Is Nvidia Stock A Buy On The Dip? Just Look At Its Resilience Without Arm

Feb. 10, 2022

Livy Investment Research

Summary

- Nvidia's market value has dipped as much as 32% from peak-to-trough this year due to rising pressure on equity prices amidst the impending tightening of monetary policy.

- Yet, the chipmaker has recently demonstrated resilience even after the announcement of its failed Arm deal.

- Despite the stock price's brief setback on Monday's announcement of the failed Arm deal, investors have not been deterred from bringing the stock back up by more than 6% since.

- The stock's recent upward momentum despite ongoing market volatility implies the return of investors' confidence in the company's robust growth prospect in coming years even if it means Nvidia will be doing it alone.

- While Nvidia's recent price pullback still makes it one of the most expensive stocks on the market, it remains a strong investment pick with further gains on the horizon thanks to its enabling role in key digital trends ahead.

Antonio Bordunovi/iStock Editorial via Getty Images

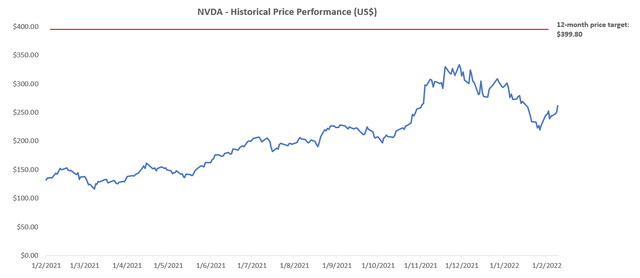

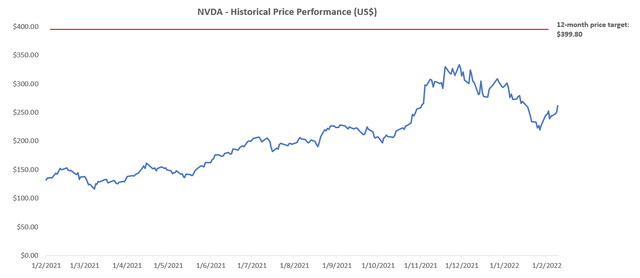

Nvidia's stock ( NVDA) was one of the strongest outperformers in 2021 after posting gains of more than 125%. Despite the recent dip of as much as 32% from peak to trough on a year-to-date basis or 40% since its November all-time high, Nvidia continues to trade 85% higher from a year ago. The stock has never been a cheap one – with a P/E (LTM) multiple of more than 77x, Nvidia is currently the second most expensive stock in the NYFANG+ Indexafter Tesla ( TSLA).

The premium on the stock is not without reason. In fact, it reflects the quality of sustainable, long-term growth exhibited by Nvidia’s underlying business. Nvidia remains the undisputed market leader in GPU and AI processors and related software. And continued strength in demand for these components and their supporting software, buoyed by key digital trends in coming years, is expected to help Nvidia emerge favourably from the ongoing market rout. This is further corroborated by the stock’s resilience against Nvidia’s recent decision to dropthe proposed acquisition of Arm Limited (“Arm”) due to significant regulatory scrutiny. There is still a robust growth runway ahead for the stock considering Nvidia’s critical role in enabling nascent technologies that underpin key digital trends of the current decade and beyond. And given the stock’s recent price pullback of 40% from its November peak, Nvidia remains an attractive long-term investment pick to add at current price levels.

Why Has the Nvidia Stock Dipped?

Since the announcement of Nvidia’s proposal to acquire Arm in September 2020, the stock appreciated by as much as 175% through its November peak before paring gains at about 95% today. Much of the accelerated growth happened in 2021 thanks to generous pandemic-era stimulus that not only helped the economy overcome uncertainties posed by evolving “ virus waves”, but also unleashed demand for high-growth technology stocks like Nvidia from both institutional and retail traders alike.

