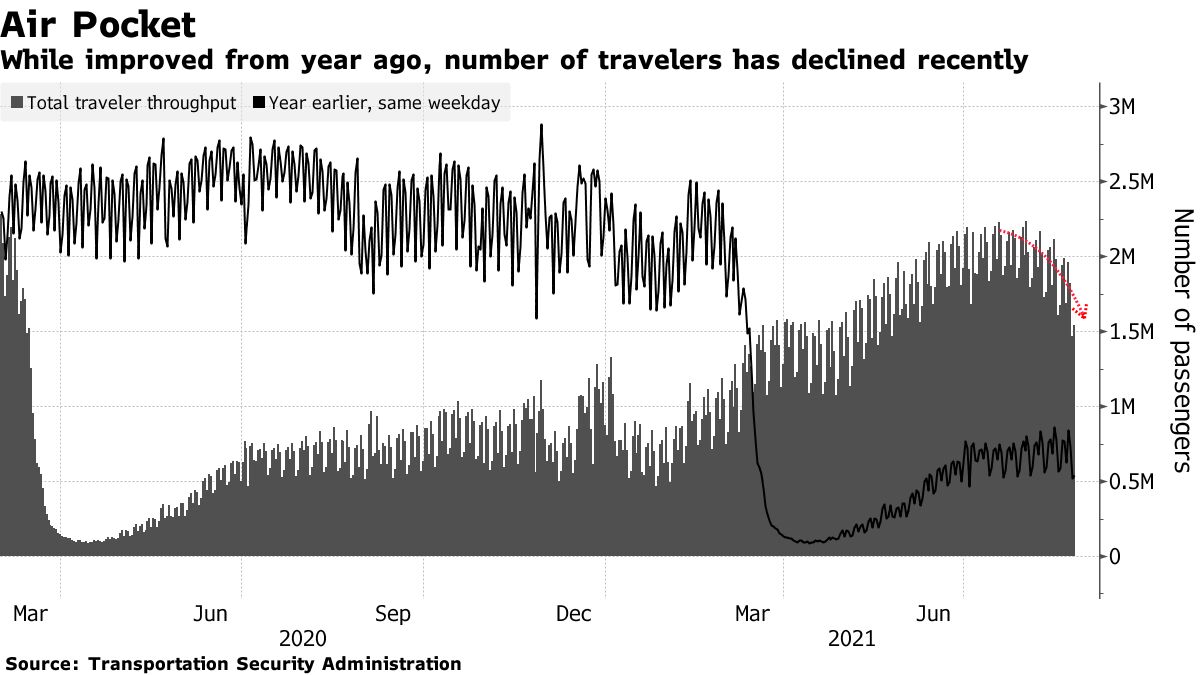

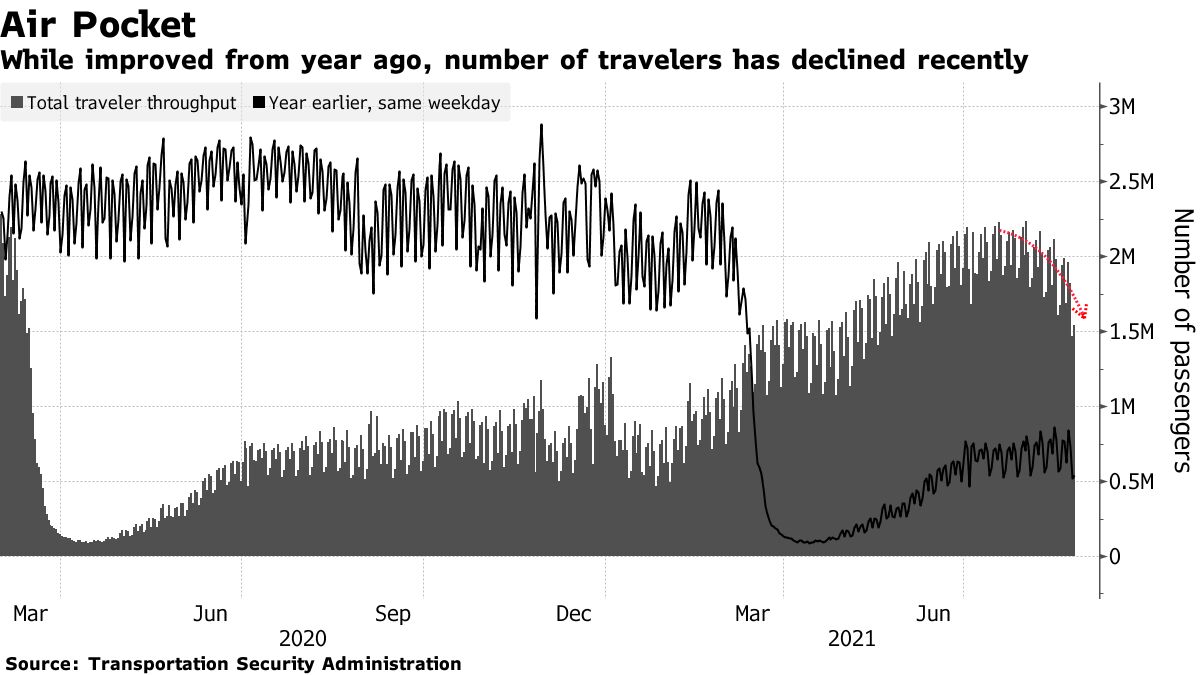

Airlines

The number of travelers moving through airport checkpoints has started to drop again.

On Tuesday, 1.47 million travelers took flights, the fewest in more than three months, according to Transportation Security Administration data. The seven-day average has declined to around 1.76 million passengers a day in late August from around 2.05 million a month earlier.

While this partly reflects the end of the summer vacation season, airlines have also cited the delta variant. There’s been a “deceleration in leisure booking and an increase in cancellations,” said Helane Becker, senior reseach analyst with Cowen Inc. As companies have delayed a return to offices, the return of business air travel is also likely delayed, she said.

