Alphabet Is Crushing It

Feb. 03, 2022

Eric Sprague

Summary

AI will be key for making Search, Maps and YouTube even more helpful in 2022.Google will continue to return information regardless of whether users are typing, speaking or looking at something wanting an answer.Revenue, operating cash flow and operating income have exploded as products have improved and advertising prices have gone up.

Justin Sullivan/Getty Images News

Introduction

In the 4Q21 call, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)CEO Sundar Pichai said we're going to continue seeing Google lead in search quality. A wide range of formats like text, images and video can be understood by a multimodal model and CEO Pichai said in the call that the world is getting more multimodal in nature:

Just like we took the leap from text to images, thinking through video, audio, incorporating it and then providing it back to users regardless of whether they are typing, speaking or looking at something wanting an answer. That's the journey between AI and Search, and we'll continue doing that.My thesis is that Google will continue thriving as they use AI to make their products better while the world keeps switching to digital.

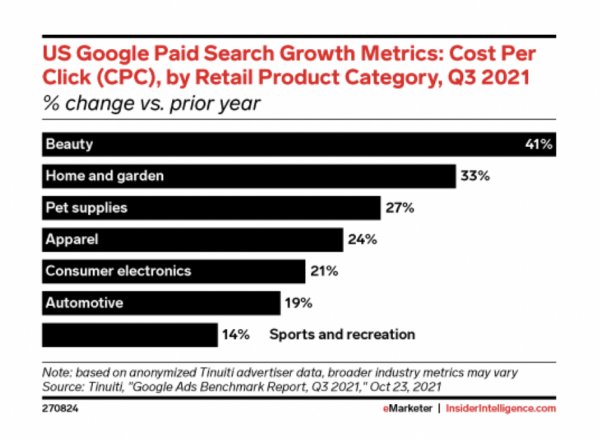

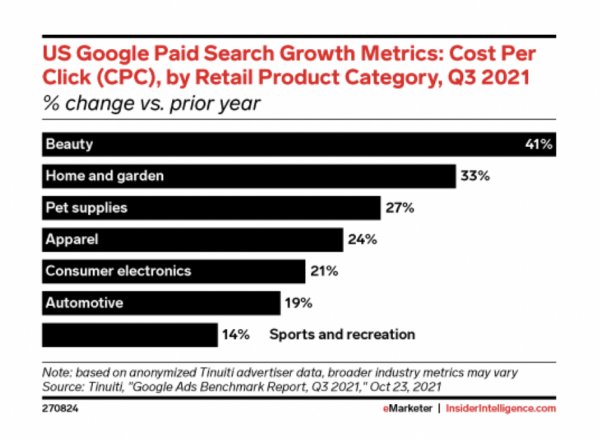

In the 4Q21 call, Alphabet CEO Pichai said AI will be key for making Search, Maps and YouTube even more helpful in 2022. He said they invest heavily in AI and they have good interfaces between the AI teams and the core product teams like Search such that investment benefits can be productized. It was pointed out in the 4Q21 call that BERT, MUM, Pathways and LaMDA power conversational experiences. These enhancements are one of the reasons why Google has been able to increase advertising prices. A November 16th eMarketer article notes that advertising on Google in the US has gotten more expensive, especially in the beauty category:

Google advertising price increases (eMarketer)

