Baidu: The Stealth Growth Is About To Become Visible

Oct. 18, 2021

Baidu, Inc. (BIDU)

The Stock Dudar

Summary

- BIDU's new businesses in AI cloud, smart devices, and intelligent driving and EVs are experiencing tremendous growth.

- Legacy businesses like Search and the Baidu App coupled with a strong balance sheet provide a reliable source of cash to fuel investment.

- BIDU's regulatory risk is significant, necessitating downside protection, but lower than other Chinese tech giants, Alibaba and Tencent.

- At a current market cap under $60 bn, my sum-of-the-parts analysis suggests BIDU's fair value could be 3x higher.

yuriz/iStock via Getty Images

Potential investors in China seem to be asking themselves, two questions right now.

- Are Chinese companies investable?

- Which companies are best poised to succeed, if the answer to question 1 is yes.

I believe the answer to the first question is yes, based on evidence I've provided in two separate articles, here and here. I'll provide more evidence below, but this article is primarily a sum-of-the-parts analysis estimating that BIDU is worth roughly 3x its current valuation. Baidu's (NASDAQ: BIDU) legacy businesses in search and its main app are throwing off cash, while the company's new businesses in AI cloud, smart devices, and intelligent driving and EVs are experiencing tremendous growth. Once the regulatory cloud hovering over Chinese tech stocks lifts, BIDU is poised to be one of the biggest beneficiaries of China's economic expansion.

Baidu Main App & SearchOnline marketing service sales totaled $3.2 billion in the quarter, up from $2.7 last year or 17% year-over-year (YoY). It's worth noting that 2020 was a favorable comparison due not only to Covid, but the fact that this segment was facing headwinds as sales dropped from 2018 to 2019 as well. To put $3.2 billion for the quarter into perspective, the number is an improvement over 2019, but essentially a flat annualized run rate compared to 2018. Fortunately, the momentum is now in BIDU's favor as the multi-year marketing services transformation is bearing fruit.

The main BIDU app reached 580 million MAU in 2Q21, up from 544 million MAU and 202 million DAU in 4Q20. This shift to the app has been underway for some time; for perspective, the BIDU app had 70 million DAU in 2014 when its mobile web search first hit 500 million MAU. The app provides users, search, content, and other services through a few core building blocks, consisting of

- Managed Page - Think Shopify/Wix as a starting point with all the tools business owners might need within the Baidu ecosystem to maintain their presence online.

- Smart Mini Programs - Think app store 2.0, for example, the ability to access and utilize Yelp, YouTube, etc. without downloading the apps.

- Baijiahao - Content from a set of almost 4 million publishers aggregated and distributed through search, feed, and short video.

Baidu's Managed Page segment has been an ongoing effort to pull merchants, and indirectly customers, into the BIDU ecosystem. Baidu has the clear, and seemingly stable, lead in search in China, but it doesn't have control over search the way Google does in the U.S. That's probably a good thing for investors, because the company has already been fined along with others for violating China's anti-monopoly law. With stagnating revenue from search, the Managed Page segment now accounts for 40% of Baidu's advertising revenue. It may have taken 3 years to return online marketing services sales to 2018 levels, but now that momentum has shifted from standalone search to the Baidu app, there's still plenty of room to run.

Source: Baidu

Segment-level margins would have been ideal, but management told us that 2Q21 margins for Baidu Core (excludes IQ, a significant source of consolidated revenue) were:

- non-GAAP operating margin - 27%

- adjusted EBITDA margin - 33%

If I use 25% to be conservative on $12 billion in annualized sales and apply a 10x PE multiplier, valuation for this segment should be at least $30 billion. Given the recent growth in this segment and China's economic expansion, 15x to 20x feels more reasonable for a valuation of $45-$60 billion.