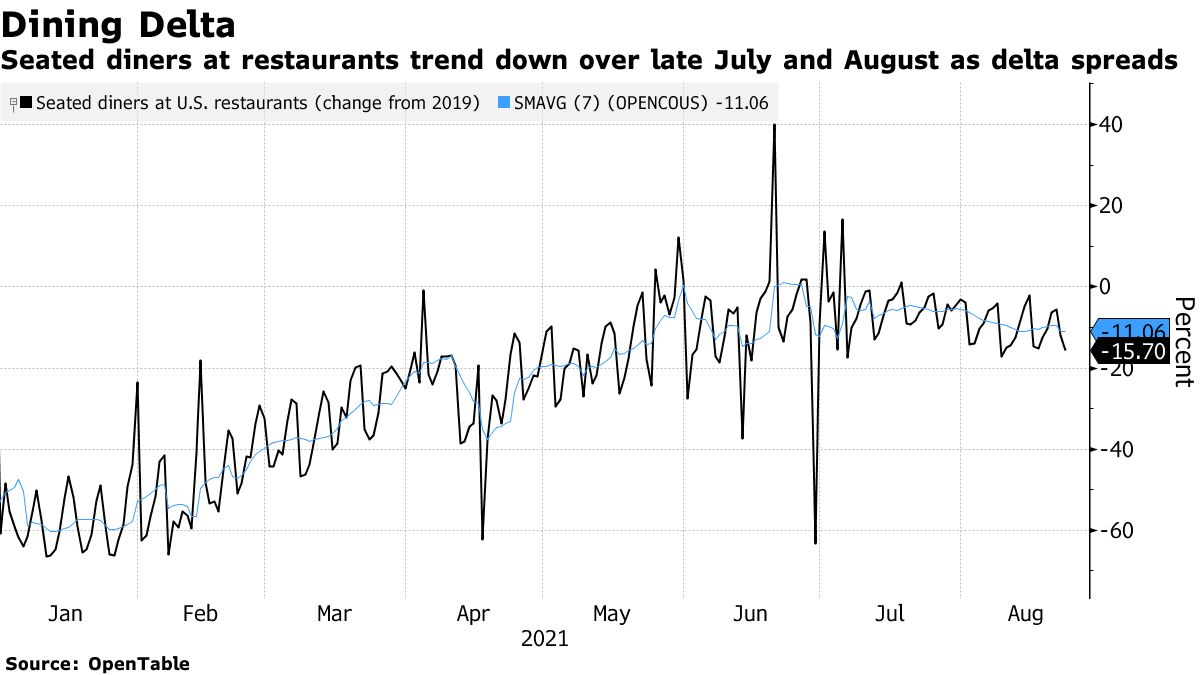

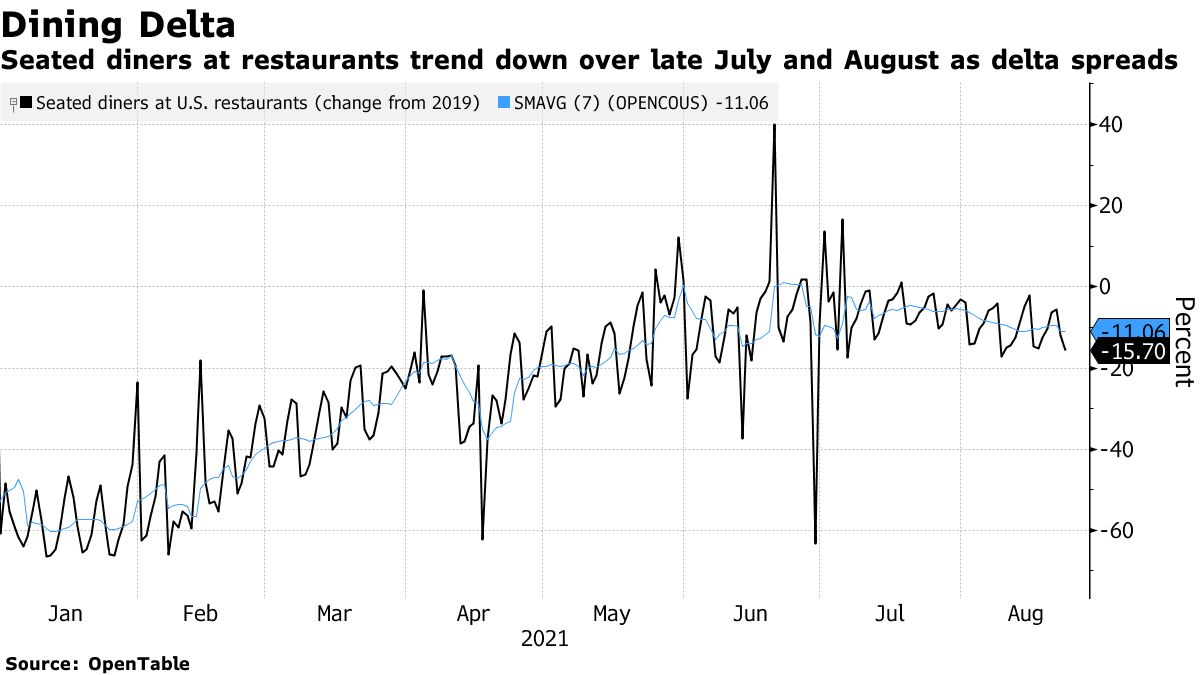

Restaurant Dining

Seated dining at U.S. restaurants has been running at about 10-11% below 2019 levels in recent weeks, after narrowing the gap to just 5-6% below in late July, according to OpenTable, which processes reservations online. Concern about delta and city mandates are playing a role, according to the company.

“We see a pronounced decline in late July and August,” said Debby Soo, chief executive officer at OpenTable. “While several factors could be at play here, we believe the primary driver of the downturn is diners’ concerns about the rise in Covid cases.”

What Bloomberg Economics Says...“The delta variant has shown some signs of restraining vigor in consumer spending on in-person services. The softer-than-expected July retail sales report, combined with moderating demand for dining out and air travel, and delayed back-to-office plans, flag downside risks to consumer momentum in the second half.” -- Eliza Winger, economist For the full note, click here

Hotel Occupancy

While leisure travel helped to boost some popular destinations over the summer, hotel occupancy has now declined for four consecutive weeks, according to STR, a lodging data tracker. Average room rates have declined for three weeks.

Among 25 large U.S. markets, none saw increased occupancy in the week ended Aug. 21 compared with the same week of 2019, STR found. Occupancy dropped by more than 40% in San Francisco, most of any market.

“Demand looks like it is running slightly worse than the typical seasonal decline,” said Bill Crow, Raymond James Financial analyst. There’s “a chill on travel caused by the delta variant case increases” with business-travel markets doing poorly.