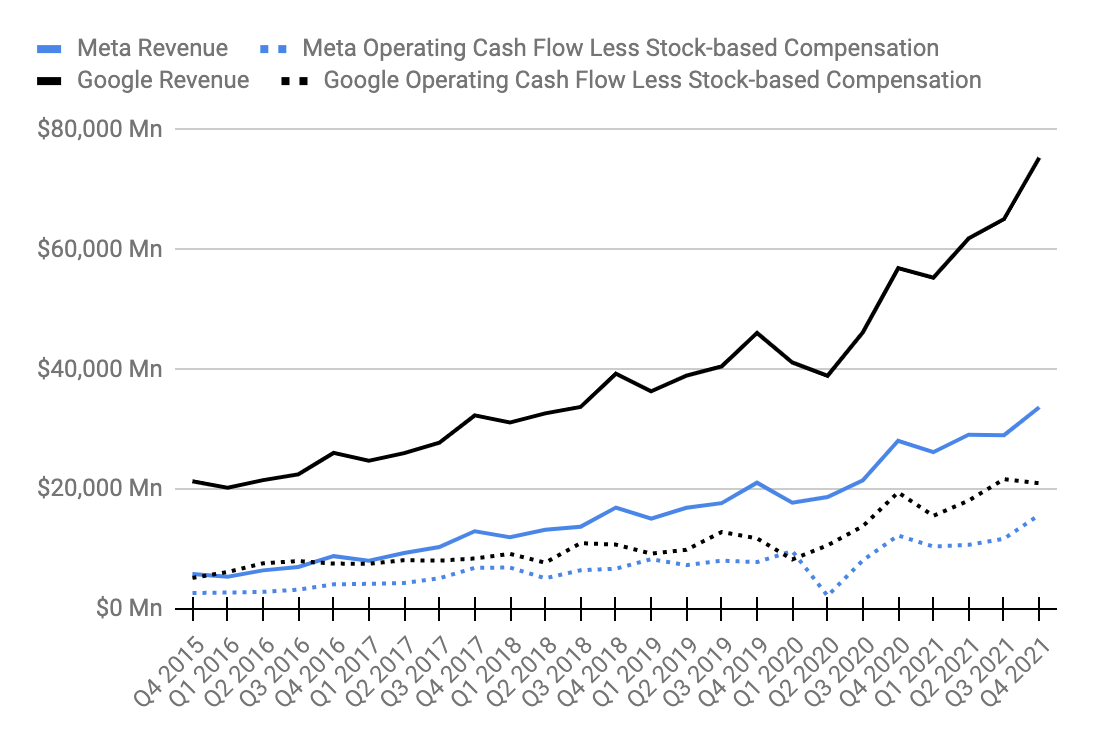

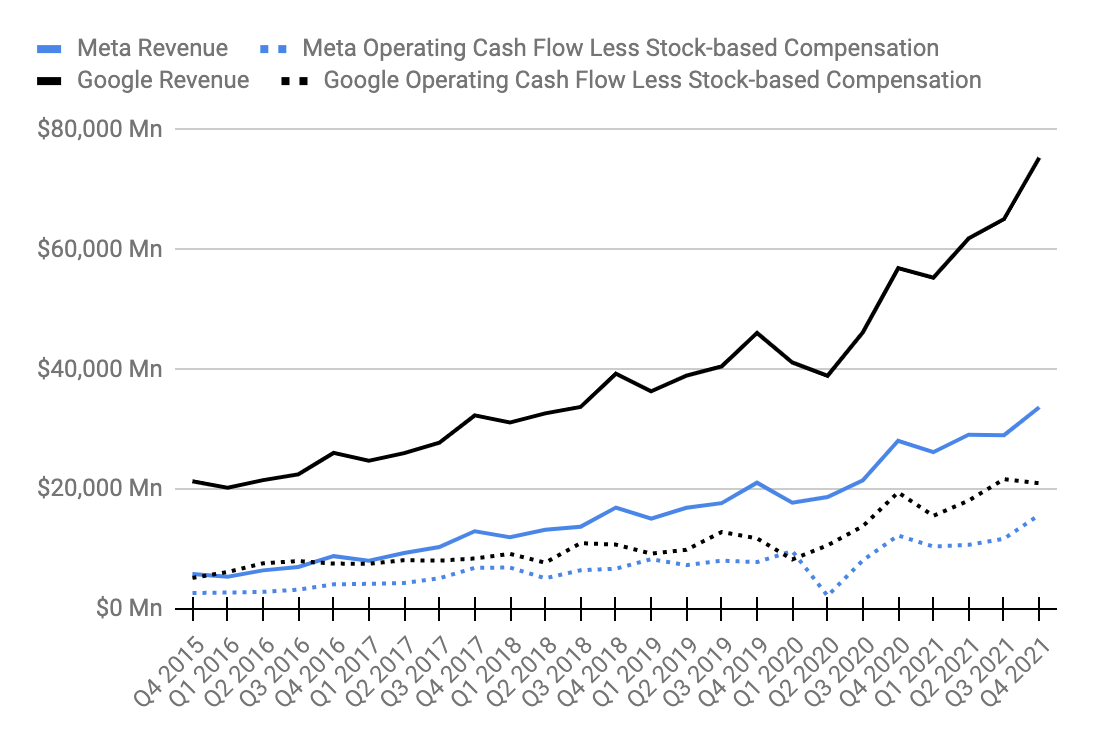

The above price increases are consistent with what COO Philipp Schindler said in the 4Q21 call about retail being the largest contributor to year-on-year revenue growth followed by finance, media and entertainment. Revenue, operating cash flow and operating income have exploded as products have improved and advertising prices have gone up. Both Google and Meta (NASDAQ: FB) have done well with digital ads over the years but Google's growth has been especially prodigious from 2Q20 to present:

Google revenue and operating cash flow (Author's spreadsheet)

