NVIDIA's Autonomous Vehicle Opportunity

Dec. 22, 2021

Michael McGrath

Summary

NVIDIA is investing heavily in an advanced computing platform for autonomous driving.NVIDIA's platform strategy leverages its advanced computing technology and provides a complete solution.Its strategy could provide significant competitive advantages, enabling it to gain substantial market share in a rapidly emerging market.With an estimated design win pipeline of $8 billion, NVIDIA should be able to achieve $2-$3 billion in annual AV revenue by 2025 or 2026.From that point, it will have leadership position in what is expected to be a very rapidly growing market.

Jae Young Ju/iStock via Getty Images

NVIDIA ( NVDA) is a computing platform company that pioneers accelerated computing to solve the most challenging computational problems. It provides computing platform solutions to four broad markets: Gaming ($3.2B in Q3/22), Data Center ($3B in Q3/22), Professional Visualization ($577M in Q3/22), and Auto ($135M in Q3/22). Auto is a developing market for NVIDIA, currently from by infotainment and AI Cockpit. Future growth will be driven mainly by autonomous vehicle (AV) solutions, offering a complete hardware & software stack.

NVIDIA is investing heavily in developing its AV computing platform. Based on LinkedIn estimates, it probably has a couple of thousand scientists, engineers, and developers working on the platform. NVIDIA has an excellent platform strategy that leverages its underlying computing technologies to create a comprehensive advanced hardware and software platform for autonomous vehicles. Its objective is to sell this platform, or significant portions of it, to AV manufacturers as part of every AV they make.

Design wins are critical in a market where the product is included in a customer's final product. NVIDIA estimates $8B in its design win pipeline from autonomous driving, software-defined cars, and AI cockpits.

The AV market is key to NVIDIA's continued growth, so let's look at it more closely, starting with an overview of its AV platform -- NVIDIA DRIVE.

NVIDIA DRIVE

NVIDIA DRIVE is a family of products for autonomous vehicles that covers everything from the computer in the vehicle, collecting data from sensors, calibrating and synchronizing the data, to sending it to the cloud for building models for perception, mapping, planning, and control. DRIVE Hyperion is the in-car solution, including a vehicle architecture that includes sensors, DRIVE AGX for computing, and software. Core to the platform is NVIDIA's computing power. The software in its solution is extensive. The DRIVE sim platform now runs on Constellation based on Omniverse.

Drive Hyperion

The center of its strategy is Hyperion 8, a production-ready platform for autonomous vehicles, including computer architecture, sensor suite, and software. This AV reference architecture accelerates development, testing, and validation by integrating DRIVE computers with a complete sensor suite that includes 12 exterior cameras, three interior cameras, nine radars, 12 ultrasonics, and lidar. DRIVE Hyperion features a comprehensive software stack for autonomous driving (DRIVE AV), driver monitoring, and visualization (DRIVE IX), which can be updated over the air, adding new features and capabilities throughout the vehicle's life. The platform is modular so that developers can take and choose what they need.

The platform is easily upgradeable. Customers could start with a Xavier computer and then upgrade to another version, making it easy to transition from generation to generation. The form factor for the Xavier is the same as the Orin, so they are Hyperion compatible. Atlan will be compatible also.

NVIDIA Computing Power

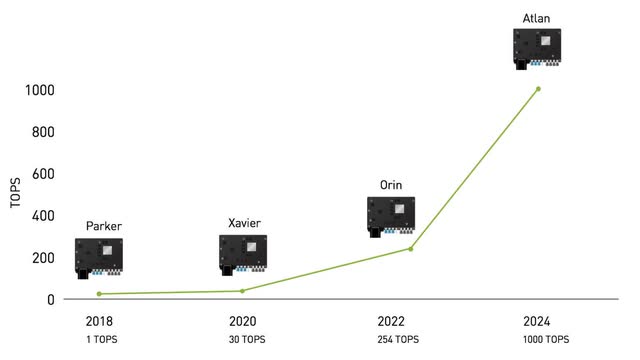

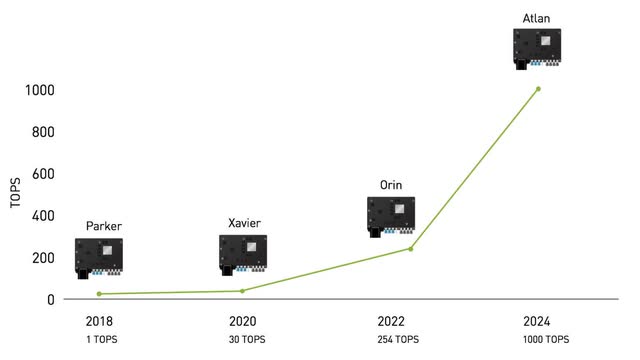

Autonomous vehicles require incredible computing power to process vast amounts of information from many sensors, interpret the data, align with detailed HD Maps, and determine the immediate route to take. TOPS (Trillions of Operations Per Second) is the current measure of computer power. Many people are now beginning to claim that TOPS is the new Horsepower for software-defined vehicles. In any case, TOPS is becoming a very critical factor in autonomous vehicles.

