Worthy of note: Prior to the gold miners bottoming on Sept 29th, Newfie stocks as a group had been outperforming gold mining stocks in general... and, they appeared set to sustain that trend into the reversal higher, with NFGC leading the way... prior to the last week in October when it suddenly reversed sharply lower... that well before "the news" that took it back down hard in the first week of November.

Since then, Newfie stocks as a group have been lagging the performance of the gold miners as a group... perhaps as is made apparent in the weekly RRG...

While NFGC itself suffered the most obvious direct impact in the reversal in its chart... many others in the camp that have tended to lag NFGC anyway... have essentially been rendered into non-participants in the current rally in the gold mining stocks by virtue of the fallout. NFGC has clearly lost momentum that likely would have had it back at its prior highs, by now... with the chart showing distribution versus accumulation, and, note, the NVI lost its upward vector in early September and has not regained it...

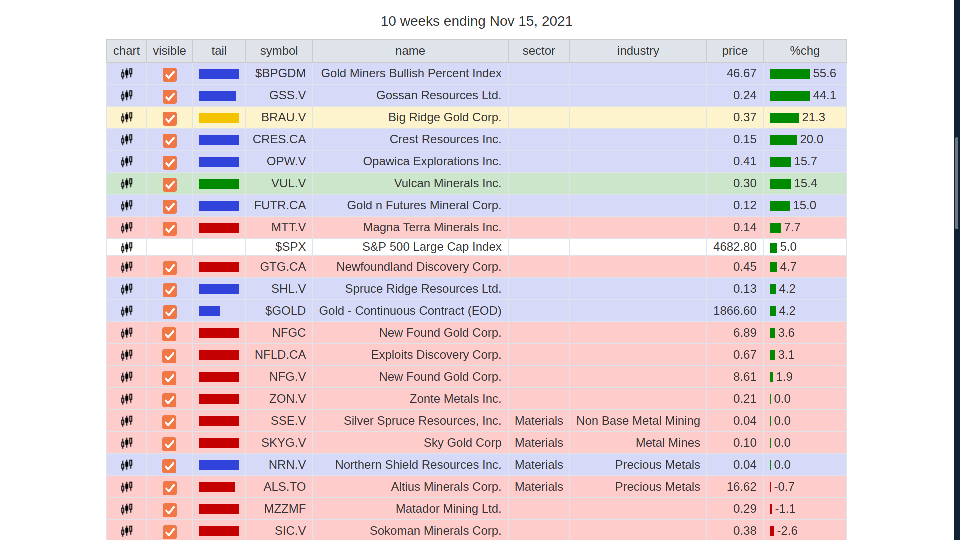

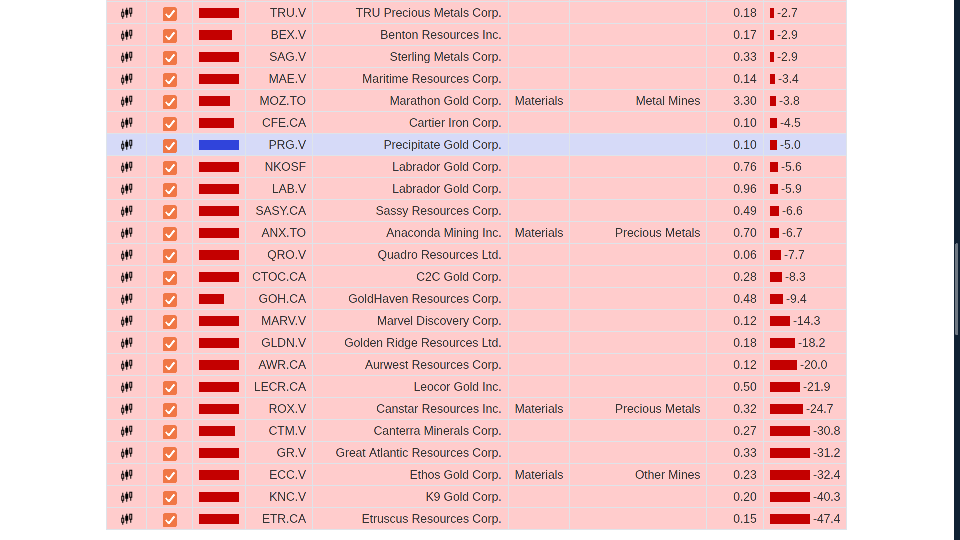

The recent price performance of Newfies on the weekly is not overly inspiring... unless, of course, you're viewing the lagging performance as "sustaining the opportunity" for the time it takes NFGC to get things set to rights. And, that might well prove to be the case... that it all comes out in the wash over time... although its also true that the 10 week view does still tend to mask the recent performances relative to a well timed trade at the bottom on Sept 29 or early October... [or November 8th for the Queensway related issues that were most impacted]... which timing in a trade shouldn't have been too hard to manage by watching the RRG versus the bellwether performance of the Gold Miners Bullish Percentage Index ?

Perhaps worth noting those that appear they are following the BPGDM performance path more closely: SKYG.V, TRU.V and NFLD.V as perhaps they're showing they're better prepared for out-performance in the near term, as they follow the miners index into the blue "improving" phase in the rotation as outliers... both in riding the rails on the outside of the rotation with the BPGDM, and in crossing the line ahead of peers...

|