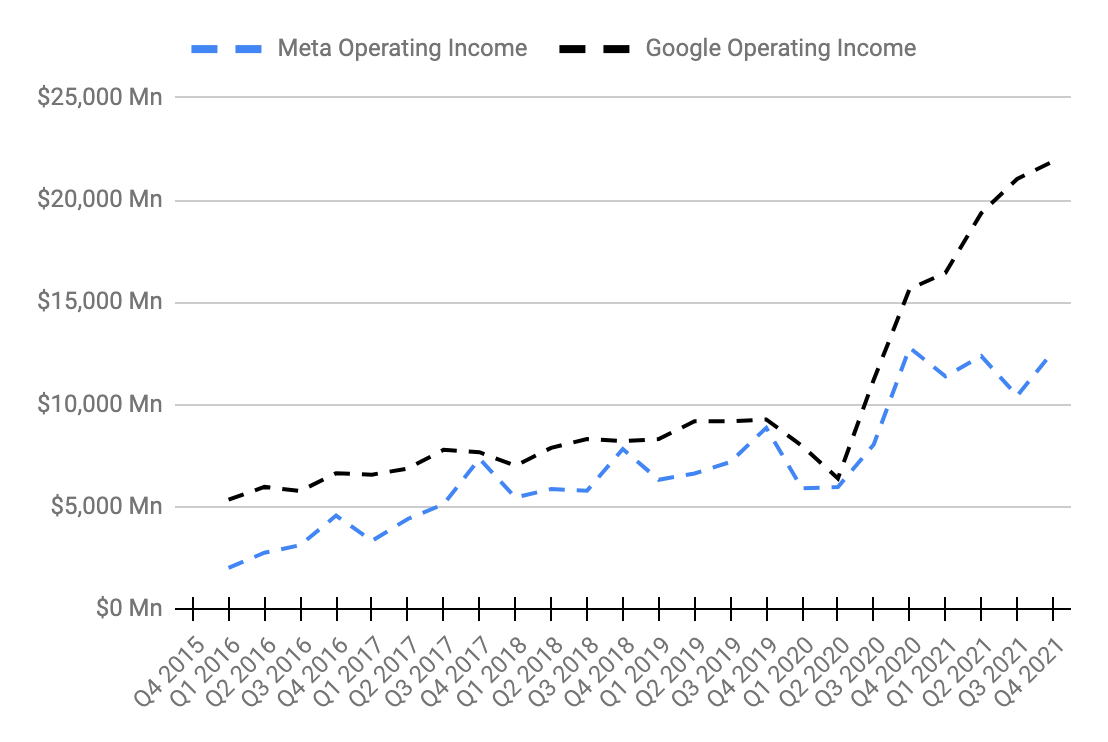

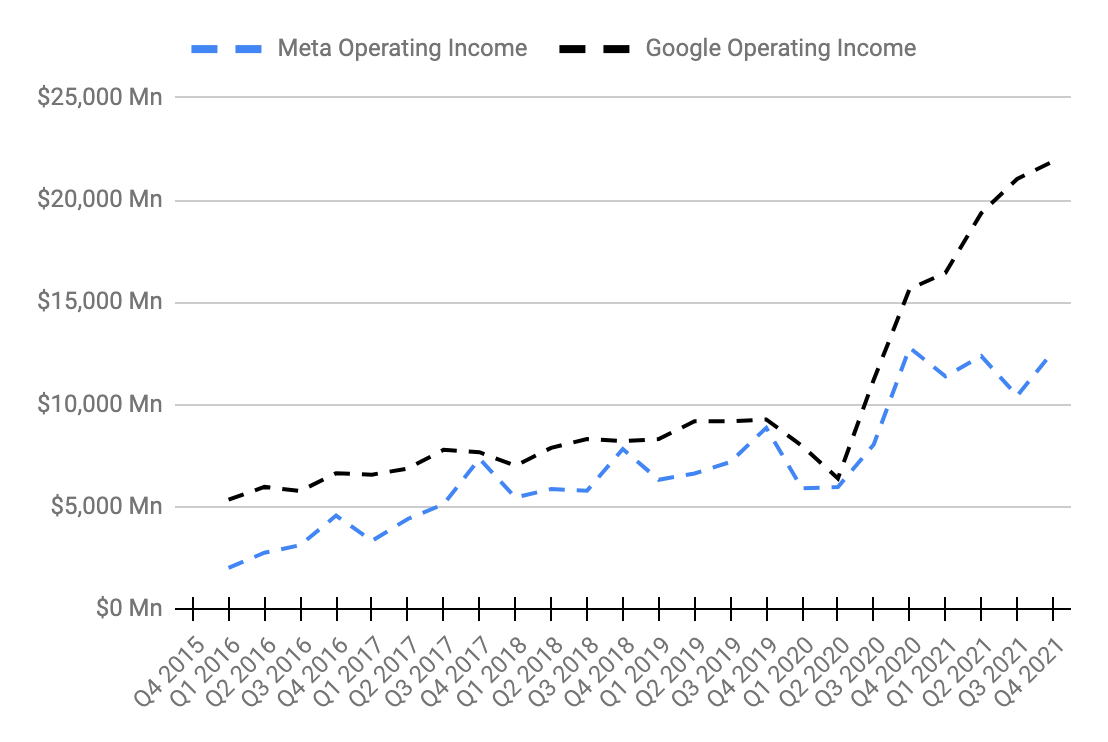

Meta's operating income was almost as high as Google's from 4Q17 to 2Q20 but those days are over now:

Google's operating income (Author's spreadsheet)

Bidirectional Encoder Representations From Transformers - BERT

BERT recognizes the context of a given word by considering the words around it in a phrase. Before BERT, a search like "2019 Brazil traveler to USA need a visa" would show information about traveling to Brazil. BERT understands that the "to" in "to USA" is key and that the user is seeking info about traveling to the US.

Multitask Unified Models - MUM

Like BERT, MUM recognizes the importance of "to" in a "to USA" search phrase. Taking things further, MUM is multimodal meaning it can use various formats like webpages, photos and videos. MUM can synthesize info from more than one language such that it can use Japanese sources if a user is typing a search query about the differences between climbing Mount Whitney in California and Mount Fuji in Japan.

In the 4Q21 call, CEO Pichai said new AI models are helpful seeing as they're conversational, multimodal and personal. Citing MUM as an example, he noted that it has already improved the searches for Covid vaccine information and they're working on more enhancements that will allow users to search with images and words at the same time.

My October article has more specifics on MUM.

New AI Architecture - Pathways

Google Research SVP Jeff Dean went through Pathways in an October 28th blog post:

Today's AI systems are often trained from scratch for each new problem - the mathematical model's parameters are initiated literally with random numbers. Imagine if, every time you learned a new skill (jumping rope, for example), you forgot everything you'd learned - how to balance, how to leap, how to coordinate the movement of your hands - and started learning each new skill from nothing. That's more or less how we train most machine learning models today. Rather than extending existing models to learn new tasks, we train each new model from nothing to do one thing and one thing only [or we sometimes specialize a general model to a specific task]. Today's models mostly focus on one sense. Pathways will enable multiple senses.Summing up, SVP Dean explains that today's machine learning models overspecialize instead of generalizing and performing many tasks. Typically they don't yet take text, images and speech as inputs all at once. Pathways will address these issues and take us beyond single-purpose models.