AI & Cloud Services

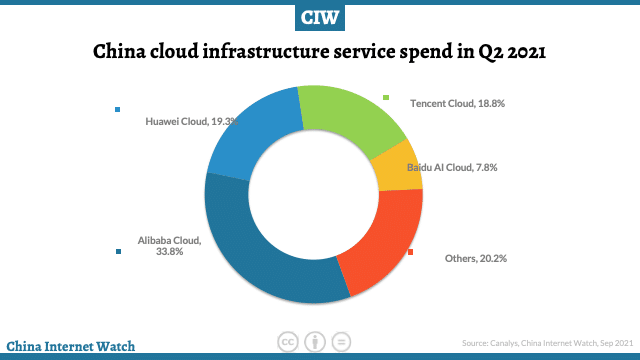

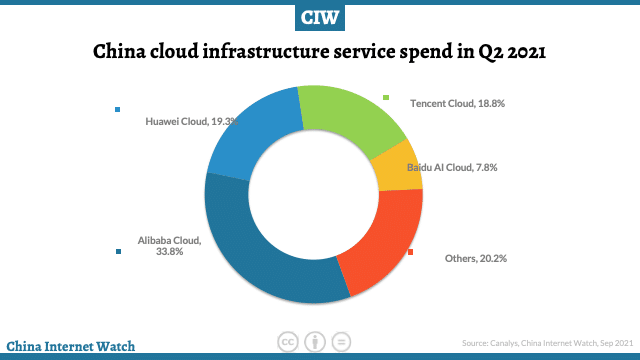

Baidu's AI Cloud segment was a standout in 2Q21 with revenue up 71% YoY on the back of overall cloud infrastructure growth in China, up 54% YoY, the fastest-growing region for cloud services in the world. Baidu is a distant 4th in China's cloud services overall, but growing faster than average, and its No. 1 AI cloud rankingsuggests the company has a big opportunity in this market.

Source: China Internet Watch

What is AI Cloud?

For years, lagging tech companies have been talking up their cloud and artificial intelligence offers to distract investors away from their otherwise dismal results. This leads some investors to dismiss both cloud and AI as buzzwords, so I want to take a minute to further explain AI cloud, and why BIDU's offerings in this market make sense for investors to get behind.

A public cloud service is primarily a set of off-sight computers and storage managed by a separate company like Amazon (NASDAQ: AMZN) or Baidu, that customers utilize via internet connection instead of relying on in-house data centers. Public cloud services are valuable because customers can centralize their IT spending, paying only for the computing resources they use without the risk of needing more resources than are available. As an example, Baidu, as a cloud provider to the healthcare industry, might help physicians and hospitals store patient data and records in a secure manner.

Artificial intelligence services take many forms, so I'll stick with my healthcare example. A problem with being treated as a patient is that you are going to be limited by the knowledge and experience of your doctor, staff, and their networks. You could end up with a rare disease that is misdiagnosed unless you happen to be examined by the right specialist. AI promises the ability to efficiently put the knowledge of the entire medical community at your doctor's fingertips where they can interpret that data as it directly relates to you, improving diagnosis accuracy and speed.

An AI cloud simply increases the value proposition of a public cloud offering with the ability to apply AI tools to data stored on the cloud provider's servers. The more seamless the AI tool application is, the greater the value in the overall service. Combining the healthcare examples above, imagine a hospital maintaining patient records and data on Baidu's cloud. If Baidu's AI cloud can analyze this data in real-time, doctors can make more informed diagnoses and optimal treatment recommendations. Healthcare is just one example, but it's not hard to imagine how the AI cloud could play into Baidu's other core competencies like advertising, driving, government optimization, and smart devices.

Baidu's AI Cloud Advantages

Developer communityLarge companies like Google (NASDAQ: GOOG) (NASDAQ: GOOGL)and Apple (NASDAQ: AAPL) have found ways to benefit from the work of independent developers by providing platforms that allow the companies to participate in any profits, with very little risk or effort once the platform is developed. Baidu may be looking to replicate that strategy in AI with a platform called PaddlePaddle, somewhat analogous to Google's Tensorflow, with a focus on deep learning, a subset of AI. According to management on Baidu's 2Q21 conference call "Our PaddlePaddle developer community reached 3.6 million up 62% year-on-year." This solid group of developers should provide Baidu an advantage for years to come.

Kunlun - Baidu's AI Chip

Baidu's home-grown Kunlun chip is optimized for cloud and AI workloads. Its 2nd generation chip will be about 3x more powerful and should begin mass production this year. Earlier in 2021, Baidu spun off its Kunlun chip unit at a $2 billion valuation with Baidu retaining 76% of those shares. With control on hardware, BIDU's AI software should have a distinct advantage going forward.