As is seen in this chart from NVIDIA, it has a very aggressive roadmap to introduce new specially designed computers with increasing power. Xavier is available now with 30 TOPS. Orin will be available in 2022 with a significant increase to 254 TOPS, and Atlan will exceed 1,000 TOPS by 2024.

Is TOPS the New Horsepower?

Source: NVIDIA

NVIDIA Xavier

This early system was designed for Level 2+ advanced driver assistance systems and Level 3 automated driving, delivering 30 trillion operations per second. At its core is the auto-grade Xavier SoC, the first of its kind in production. It incorporates six different processors for running redundant and diverse algorithms for AI, sensor processing, mapping, and driving.

The Xpeng P7 is one of the first EVs powered by the DRIVE AGX platform, which features Nvidia's high-performance, energy-efficient Xavier system-on-a-chip (SoC). It powers the Xpeng's autonomous driving system it calls XPILOT.

NVIDIA DRIVE AGX Pegasus

Pegasus uses the power of two NVIDIA Xavier SoCs and two Turing GPUs to achieve 320 TOPS supercomputing capability. The platform is designed and built for autonomous vehicles, including Level 4 highly automated driving and autonomous ride services vehicles.

Drive PX Pegasus packs in four AI processors, including two of Nvidia's latest generation Xavier system-on-a-chip models with embedded Nvidia Volta GPUs, with two next-generation discrete GPUs explicitly designed to help accelerate deep learning and computer vision. The system's overall size is roughly that of a license plate, and it dramatically reduces energy consumption and overall cost.

NVIDIA DRIVE Orin

In April 2021, NVIDIA announced the NVIDIA DRIVE Orin high-performance AI platform to power autonomous vehicles. NVIDIA DRIVE Orin™ SoC (system-on-a-chip) delivers 254 TOPS (trillion operations per second) and is the central computer for intelligent vehicles. The scalable DRIVE Orin product family lets developers build, scale, and leverage one development investment across an entire fleet, from Level 2+ systems to Level 5 fully autonomous vehicles.

The NVIDIA DRIVE AGX Orin chip can perform more than 254 trillion operations per second, almost seven times as many as NVIDIA's previous Xavier chip (30 trillion operations) and more than Tesla's FSD Computer (144 trillion).

NIO announced a new vehicle that will use 4 Orins with production starting in 2022.

NVIDIA DRIVE Atlan

NVIDIA's next-generation SoC NVIDIA DRIVE will be the Atlan, which it claims will be a data center on wheels, complete with data center technologies performance, safety, and security. Atlan will achieve 1,000 TOPS of computing performance, the basis for a safe and secure autonomous vehicle development platform in the future. The expected availability is 2024, and it will be compatible with the DRIVE Hyperion platform.

NVIDIA DRIVE Autonomous Software

In addition to its hardware platform, NVIDIA offers a suite of autonomous driving software. This helps AV developers and incents them to use the Hyperion platform.

DRIVE OS

The foundation of the DRIVE Software stack, DRIVE OS is the operating system for accelerated computing. It includes sensor input processing, libraries for efficient parallel computing implementations, real-time AI inference, and developer tools and modules to access hardware engines.

DriveWorks

The NVIDIA DriveWorks software development kit provides middleware functions of DRIVE OS that are fundamental to autonomous vehicle development. These include sensor abstraction and sensor plugins, a data recorder, vehicle I/O support, and a deep neural network framework. It's modular, open, and designed to comply with automotive industry software standards.

DRIVE AV

The DRIVE AV software stack contains the perception, mapping, and planning layers. These are used for autonomous driving and mapping. In the planning and control layer, the NVIDIA Safety Force Field computational module keeps a vehicle out of harm's way.

DRIVE Chauffer

Nvidia's Drive Chauffeur is the company's AI-assisted driving platform. It uses the sensors from Hyperion 8 and allows vehicles to drive from address to address on their own in highways and urban environments. In addition to driving itself, Chauffeur can act as a high-end emergency intervention system for those who'd still rather drive on their own.

DRIVE IX

DRIVE IX is an open software platform that delivers interior sensing for innovative AI cockpit solutions. It provides perception, applications to access features for advanced driver and occupant monitoring, AR/VR visualization, and natural language interactions between the vehicle and passengers.

DRIVE Concierge

DRIVE Concierge is built on NVIDIA DRIVE IX and the Omniverse Avatar for real-time conversational AI. It gives vehicle occupants access to new, always-on intelligent services. Omniverse Avatar enables DRIVE Concierge to serve as everyone's digital assistant, making recommendations, helping book reservations, making phone calls, accessing vehicle controls, and providing alerts using natural language. DRIVE Concierge also provides a dashboard view of what the DRIVE Chauffeur sees around the car and its planning. Plus, it serves as a valet, automatically parking and summoning the car.