CEO Pichai introduced Pathways to investors in the 4Q21 call repeating what Research SVP Dean said in his blog post about Pathways going beyond single-purpose models:

In October, we introduced a new AI architecture called Pathways. AI models are typically trained to do only one thing. With Pathways, a single model can be trained to do thousands, even millions of things.

Language Model for Dialogue Applications - LaMDA [Conversation Tech]

A May 2021 blog post by Product Management VP Eli Collins and Senior Research Director Zoubin Ghahramani explains that LaMDA is needed because language is nuanced. It is important to recognize when a conversation is literal and when it is figurative:

LaMDA's conversational skills have been years in the making. Like many recent language models, including BERT and GPT-3, it's built on Transformer, a neural network architecture that Google Research invented and open-sourced in 2017. That architecture produces a model that can be trained to read many words [a sentence or paragraph, for example], pay attention to how those words relate to one another and then predict what words it thinks will come next. But unlike most other language models, LaMDA was trained on dialogue. During its training, it picked up on several of the nuances that distinguish open-ended conversation from other forms of language. One of those nuances is sensibleness. Basically: Does the response to a given conversational context make sense?

Closing Thoughts

CEO Pichai talked about specific AI investments in the 4Q21 call noting that the benefits go beyond Search:

From MUM to Pathways to BERT and more, these deep AI investments are helping us lead in Search quality. They're also powering innovations beyond Search.

The part about these investments going beyond search is something that makes Alphabet special. They were clairvoyant when they bought YouTube for a mere $1.65 billion back in 2006 and they have built it up nicely by leveraging search investments and repurposing them. CEO Pichai discusses the common infrastructure for YouTube later in the 4Q21 call:

Maybe quickly on YouTube and commerce. Look, one thing I would say is across both Search, YouTube and other areas, there's a lot of common infrastructure that's getting done, right? So this is focused on merchants, onboarding merchants and all the back end so that we can have the broadest and the most comprehensive inventory available. And there, our partnership with other e-commerce platforms is a basic foundational layer we are putting in.

CFO Ruth Porat said they repurchased a total of $50 billion of shares in 2021. This goes well beyond the amount needed to offset the dilution from stock based compensation and I don't think management would commit this much capital to repurchases if they thought the stock was overvalued. My valuation thoughts haven't changed significantly since my October article when I came up with a range of about $2 trillion to $2.5 trillion.

The market cap is the sum of class A and class B shares times the class A GOOGL price as the first component plus the class C shares times the class C GOOG price as the next component. The 2021 10-K filing shows 300,754,904 A shares and 44,576,938 B shares which add up to 345,331,842 shares that need to be multiplied by the February 2nd GOOGL price of $2,960.00. The 10-K also shows 315,639,479 C shares that need to be multiplied by the February 2nd GOOG price of $2,960.73. Summing things up, we get a market cap of $1,957 billion or $1,022 billion plus $935 billion. The enterprise value is less than the market cap seeing as the $139.6 billion cash and equivalents lowers things and this is only partially offset by $14.8 billion in long-term debt and $11.4 billion in operating leases.

Seeing as the enterprise value is below my valuation range, I think the stock is a good buy for long-term shareholders who are patient enough to hold for 5 years or so.

This article was written by

Eric Sprague

I'm an individual investor heavily influenced by Warren Buffett and Charlie Munger. Munger's 1994 USC Business School Speech is something I think about a lot:

### Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result. ... Another very simple effect I very seldom see discussed either by investment managers or anybody else is the effect of taxes. If you're going to buy something which compounds for 30 years at 15% per annum and you pay one 35% tax at the very end, the way that works out is that after taxes, you keep 13.3% per annum. In contrast, if you bought the same investment, but had to pay taxes every year of 35% out of the 15% that you earned, then your return would be 15% minus 35% of 15%—or only 9.75% per year compounded. So the difference there is over 3.5%. And what 3.5% does to the numbers over long holding periods like 30 years is truly eye-opening. If you sit back for long, long stretches in great companies, you can get a huge edge from nothing but the way that income taxes work. ###

seekingalpha.com |