NFGC Crap. I missed it... (maybe?) huge buying opportunity today in NFGC... down as low as $5.53... as they put out news... which largely failed in presenting a proper text based description, one that investors might understand, properly illuminating the impact of an issue they found in variations between assays reported and the QC / QA duplicates...

Here's the news:

New Found Provides Update on Its QA/QC Program and Announces Collaboration with MSALABS to Utilize Chrysos PhotonAssayTM Methods for Its Queensway Project

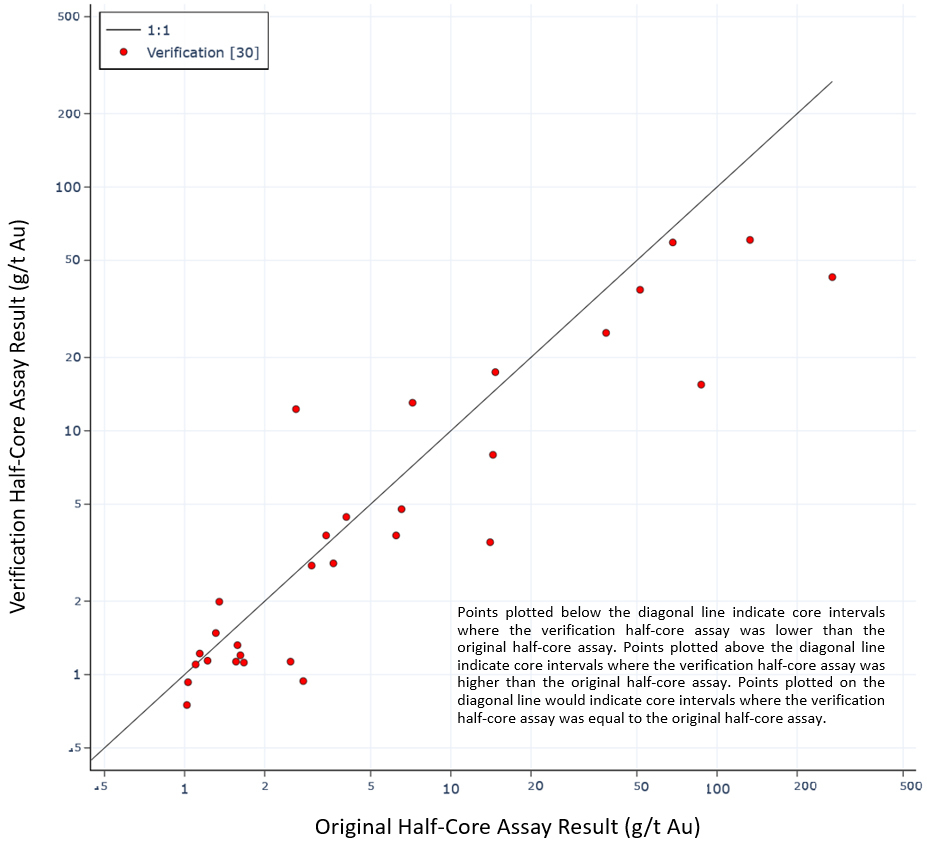

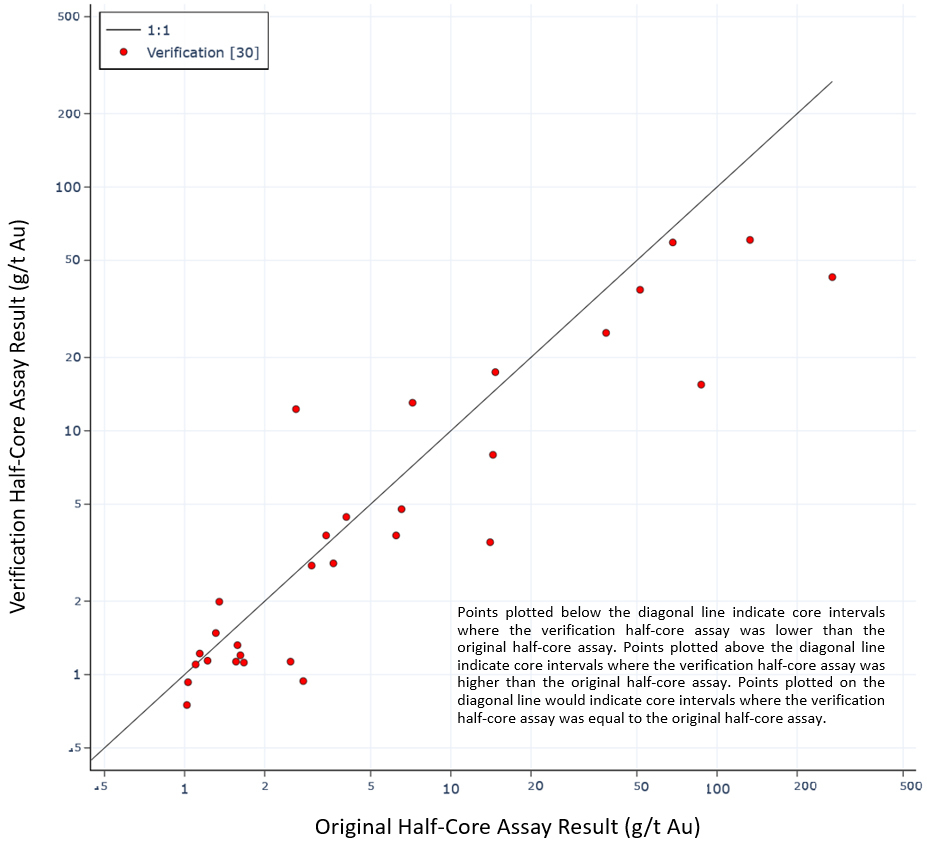

The key element of which is this graph (below)... showing the impact of "nugget effect" bias in some assays. The outlier on the high (right) end of the scale shows one assay of ~ 300 g/ton (lower scale) that had the half core duplicate assay as something like 43 g/ton (left scale)... (continued below the graph)

The impact that has, in that instance, is to over-report the grade in that instance...

But, the impact is highly unlikely to be nearly as dire as some might suggest it must be... with NFGC apparently over-reporting some values as ten times higher than they may be...

That isn't due to the counter error, in which the outlier in the opposite shows an assay of around 3 grams per ton that had the other half of the core assay out at around 13 grams per ton... but is more about the nature of the drivers of such a bias occurring... and the relationship between reports of those high grade samples that might be over-stated due to that bias... and the statistical impact that has in relation to averaging values in the modeling of an ore body... where the very high grades already rapidly smear out into the mass of the many more reports of values that don't have much interest in respect of high values in visible gold.

The percentage of samples that are "high grade outliers" likely to serve as attractors of the bias is still going to be fairly small relative to the whole number of cores assayed...

The innate tendency of investors will be to read the above instances, wrongly, as saying 43 grams per ton was reported as 300 grams per ton, and 13 grams per ton was reported as 3...

Instead what it does say is that half of one core had 300 grams while the other half had 43... and half of one core was 3 grams while the other half was 13 grams per ton. The error in the average of what was reported in those few cores is likely the difference between 300 g/ton... and 171 g/ton... or 3 g/ton and 8 g/ton... a factor of around 2... versus the factor of 5 or 10 it might appear to be at first glance...

The likely origin of the bias seems obvious enough....

A big nugget apparent on the surface of one core... explains that easily enough. You've seen the pictures of them with the visible gold circled with a marker... so, they're noted, and left apparent before the core is split... with those splitting the cores influenced by seeing them.

But, if that's what it is... you shouldn't see the same bias occurring in cores that have nuggets inside of them... when that gold isn't apparent on the surface of the core ? Nor should you see it influence the bulk of cores being assayed that have lower grades or a more uniform distribution in more disseminated and less visible gold, etc. Those that are too boring to be noteworthy relative to those that are noteworthy... shouldn't see the bias resulting from being noted... and that should still be the large majority of cores reported... so that the bias that does exist... influences a fairly small percentage of the whole number of cores.

Compute the number of "high grade" outliers reported... versus the statistical average number of cores incorporated into the modeling of an ore body unit... and the impact should exist mostly inside of that smaller percentage of cores that are significant enough outliers that the bias effect observed comes into play...

Otherwise, investors tend to respond in disproportion to eye-popping reports of high grade... when the reality in the value of the deposit is far more dependent on the ubiquity of value distributed throughout each of the units of the ore bodies being defined... as held against the costs of accessing and producing each unit cell represented in the model.

NFGC is still early enough in the exploration effort... that most investors haven't shifted focus from value seen as "grade" in the reports of results in drill core... to a far better view of value as seen in modeling of ore bodies... showing you "value" in the volumes of gold present... versus the less useful but "shinier lure" seen in high grade portions in sample or a drill core... The real value still depending both on the volume in gold that's there... and what it costs to produce it... not the highlights reported in the fewer high grade intersections.

Still really early in the exploration effort, much less in the definition of the volume of gold present in the ores at Queen's Way...

And, they appear to still be focusing more on expanding the effort in drilling that is targeting "nearer surface" ores in a multiplicity of locations... more than they are focused on drilling deeper in the known locations... where it is reasonable to expect not only continuity, but a trend into higher grades at depth...

It looks like they've identified a proper approach to defining the nature and origin of the bias shown... and already have determined a more than adequate solution to solve the problem that's been identified.

What I don't see in the news they've released... is any effort like that I've addressed... to try to define that probable impact of the effect they've seen...

As they've not yet reported any resource estimates... there's no resulting impact in altering them...

But, that leaves more uncertainty in the impact, even in relation to the percentage of holes impacted... and the impact in relation to the holes it does impact... versus a statistically meaningful read on the impact of the issue on the aggregate.

Timing issues... in the time it will take to implement efforts to provide a higher resolution view of the problem... and in the time it will take to implement the solution with new technology being applied to obviate the future risk from those errors that are now exposed... as in the time it might take to re-define prior results reported already in light of the observation...

Cost issues too... in having to do the work to define the extent of the problem and its probable impact... and perhaps in having to re-accomplish a fair amount of assay work already done...

And, maybe, the event might drive some shift in focus... to slow things down a bit in order to better avoid tripping on your own shoelaces, again ? And, as part of that... perhaps shift a bit of effort from "more, faster, looking from the surface to shallow depths"... to "more, at depth" better defining the extent of structure and the impact of structural controls at depth, along with the correlation of grade with structural controls at depth... to prove the deposit being defined correlates well with the model as a "mega epizonal" deposit... with grades that increase with depth. |