As mentioned in earlier sections, the stock has declined 40% in value since its November all-time high driven primarily by two market headwinds that are non-specific to Nvidia’s growth narrative. The first wave of declines came in late November, shortly after the stock’s price peaked at $346.43, due to the resurgence of the Omicron coronavirus variant which led to increased worries over a potential drawback in pace of economic reopening.

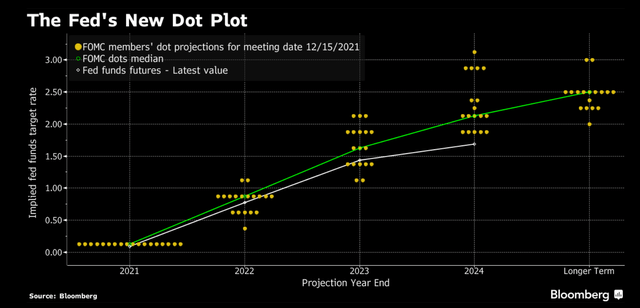

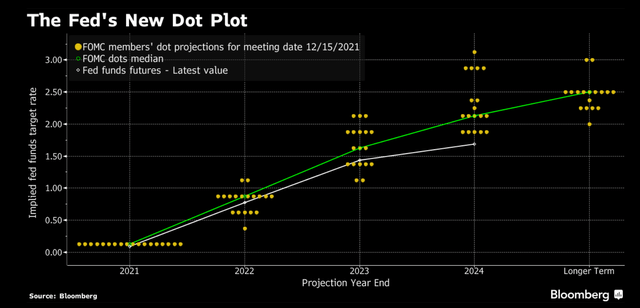

The declines became more pronounced after the Federal Open Market Committee’s (“FOMC”) policy meeting in mid-December. With ongoing pandemic-induced supply chain bottlenecks pushing inflation towards its hottest run in a generation, the Federal Reserve decided then to increase the pace at which it was dialing back on the $120 billion monthly bond repurchasing program from $15 billion per month, which began in November, to $30 billion per month. The new strategy would effectively conclude the stimulus program, put in place at the onset of the pandemic, coming March rather than in July as initially planned. And rate hikes are expected to lift-off soon after to counter rising price pressures. The Federal Reserve’s dot plot released at the time signalled potential for the Federal Fund Rate to lift-off from near-zero beginning early 2022 with three quarter-point increases, plus another three in 2023 and two more in 2024. The process is expected to up the funds rate to 2.1% by 2024.

December FOMC Dot Plot (Bloomberg)

The upcoming tightening of central bank policy has stoked fear amongst equity investors as they mull on how to price the upcoming rate hike impacts into asset valuations. The increase in interest rates will accordingly drive up the cost of capital deployed on growth, leading to fears of potential erosion of value on future earnings, especially in high-growth tech stocks, including Nvidia, which have rallied throughout 2021.

And the Fed’s increasingly hawkish narrative, which has indicated an urgency for faster and sooner rate hikes to tame runaway inflation, has only further fuelled investors’ angst. During the latest FOMC policy meeting in late January, Federal Reserve Chair Jerome Powell “did not rule out moving [interest rates] at every meeting to tackle the highest inflation in a generation” – the FOMC reconvenes eight times per year. Paired with stronger-than-expected jobs datain January, and an expectation for the upcoming release of updated inflation data on Thursday to remain elevated at 7%, some are expecting up to fivequarter-point rate hikes this year, while others are expecting a 50bps increase for the first time since 2000 coming March. Much of Nvidia’s year-to-date declines have been triggered by said macroeconomic headwinds, while its growth narrative remains largely unchanged.

Resilience Against Losing Arm

The biggest headline on Nvidia at the moment is its announcement on dropping the proposed Arm acquisition from SoftBank on Monday. The mounting level of scrutiny from both regulators and Arm’s customers over the deal since its proposal in 2020 peaked in December when the U.S. FTC took the extremity of suing to block the $40 billion transaction from moving forward. And rumours of Nvidia “ quietly preparing to abandon the deal” have been brewing since, which makes the recent deal termination announcement unsurprising to most. Nonetheless, the stock still took a brief setback on the news, dropping as much as 4% on Monday’s regular session and another 3% between late-trading and Tuesday’s morning session. Yet, the stock rebounded steeply to close Tuesday’s session higher by 1.5% compared to the previous day at $251.08.