NVIDIA DRIVE Sim

NVIDIA DRIVE Sim is an end-to-end simulation platform architected from the ground up to run large-scale, physically accurate multi-sensor simulation. It's open, scalable, modular, and supports AV development and validation. The next generation of DRIVE Sim is based on NVIDIA's new Omniverse technology.

It creates a virtual world using its Omniverse technology to help train AI models on potential driving situations that would otherwise require a lot of physical human resources. The idea is to help AI models that could eventually be used to help autonomous vehicles better understand how to drive through various scenarios.

Omniverse obeys the laws of physics. It can simulate particles, fluids, materials, springs, and cables-making it perfect for training robots, designing products, or creating digital twins of buildings, factories, and even cities.

NVIDIA Omniverse is the confluence of almost every core technology developed by NVIDIA. And DRIVE Sim takes advantage of the company's expertise in graphics, high-performance computing, AI, and hardware design. Combining these capabilities provides a perfect technology platform for autonomous vehicle simulation.

Customers

Design wins are the key for NVIDIA and others since this determines the eventual sales volume to companies manufacturing the AVs. Some AV companies develop their computer systems instead of using NVIDIA or others. While this gives them more control over the entire AV platform, it may be a limiting strategy. They may not keep advancing the technology and making the investments that NVIDIA makes and could fall behind on this critical AV technology.

NVIDIA claims to have more than $8 billion worth of business in its pipeline from design wins. Although these are only estimates, it is pretty impressive at this early stage. Additionally, it has a broad base of customers across the full range of AV markets.

Autonomous Ride Service Companies

Autonomous ride services will be one of the early markets for AVs, and NVIDIA has several significant customers, including:

Cruise is the most critical customer in this group, and it expects to build tens of thousands of its new AVs in 2023. Notably missing in this group are Waymo and Agro, both using their own computer systems, at least for the initial launch.

Autonomous Trucking Companies

NVIDIA has design wins at many of the autonomous trucking companies, including:

Auto Companies

NVIDIA systems are also built into the autonomous versions of several auto manufacturers, including:

Mercedes and NVIDIA have a broad partnership with a shared revenue business model. The first five companies listed are aggressive EV startups. In 2018, Tesla changed from using a version of NVIDIA's computing system to its own.

Potential Revenue Impact

NVIDIA's AV strategy is very strong. It is leveraging its advanced technology. It is building a complete platform solution. It is investing much more than others. Obviously, the company sees a very significant opportunity in this market. It should capture a significant market share. Some AV companies developing their own computers will need to rethink their make vs. buy strategies, since they may not be able to keep up with internal investment in technology. NVIDIA should also be able to charge a premium price for their systems.

AV can be a significant new market for NVIDIA that will drive continued revenue growth. The open question is how much revenue will this generate over the next five years or so? Revenue projections require assumptions of the market size, NVIDIA's market share, and the average selling price of the DRIVE platform.

The company estimates a pipeline from design wins of $8 billion. Although the timeframe for this is not disclosed, if it occurs over the next 3-5 years, it could create approximately $2 billion per year in incremental revenue in that period.

Autonomous Vehicles: Opportunities, Strategies, and Disruptions estimates about 500,000 new AVs annually in the US by 2025 or 2026, and twice as many worldwide. The US estimate is based on approximately 200,000 autonomous ride services AVs, 150,000 autonomous trucks, and 150,000 autonomous delivery vehicles. From 2026 to 2030, the market could increase significantly to 4-6 million AVs per year.

NVIDIA doesn't disclose DRIVE pricing, but some estimates are necessary to forecast potential revenue. For example, $5,000 per AV and a 50% market share would equate to $2.5 billion in AV revenue for NVIDIA, consistent with its estimated $8 billion pipeline. With the computer replacing the engine in the software-defined future vehicle, premium pricing may be possible. Based on the estimates for 2026-2030 and price and market share assumptions, NVIDIA's revenue opportunity could be $10-$15 billion per year.

This article was written by

Michael McGrath

Author of Autonomous Vehicles: Opportunities, Strategies, and Disruptions. Michael E. McGrath is a proven expert on the strategies of technology-based companies. He has researched autonomous vehicles for the last 3 years, leading to the original publication of this book, as well as the recently expanded and updated second edition. He is a founder of PRTM, the leading management consulting firm to technology companies, former CEO of i2Technologies and experienced board member, serving on four public company boards, as well as several venture capital-funded companies. In addition to Autonomous Vehicles, he is the author of Product Strategy for High-Technology Companies, which has been used by many technology-based companies to guide their strategies.

seekingalpha.com |