| | | Alphabet's split decision bodes well for shares - BofA

Feb. 08, 2022 12:56 PM ET Alphabet Inc. (GOOG), GOOGL QQQ, SP500, SPY By: Kim Khan, SA News Editor 13 Comments

Sean Gallup/Getty Images News Sean Gallup/Getty Images News

Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) proposed 20:1 stock and more aggressive buybacks indicates that management is becoming more shareholder friendly, according to BofA.

While it does not change fundamentals, the split can increase liquidity, analyst Justin Post said.

"Alphabet shares are currently the most expensive on the NASDAQ ( COMP.IND) (NASDAQ: QQQ), trading near $2,800," the BofA Research Investment Committee wrote in a note. "A 20:1 split would mean the company will trade at about $140/share."

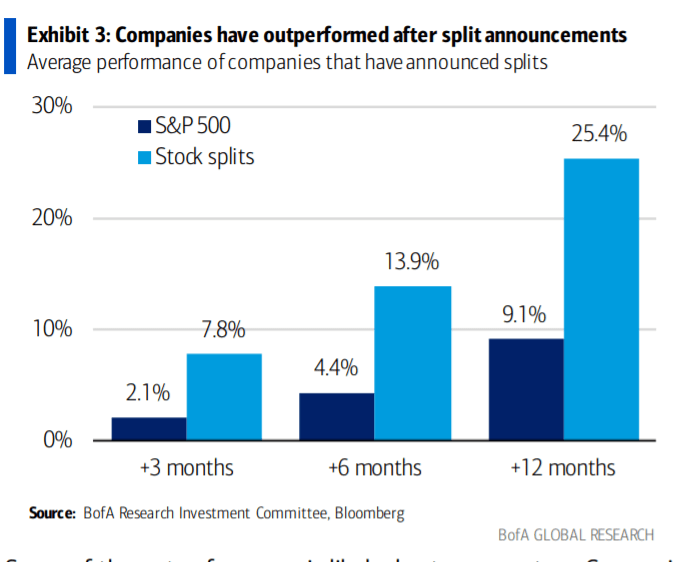

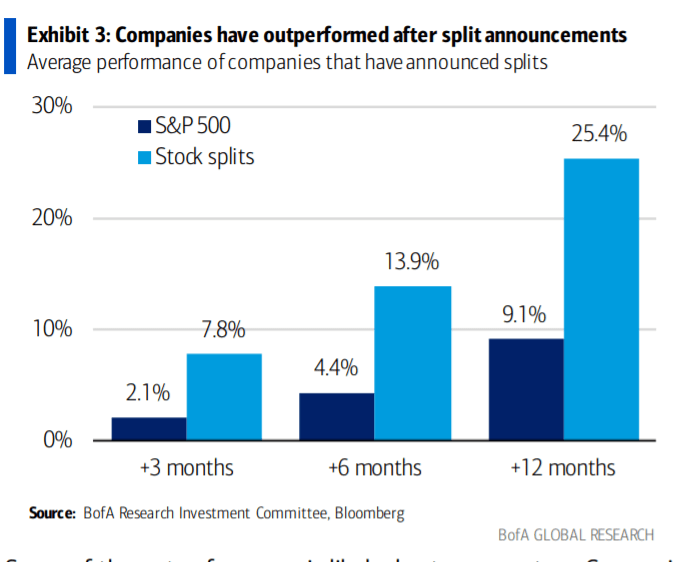

"Based on Bloomberg corporate action data since 1980, S&P 500 ( SP500) (NYSEARCA: SPY) stocks that have announced stock splits have significantly outperformed the index 3, 6, and 12 months after the initial announcement," they said. "Stocks that have split on average gained 25% over the next twelve months, versus 9% gains for the broad index."

"Some of the outperformance is likely due to momentum. Companies that announce splits have likely seen sustained market outperformance and expect that outperformance to continue," they added. "Underlying strength in the company is a primary driver of elevated prices. Once the split is executed, investors who have wanted to gain or increase exposure may start to rush for the chance to buy."

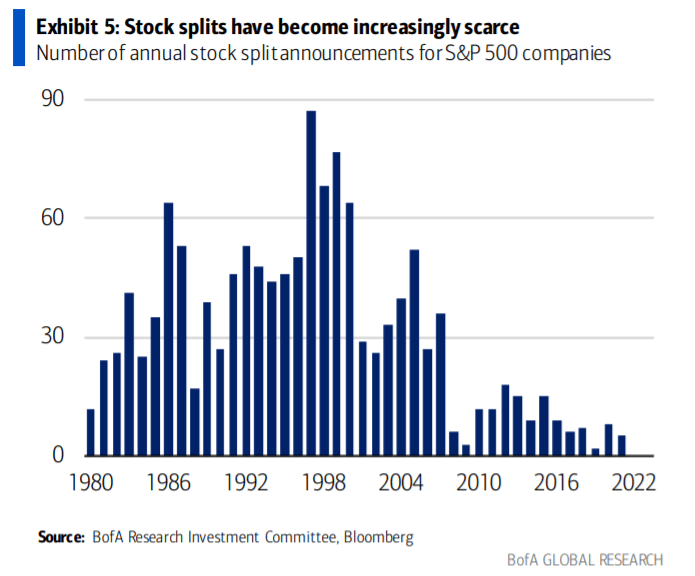

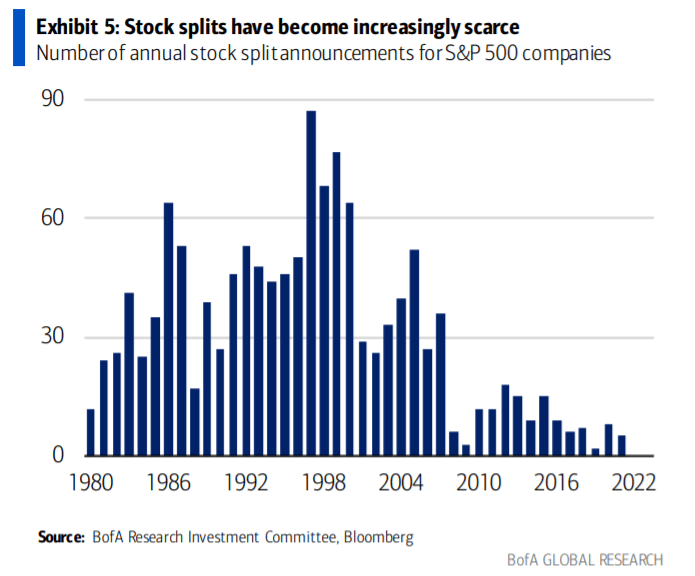

"Stock split announcements have become increasingly scarce over the past decade with the bulk of splits coming before 2000. There have been just 28 stock split announcements in the past five years compared to the peak of 346 between 1996 and 2000. The average 12 month return over the last five years has been 20.9% after split announcements."

"Performance is not always positive after a split," they said. "Stocks see negative returns about 30% of the time 12 months later (-22% average)."

Along with the split announcement, Alphabet ( GOOG) ( GOOGL) shares benefited from strong digital ad performance.

Alphabet's split decision bodes well for shares - BofA (NASDAQ:GOOG) | Seeking Alpha |

|

Sean Gallup/Getty Images News

Sean Gallup/Getty Images News