The original intention of the acquisition was to bolster Nvidia’s foray in data centers and AI computing, and accelerate its development in emerging technologies like chips used in powering autonomous driving technology. Arm is currently one of the world’s largest and most prominent chip designers. Instead of producing and selling its own chips like Nvidia, Arm “designs core semiconductor components and licenses the blueprints to other firms to produce them in exchange for a fee based on how many are made”. To date, Arm’s technology can be found in more than 200 billion chips applied across a wide array of use cases ranging from smartphones to powerful data centers. About 70% of the global population is estimated to be using products powered by Arm’s technology on a daily basis. Its current customers include chipmakers like Nvidia and Intel ( INTC), as well as other tech giants like Apple ( AAPL) which design their own chips.

The widespread, yet neutral, role that Arm currently plays within the global chipmaking industry as discussed above meant a death sentence to any potential merger with another industry peer, including Nvidia. As mentioned in earlier sections, the U.S. FTC has sued to block the deal citing it would “hobble innovation and undermine Nvidia’s rivals”. Meanwhile, regulators from the EU and the U.K. also raised concerns over the potential compromise of Arm’s neutral role in “critical national infrastructure and military equipment” if the deal was materialized. Arm’s Chinese customers, including Huawei Technologies, also presented a case to Chinese regulators that the amalgamation of Nvidia and Arm could potentially force the latter to “cut off Chinese clients” due to pressure and influence from the U.S. government. It was clear the common theme in complaints raised was none but concerns over a potential breach of Arm’s “neutrality”.

Yet, many saw Nvidia’s final decision to drop the proposed acquisition of Arm as a relief. This was further echoed by the stock’s resilience against confirmation on the soured deal. Analysts from key financial institutions including Bank of America ( BAC) and Wedbush Securities have expressed positive views on Nvidia’s outlook without Arm. First, it would save Nvidia billions of dollars associated with efforts against “regulatory pushback” and “complicated royalty negotiations”, which could be redeployed towards ongoing growth initiatives in emerging technologies like AI, the “Omniverse”, gaming, and autonomous driving. Second, Nvidia has already proven its competency in innovative graphics and computing technology through its market leadership, and does not need ownership of Arm’s architectures to increase its exposure in data center and AI computing sales. Echoing what Nvidia said in its press release, the company can continue to benefit from Arm’s technology as a “proud licensee for decades to come”, which would make more sense economically and operationally in the long-run.

Is Nvidia a Good Long-Term Stock?

As discussed in detail in our most recent coverage on Nvidia's stock, the underlying business remains a critical enabler of key digital trends that underpin the future of technology:

- Omniverse: The advent of the metaverse touted by Facebook ( FB), which has recently changed its name to Meta Platforms to better reflect its shift in focus to virtual reality, also underpins new growth opportunities ahead for Nvidia. The chipmaker has recently introduced an " Omniverse" software platform, which builds on its existing strengths in graphics and AI, to enable a three-dimensional environment for use cases beyond recreational application. Available use cases for the Omniverse currently include virtual simulation tool “ Nvidia Replicator” and digital avatar creator “ Nvidia Omniverse Avatar”. And it is likely Nvidia will continue to expand its portfolio of Omniverse applications over the longer-term as adoption picks up.

With metaverse-driven software and hardware opportunities expected to blossom into an $800 billion market(70% software, 30% hardware) over the next five years, Nvidia stands to benefit generously with its recent development of the Omniverse. The Avatar application alone already addresses opportunities valued at more than $165 billion per year, which represents about 30% of the total software-based metaverse market. And given Nvidia’s prowess in GPU and AI processors, the chipmaker remains a critical function to the ongoing development of metaverse-related infrastructure, making it a key benefactor of related opportunities ahead.

