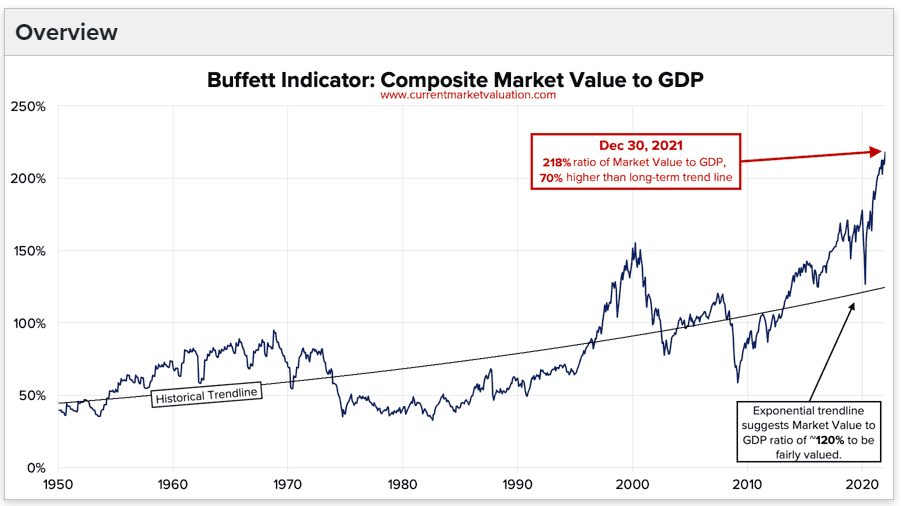

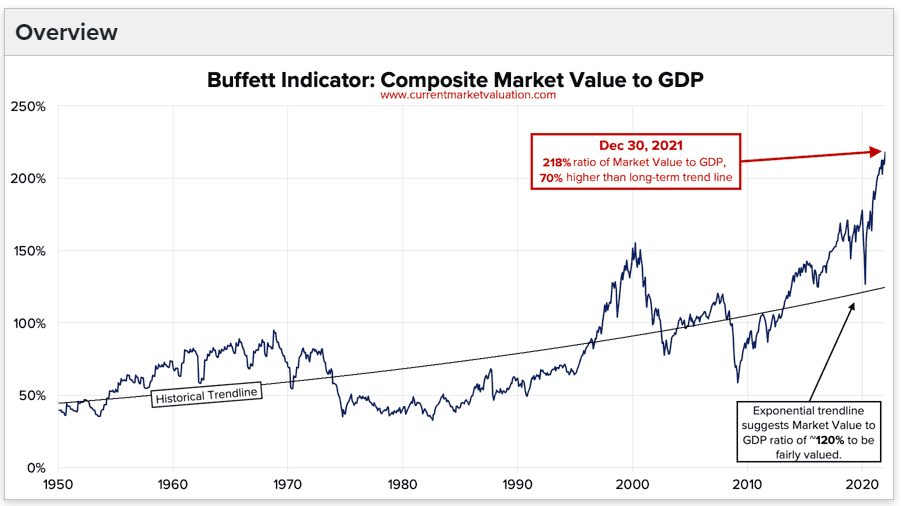

Buffet indicator, ratio of total value of stock market to GDP, is sky high (70-80% above historical trend line), indicating severe overvaluation, a point repeatedly made by Pomboy.

Sooner or later, probably sooner given the lengthy time the stock market has been overvalued, it is going to hit the fan, big time.

Some might say that historically low interest rates have artificially affected the stock market valuation. IMO 70% is simply too high, internet bubble high. There is no way that low interest rates account for more than 20% of the overvaluation. And they are trending up.

Plus, stock buybacks have disguised statistics, making earnings per share look good, while (as Pomboy suggests) it is more credible to look at earnings in terms of units sold, or profit/earnings per unit sold, or some other metric that doesn't take into account per share numbers. Substantial stock buybacks have masked deteriorating earnings because, obviously, the fewer shares on the market, the higher per share earnings tend to be. Per unit metrics ignore that "per share" tomfoolery. She also noted how insiders at the corporations engaging in buybacks are selling their shares. They know.

Her comments on China were very interesting. She surmises/speculates that the next global credit crisis is likely to come out of the Chinese real estate market, though I saw some news last week indicating that the PBC was loosening, rather than letting the chips fall where they may. So, perhaps the PBC has been infected by the DCQE virus. We'll see. A data point very much worth watching.

Interesting that she mentioned a factoid that made my head swivel - the junkiest of junk bonds are paying 4%, and are losing ground to inflation.

She suggests gold and commodities, particularly oil. I agree.

Batten down the hatches.

|