SARK soars and ARKK capsizes as the Nasdaq sells off

Jan. 21, 2022 9:36 AM ET Collaborative Investment Series Trust - Tuttle Capital Short Innovation ETF (SARK), ARKK, COMP.IND TDOC, ZM, DOCU, AAPL, MSFT, GOOG By: Jason Capul, SA News Editor 49 Comments

MicroStockHub/iStock via Getty Images MicroStockHub/iStock via Getty Images

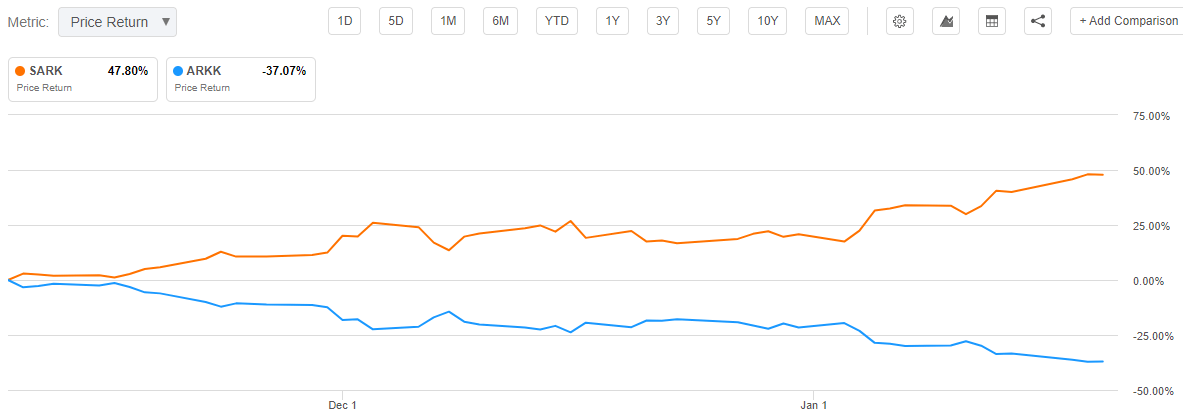

The Tuttle Capital Short Innovation ETF (NASDAQ: SARK) is an actively managed ETF that provides the investment community with a contrarian viewpoint to the popular ARK Innovation ETF (NYSEARCA: ARKK). SARK is +51.8% since its debut and also +24.4% in 2022, while ARKK is -20.9% YTD.

SARK aims to achieve a -1X inverse return of ARKK for a single day and not for any other period. Moreover, the two exchange traded funds have experienced a 45.3% performance differential so far this year. See below the return comparisons between SARK and ARKK since SARK’s inception back on Nov 9:

Seeking Alpha spoke with Matthew Tuttle, CEO and CIO of Tuttle Capital Management, in an exclusive interview and asked, being that the Nasdaq ( COMP.IND) has dipped into correction territory, what implications does that have for SARK and ARKK moving forward.

Tuttle explained that he believes we have not bottomed out and markets can continue to see selling pressures, stating: “My thought is that we got more room to go, and it could be a good amount.”

He also added: “There’s a massive difference between unprofitable tech and profitable tech. So, you’re talking about Teledoc Health (NYSE: TDOC), Zoom Video Communications (NASDAQ: ZM), and DocuSign (NASDAQ: DOCU) versus Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Google (NASDAQ: GOOG).”

Yes, the Nasdaq is selling off, but “you will only see so much” selling regarding profitable tech names, Tuttle stated.

SARK is the hedge against unprofitable tech, which bets against specific ultra-high growth names that look to become the next wave of tech leaders five years from now. These lofty names are most sensitive to potential rate hikes and market volatility, and that’s one of the reasons individuals have seen them fall.

Cathie Wood, on the other hand, continues to stand by her long-term thesis, believing the stocks she holds inside of ARKK and other innovative funds are the stocks of the future. Wood also believes that if a market bubble is growing, it is being created within value stocks and not growth names. |

MicroStockHub/iStock via Getty Images

MicroStockHub/iStock via Getty Images