GPU: Nvidia is currently the global market leader in GPU processors and commands more than 80% of related opportunities. The chipmaker’s continued commitment to innovation has made its GPU processors critical to continued expansion of the gaming and data center segments. Nvidia’s recent introduction of the second generation RTX architecture, Ampere, improves ray-tracing technology to make gaming graphics more realistic. It has also recently unveiled the all-new GeForce RTX 3080 Ti graphics processor for use in high-end gaming laptops, underpinning greater exposure to the $125 billion global gaming market in coming years.

On the enterprise front, GPUs are also in high demand from hyperscale data center and high performance computing (“HPC”) segments considering the technology’s ability in processing complex workloads related to machine learning, deep learning, AI and data mining. And the “ Nvidia A100” GPU – one of many data center GPUsoffered by the chipmaker – does just that. The technology, introduced in 2020, is built based on the Ampere architecture as discussed above and delivers up to 20x higher performance than its predecessors. The A100 is built specifically for supporting “data analytics, scientific computing and cloud graphics”. There is also the recently introduced “ HGX AI Supercomputer” platform built on the Nvidia A100, which is capable of providing “ extreme performance to enable HPC innovation”.

The chipmaker’s continued commitment to improving solutions for enterprise workloads makes it well-positioned for capturing growing opportunities from the data center and HPC segments in coming years. Global demand for data center chips is expected to rapidly expand at a compounded annual growth rate (“CAGR”) of 36.7% over the next five years.

And the “continued build-out of data center capacity” observed across major operators including Microsoft ( MSFT), AWS ( AMZN), and Meta Platforms already supports this forecasted trend. For instance, Microsoft has recently committed to adding 50 to 100 new data centers per year within the ”foreseeable future” to further extend its global footprint. Meanwhile, Meta Platforms continues to focus on the build-out of its data center capacity to support the ongoing expansion of its metaverse. The social media giant has also recently announced the development of “ AI Research SuperCluster”, one of the world’s fastest supercomputers once it is complete this year. The AI Research SuperCluster will incorporate 16,000 “Nvidia A100” GPUs to “train machine-learning models faster and more accurately”. The pipeline of planned data center and HPC developments continue to underscore high quality, sustainable, and long-term growth for Nvidia as mentioned in earlier sections.

AI: Nvidia’s expertise in GPU technologies has also accelerated its AI proficiencies, including the development of “ Jetson AI”, “ Nvidia DGX Systems”, and “ NVIDIA Drive”. Jetson is currently “the world’s leading platform for autonomous machines and other embedded applications”, making it a critical piece to the fast-growing AI market. Similarly, the DGX system offers a family of hardware that leverages Nvidia’s existing expertise in GPUs, including the Nvidia A100, used in training, storing, and managing complex AI and HPC workloads with high, scalable performance. Meanwhile, NVIDIA Drive is slated to accelerate the chipmaker’s penetration into the $60 billion market for autonomous driving technology. NVIDIA Drive solutions have already been sold to established OEMs, electric vehicle start-ups, robotaxi developers, as well as trucking companies including Daimler’s Mercedes-Benz ( OTCPK:DDAIF), NIO ( NIO), GM’s Cruise ( GM) and Volvo. The track record already serves as validation for the technology’s competency, which further bolsters Nvidia’s automotive segment sales over the longer-term as autonomous driving adoption continues to ramp up.

Nvidia has also taken large strides in the development of software to complement its AI solutions. This includes “ NVIDIA AI Enterprise”, a comprehensive suite of AI and data analytics tools designed for streamlining the development and deployment of advanced AI solutions such as "diagnostics in healthcare, smart factories for manufacturing, and fraud detection in financial services" for commercial customers. And Nvidia's acquisition of Mellanox Technologies in 2020 further supports its competencies in AI and HPC computing in recent years by combining Nvidia’s leading expertise in these areas with Mellanox's high-performance networking technology. This in turn drives additional synergies by offering customers with full-stack, end-to-end solutions while also enabling cost-efficiencies.

