Re << Prices are up by over 100% and for a good reason >>

… love stuff that moves with such high vol. They save lives.

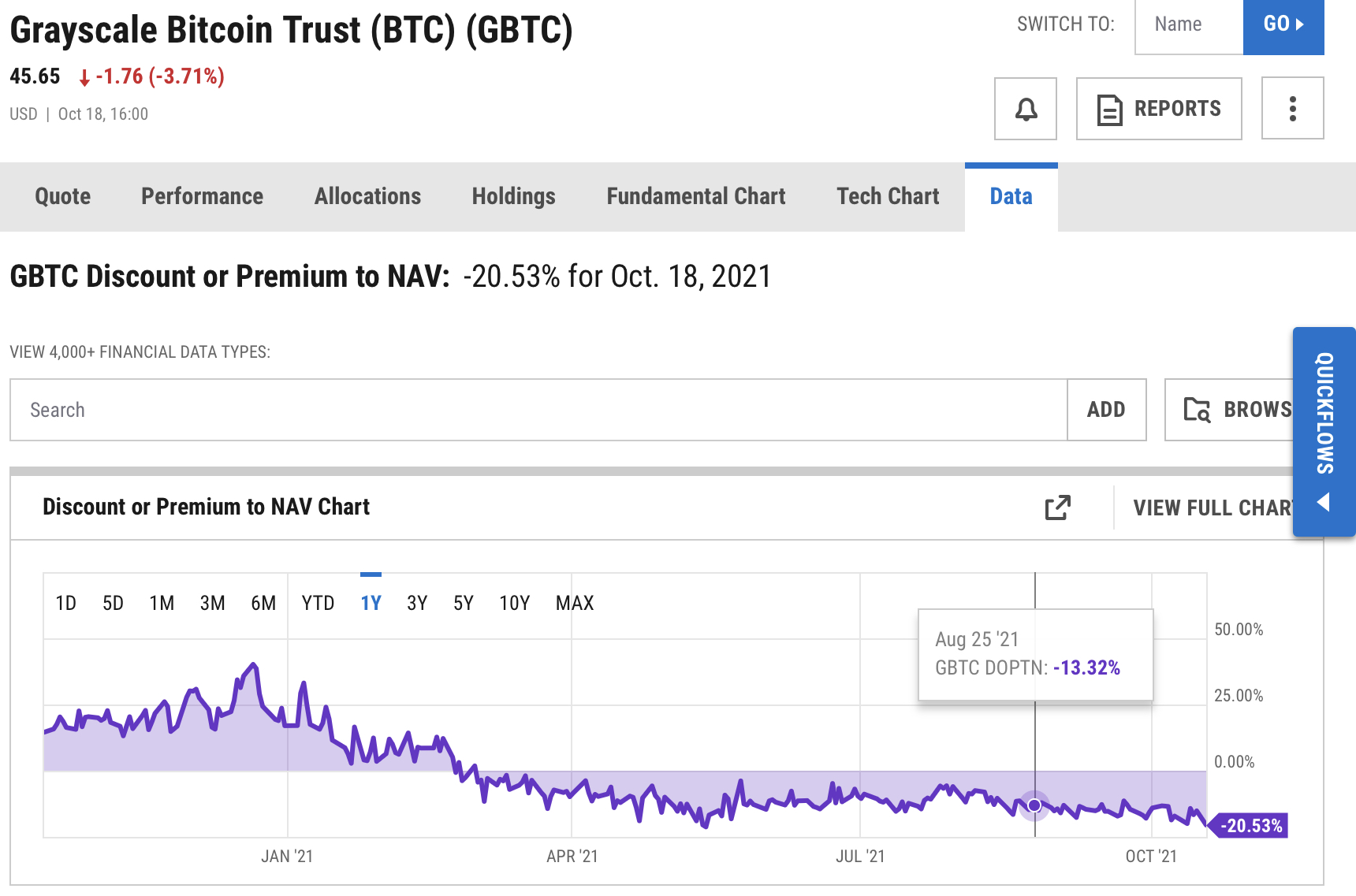

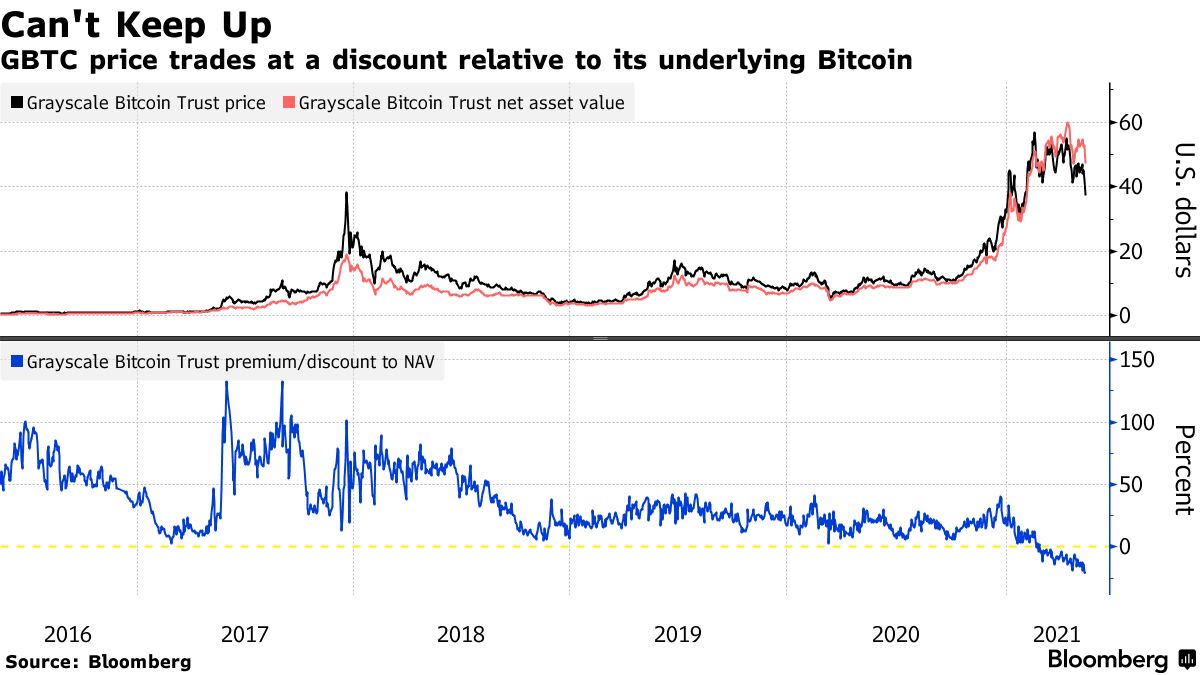

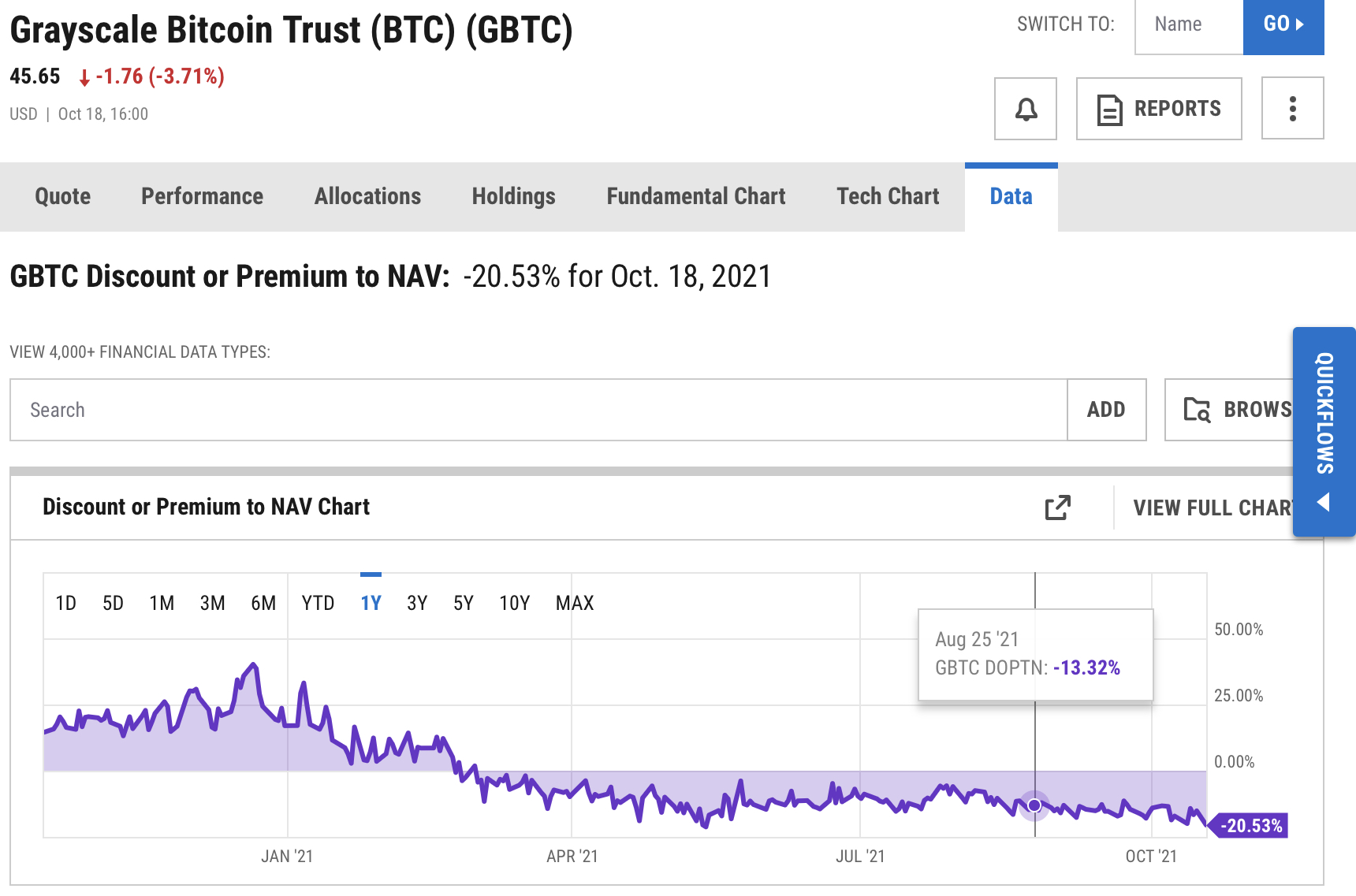

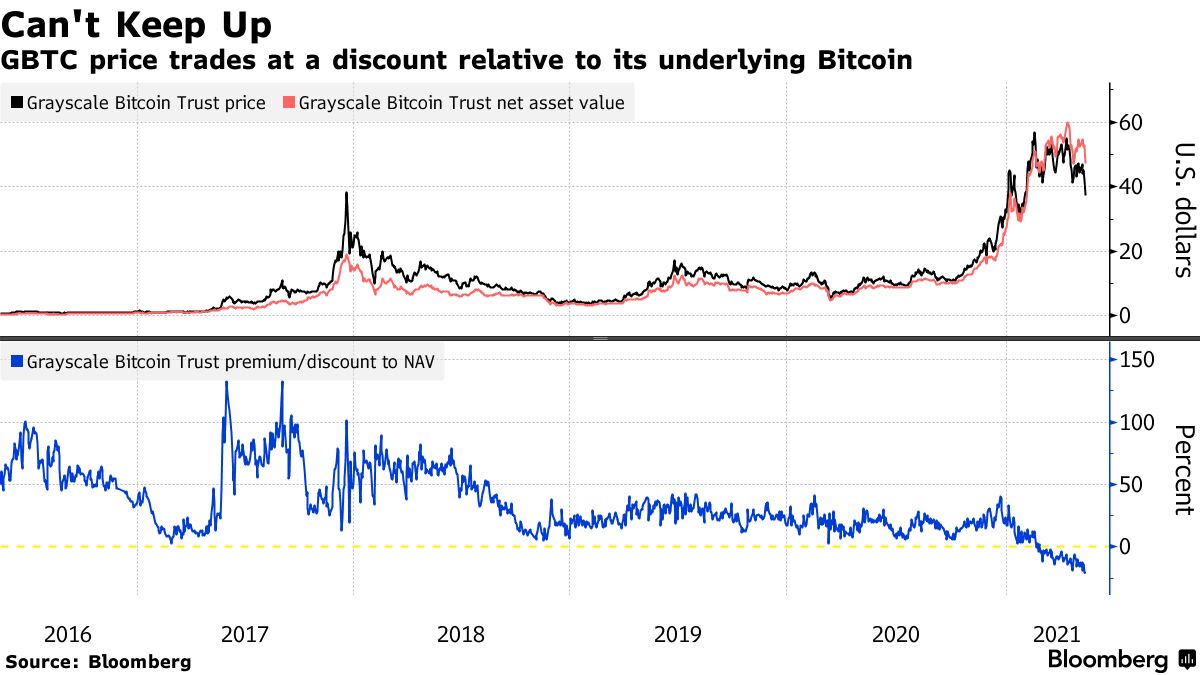

In the meantime GBTC finance.yahoo.com is selling at ~20% discount to NAV ycharts.com and this is not sustainable. Either BTC shall fall or GBTC shall rise.

bloomberg.com

Grayscale Wants to Turn the World’s Biggest Bitcoin Fund Into an ETF

Katherine Greifeld

October 19, 2021, 8:32 PM GMT+8

Grayscale Investments LLC and the New York Stock Exchange are filing as soon as Tuesday to convert the world’s biggest Bitcoin fund into an ETF, according to the asset manager.

The application to flip the $40 billion Grayscale Bitcoin Trust (ticker GBTC) will land on the same day as the ProShares Bitcoin Strategy ETF ( BITO) debuts, becoming the first exchange-traded fund in the U.S. investing in futures on the digital asset. While the Securities and Exchange Commission has allowed the derivatives-based product to launch, it has yet to permit the kind of structure used by Grayscale, which directly holds the largest cryptocurrency.

Grayscale’s filing will start a window for the SEC to reject or delay the GBTC conversion application. Michael Sonnenshein, the asset manager’s chief executive officer, has stated the firm is “ 100% committed” to turning GBTC into an ETF as soon as U.S. regulators allow.

Bloomberg

Grayscale hired a global ETF head in August to further those efforts. With BITO’s launch, physical Bitcoin ETF approval is likely only a matter of time, Sonnenshein said.

“We are of the firm belief that because the futures and the spot pricing for Bitcoin are inextricably tied, that we have the willingness to allow or clear the way for a Bitcoin futures ETF in the market, and also clear the way for a spot ETF,” Sonnenshein said in an interview. GBTC currently holds roughly 3.4% of the world’s supply of Bitcoin, according to Grayscale.

The conversion would likely solve a persistent problem for Grayscale: the trust’s discount to net asset value. The product’s price has traded below its underlying Bitcoin holdings for a prolonged period because shares in the vehicle can’t be destroyed in the same way as they can in an ETF.

Specialized traders known as authorized participants are able to create and redeem shares of an ETF to keep its price in line with its net asset value, but that process doesn’t exist for trusts like GBTC. The number of outstanding shares in the fund has ballooned over the past 12 months as Bitcoin soared.

Barry Silbert’s Digital Currency Group Inc. -- Grayscale’s parent company -- has scooped up hundreds of millions of dollars worth of GBTC in an attempt to reverse the dynamic.

Sent from my iPad |