Energy

Supply, geopolitics put

oil on track for biggest

monthly gain in almost a

year...

NEW YORK, Jan 31 (Reuters) - Oil prices were on track for their biggest monthly gain in almost a year on Monday, boosted by a supply shortage and political tensions in Eastern Europe and the Middle East.

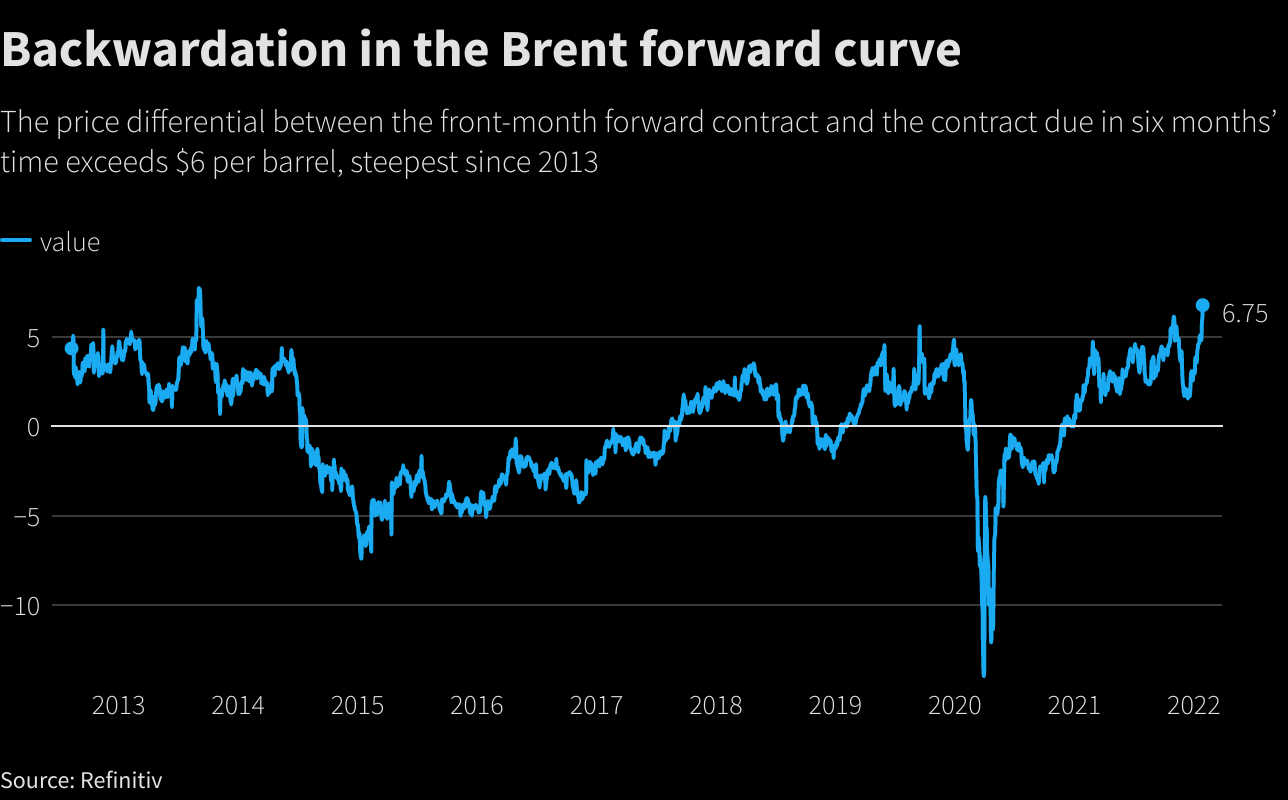

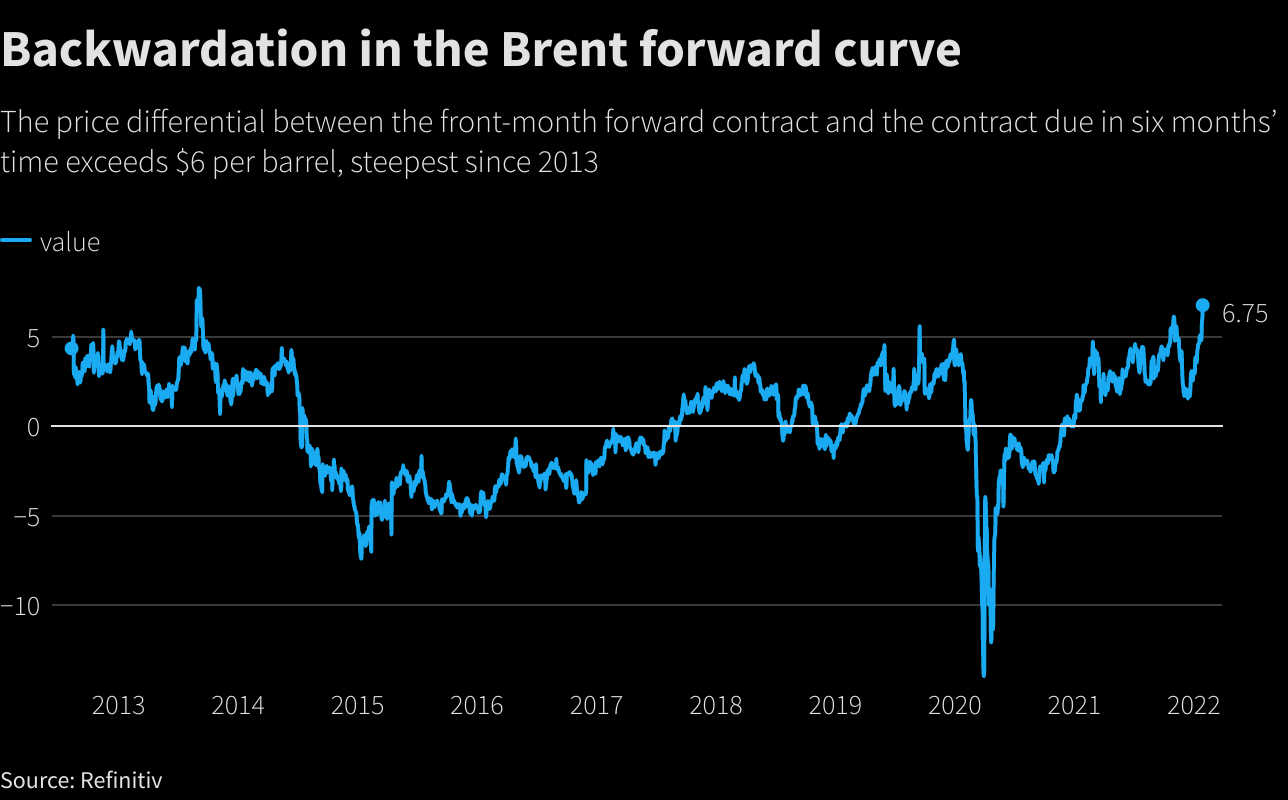

The most-active Brent contract, for April delivery, was trading up 48 cents to $89.00 per barrel by 1630 GMT. The front-month contract, for March delivery, rose $1.15 to $91.18 a barrel but was set to expire later in the day.

U.S. West Texas Intermediate crude rose 56 cents to $87.38 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, at $91.70 and $88.84, respectively, and their sixth straight weekly gain. They were headed for gains of more than 16% this month, the most since February 2021.

Market analysts and Reuters sources widely expect OPEC+ to keep to its policy of gradual production increases when it meets on Wednesday. read more

Major producers in the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, collectively known as OPEC+, have raised their output by 400,000 bpd every month since August.

The "month-to-month supply increases of 400,000 bpd are either too immaterial for the market to appreciate and more importantly, not being completely fulfilled by the group," said Louise Dickson, Rystad Energy's senior oil markets analyst.

"The only short-term solution for balancing the supply-short oil market will therefore need to come from OPEC+, and steered by Saudi Arabia, the producer with the largest spare capacity."

Geopolitical tensions involving major oil producers Russia and the United Arab Emirates have increased recently.

The head of NATO said on Sunday that Europe needed to diversify its energy supplies as Britain warned it was "highly likely" that Russia was looking to invade Ukraine. read more

The market is also on alert over the Middle East after the United Arab Emirates said it had intercepted a ballistic missile fired by Yemen's Houthi as the Gulf state hosted Israeli President Isaac Herzog, in a first such visit. read more

reuters.com

M |