CPU: Nvidia has also announced its entry into data center server chips during the GTC conference last year with the development of “ NVIDIA Grace”. NVIDIA Grace is designed based on Arm architecture and delivers a “10x performance leap for systems training giant AI models”. The Grace chip would directly compete against key industry rivals like Intel and AMD ( AMD) within the realm of HPC – a $108 billion addressable market – upon its anticipated launch in 2023.The above developments continue to underscore Nvidia’s robust growth trajectory ahead. Paired with its strong balance sheet, Nvidia remains a favourable growth stock, especially under the current macroeconomic environment where the impacts of paring pandemic-era stimulus and increasing interest rates are becoming more prominent.

Is Nvidia Stock at a Fair Valuation?

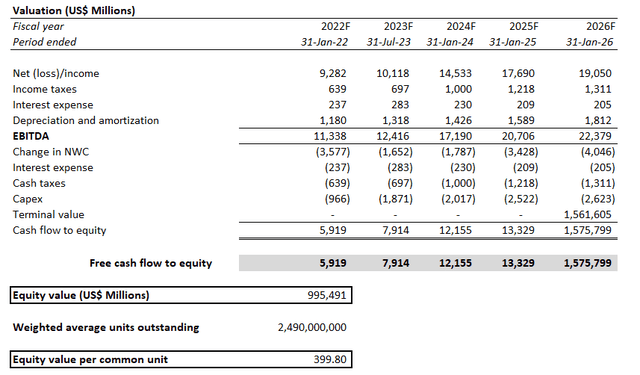

As mentioned in earlier sections, Nvidia's stock has rarely been “cheap” even at times of temporary drawbacks. Even with the recent dip, the stock continues to trade at a near-80x P/E (LTM) multiple, making it one of the most expensive in the market. But considering its critical involvement across a wide array of key emerging technologies that underpin continued digitization efforts worldwide, Nvidia’s current price levels will likely be considered “cheap” when looking in hindsight over the “long time frame”.

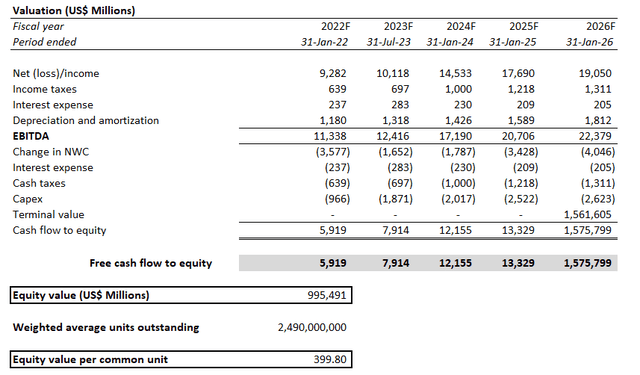

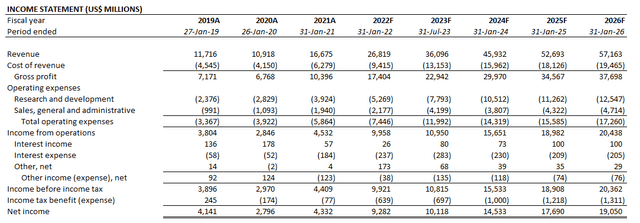

Nvidia Valuation Analysis (Author)