Early mover advantage

Still in the early days of AI development with a rapidly-growing Chinese cloud market, BIDU has numerous wins in the field. These early victories pay dividends going forward by creating moats in terms of tools and experience. Baidu's CFO, Herman Yu, gave the example that their Smart Transportation started by trying to synchronize traffic lights. Through this work, Baidu became familiar with the legacy government systems and the company developed a baseline set of tools to do the work. As they moved to different cities and beyond traffic lights, they still had to interface with the same systems but could now work much faster. This early success not only leads to new contract wins as evident from the revenue growth rate, but also a large amount of repeat business as CFO Yu stated on the 2Q21 call: "Look, we're in 20 cities, if you look at contracts over 10 million, 9 [million] of them have renewed."

Baidu's AI Cloud Valuation

AI Cloud revenue annualized from Q2 results is around $2 billion growing around 70%. Cloud margins are typically desirable, while AI cloud margins are even higher, and Baidu has a mix of both. Given the existing growth, market opportunity, and profitability in this segment, even 10x sales might be too cheap. Baidu's AI Cloud could earn $2.5 billion in net income by 2025, and investors historically have assigned Baidu a 10x PE, so this segment would be worth $25 billion. If China is once again deemed fully investable, and Baidu gets anything close to a typical, high growth, tech valuation, $50 billion could be a fair value.

Intelligent/Autonomous Driving & Electric Vehicles

The line between BIDU's transportation, AI, and Smart Device segment can be blurry, so for the purpose of this article, I'll discuss Apollo Go ride-hailing, robotaxis, and EVs here, leaving DuerOS and Smart Transportation contracts to other sections.

Apollo Robotaxis

Earlier this year, BIDU introduced its 5th generation robotaxi, Apollo Moon, in conjunction with BAIC Group with a plan to roll out 1,000 vehicles over the next three years. The expected manufacturing price is $74,680, which while expensive, is 68% lower than per unit production price of the average autonomous vehicle used for ride-hailing. This fully electric, luxury midsize crossover SUV is level 4 autonomous capable with more tech features than an average taxi ride will allow time to figure out, let alone utilize. Relative to any other luxury vehicle, this is a competitive price, but I have little doubt that the company will continue to optimize. BIDU's leadership in AI and first-mover advantage in autonomous driving make them one of the companies to beat in the ride-hailing market.

Apollo vehicles may soon be cheaper than a human driver, and those already in operation are arguably safer. Apollo Go added its 4th operational city in 2Q21 and totaled 47,000 rides with a very high customer satisfaction rating. BIDU plans to roll this service out to 30 cities over the next 2-3 years already adding Shanghai as the 5th city after Q2 ended.

Apollo Valuation

For all the advantages Apollo Go has with autonomous vehicles, Didi Chuxing ( DIDI) currently dominates ride-hailing, providing billions of rides last year. DIDI's moat is huge because customers reach for the convenience of a service that they know will be available on demand due to the massive amount of drivers working for DIDI. To compete in a human driving market, BIDU would have to find drivers and massively scale, incurring expenses that simply don't make sense. Autonomous vehicles change the game completely in terms of scalability and profitability which is why DIDI is rushing to make investments in driverless vehicles too. What Apollo Go currently lacks in name recognition and app downloads, it makes up for with technological superiority and experience over DIDI. Given the advantages, Apollo Go could be at least as valuable as DIDI with a current $40 billion market cap. Keep in mind that this is down from DIDI's IPO price of $67 billion after finding itself in the central government's crosshairs.

Electric Vehicles

Early this year, Baidu and Geely ( OTCPK:GELYF) ( OTCPK:GELYY)announced an electric vehicle joint venture, Jidu Auto, with Baidu focused on the software and Geely's manufacturing expertise to build the vehicles. Just six months after the joint venture began, Jidu completed wind tunnel testing on a full-size clay model of the design prototype. BIDU owns a 55% stake in the company, with BIDU and Geely aiming to invest $7.7 billion over the next five years to produce smart cars.

Jidu Auto is the perfect company to create a futuristic EV playing to all the strengths of the

Baidu-Geely partnership

- Apollo's expertise in autonomous driving

- DuerOS's conversational AI and existing vehicle usage

- Kunlun chips to provide processing power

- Geely's open-source electric vehicle platform

- Geely's existing manufacturing infrastructure

Electric Vehicle Valuation

Because Jidu Auto won't report any meaningful sales or profit numbers, I rely on existing Chinese EV manufacturers like NIO (NYSE: NIO) for comparison. I placed a speculative bet on NIO in early 2020 with the company valued around $6 billion. I sold out early, as I always do, but the current $60 billion valuation looks frothy, especially when I was uncertain at $6 billion.

I feel as though the world has forgotten that automotive manufacturing is a low margin business, and I struggle to think of another industry that needs more competition less than this one. I suspect the $7.7 billion investment is just a starting point that will turn into tens of billions down the road. The automotive industry is littered with startups and century year old companies alike that have gone bankrupt. Despite the competitive advantages Jidu Auto has through its backing by Baidu and Geely, this business is likely to provide low margin profits with a risky balance sheet at best. At worst, it will be a black hole for BIDU to pour money in. For these reasons, I assign no additional value to Jidu Auto or BIDU's stake in the company beyond its contributions to Apollo's valuation estimate.

Xiaodu Smart Devices and DuerOS

I've been tracking Baidu's lead in the Chinese smart speaker market for a while, but I've only recently noticed how dominant the company is in smart displays, speaker + screen (apparently these aren't called phones). When I say dominant, I mean globally, with Baidu claiming 38% of global market share, while the next closest was Amazon with 26%. Amazon still leads in speaker/displays combined, but Baidu leads the combined category in China, with over a million more shipments in 2Q21 than Alibaba (NYSE: BABA), and more than double the shipments of Xiaomi ( OTCPK:XIACF) ( OTCPK:XIACY). I imagine the margins on BIDU's Xiaodu hardware sales are paper-thin, but the company's strategy has always been software focused. From a small base, Xiaodu services revenue like advertising and subscriptions multiplied 5x YoY, and now makes up 1/10 of Xiaodu's overall revenue. In 2019, CEO Li described the $50 average selling priceof the Xiaodu smart display as a "sweet spot", but these command premium over speakers. If I assume an average selling price of $30 for the 6.2 million smart devices BIDU shipping in 2Q21 and extrapolate annually, it's about $800 million in annual sales, implying ~$90 million from Xiaodu's rapidly-growing services.

The other big market for the software behind Xiaodu devices, DuerOS, is automobiles, with the system installed in 1.8 million vehicles, up 265% YoY. This effectively completes BIDU's strategy to be everywhere consumers are, in their pockets, homes, cars, and computers; Xiaodu devices even found a big market in hotels. DuerOS leverages BIDU's AI capabilities with features like conversational AI, creating a moat around what would otherwise be commoditized hardware.

This segment is particularly hard to value, and while I'll include a number, I encourage readers to use the information I provide as a starting point to form their own conclusions. On the low end, Xiaodu recently closed Series B financing at a $5.1 billion valuation. Before we take that valuation as gospel, it is worth noting that Xiaodu completed Series A funding less than a year ago at a $2.9 billion valuation. Either the market was wrong in one of these rounds, or Xiaodu's intrinsic value increased by 75% in less than a year. I'm willing to bet it's the former.

CEO Li specifically mentioned China's 300 million elders as a use case for Xiaodu smart displays to connect elders with senior community assistance, emergency services, and non-invasive monitoring. Interestingly, Amazon just launched an elder care subscription service called Alexa Together, at $20/month after a 6-month free trial. If BIDU were to charge a quarter of that amount and only reach 5% of China's elderly population, the service revenue from this one subscription would be almost $1 billion. The opportunities in advertising, vehicle integration, and skill sales could be even larger, although even Amazon has had little luck monetizing Alexa in what should be a lucrative U.S. market. If service revenue does account for 1/10 of Xiaodu-related sales, BIDU might actually be figuring out what Amazon can't.

Since the bulk of Baidu's sales coming from advertising, the most straightforward way to monetize DuerOS would be to improve Baidu's advertising capabilities with insight gathered through the platform. Given Xiaodu's market penetration and the rate of service growth, BIDU might be able to generate $1 billion in EBITDA from hardware + services and another $1 billion in advertising/data related earnings. A 10 to 15 multiplier values this segment anywhere from $20-$30 billion in the next few years. I'll use $20 billion because it's unclear what stake Baidu still owns beyond a " supermajority."

Share Buyback, Balance Sheet and Investments

Baidu bought back $566 million of shares in 2Q21, and with the current state of its balance sheet, the company does not have to choose between future investments and share repurchases.

| Cash, Equivs. ST investments, Account Rec. | $27.6 billion | | Total Assets | $60.2 billion | | Total Liabilities | $23.2 billion

Baidu Balance Sheet Snapshot with data from 2Q21 Form 6-K |

The top row of the table lists BIDU's current assets excluding: restricted cash, amounts due from related parties, and other current assets. I wanted to take a conservative approach and didn't feel there was enough information to include these $3.3 billion of additional current assets. Subtracting the top and bottom rows gives BIDU $4.4 billion of current assets, net of all liabilities. Under non-current assets, the company assigns $15.7 billion to their long-term investments, an increase of nearly $4 billion since year-end 2020. We don't know how risky some of these long-term investments are, so to be conservative, I'll use $8 billion, half of BIDU's stated value.

Finally, BIDU's roughly 56% stake in streaming platform iQIYI ( IQ) has fluctuated over time, currently sitting at an all-time low with a ~$7 billion market cap. This feels low given IQ's larger user base than Bilibili Inc. ( BILI) with a market cap near $27 billion. That said, I haven't sufficiently analyzed IQ to assign it a value, and will therefore use the market's current value, which would make BIDU's stake worth $4 billion.

Putting together the $4.4 of net assets, $8 billion in long-term investments, and the IQ stake of $4 billion, BIDU's balance sheet plus investments are conservatively worth $16 billion.

Risks, Chinese Stocks, and Baidu's Debt OfferingI've provided links in the intro to articles I've written providing evidence that fears associated with China's clampdown are overblown, but I want to talk about risks as they specifically relate to BIDU.

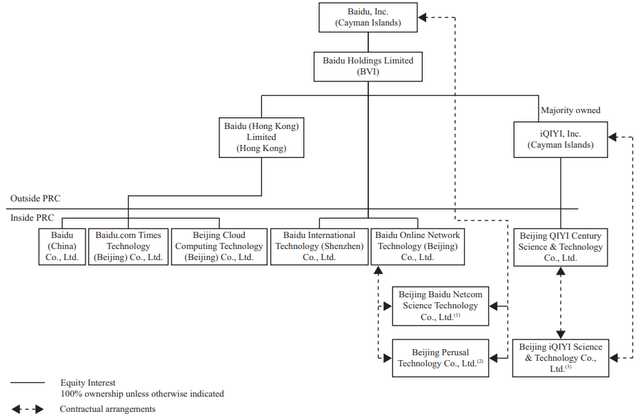

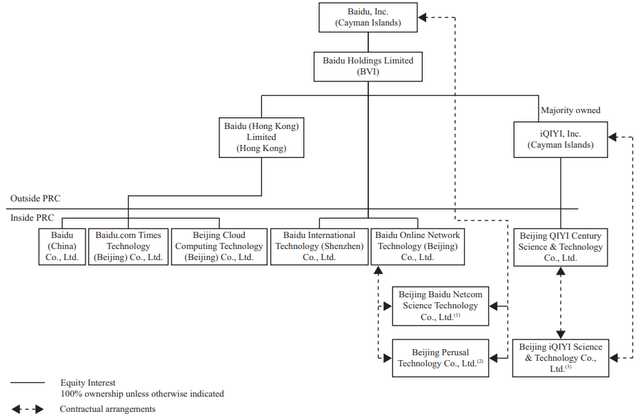

The Bond Market's View on Baidu's RiskLike many Chinese companies listed on U.S. and Hong Kong exchanges, Baidu Inc. is a Cayman Islands holding company utilizing the familiar VIE structure. This means shareholders don't have any ownership interest in the underlying companies based in China like Beijing Baidu Netcom Science Technology, for example. According to BIDU's latest Form 20-F filing, the company's organizational structure on page 107 looks like this:

Source: Baidu Form 20-F

There are contractual agreements, only enforceable in China, that profits from the Chinese incorporated companies flow through to BIDU. On August 18, 2021, BIDU announced an offering of $1 billion of debt in two amounts paying 1.625% and 2.375% due in 2027 and 2031, respectively. The dates are relevant as both sets of notes would mature after the time limit set in the Holding Foreign Companies Accountable Act, leading to a possible delisting of BIDU ADSs from U.S. exchanges. However, the notes will be listed on the Hong Kong stock exchange, so there shouldn't be any direct implications. What's really interesting about the debt offerings is that BIDU was able to secure competitive rates. I don't spend a ton of time in the bond market, but given that Baidu Inc. is the entity issuing the debt, bondholders should be subject to the same VIE risks as stockholders. During the height of Covid, some airline and cruise ship operators had to offer double-digit interest rates to sell their debt, and that's with bondholders having a claim to the considerable book value in these companies. While the stock market cut BIDU's valuation by more than half in response to new regulations from Chinese authorities, the bond market appears surprisingly calm despite a questionable claim on BIDU's assets. The bond market isn't always right, but the divergence between stock prices and bond yields suggests the institutional players that dominate the bond market aren't as fearful of a major crackdown or takeover of BIDU as stock market participants.

RisksMonopoly RisksBaidu, like most Chinese tech giants, has been fined under China's anti-monopoly laws, but they appear to fly under the radar compared to Alibaba and Tencent ( OTCPK:TCEHY). CFO Yu gave us some insight into China's Development Plan on the 2Q21 conference call stating that "it will not be surprising if certain incentives for the older industries gradually decrease while the new economy benefits from government incentives." The implication that while the "search" business could continue to receive fines against it, BIDU's AI Cloud, Smart Transportation, autonomous driving, smart devices, and AI chip businesses, which are all far from monopolies, could see new government incentives going forward. That said, it is important to remember that BIDU's more entrenched businesses provide the bulk of the company's sales and earnings. If the government went after those specific businesses, BIDU would struggle to make the investments required in segments like AI Cloud without their cash-generating capability.

CompetitionAs shown in the cloud market share graphic earlier in the article, one of BIDU's most promising segments has less than 10% of China's market share, while leader Alibaba has over 30%. Deep-pocketed Huawei and Tencent each have roughly 20% market share, so I would expect spending to intensify from here. BIDU has found a niche in AI Cloud, but I suspect the vast majority of cloud users won't need, or even understand, BIDU's AI capabilities. If customer decisions come down to more traditional cloud metrics like cost, speed, and reliability, BIDU could have trouble competing.

It looks like Baidu is leading the pack when it comes to smart displays and intelligent driving, but they aren't generating much, if any, profit at the moment, and smart speakers/displays could be difficult to monetize. Both areas will likely require additional investment before they start generating profits, so there's still room for competitors. In driving, DIDI could present a challenge with its own autonomous driving efforts as it seeks to capitalize on its huge existing user base.

Final ThoughtsRegulatory fears have taken the same toll on BIDU as they have on just about every other publicly traded Chinese name. As a result, BIDU now looks significantly undervalued on a sum-of-the-parts analysis.

| Business Segment | Estimated Value | | Search + Main App | $45-$60 billion | | AI Cloud | $50 billion | | Driving and Electric Vehicles | $40 billion | | Smart Devices & DuerOS | $20 billion | | Balance Sheet, Investments, IQ | $16 billion | | Total | $171-186 billion |

Source: Author Estimated Values

With a current market cap under $60 billion, fair value for BIDU could be as much as 3x higher.

I conclude with the same warning I've given for years when it comes to owning Chinese stocks. There is an element of unknowability that places U.S. investors at the whims not only of Beijing, but Washington D.C. as well. For that reason, I feel it is important to protect yourself on the downside either through options or another strategy you are comfortable with. With downside protection in place, the potential for a 3x return on BIDU could be worthwhile for risk-tolerant investors.

I, The Stock Dudar, tend to write longer-form articles to give the most complete picture I can. If you find that style appealing or the information I provide useful, please consider leaving a comment to let me know you appreciated the article. |