Declining Occupancy Delta has contributed to more empty hotel rooms

STR

Week ended Aug. 21 versus comparable 2019 week

Job Listings

While the labor market has become tighter this year, and many employers say they are struggling to fill positions, there are a few signs of slackening demand amid delta. For example, there’s been a decline in job postings on Indeed for dental office and child-care jobs, positions that would call for close contact with the public.

“During the latest wave of the virus, those virus-sensitive sectors have already seen a drop in job postings,” said Jed Kolko, Indeed’s chief economist. If the wave continues, “Labor demand might drop if people cut back on travel, eating out, and other services spending.” And potential workers might be reluctant to look for work, he added.

Listings LullIndustries sensitive to Covid - such as childcare and dentistry - have seen a nearly 7% decline in average job postings in recent weeks

Source: Indeed

Percent change in postings compared to Feb. 2020

Home Again

The plans of big U.S. companies to return workers to their offices in bustling business districts are going in reverse. Average office occupancy in 10 of the largest business districts fell to 31.3% of pre-Covid-19 levels in the week ended Aug. 18, according to data from Kastle Systems.

While August vacations may be contributing, “the return to normal offices has been slowed up a bit because of delta,” said JPMorgan Chase real estate investment trust analyst Anthony Paolone.

That affects not only real estate but also a swath of businesses that depend on offices, like dry cleaners and urban restaurants, and cities through taxes.

“There is a cascading effect to the vibrancy of different urban cores,” he said.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |