Tesla: Incredible Progress Is Being Made But It's Still An Overvalued Car Company

Oct. 25, 2021 8:30 AM ET Tesla, Inc. (TSLA)

FWIW, Tesla went up 12% today to exceed $1 trillion in market cap after getting an order from Hertz for 100,000 electric vehicles, a contract worth $4.2 billion. However, Tesla is even more over-valued than the article Indicates, sporting a really nose-bleed valuation of a forward P/E of 175. Really unbelievable!

Summary

- Tesla has soared back to an $890.5 billion market cap and trades at an equity to market cap multiple of 31.25x and a FCF multiple of 346.9x.

- The entire team at Tesla deserves a tremendous amount of credit as they have built a fabulous company that is now generating billions in profits.

- Tesla the stock isn't being valued by any metrics that make sense and today investors are paying too much for their future growth which is dangerous.

- Volkswagen has a market cap that is $753.49 billion smaller than TSLA, yet they produce $27.23 billion in additional FCF, and their growth exceeds TSLA in revenue and net income.

Joe Raedle/Getty Images News

What's not to love about Tesla ( TSLA) except for the valuation?

I have been bearish on TSLA the stock, not TSLA the company. TSLA the stock is absolutely overvalued by every metric I see, yet its cult following will continue to buy more shares regardless of the price. TSLA, the company, is proving the naysayers wrong as their progress continues to defy estimates. In Q3 2021, TSLA booked record vehicle production levels and deliveries in their corporate history while generating $1.3 billion in free cash flow. TSLA has become extremely profitable as it posted $2 billion in GAAP operating income and $1.6 billion in GAAP net income. TSLA has achieved great margins with a 14.6% operating margin and a 30.5% automotive gross margin. TSLA's numbers can't be refuted as their revenue has jumped by $4.99 billion (57%) YoY in Q3 alone. TSLA's revenue continues to impress while their net income has sequentially grown QoQ and more impressively by 389% or $1.29 billion YoY in Q3 2021.

I read through the Q3 report, and I commend everything that TSLA has accomplished. As a company, TSLA is doing everything correctly and defying the odds. This company started from scratch, entered the ring against Ford ( F), General Motors ( GM), and all the other auto manufacturers, and is succeeding. My problem with TSLA is the valuation and how overvalued TSLA is. Many have argued that I don't understand growth, while others have argued that TSLA is more than an automotive company. I would challenge anyone who believes that I don't understand growth to read one of my recent articles on Amazon ( AMZN ). TSLA has a market cap of $861.42 billion, and the valuation is dangerous as it's valued as a mega-cap tech conglomerate while it's nothing more than an impressive automotive company.

(Source: Tesla)

What Tesla is doing right and why things are exciting

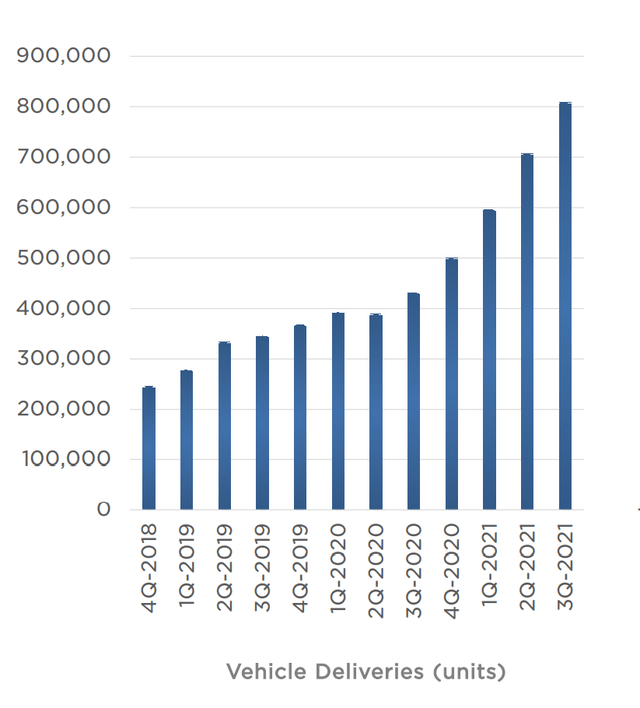

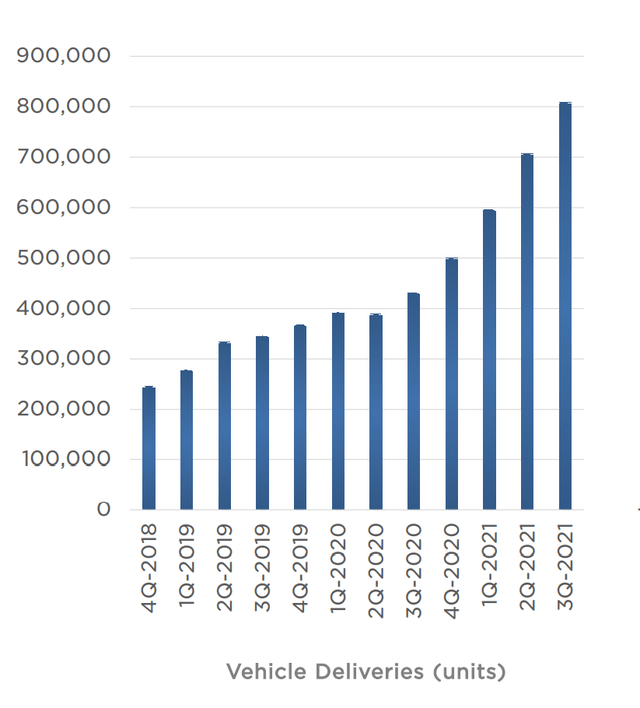

TSLA is manufacturing vehicles at a record pace, and their deliveries have increased sequentially, which has driven its financial growth. TSLA's total automotive production has increased by 92,787 (63.98%), and deliveries have increased by 101,798 vehicles (72.92%) YoY. TSLA's supercharger stations have increased by 1,073 (49.2%) YoY, and their supercharger connectors have grown by 9,844 (50.65%) YoY. No one can say TSLA isn't succeeding as there have been just over 800,000 vehicles delivered over the past twelve months. TSLA has a loyal following, and people are lining up to buy their vehicles. TSLA is scaling production to meet demand, and the demand is growing at an impressive rate. Looking at the trailing twelve months (TTM) over the past four quarters, TSLA's deliveries increased by roughly 17.65% in Q4 2020, 20% in Q1 2021, 16.67% in Q2 2021, and by 14.29% in Q3 2021. TSLA's deliveries have accelerated a great deal compared to 2019 and the majority of 2020. While on a percentage basis, growth is slowing, from a hard number perspective, TSLA has been increasing by roughly 100,000 vehicles for three consecutive quarters.

(Source: Tesla Q3 Report)

TSLA is planning on growing its manufacturing at an average growth rate to represent a 50% annual increase in vehicle deliveries. TSLA's target to build their first Model Y in Berlin and Austin remains on track for the end of 2021 as they work on the industrialization of the Cybertruck, which is planned for production in their Austin facility. Today TSLA's production capacity is roughly 1.05 million vehicles as the California plant can produce 600,000 vehicles and the Shanghai facility can exceed 450,000. Berlin and Texas have facilities under construction, and TSLA has four new products in development for the Cybertruck, Tesla Semi, Roadster, and Future Project.

TSLA is also making progress in its other business segments. During their AI day, TSLA announced that they started to expand their Full Self Driving (FSD) City Street Beta to an increased number of drivers. TSLA continues to make progress on its 4680 in-house cell project and is producing an increased amount of battery packs for testing. TSLA deployed 83 MW in Q3 of solar, which increased 46% YoY, while their solar roof deployments more than doubled. TSLA has also rolled out a telematics insurance product that will analyze a driver's data from several driving aspects and determine an insurance rate through TSLA's new insurance program.

You can't agree with success, and TSLA is succeeding. TSLA is producing and delivering a product that the consumer is demanding, and their vehicle sales continue to increase. TSLA is working on many other products and is in the early stages of a complete ecosystem, from the energy that powers your home to powering your vehicle and collecting insurance premiums. It's an interesting model and has tremendous future potential. The big difference when talking about ecosystems is TSLA's is expensive. I believe TSLA is going to need a base model that doesn't exceed $25,000 to really penetrate the automobile industry.

(Source: Tesla)

Tesla's success is exciting, but they are still an automotive manufacturer that is overvalued

I don't hate TSLA or growth companies; what I hate is paying too much for growth. TSLA is doing all the right things, their revenue, net income, and free cash flow are growing considerably, but at today's levels, investors are paying way too much for TSLA's future growth as a tremendous amount is priced in. A report came out the other day where Bernstein went on a fact-finding mission. Their firm determined that 99% of global car sales originated from traditional auto OEMs. Internal combustion engines accounted for 97%, while battery electric vehicles came in at 2%. The most interesting thing about the report was that the top 15 OEMs had a collective market cap of $1.2 trillion while the pure-play EV companies, with TSLA at the helm, had a collective market cap of $1.1 trillion, yet they sell 1% of all cars today.

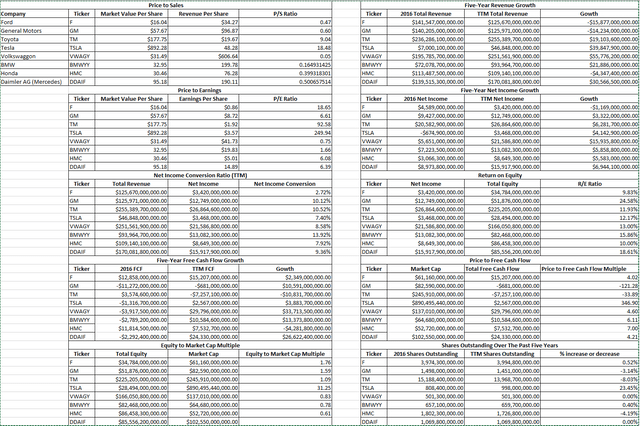

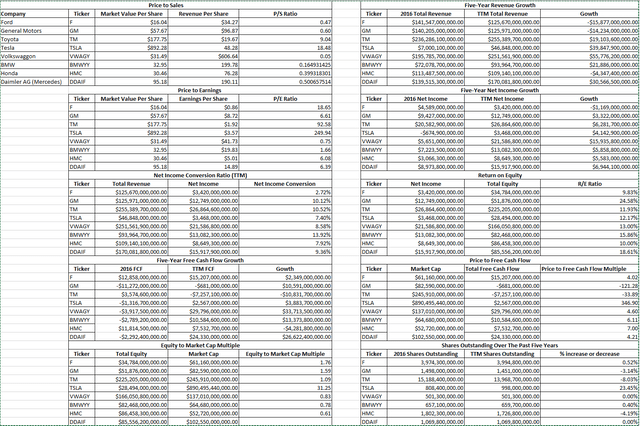

Currently, TSLA has a market cap of $890.5 billion while the combination of Ford ( F), General Motors ( GM), Toyota ( TM), Volkswagen ( OTCPK:VWAGY), BMW ( OTCPK:BMWYY), Honda ( HMC), and Daimler AG ( OTCPK:DDAIF) have a combined market cap of $746.62 billion. TSLA in the TTM has generated $46.85 billion in revenue, $3.47 billion in net income, and $2.57 billion in FCF, while the combined entity of F, GM, VWAGY, BMWYY, TM, HMC, and DDAIF generated $1.13 trillion in revenue, $102.27 billion in net income, and $79.51 billion in FCF. People who are investing in TSLA today are paying too much for their growth. It's perplexing, and the numbers don't make sense. By these numbers, TSLA would need to increase their revenue by $1.08 trillion (2,316%), net income by $98.8 billion (2,849%), and their FCF by $76.95 billion (2,997%) to equal what these companies are producing currently, yet TSLA's market cap is $143.88 billion larger than these companies combined. There is no justification for TSLA's market cap, and all of the innovative ways they are potentially going to generate revenue from aren't filling this void anytime soon. The premium on TSLA's growth is dangerous, and there isn't a single logical justification that has been made to support their market cap.

TSLA has a current P/S of 18.48 ($892.28 / $48.28 (revenue per share)) and a current EPS of 249.94 ($892.28 / $3.57). TSLA is in the middle of the pack as its net income conversion ratio is 7.4%. I know what the bulls are going to say, TSLA is growing more than everyone else, and I don't understand growth. I have a question, are they? I used many companies here, but let's look at just VWAGY for a one-to-one comparison. TSLA has increased its total revenue by $39.85 billion over the past five years and it's grown from $7 billion to $46.85 billion in the TTM. I admit that's incredible, but so is what VWAGY did. In the same period, VWAGY has increased its revenue by $55.78 billion as it went from $195.79 billion to $251.56 billion. Sure, TSLA has a much higher percentage from a percentage base, but VWAGY, as an established company, grew by more than $8.2 billion over the same period. The same goes for net income, as VWAGY saw its net income increase by $15.94 billion over the past five years while TSLA's increased by $4.14 billion. VWAGY has a 13% ROE ratio, while TSLA's is 12.17%. VWAGY saw its FCF increase by $33.71 billion in the last five years while TSLA's grew by $3.88 billion, yet VWAGY trades at a 4.6x price to FCF multiple while TSLA's multiple is 346.9x. Mr. Market has also placed a 0.83x value on VWAGY's equity regarding its market cap, while TSLA trades at 31.25x. The kicker is that TSLA has diluted shares as they have increased the amount of TSLA shares outstanding by 23.45%, and VWAGY has done all of this while keeping outstanding shares the same. TSLA's market cap is $753.49 billion larger than VWAGY, and if you think VWAGY is standing still in the EV market, they aren't. TSLA's valuation doesn't work, and it's not justifiable as an automotive company.

(Source: Steven Fiorillo) (Data Source: Seeking Alpha) (Source: Steven Fiorillo) (Data Source: Seeking Alpha)

Tesla's valuation isn't even in the realm of reality if you value them as a big tech company

TSLA is an automobile manufacturer, and they are not a technology company or a software company. Today 100% of TSLA's gross profit and 100% of their net income is generated from automotive sales and leasing. TSLA generated $3.67 billion in gross profit from total automotive revenue while they produced $3 million from Energy generation and storage and lost -$16 million from Services and other. There are no facts to support the claims of TSLA being much more than an automobile company. Sure, they have software packages and upgrades in the energy generation business, but their statement of operations clearly indicates that their automotive revenue funds 100% of their profits.

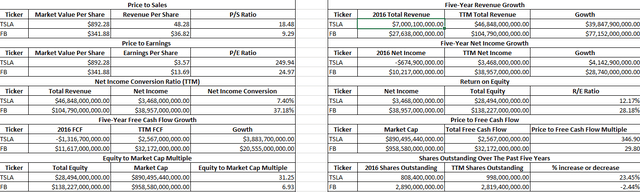

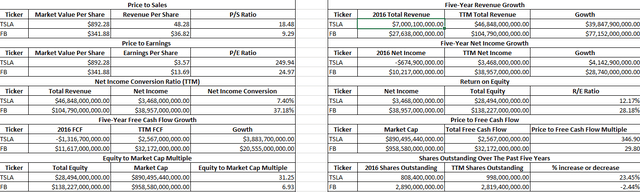

For everyone who wants to pretend TSLA is a software or technology company and use that as the reasoning why paying for TSLA's growth is justified, let's put TSLA up against a technology company that's similar in size. TSLA's market cap is $890.5 billion, and Facebook (NASDAQ: FB) has a market cap of $958.58 billion, so they are similar in size.

FB has a P/S of 9.29 and a P/E of 24.97 compared to TSLA's 18.48 P/S and 249.94 P/E. For those who think old-school valuations don't apply, I will overlook those. Over the past five years, TSLA has generated $39.85 billion in revenue growth and, in the TTM, has produced $46.85 billion in revenue. All of the TSLA bulls swear by their growth, and this is the premise of the valuation. FB has generated $104.79 billion in revenue over the TTM and has grown its revenue by $77.15 billion in the last five years. FB's revenue has increased over the last five years by 39.3% more revenue than what TSLA produces. Companies go into business to generate a profit, so net income and FCF are very important. In the last five years, TSLA has increased its net income by $4.14 billion and, in the TTM, has generated $3.47 billion in net income. FB has produced more than 10x TSLA's net income in the TTM as they have generated $38.96 billion in net income. FB has also increased its net income by $28.74 billion over the past five years. When it comes to FCF, TSLA generates $2.57 billion in FCF while FB produces $32.17 billion. FB has increased its FCF by $20.56 billion over the past five years, while TSLA has increased its FCF by $3.88 billion. TSLA converts 7.4% of its revenue to net income, while FB's net income conversion rate is 37.18%. TSLA has an ROE of 12.17%, while FB's is 28.18%.

FB has better ratios and their growth is more impressive than TSLA's, yet the market is placing much larger multiples on TSLA. Mr. Market has placed a 31.25x multiple on TSLA's equity relative to market cap while FB's is 6.93x. The FCF multiple is even crazier as the market has placed a 346.9x multiple on TSLA's FCF and 29.8x on FB's FCF. TSLA also has diluted their shareholders by 23.45% over the past five years, while FB has bought back 2.44% of their outstanding shares.

There is not a single category that TSLA had a better metric or resulted in compared to FB. TSLA isn't even valued as a tech company considering it has a 346.9x FCF multiple than FB's 29.8x. While FB generates 12.53x the FCF that TSLA generates and has grown its FCF by an additional 529% in the last five years. TSLA is on a gigantic hype train, and the valuation doesn't make sense as a tech company, and it sure doesn't make sense as an automobile manufacturer.

(Source: Steven Fiorillo) (Data Source: Seeking Alpha) (Source: Steven Fiorillo) (Data Source: Seeking Alpha)

Conclusion: Tesla is a great company but its stock is overhyped and dangerous

At some point, numbers will matter, and people will ultimately realize there is such a thing as paying too much for growth. Today is different than the tech bubble of 2000 as companies like TSLA are generating tens of billions in revenue and billions in actual profits, but the valuations of companies such as TSLA are overinflated. The idea of operating a business is to make money, and the almighty dollar doesn't care if you're a tech company, a transportation company, or a restaurant. $1 of revenue will always equal $1 of revenue, and the same goes for net income and FCF. VWAGY has a market cap of $137.01 billion and decimates TSLA on the numbers. VWAGY trades at an FCF multiple of 4.6x while its revenue, net income, and FCF growth exceed TSLA's. When comparing TSLA to FB, an actual technology company, it isn't even in the same league, and it's almost comparing single-A ball to the Major Leagues. TSLA is a great company; they are doing all the right things and building an incredible ecosystem. They have a cult following that drives demand for its products, and what they have accomplished is remarkable. This doesn't change the fact that TSLA is one of the most overhyped stocks in the market, and the valuation is ridiculous.

As Paul Gabrail from Everything Money loves to point out, look at Cisco ( CSCO) and Intel ( INTC). These were two of the largest companies in the world during the dot com era. They both generated billions in revenue and billions in net income. Neither of these companies has traded near their all-time highs in the last two decades because their stocks got overinflated during the dot com bubble. In 2000 CSCO generated $18.93 billion in revenue and $2.67 billion in net income. This increased to $49.82 billion of revenue and $10.59 billion of net income in the TTM, yet shares of CSCO are still significantly lower than where they traded in 2000. INTC has the same story. There is such a thing as paying too much for growth, and sometimes good companies get overinflated, and it can take decades to grow into the previous valuation. I think TSLA is a fantastic company, but its stock is tremendously overvalued. Not only are their metrics not best in class for automotive companies, but they are also continuously diluting shareholders. If anyone wants to try to convince me otherwise, I am happy to engage in conversation, but please provide facts for me to read and evaluate.

This article was written by

Steven Fiorillo

seekingalpha.com |