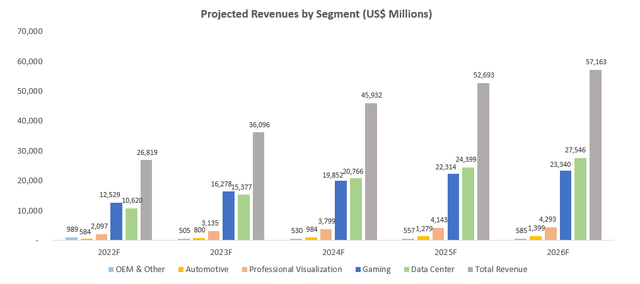

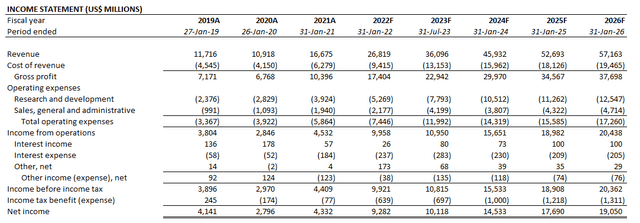

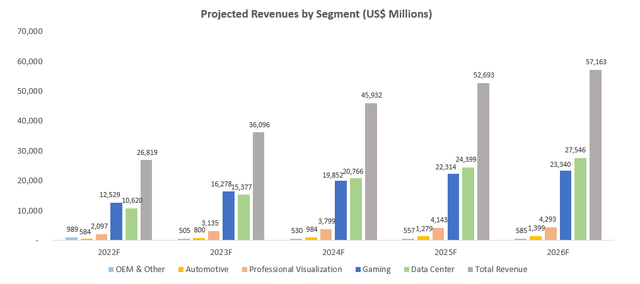

Based on our most recent deep dive on Nvidia’s fundamental and valuation prospects, the stock is expected to advance towards $400 within the near-term, even without the acquisition of Arm. Despite recent market volatility triggered by uncertainties over the timing and magnitude of upcoming rate hikes, we see Nvidia’s Q4 and full-year FY 2022 earnings call next week to be a key catalyst that just might further jumpstart the stock. Based on our base case financial forecast for Nvidia as analyzed in detail in our previous coverage, Nvidia’s top line is expected to have grown by more than 50% to $7.5 billion in its fiscal fourth quarter. This would bring the anticipated full-year revenue figure for FY 2022 to $26.8 billion, up 61% from the prior year which is consistent with Nvidia’s performance in recent periods as well as management’s guidance for the fiscal year. And we are expecting management to guide revenue growth of at least 30% to 35% for the current fiscal year (i.e. FY 2023), buoyed by robust data center, HPC, AI and gaming demand as discussed in the foregoing analysis.

Nvidia Financial Forecast (Author)

i. Base Case Financial Forecast:

Nvidia Financial Forecast (Author)

Nvidia_-_Forecasted_Financial_Information.pdf

Market activity observed last week continued to underscore investors’ focus on robust earnings and sales growth forecasts in addition to upbeat financial results from past quarters. While the increasingly hawkish Federal Reserve has unleashed a wave of anxiety that has whipsawed assets in recent months, steep rebounds observed on big tech stocks like Amazon and Google ( GOOG / GOOGL) which have reassured their growth prospects prove that the upcoming tightening of central bank policy alone is not enough to “overwhelm the countervailing force of rising profits”. And in Nvidia’s case, its growth prospects remain robust as discussed in the foregoing analysis. The stock appears well-poised for further uptrends in coming weeks with further advance towards the $400 price target over the next year.

i. Base Case Valuation Analysis:

Nvidia Valuation Analysis (Author)

Is Nvidia Stock a Buy, Sell or Hold?

Based on our foregoing analysis on Nvidia, the stock remains a strong buy, especially considering the recent price pullback. The stock’s continued upwardmomentum exhibited since Nvidia’s announcement of its failed Arm deal earlier this week is also a testament to investors’ returning confidence in the company's growth trajectory in coming years, making it a resilient bet against the current macroeconomic backdrop. While the stock continues to be one of the most expensive on the market, it remains an attractive investment at current price levels.

This article was written by

Livy Investment Research

Boutique investment research shop providing professional coverage on disruptive thematic equities. Our analysis provides a deep dive on growth drivers present in the secular market to identify outperforming investments.

google.com |